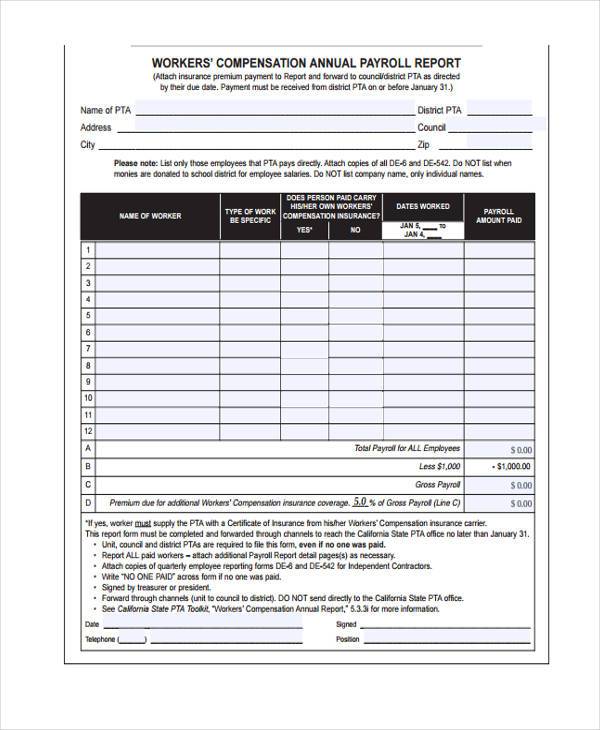

Workers Compensation Insurance Payroll Report Form

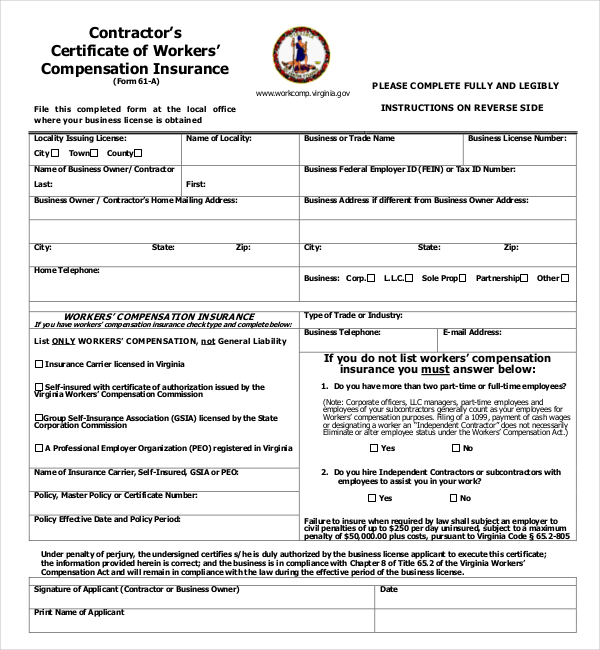

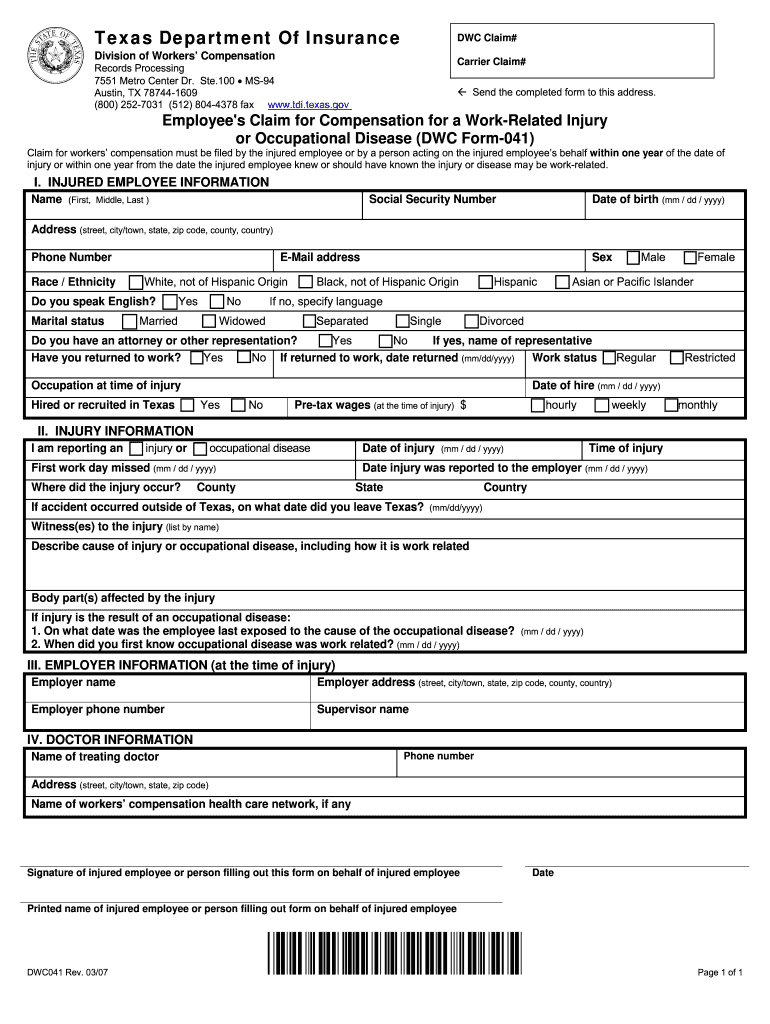

Workers Compensation Insurance Payroll Report Form - Web there are three different ways to submit your payroll reports. 4 minutes get more details about your payroll report. Submit payroll electronically by enrolling in state fund online. Depending on your state, workers’ compensation audits can also be a legal requirement. Web if your workers’ compensation policy is in a single state, you can enter your payroll report online when it’s convenient for you, rather than mailing your report with your premium payment. Web employer guide report your payroll featured video how to report payroll watch on how to report payroll payroll can be complicated and confusing. In this video, we walk you through what a payroll report is, why it’s important, and how to submit one. Web your workers’ comp policy requires audits to verify your estimated payroll. Be sure to have your current policy number and unique invoice number, which can be found on the payroll report form mailed to you. Web follow the steps outlined to report payroll for domestic workers by classification code:

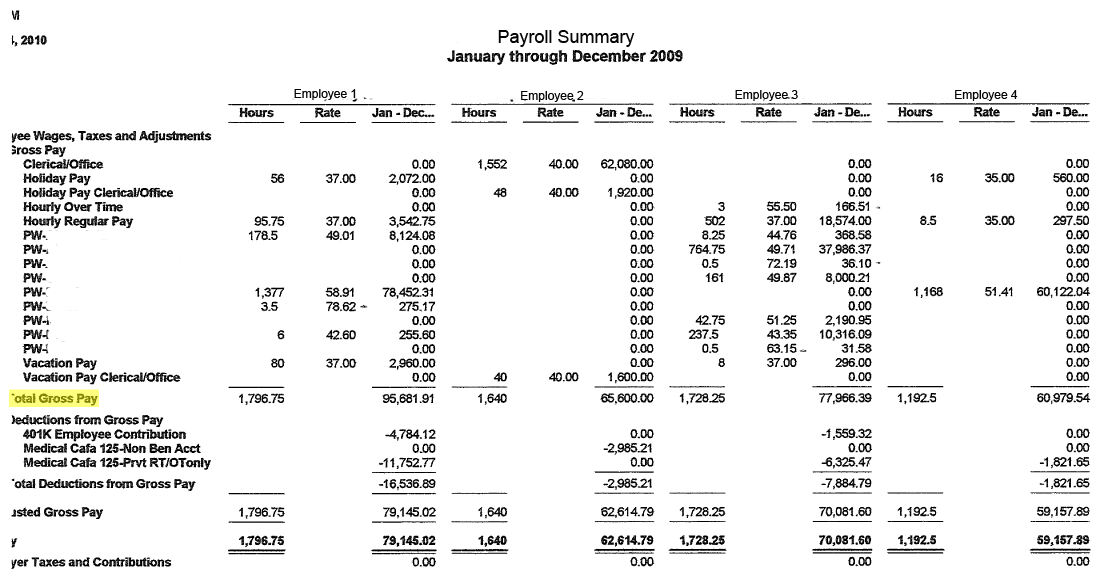

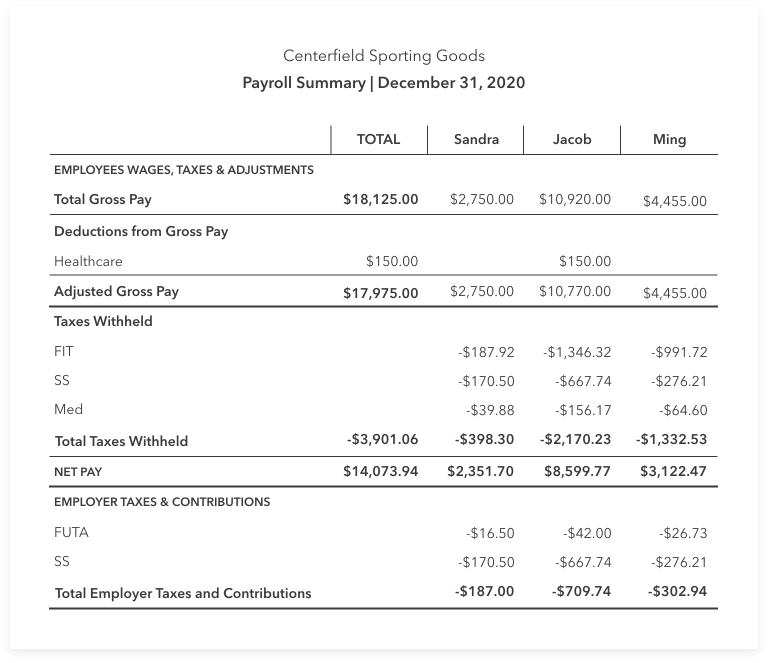

Enter the payroll paid, the number of employees, and the locations indicated for the period listed. Be sure to have your current policy number and unique invoice number, which can be found on the payroll report form mailed to you. Submit payroll electronically by enrolling in state fund online. In this video, we walk you through what a payroll report is, why it’s important, and how to submit one. State fund online has many benefits including allowing you to report all of your payroll and pay premium electronically. 4 minutes get more details about your payroll report. If your company submits your insurance policy information to us, we can even create a more generic workers’ compensation report. Web at connectpay, we provide quarterly tax reports and a gross payroll report so you can seamlessly meet your deadlines. Web any person who knowingly files an application for insurance or claim statement containing any materially false information with intent to defraud or conceals information concerning any material fact for the purpose of misleading is committing a fraudulent insurance act. Web follow the steps outlined to report payroll for domestic workers by classification code:

Depending on your state, workers’ compensation audits can also be a legal requirement. Submit payroll electronically by enrolling in state fund online. Web any person who knowingly files an application for insurance or claim statement containing any materially false information with intent to defraud or conceals information concerning any material fact for the purpose of misleading is committing a fraudulent insurance act. Be sure to have your current policy number and unique invoice number, which can be found on the payroll report form mailed to you. In this video, we walk you through what a payroll report is, why it’s important, and how to submit one. State fund online has many benefits including allowing you to report all of your payroll and pay premium electronically. Enter the payroll paid, the number of employees, and the locations indicated for the period listed. Web at connectpay, we provide quarterly tax reports and a gross payroll report so you can seamlessly meet your deadlines. 4 minutes get more details about your payroll report. Web your workers’ comp policy requires audits to verify your estimated payroll.

1 Payroll Service Just for Construction Payroll4Construction

Web employer guide report your payroll featured video how to report payroll watch on how to report payroll payroll can be complicated and confusing. Web follow the steps outlined to report payroll for domestic workers by classification code: In this video, we walk you through what a payroll report is, why it’s important, and how to submit one. 4 minutes.

Workers Compensation Insurance Workers Compensation Insurance Payroll

If your company submits your insurance policy information to us, we can even create a more generic workers’ compensation report. Web there are three different ways to submit your payroll reports. 4 minutes get more details about your payroll report. Web employer guide report your payroll featured video how to report payroll watch on how to report payroll payroll can.

Workers Compensation Insurance Form INSURANCE DAY

Be sure to have your current policy number and unique invoice number, which can be found on the payroll report form mailed to you. In this video, we walk you through what a payroll report is, why it’s important, and how to submit one. Depending on your state, workers’ compensation audits can also be a legal requirement. Web any person.

FREE 13+ Sample Workers Compensation Forms in PDF XLS Word

Web there are three different ways to submit your payroll reports. Enter the payroll paid, the number of employees, and the locations indicated for the period listed. State fund online has many benefits including allowing you to report all of your payroll and pay premium electronically. Be sure to have your current policy number and unique invoice number, which can.

Payroll reports for small business Article

Web if your workers’ compensation policy is in a single state, you can enter your payroll report online when it’s convenient for you, rather than mailing your report with your premium payment. These audits help make sure you’re paying the right amount for the right coverage. Web employer guide report your payroll featured video how to report payroll watch on.

Payroll Reporting FAQs

Web follow the steps outlined to report payroll for domestic workers by classification code: Web if your workers’ compensation policy is in a single state, you can enter your payroll report online when it’s convenient for you, rather than mailing your report with your premium payment. In this video, we walk you through what a payroll report is, why it’s.

Form Fill Online, Printable, Fillable, Blank pdfFiller

Web at connectpay, we provide quarterly tax reports and a gross payroll report so you can seamlessly meet your deadlines. Depending on your state, workers’ compensation audits can also be a legal requirement. Web your workers’ comp policy requires audits to verify your estimated payroll. Web if your workers’ compensation policy is in a single state, you can enter your.

Liberty mutual home protector plus form hrombat

Be sure to have your current policy number and unique invoice number, which can be found on the payroll report form mailed to you. These audits help make sure you’re paying the right amount for the right coverage. State fund online has many benefits including allowing you to report all of your payroll and pay premium electronically. Web any person.

Arizona Court Says No Coverage for Worker Hurt in Wreck after Business

Web any person who knowingly files an application for insurance or claim statement containing any materially false information with intent to defraud or conceals information concerning any material fact for the purpose of misleading is committing a fraudulent insurance act. Web if your workers’ compensation policy is in a single state, you can enter your payroll report online when it’s.

Payroll Reporting FAQs

Web if your workers’ compensation policy is in a single state, you can enter your payroll report online when it’s convenient for you, rather than mailing your report with your premium payment. In this video, we walk you through what a payroll report is, why it’s important, and how to submit one. 4 minutes get more details about your payroll.

Web At Connectpay, We Provide Quarterly Tax Reports And A Gross Payroll Report So You Can Seamlessly Meet Your Deadlines.

Web employer guide report your payroll featured video how to report payroll watch on how to report payroll payroll can be complicated and confusing. 4 minutes get more details about your payroll report. Be sure to have your current policy number and unique invoice number, which can be found on the payroll report form mailed to you. Web if your workers’ compensation policy is in a single state, you can enter your payroll report online when it’s convenient for you, rather than mailing your report with your premium payment.

Submit Payroll Electronically By Enrolling In State Fund Online.

Web follow the steps outlined to report payroll for domestic workers by classification code: Depending on your state, workers’ compensation audits can also be a legal requirement. In this video, we walk you through what a payroll report is, why it’s important, and how to submit one. Web there are three different ways to submit your payroll reports.

Web Any Person Who Knowingly Files An Application For Insurance Or Claim Statement Containing Any Materially False Information With Intent To Defraud Or Conceals Information Concerning Any Material Fact For The Purpose Of Misleading Is Committing A Fraudulent Insurance Act.

State fund online has many benefits including allowing you to report all of your payroll and pay premium electronically. Web your workers’ comp policy requires audits to verify your estimated payroll. These audits help make sure you’re paying the right amount for the right coverage. Enter the payroll paid, the number of employees, and the locations indicated for the period listed.