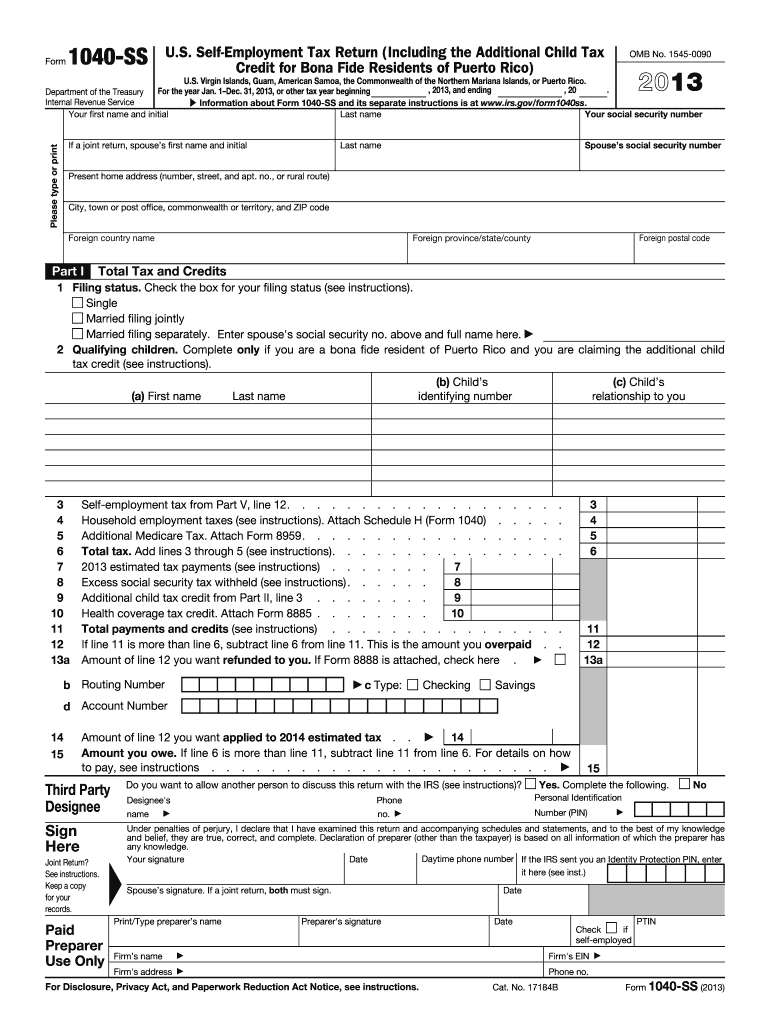

1040 Ss Tax Form

1040 Ss Tax Form - Department of the treasury |. Web popular forms & instructions; Complete, edit or print tax forms instantly. Individual tax return form 1040 instructions; Individual tax return form 1040 instructions; Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and. Web other form 1040 tables & reports. Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. Complete, edit or print tax forms instantly. Request for taxpayer identification number (tin) and certification.

31, 2020, or other tax year beginning , 2020, and ending , 20. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of columbia—even if you don’t live in the. Request for taxpayer identification number (tin) and certification. To get this automatic extension, you. Individual income tax returns (annual soi bulletin article & tables) individual income tax rates. For instructions and the latest information. Web for the year jan. Web popular forms & instructions; Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and. Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security.

Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and. Tax payments to report include federal income tax withholding, excess. Web individual tax return form 1040 instructions; Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security. Web popular forms & instructions; Web for the year jan. Department of the treasury |. For some of the western states, the following addresses were previously used: Web popular forms & instructions;

Formulario 1040SR Declaración de impuestos de los Estados Unidos para

Volunteers should remind veterans to mail their form 1040x to the irs address provided within one. Request for taxpayer identification number (tin) and certification. Tax payments to report include federal income tax withholding, excess. Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040. Web between $32,000 and $44,000, you may have.

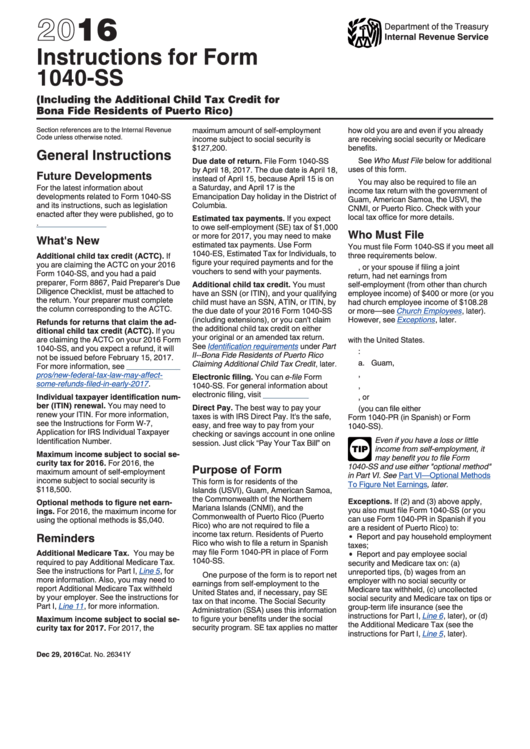

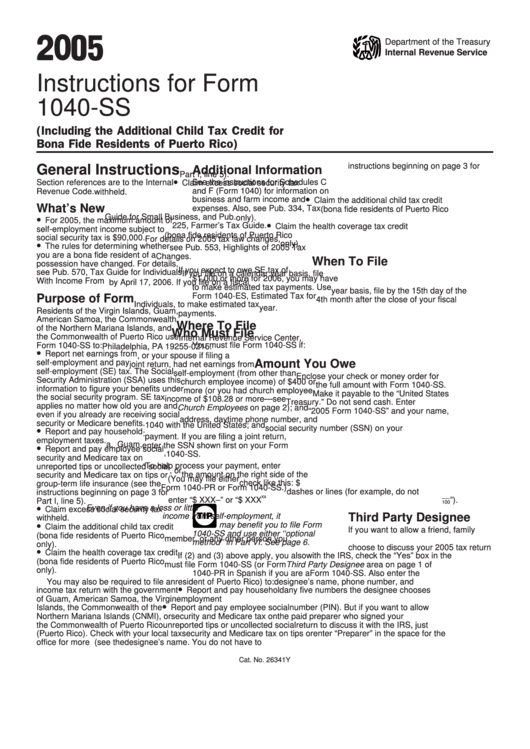

Instructions for IRS Form 1040ss U.S. Selfemployment Tax Return

More than $44,000, up to 85 percent of your benefits may be taxable. Individual tax return form 1040 instructions; Web popular forms & instructions; Individual tax return form 1040 instructions; For some of the western states, the following addresses were previously used:

1040 (2017) Internal Revenue Service

Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and. For taxpayers that are bona fide residents of puerto. Department of the treasury |. Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent.

Instructions For Form 1040Ss U.s. SelfEmployment Tax Return

For instructions and the latest information. To get this automatic extension, you. For some of the western states, the following addresses were previously used: The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of columbia—even if you don’t live in the. Individual income tax returns (annual soi bulletin article &.

2013 Form IRS 1040SS Fill Online, Printable, Fillable, Blank PDFfiller

Volunteers should remind veterans to mail their form 1040x to the irs address provided within one. Web for the year jan. For taxpayers that are bona fide residents of puerto. Department of the treasury |. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount.

worksheet. 1040 Worksheet. Worksheet Fun Worksheet Study Site

Web for the year jan. Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040. Web other form 1040 tables & reports. Complete, edit or print tax forms instantly. Individual tax return form 1040 instructions;

Form 1040SS U.S. SelfEmployment Tax Return Form (2014) Free Download

31, 2020, or other tax year beginning , 2020, and ending , 20. Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security. For instructions and the latest information. The due date is april 18, instead of april 15, because.

Form 1040 Tax Tables 2017 printable pdf download

Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. Individual tax return form 1040 instructions; Web individual tax return form 1040 instructions; Complete, edit or print tax forms instantly. Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040.

Instructions For Form 1040Ss printable pdf download

Individual income tax returns (annual soi bulletin article & tables) individual income tax rates. More than $44,000, up to 85 percent of your benefits may be taxable. Web popular forms & instructions; Tax payments to report include federal income tax withholding, excess. Individual tax return form 1040 instructions;

Instructions For Form 1040Ss U.s. SelfEmployment Tax Return

To get this automatic extension, you. Request for taxpayer identification number (tin) and certification. Web individual tax return form 1040 instructions; For instructions and the latest information. Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security.

Tax Payments To Report Include Federal Income Tax Withholding, Excess.

To get this automatic extension, you. Department of the treasury |. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Individual Tax Return Form 1040 Instructions;

Individual tax return form 1040 instructions; Web for the year jan. Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040. For instructions and the latest information.

Web The Taxable Portion Of The Benefits That's Included In Your Income And Used To Calculate Your Income Tax Liability Depends On The Total Amount Of Your Income And.

Web popular forms & instructions; Web individual tax return form 1040 instructions; Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. 31, 2020, or other tax year beginning , 2020, and ending , 20.

Individual Income Tax Returns (Annual Soi Bulletin Article & Tables) Individual Income Tax Rates.

More than $44,000, up to 85 percent of your benefits may be taxable. Volunteers should remind veterans to mail their form 1040x to the irs address provided within one. For some of the western states, the following addresses were previously used: Web other form 1040 tables & reports.