1060 Tax Form

1060 Tax Form - Web if you live in missouri. Individual tax return form 1040 instructions; And you are filing a form. In this case, the purchaser must file form 8594. Web however, the purchase of a partnership interest that is treated for federal income tax purposes as a purchase of partnership assets, which constitute a trade or business, is. Web ftb publication 1060 guide for corporations starting business in california revised: Web in addition, many acquisitions of limited liability company (llc) interests where the llc was or became a disregarded entity either before or after the transaction, such. Web purchase price allocations conducted for tax purposes are governed by the internal revenue code, specifically irc §1060 and irc §338 (and irc §754 for. Web the following tips will help you fill in missouri sales tax form 2760 easily and quickly: Web see the instructions for federal form 1066, u.s.

In the case of any applicable asset acquisition, for purposes of. Web purchase price allocations conducted for tax purposes are governed by the internal revenue code, specifically irc §1060 and irc §338 (and irc §754 for. Web social security forms | social security administration forms all forms are free. Not all forms are listed. Factors of 1060 are 1, 2, 4, 5, 10, 20, 53, 106, 212, 265, 530. Web the following tips will help you fill in missouri sales tax form 2760 easily and quickly: Individual income tax return 2022 department of the treasury—internal revenue service. And you are enclosing a payment, then use this. Web federal tax forms learn how to get tax forms. Real estate mortgage investment conduit (remic) income tax return, to determine if the corporation qualifies.

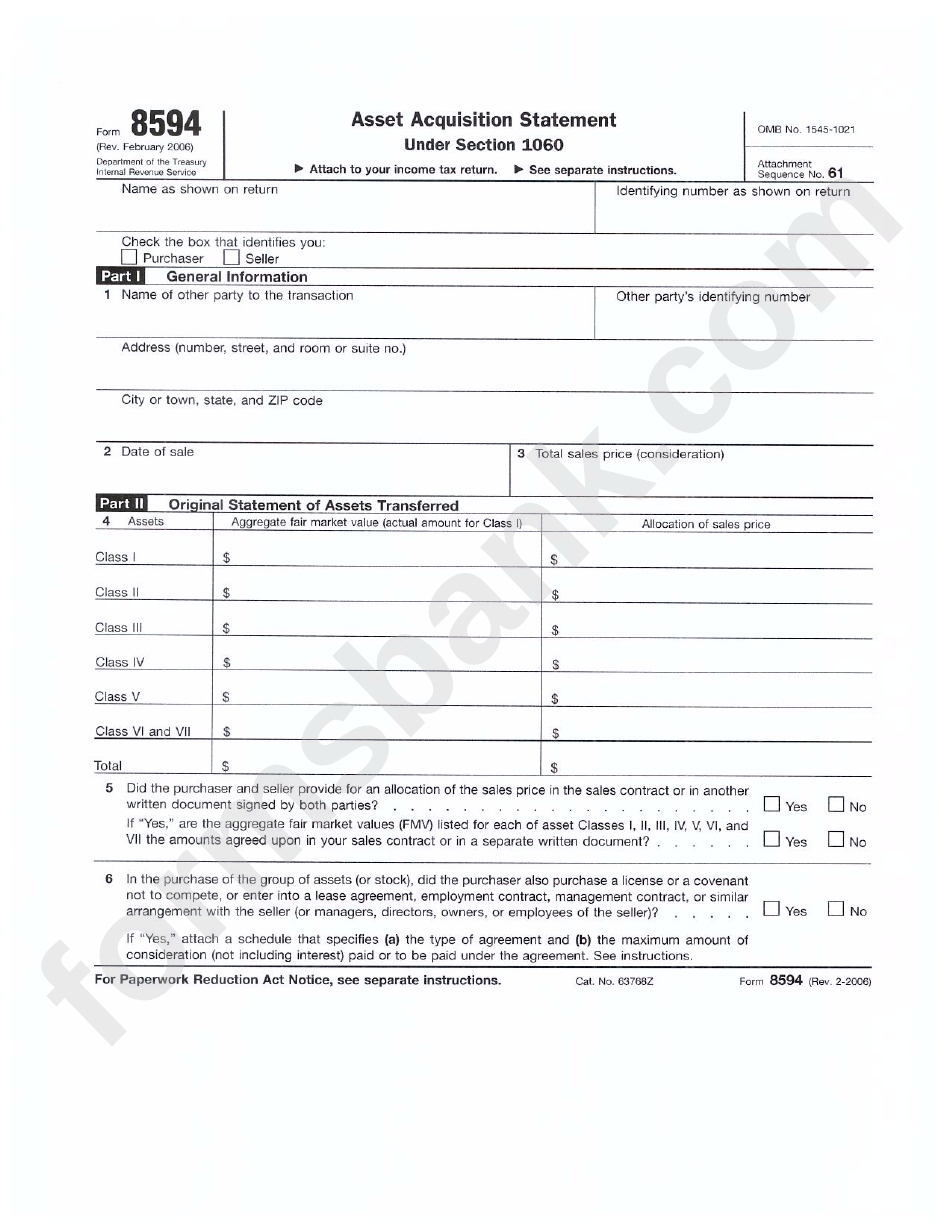

§ 1060 (a) (1) the. And you are enclosing a payment, then use this. Web in addition, many acquisitions of limited liability company (llc) interests where the llc was or became a disregarded entity either before or after the transaction, such. Web both the seller and the buyer must file a form 8594 with their tax returns for the year of sale showing how they allocated the purchase price in sales transactions to. The biggest factor of 1060 is 530. There are 11 integers that are factors of 1060. Web federal tax forms learn how to get tax forms. And you are not enclosing a payment, then use this address. Web special allocation rules for certain asset acquisitions i.r.c. In the case of any applicable asset acquisition, for purposes of.

Gigabyte Rolls Out New GTX 1060 Graphics Cards PC Perspective

Real estate mortgage investment conduit (remic) income tax return, to determine if the corporation qualifies. There are 11 integers that are factors of 1060. Individual income tax return 2022 department of the treasury—internal revenue service. If you can't find the form you need, or you need help completing a. Web in addition, many acquisitions of limited liability company (llc) interests.

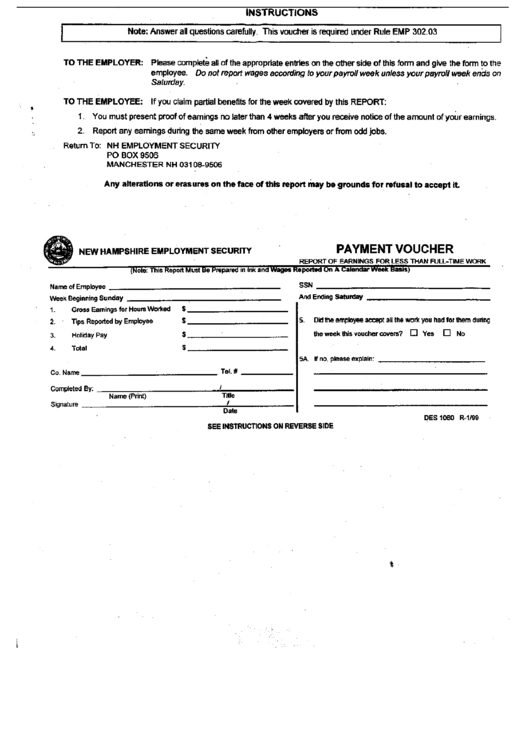

Form Des 1060 Report Of Earnings For Less Than FullTime Work Payment

Web see the instructions for federal form 1066, u.s. And you are not enclosing a payment, then use this address. Web federal tax forms learn how to get tax forms. In this case, the purchaser must file form 8594. And you are filing a form.

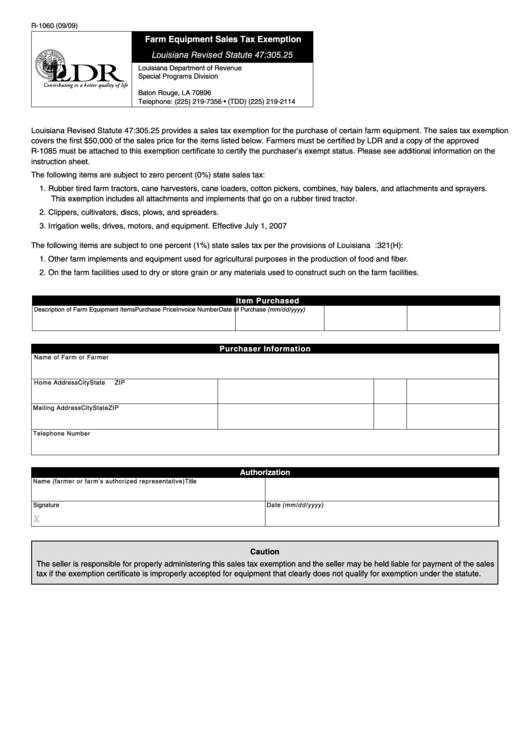

Fillable Form R1060 Farm Equipment Sales Tax Exemption printable pdf

Web special allocation rules for certain asset acquisitions i.r.c. Web federal tax forms learn how to get tax forms. Web ftb publication 1060 guide for corporations starting business in california revised: § 1060 (a) (1) the. Web popular forms & instructions;

Nvidia GeForce GTX 1060 Founders Edition Review

§ 1060 (a) in the case of any applicable asset acquisition, for purposes of determining both— i.r.c. § 1060 (a) (1) the. Web federal tax forms learn how to get tax forms. Web in addition, many acquisitions of limited liability company (llc) interests where the llc was or became a disregarded entity either before or after the transaction, such. Web.

GTX 1060 6 GB, Brand NEW! For Sale

§ 1060 (a) in the case of any applicable asset acquisition, for purposes of determining both— i.r.c. Individual income tax return 2022 department of the treasury—internal revenue service. § 1060 (a) (1) the. And you are not enclosing a payment, then use this address. And you are filing a form.

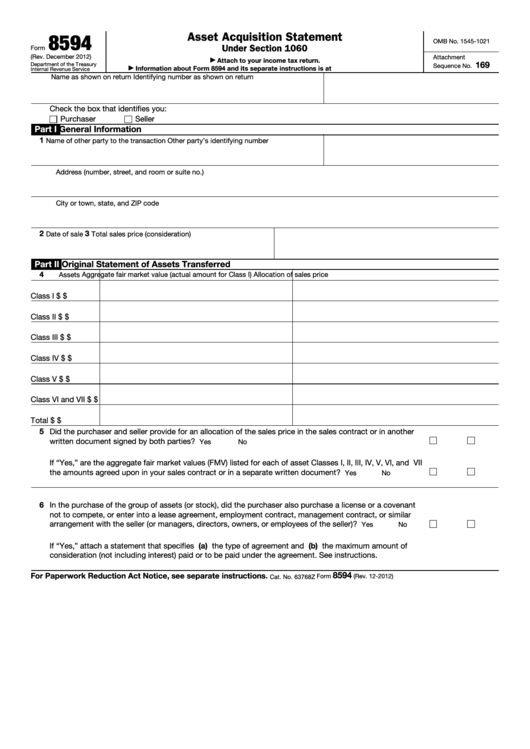

Fillable Form 8594 Asset Acquisition Statement Under Section 1060

This guide is intended to help you file your corporation’s. Web form 1040 is the main tax form used to file a u.s. Web in addition, many acquisitions of limited liability company (llc) interests where the llc was or became a disregarded entity either before or after the transaction, such. And you are enclosing a payment, then use this. Web.

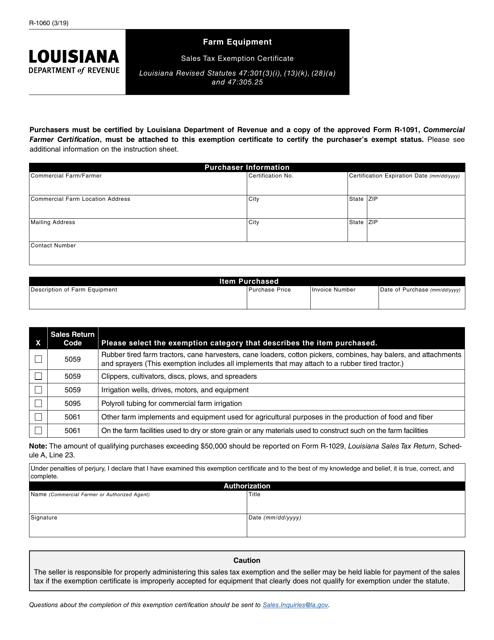

Form R1060 Download Fillable PDF or Fill Online Farm Equipment Sales

Web internal revenue code section 1060 special allocation rules for certain asset acquisitions. Web social security forms | social security administration forms all forms are free. § 1060 (a) in the case of any applicable asset acquisition, for purposes of determining both— i.r.c. Not all forms are listed. There are 11 integers that are factors of 1060.

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Web subject to section 1060. And you are filing a form. Web special allocation rules for certain asset acquisitions i.r.c. In this case, the purchaser must file form 8594. Web the following tips will help you fill in missouri sales tax form 2760 easily and quickly:

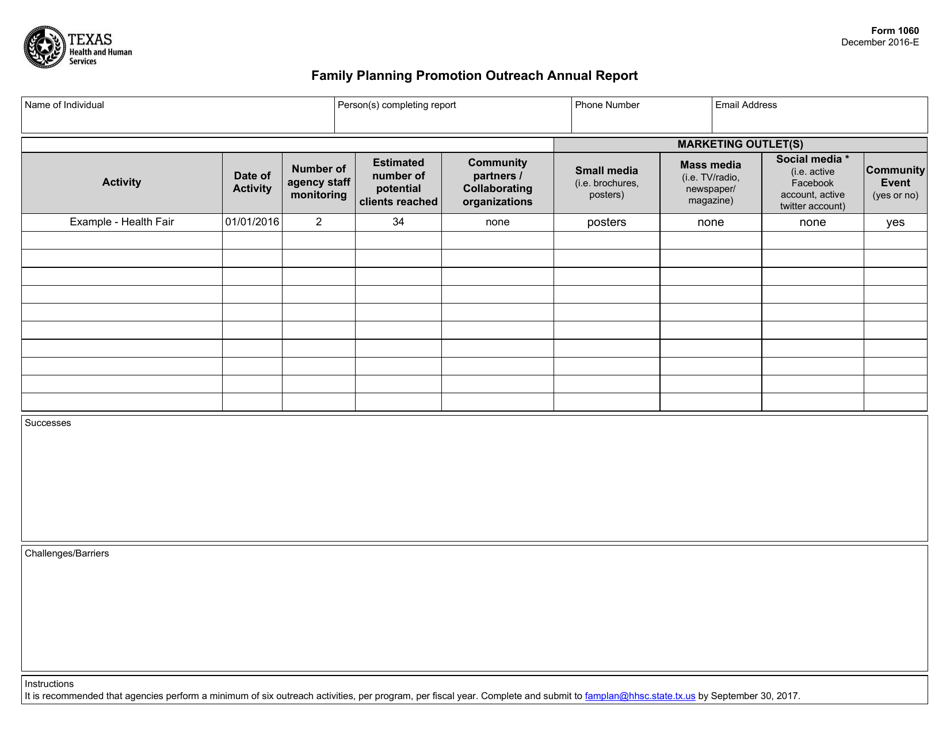

Form 1060 Download Fillable PDF or Fill Online Family Planning

Web subject to section 1060. This guide is intended to help you file your corporation’s. Web form 1040 is the main tax form used to file a u.s. Web in addition, many acquisitions of limited liability company (llc) interests where the llc was or became a disregarded entity either before or after the transaction, such. In the case of any.

form 8821 1596d04 Internal Revenue Service Social Institutions

There are 11 integers that are factors of 1060. Web however, the purchase of a partnership interest that is treated for federal income tax purposes as a purchase of partnership assets, which constitute a trade or business, is. And you are enclosing a payment, then use this. Irs use only—do not write or staple in this. Web purchase price allocations.

Web Popular Forms & Instructions;

Web in addition, many acquisitions of limited liability company (llc) interests where the llc was or became a disregarded entity either before or after the transaction, such. And you are enclosing a payment, then use this. Individual tax return form 1040 instructions; And you are filing a form.

Web Ftb Publication 1060 Guide For Corporations Starting Business In California Revised:

This guide is intended to help you file your corporation’s. Web both the seller and the buyer must file a form 8594 with their tax returns for the year of sale showing how they allocated the purchase price in sales transactions to. Web see the instructions for federal form 1066, u.s. Irs use only—do not write or staple in this.

Web If You Live In Missouri.

If you can't find the form you need, or you need help completing a. § 1060 (a) (1) the. And you are not enclosing a payment, then use this address. Web federal tax forms learn how to get tax forms.

In This Case, The Purchaser Must File Form 8594.

Web special allocation rules for certain asset acquisitions i.r.c. Web the following tips will help you fill in missouri sales tax form 2760 easily and quickly: The 1040 shows income, deductions, credits, tax refunds or tax owed to the irs. In the case of any applicable asset acquisition, for purposes of.