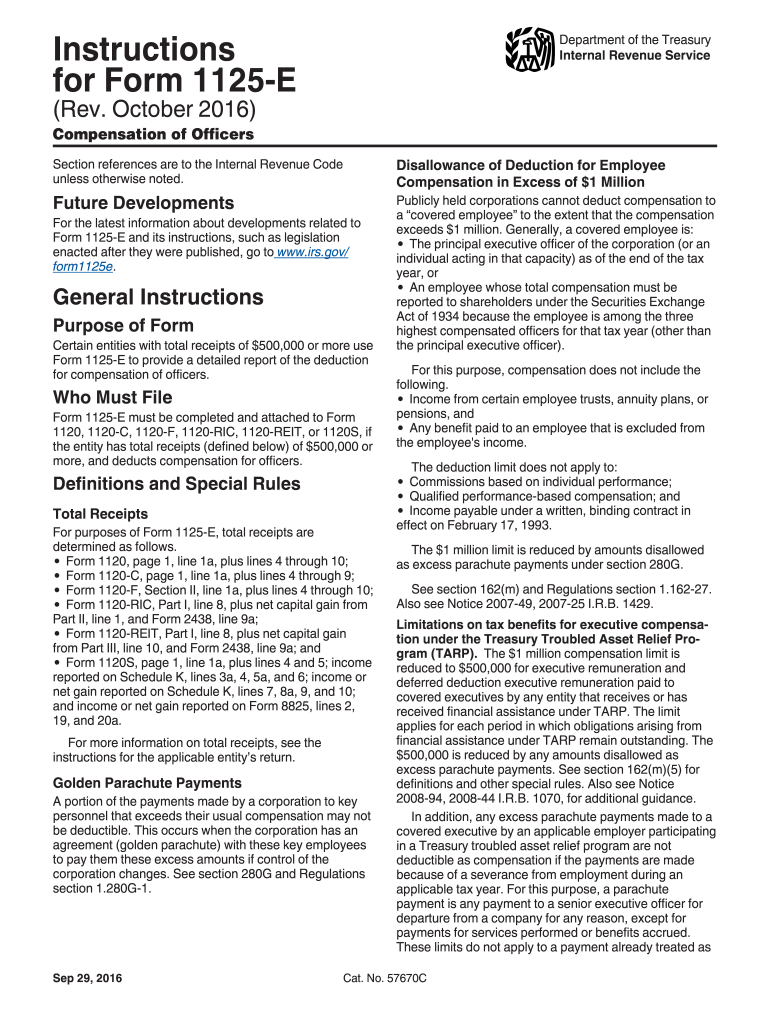

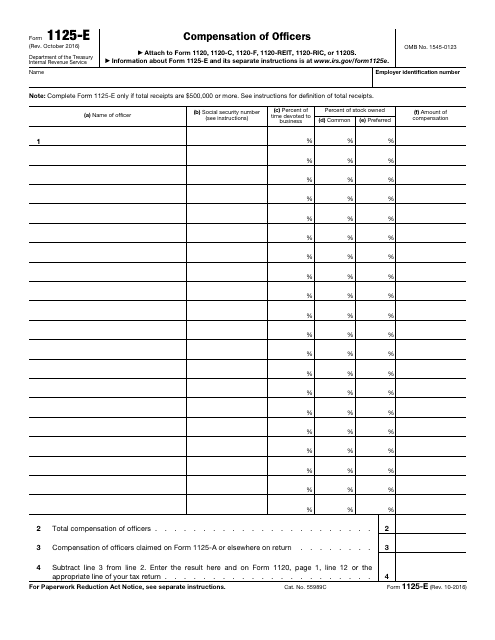

1125-E Irs Form

1125-E Irs Form - Try it for free now! Web for example, enter 40 to indicate 40 percent. Include only the deductible part of. Do not include compensation deductible. It is not a form provided an officer to prepare their own return. Upload, modify or create forms. Web what is irs form 1125 e? Complete, edit or print tax forms instantly. It is for separate entity business returns. Certain entities with total receipts.

Complete, edit or print tax forms instantly. Web what is irs form 1125 e? Is the form supported in our. Include only the deductible part of. Upload, modify or create forms. Do not include compensation deductible. You can download or print current or. Web for example, enter 40 to indicate 40 percent. Certain entities with total receipts. It is for separate entity business returns.

It is not a form provided an officer to prepare their own return. You can download or print current or. Complete, edit or print tax forms instantly. Web for example, enter 40 to indicate 40 percent. Try it for free now! Upload, modify or create forms. Do not include compensation deductible. Include only the deductible part of. Web what is irs form 1125 e? It is for separate entity business returns.

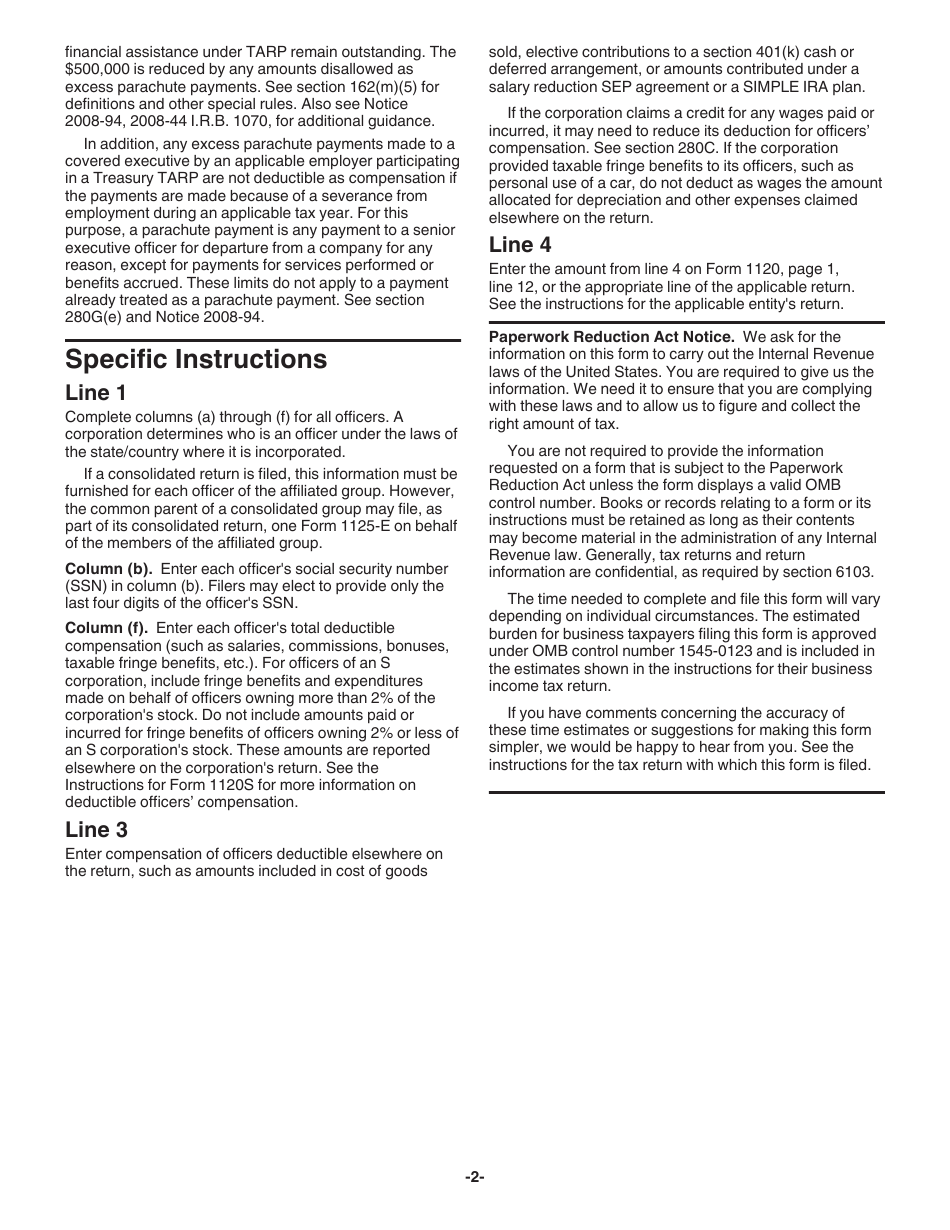

2013 Form IRS Instruction 1125E Fill Online, Printable, Fillable

Is the form supported in our. Include only the deductible part of. It is for separate entity business returns. You can download or print current or. Do not include compensation deductible.

3.11.217 Form 1120S Corporation Tax Returns Internal Revenue

Include only the deductible part of. Complete, edit or print tax forms instantly. You can download or print current or. It is not a form provided an officer to prepare their own return. Certain entities with total receipts.

3.11.217 Form 1120S Corporation Tax Returns Internal Revenue

You can download or print current or. Do not include compensation deductible. It is not a form provided an officer to prepare their own return. Complete, edit or print tax forms instantly. Upload, modify or create forms.

Form 1125 Fill Out and Sign Printable PDF Template signNow

Include only the deductible part of. Upload, modify or create forms. Certain entities with total receipts. It is for separate entity business returns. You can download or print current or.

نموذج مصلحة الضرائب 1120S تعريف ، تحميل ، و 1120S تعليمات 2022

Complete, edit or print tax forms instantly. Is the form supported in our. It is not a form provided an officer to prepare their own return. Certain entities with total receipts. Include only the deductible part of.

IRS Form 1125E Download Fillable PDF or Fill Online Compensation of

It is for separate entity business returns. Complete, edit or print tax forms instantly. Upload, modify or create forms. Certain entities with total receipts. Is the form supported in our.

Download Instructions for IRS Form 1125E Compensation of Officers PDF

Do not include compensation deductible. You can download or print current or. It is not a form provided an officer to prepare their own return. Is the form supported in our. Complete, edit or print tax forms instantly.

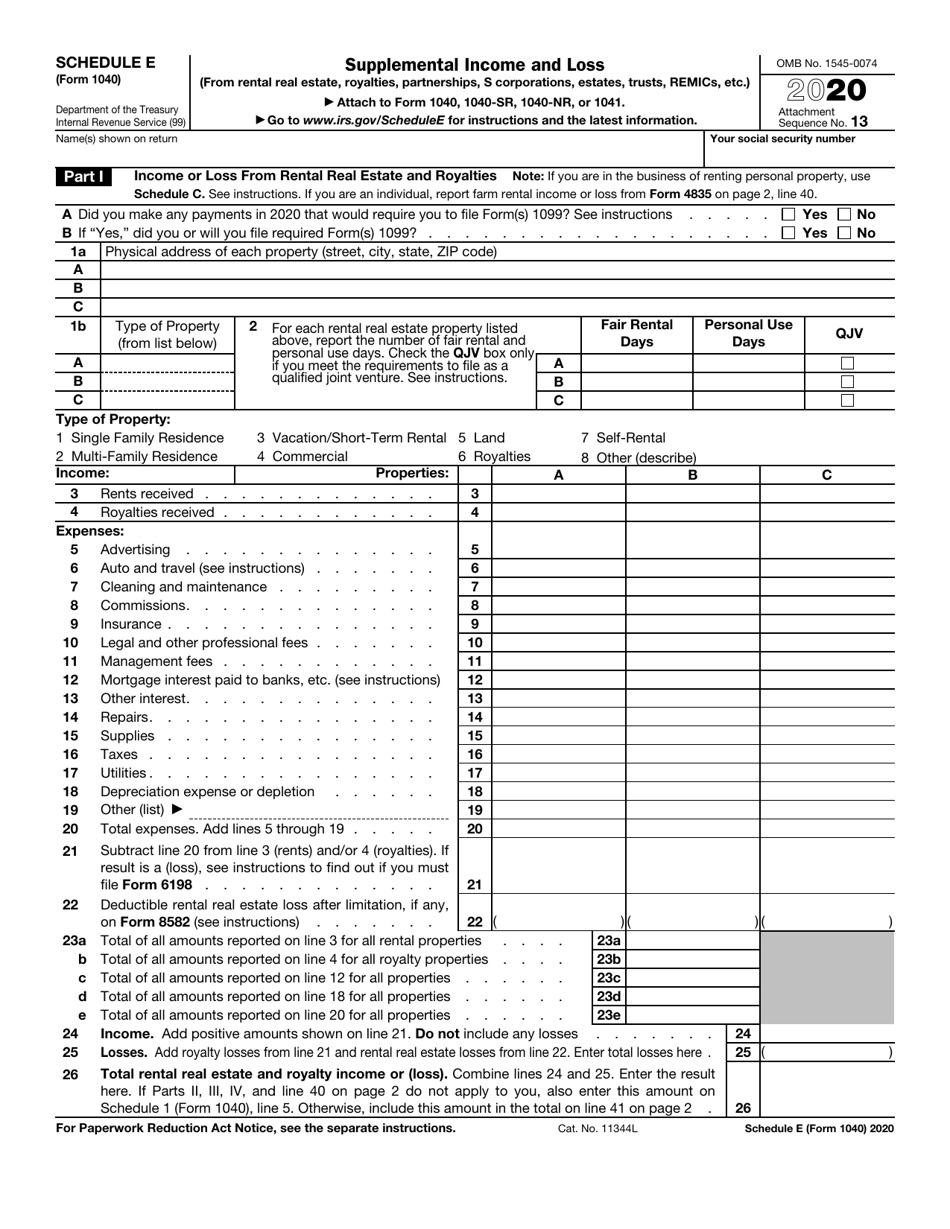

IRS Form 1040 Schedule E Download Fillable PDF or Fill Online

Complete, edit or print tax forms instantly. Web for example, enter 40 to indicate 40 percent. Do not include compensation deductible. It is for separate entity business returns. Include only the deductible part of.

Form 1125E Compensation of Officers (2013) Free Download

Try it for free now! Certain entities with total receipts. Do not include compensation deductible. Web for example, enter 40 to indicate 40 percent. It is for separate entity business returns.

Include Only The Deductible Part Of.

It is not a form provided an officer to prepare their own return. It is for separate entity business returns. Upload, modify or create forms. Is the form supported in our.

Certain Entities With Total Receipts.

Complete, edit or print tax forms instantly. You can download or print current or. Web what is irs form 1125 e? Do not include compensation deductible.

Web For Example, Enter 40 To Indicate 40 Percent.

Try it for free now!