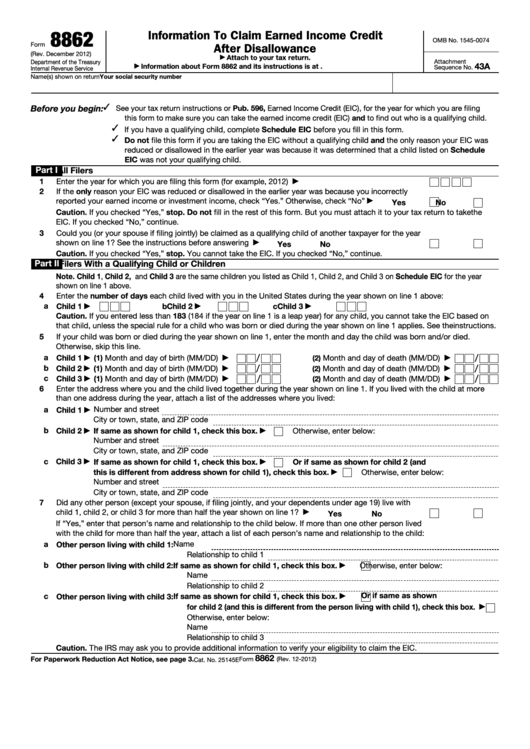

8862 Tax Form

8862 Tax Form - You can't be a qualifying child on another return. You must be a citizen of the united states, and must live in the u.s. Web march 26, 2020 7:26 am. Filing this form allows you to reclaim credits for which you are now eligible. Married filing jointly vs separately. You must have earned income for the tax year and a valid social security number (ssn). December 2022) department of the treasury internal revenue service. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Information to claim certain credits after disallowance. Guide to head of household.

You must have earned income for the tax year and a valid social security number (ssn). Your eic was reduced or disallowed for any reason other than a math or clerical error for a year after 1996. You can download form 8862 from the irs website and file it. Filing this form allows you to reclaim credits for which you are now eligible. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Web several standards must be met for you to claim the eic: You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Guide to head of household. December 2022) department of the treasury internal revenue service. You must be a citizen of the united states, and must live in the u.s.

March 23, 2022 6:03 pm. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. Web march 26, 2020 7:26 am. Guide to head of household. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web several standards must be met for you to claim the eic: You’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another notice from the irs). December 2022) department of the treasury internal revenue service. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error.

Fillable Form 8862 Information To Claim Earned Credit After

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax.

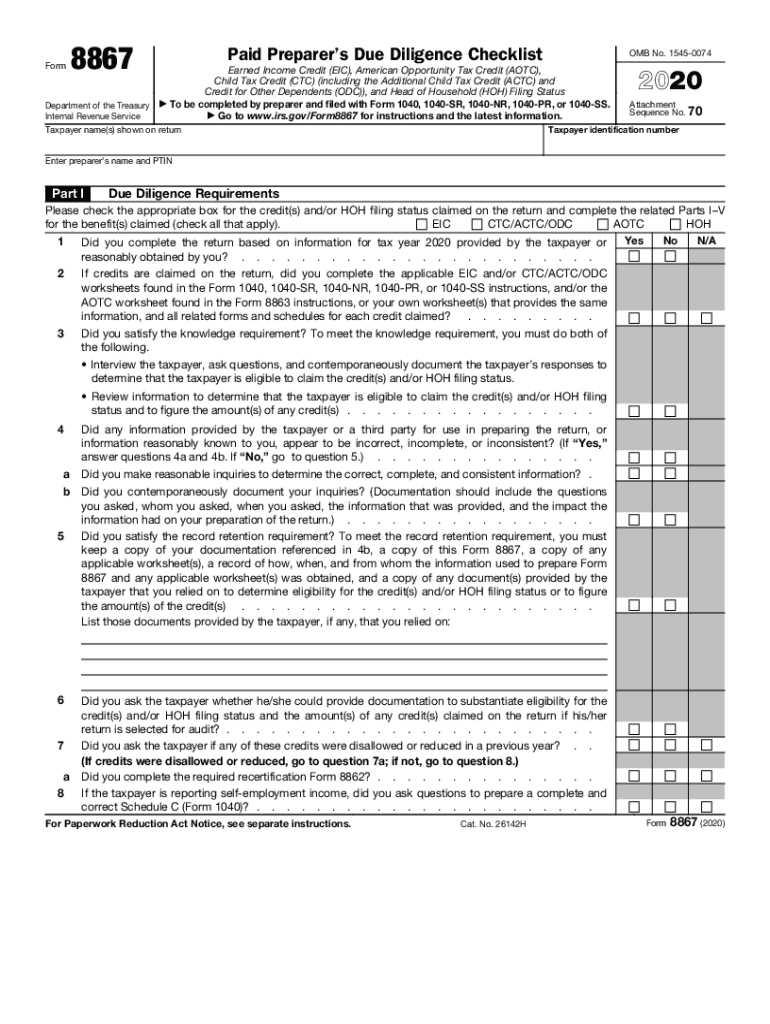

2020 Form IRS 8867 Fill Online, Printable, Fillable, Blank pdfFiller

File taxes with no income. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. Web how do i enter form 8862? Filing this form allows you to reclaim credits.

IRS Publication Form 8867 Earned Tax Credit Irs Tax Forms

For more than half of the year. Guide to head of household. You can download form 8862 from the irs website and file it. You can't be a qualifying child on another return. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits.

Fill Free fillable F8862 Form 8862 (Rev. November 2018) PDF form

December 2022) department of the treasury internal revenue service. Guide to head of household. You now want to claim the eic and you meet all the requirements. You can download form 8862 from the irs website and file it. Web several standards must be met for you to claim the eic:

How Do I File My Form 8862? StandingCloud

March 23, 2022 6:03 pm. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. You can't be a qualifying child on another return. Web march 26, 2020 7:26 am. Information to claim.

Form 8862 Information to Claim Earned Credit After

March 23, 2022 6:03 pm. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc,.

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Filing this form allows you to reclaim credits for which you are now eligible. For more than half of the year. Earned income.

Irs Form 8862 Printable Master of Documents

You now want to claim the eic and you meet all the requirements. For more than half of the year. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits..

37 INFO PRINTABLE TAX FORM 8862 PDF ZIP DOCX PRINTABLE DOWNLOAD * Tax

You must be a citizen of the united states, and must live in the u.s. You can't be a qualifying child on another return. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web several standards.

Form 8862Information to Claim Earned Credit for Disallowance

Web how do i enter form 8862? Filing this form allows you to reclaim credits for which you are now eligible. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) You must be a citizen of the united states, and.

Filing This Form Allows You To Reclaim Credits For Which You Are Now Eligible.

If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. December 2022) department of the treasury internal revenue service. You must have earned income for the tax year and a valid social security number (ssn). Information to claim certain credits after disallowance.

You Must Be A Citizen Of The United States, And Must Live In The U.s.

File taxes with no income. You’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another notice from the irs). Web taxpayers complete form 8862 and attach it to their tax return if: You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits.

You Can't Be A Qualifying Child On Another Return.

Web how do i enter form 8862? Web tax tips & video homepage. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. Solved • by turbotax • 7243 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows you to use the credit again.

Your Eic Was Reduced Or Disallowed For Any Reason Other Than A Math Or Clerical Error For A Year After 1996.

You can download form 8862 from the irs website and file it. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. You now want to claim the eic and you meet all the requirements. Married filing jointly vs separately.