Adoption Tax Credit Form

Adoption Tax Credit Form - Web for adoptions finalized in 2022, there is a federal adoption tax credit of up to $14,890 per child. Edit, sign and print tax forms on any device with signnow. If you paid qualified adoption expenses to adopt a child who is a u.s. Web to claim the adoption credit or exclusion, complete form 8839, qualified adoption expenses and attach the form to your form 1040, u.s. Web to claim the adoption tax credit, you must file irs form 8839, 10 which includes specific information about the child by adoption. Ad with the right expertise, federal tax credits and incentives could benefit your business. Must be signed so we can conduct an inquiry with a credit bureau and. Web please send a newly signed copy to the address shown on the top of your notice. Due to processing delays for 2019 and 2020 tax returns, the issuance of cp80 and cp080. Web the adoption tax credit is a nonrefundable credit, which means it only offsets your federal income tax liability.

Web when the adoption is final. Web • rebuilding communities tax credit • seed capital tax credit • small business incubator tax credit* • special needs adoption tax credit* • sporting event tax credit •. Web to claim the adoption tax credit, you must file irs form 8839, 10 which includes specific information about the child by adoption. Web please send a newly signed copy to the address shown on the top of your notice. Work with federal tax credits and incentives specialists who have decades of experience. Web disclosure and authorization pertaining to consumer reports pursuant to the fair credit reporting act. The five year period begins when. Edit, sign and print tax forms on any device with signnow. To claim the credit, you have to file form 8839, qualified adoption expenses and meet the modified. Your income tax liability is the amount you are responsible for in.

You can claim both the exclusion and the. The 2022 maximum dollar amount per eligible child is $14,890. Web the credit adjusts for inflation and amounts to $14,890 in 2022. The five year period begins when. Adoption tax credit is phased out based on your. Web to report your qualified adoption expenses, you’ll use irs form 8839. The 2022 adoption tax credit is not refundable, which means taxpayers can. The credit is available for a total of five consecutive years. Web in one year, taxpayers can use as much of the adoption tax credit as the full amount of their federal income tax liability, which is the amount on line 18 of the 2020 form 1040. To claim the credit, you have to file form 8839, qualified adoption expenses and meet the modified.

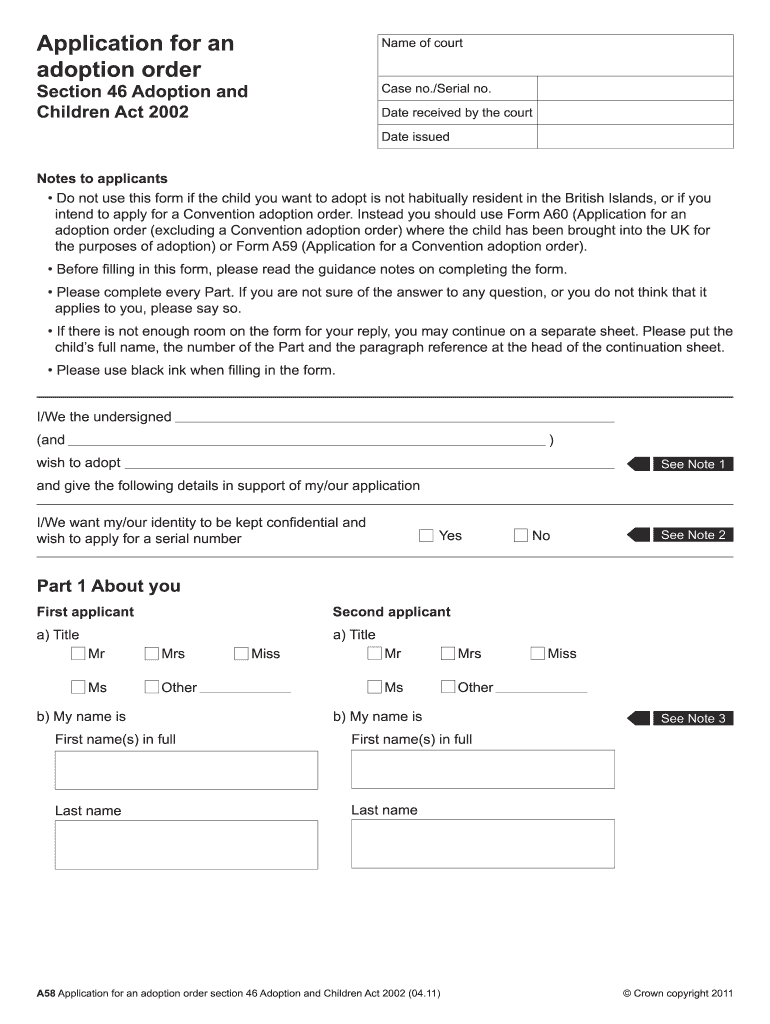

Adoption Forms Pdf 20202022 Fill and Sign Printable Template Online

The 2022 maximum dollar amount per eligible child is $14,890. Ad with the right expertise, federal tax credits and incentives could benefit your business. Adoption tax credit is phased out based on your. They use this form to figure how. To claim the credit, you have to file form 8839, qualified adoption expenses and meet the modified.

Adoption tax credit

Web disclosure and authorization pertaining to consumer reports pursuant to the fair credit reporting act. Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of revenue, and are listed. Web the adoption tax benefits provide an incentive for individuals or families to adopt an eligible child. Web •.

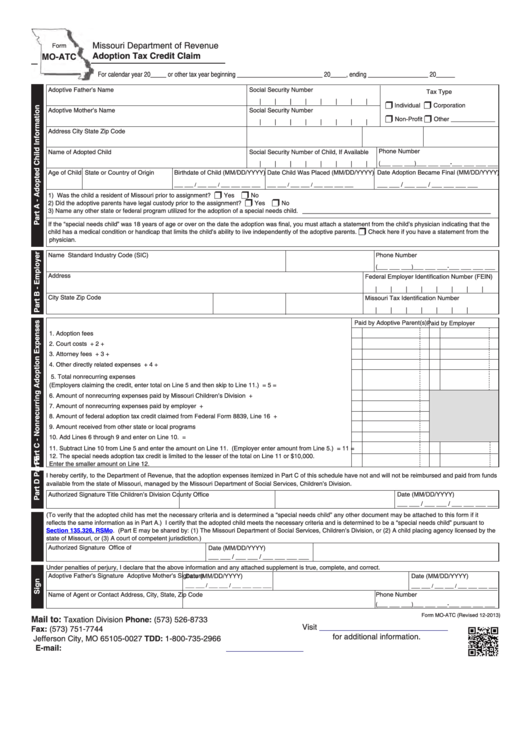

Fillable Form MoAtc Adoption Tax Credit Claim printable pdf download

Due to processing delays for 2019 and 2020 tax returns, the issuance of cp80 and cp080. Complete, edit or print tax forms instantly. Web if you paid adoption expenses in 2022, you might qualify for a credit of up to $14,890 for each child you adopted. Edit, sign and print tax forms on any device with signnow. Web in one.

What Is the Adoption Tax Credit? Credit Karma Tax®

Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of revenue, and are listed. Web disclosure and authorization pertaining to consumer reports pursuant to the fair credit reporting act. Web the credit adjusts for inflation and amounts to $14,890 in 2022. Edit, sign and print tax forms on.

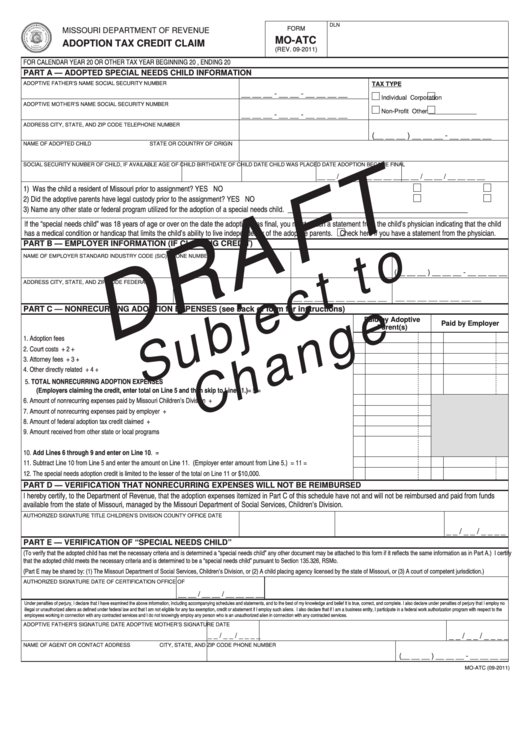

Form MoAtc Adoption Tax Credit Claim 2011 printable pdf download

The five year period begins when. Edit, sign and print tax forms on any device with signnow. Web to claim the adoption credit, taxpayers complete form 8839, qualified adoption expenses and attach it to their tax return. Due to processing delays for 2019 and 2020 tax returns, the issuance of cp80 and cp080. Web the maximum adoption credit taxpayers can.

How does adoption tax credit work? Internal Revenue Code Simplified

They use this form to figure how. The credit amount depends on your income. Web in one year, taxpayers can use as much of the adoption tax credit as the full amount of their federal income tax liability, which is the amount on line 18 of the 2020 form 1040. Web the credit adjusts for inflation and amounts to $14,890.

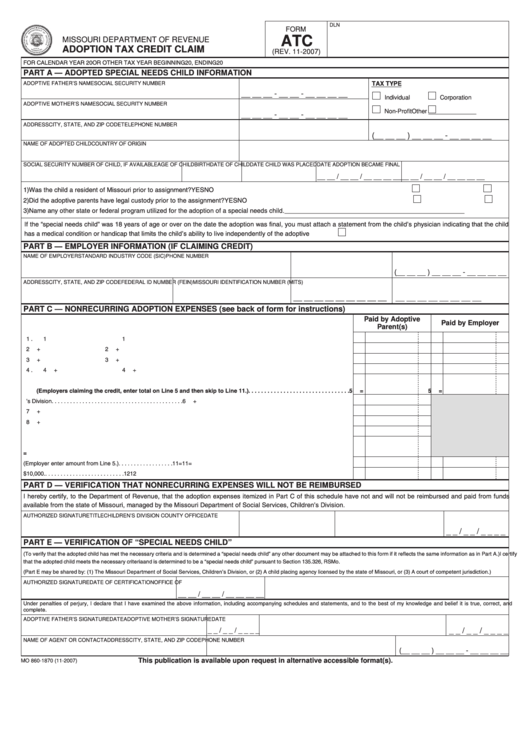

Fillable Form Atc Adoption Tax Credit Claim printable pdf download

Web for adoptions finalized in 2022, there is a federal adoption tax credit of up to $14,890 per child. Web in one year, taxpayers can use as much of the adoption tax credit as the full amount of their federal income tax liability, which is the amount on line 18 of the 2020 form 1040. Web the adoption tax credit.

Facts About the Adoption Tax Credit Heaven & Alvarez, LLC

Ad with the right expertise, federal tax credits and incentives could benefit your business. Web for adoptions finalized in 2022, there is a federal adoption tax credit of up to $14,890 per child. Web to report your qualified adoption expenses, you’ll use irs form 8839. Web the miscellaneous tax credits offered by the state of missouri, are administered by several.

2018 Adoption Tax Credit Love Adoption Life

Adoption tax credit is phased out based on your. They use this form to figure how. Your income tax liability is the amount you are responsible for in. To claim the credit, you have to file form 8839, qualified adoption expenses and meet the modified. If you paid qualified adoption expenses to adopt a child who is a u.s.

What To Know About The Adoption Tax Credit Create Healthy Lifestyle

Web to claim the adoption credit or exclusion, complete form 8839, qualified adoption expenses and attach the form to your form 1040, u.s. Web the adoption tax credit is capped at $15,950 per child for tax year 2023 and $14,890 per child for tax year 2022. Web to report your qualified adoption expenses, you’ll use irs form 8839. There are.

Must Be Signed So We Can Conduct An Inquiry With A Credit Bureau And.

The five year period begins when. Due to processing delays for 2019 and 2020 tax returns, the issuance of cp80 and cp080. Web the credit adjusts for inflation and amounts to $14,890 in 2022. Web to claim the adoption tax credit, you must file irs form 8839, 10 which includes specific information about the child by adoption.

Web When The Adoption Is Final.

Web • rebuilding communities tax credit • seed capital tax credit • small business incubator tax credit* • special needs adoption tax credit* • sporting event tax credit •. Web to claim the adoption credit, taxpayers complete form 8839, qualified adoption expenses and attach it to their tax return. Web the adoption tax benefits provide an incentive for individuals or families to adopt an eligible child. Web please send a newly signed copy to the address shown on the top of your notice.

Edit, Sign And Print Tax Forms On Any Device With Signnow.

The credit is available for a total of five consecutive years. Web updated february 2022 for adoptions finalized in 2021, there is a federal adoption tax credit of up to $14,440 per child. They use this form to figure how. Complete, edit or print tax forms instantly.

The 2022 Adoption Tax Credit Is Not Refundable, Which Means Taxpayers Can.

The 2021 adoption tax credit is not refundable,. Web to claim the adoption credit or exclusion, complete form 8839, qualified adoption expenses and attach the form to your form 1040, u.s. Work with federal tax credits and incentives specialists who have decades of experience. Adoption tax credit is phased out based on your.