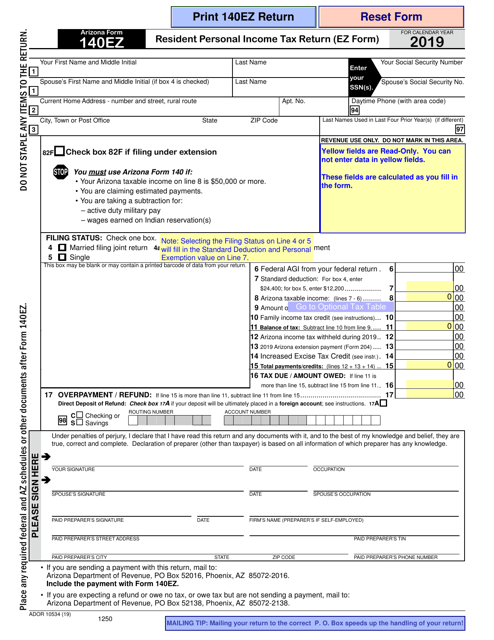

Arizona Tax Form 140Ez

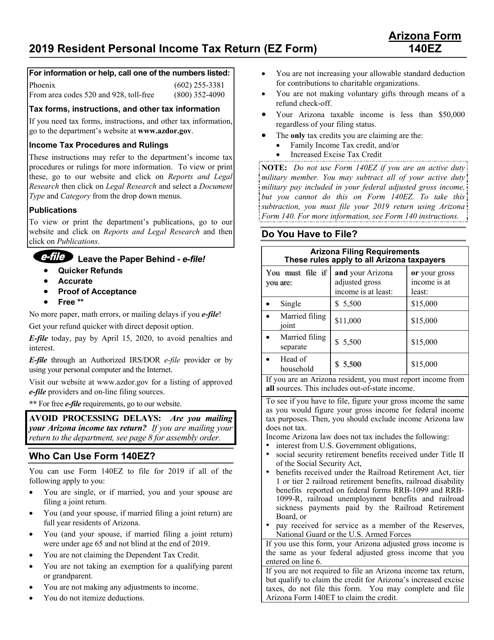

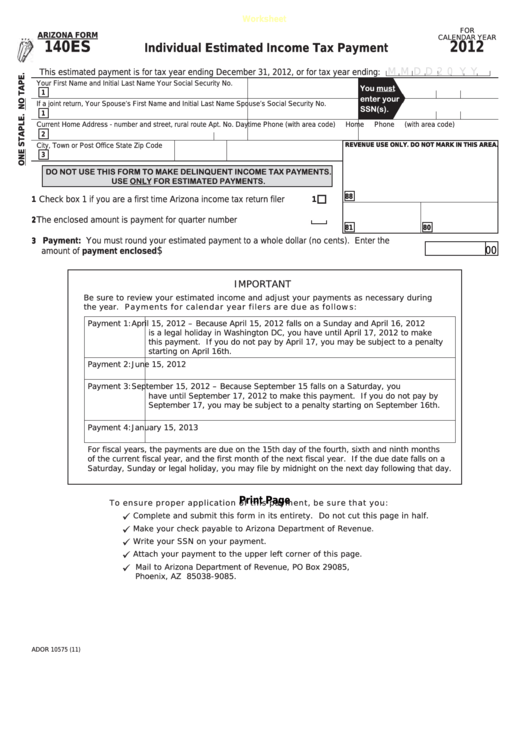

Arizona Tax Form 140Ez - Your arizona taxable income is $50,000 or more, regardless of filing status. Your arizona taxable income is $50,000 or more, regardless of filing status; Stop you must use arizona form 140 if: Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. You are single, or if married, you and your spouse are filing a joint return. 16, 2023, with an extension. Form number 140es category individual payment vouchers This form should be completed after filing your federal taxes, using form 1040. You must use form 140 if any of the following apply:

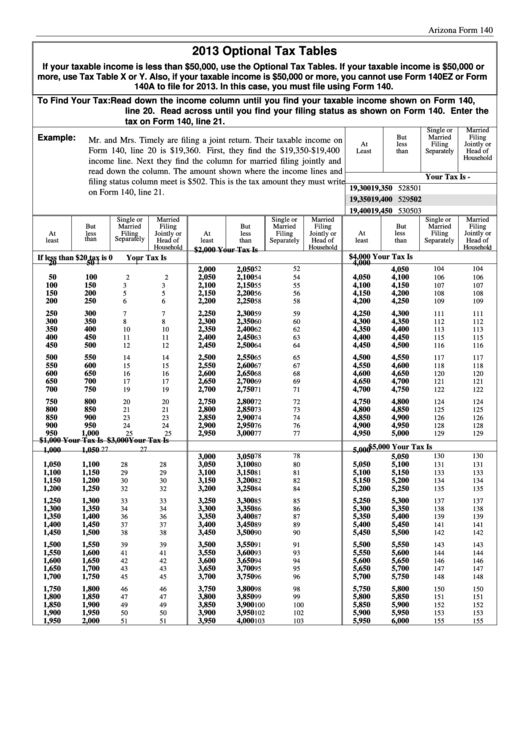

You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Designed for simplicity, the form is geared toward taxpayers with less than $50,000 in annual income and a. Web what is the arizona form 140ez? • your arizona taxable income on line 8 is $50,000 or more. Get your online template and fill it in using progressive features. • you are single, or if married, you and your spouse are filing a joint return. Web personal income tax return filed by resident taxpayers. The arizona 140ez form is a streamlined tax return form for eligible residents in arizona. •ou are single, or if married, you and your spouse are filing a y joint return. Web 2021 arizona optional tax tables for forms 140, 140a, and 140ez if your taxable income is less than $50,000, use the optional tax tables.

•ou are single, or if married, you and your spouse are filing a y joint return. You must use form 140 if any of the following apply: Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. Web include the payment with form 140ez. Your arizona taxable income is $50,000 or more, regardless of filing status. Arizona state income tax returns for tax year 2022 were due april 18, 2023, or oct. Web who can use arizona form 140ez? Your taxable income is less than $50,000 regardless of your filing status. The arizona 140ez form is a streamlined tax return form for eligible residents in arizona. In this case, you must file using form 140.

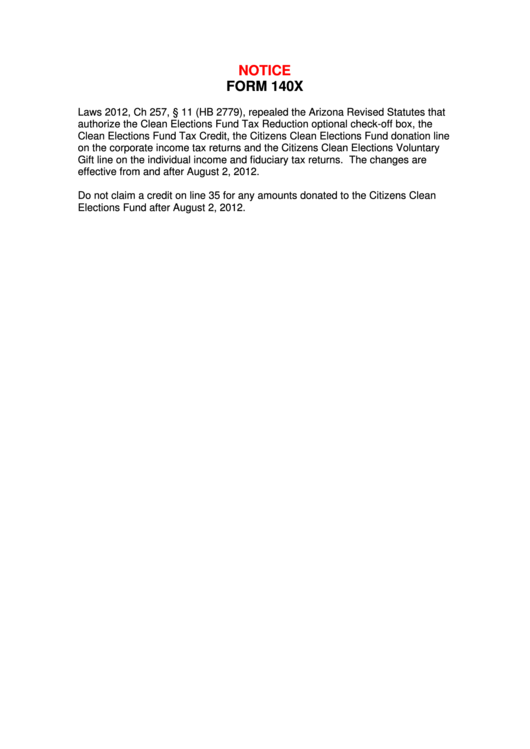

Fillable Arizona Form 140x Individual Amended Tax Return

•ou, and your spouse if married filing a joint return, are full y year residents of arizona. You are single, or if married, you and your spouse are filing a joint return. Web 2021 arizona optional tax tables for forms 140, 140a, and 140ez if your taxable income is less than $50,000, use the optional tax tables. Web you can.

Download Instructions for Arizona Form 140EZ, ADOR10534 Resident

Your taxable income is less than $50,000 regardless of your filing status. Designed for simplicity, the form is geared toward taxpayers with less than $50,000 in annual income and a. You are making adjustments to income Stop you must use arizona form 140 if: If your taxable income is $50,000 or more, use tax table x or y.

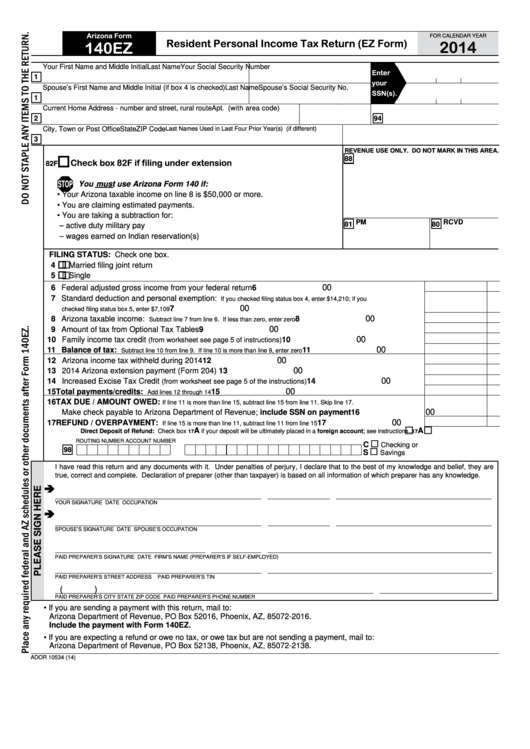

Fillable Arizona Form 140ez Resident Personal Tax Return (Ez

16, 2023, with an extension. Form number 140es category individual payment vouchers Web include the payment with form 140ez. This form is used by residents who file an individual income tax return. Stop you must use arizona form 140 if:

Arizona 140ez Fillable Form

You can print other arizona tax forms here. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. This.

azdor.gov Forms 140EZ_fillable

Web arizona state income tax form 140 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated the resident personal income tax (ez form) package in february 2023, so this is the latest version.

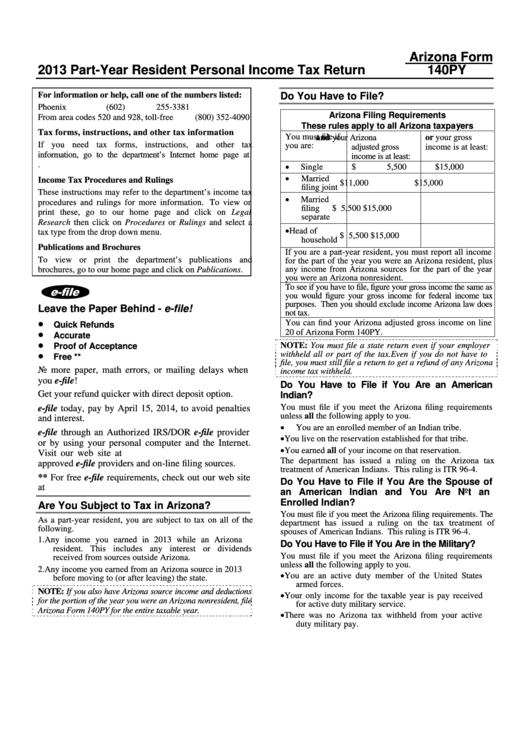

Arizona Form 140py PartYear Resident Personal Tax Return

•ou are single, or if married, you and your spouse are filing a y joint return. This form should be completed after filing your federal taxes, using form 1040. If your taxable income is $50,000 or more, you cannot use form 140ez or form 140a to file for 2021. • you, and your spouse if married filing a joint. Web.

Arizona Form 140EZ (ADOR10534) Download Fillable PDF or Fill Online

Designed for simplicity, the form is geared toward taxpayers with less than $50,000 in annual income and a. Web include the payment with form 140ez. If your taxable income is $50,000 or more, use tax table x or y. • you, and your spouse if married filing a joint. Your taxable income is less than $50,000 regardless of your filing.

Fillable Arizona Form 140es Individual Estimated Tax Payment

If your taxable income is $50,000 or more, you cannot use form 140ez or form 140a to file for 2021. You must use tax tables x and y to figure your tax. You are single, or if married, you and your spouse are filing a joint return. • your arizona taxable income on line 8 is $50,000 or more. You.

azdor.gov Forms 140EZ20instructions

Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue. In this case, you must file using form 140. Your taxable income is less than $50,000 regardless of your filing status. The allowable $5,000 subtraction was repealed. • you are single, or if married, you and your spouse are filing a joint return.

Arizona Form 140 Optional Tax Tables 2013 printable pdf download

Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. If your taxable income is $50,000 or more, use tax table x or y. Printable arizona state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. •ou,.

Web Who Can Use Arizona Form 140Ez?

You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. You must use tax tables x and y to figure your tax. •ou, and your spouse if married filing a joint return, were y under age 65 and not blind a. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

Your Taxable Income Is Less Than $50,000 Regardless Of Your Filing Status.

Web we last updated the resident personal income tax (ez form) package in february 2023, so this is the latest version of form 140ez, fully updated for tax year 2022. If your taxable income is $50,000 or more, you cannot use form 140ez or form 140a to file for 2021. Here are links to common arizona tax forms for individual filers, along with instructions: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability.

Web If Your Taxable Income Is $50,000 Or More, You Must Use Tax Tables X And Y To Figure Your Tax.

Designed for simplicity, the form is geared toward taxpayers with less than $50,000 in annual income and a. You may use form 140ez if all of the following apply: You are single, or if married, you and your spouse are filing a joint return. In this case, you must file using form 140.

You Must Use Form 140 If Any Of The Following Apply:

Web personal income tax return filed by resident taxpayers. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. You must use form 140 if any of the following apply: Web include the payment with form 140ez.