Blank Form 1099-Nec

Blank Form 1099-Nec - Web the 1099 form is a combined federal/state information return, with a copy furnished to the recipient payee. You'll be able to obtain the blank form from the pdfliner catalog. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone engaged in the trade or business. Current general instructions for certain information returns. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Instructions for the recipient (copy b) are printed on the back of each of the 3 forms. Press the green arrow with the inscription next to jump from one field to another. The address you use depends on the location of your business and will either need to be. Both the forms and instructions will be updated as needed. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor.

The address you use depends on the location of your business and will either need to be. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Payer’s information, including name, address and taxpayer identification number (tin). Web this form is used to report payments made to independent contractors and other nonemployees for services performed. You'll be able to obtain the blank form from the pdfliner catalog. Examples of this include freelance work or driving for doordash or uber. Both the forms and instructions will be updated as needed. For internal revenue service center. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Current general instructions for certain information returns.

Instructions for the recipient (copy b) are printed on the back of each of the 3 forms. Web this form is used to report payments made to independent contractors and other nonemployees for services performed. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during the year. Current general instructions for certain information returns. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Examples of this include freelance work or driving for doordash or uber. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Web the 1099 form is a combined federal/state information return, with a copy furnished to the recipient payee. Both the forms and instructions will be updated as needed. It also includes professionals such as accountants and attorneys.

Now is the Time to Start Preparing for Vendor 1099 Forms Innovative

Current general instructions for certain information returns. The address you use depends on the location of your business and will either need to be. It also includes professionals such as accountants and attorneys. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Both the forms and instructions will be updated as needed.

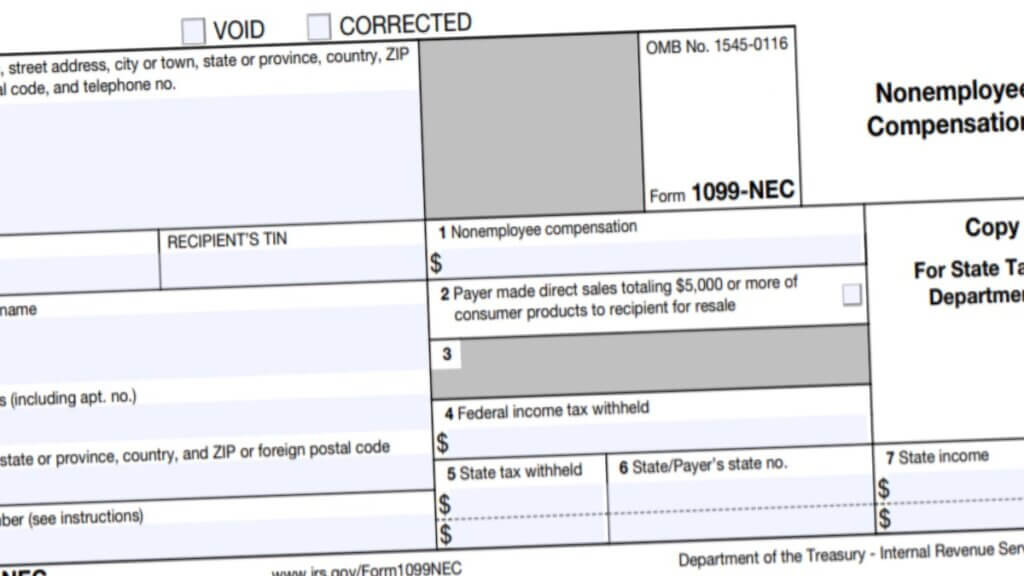

How to File Your Taxes if You Received a Form 1099NEC

Instructions for the recipient (copy b) are printed on the back of each of the 3 forms. It also includes professionals such as accountants and attorneys. Examples of this include freelance work or driving for doordash or uber. You'll be able to obtain the blank form from the pdfliner catalog. For internal revenue service center.

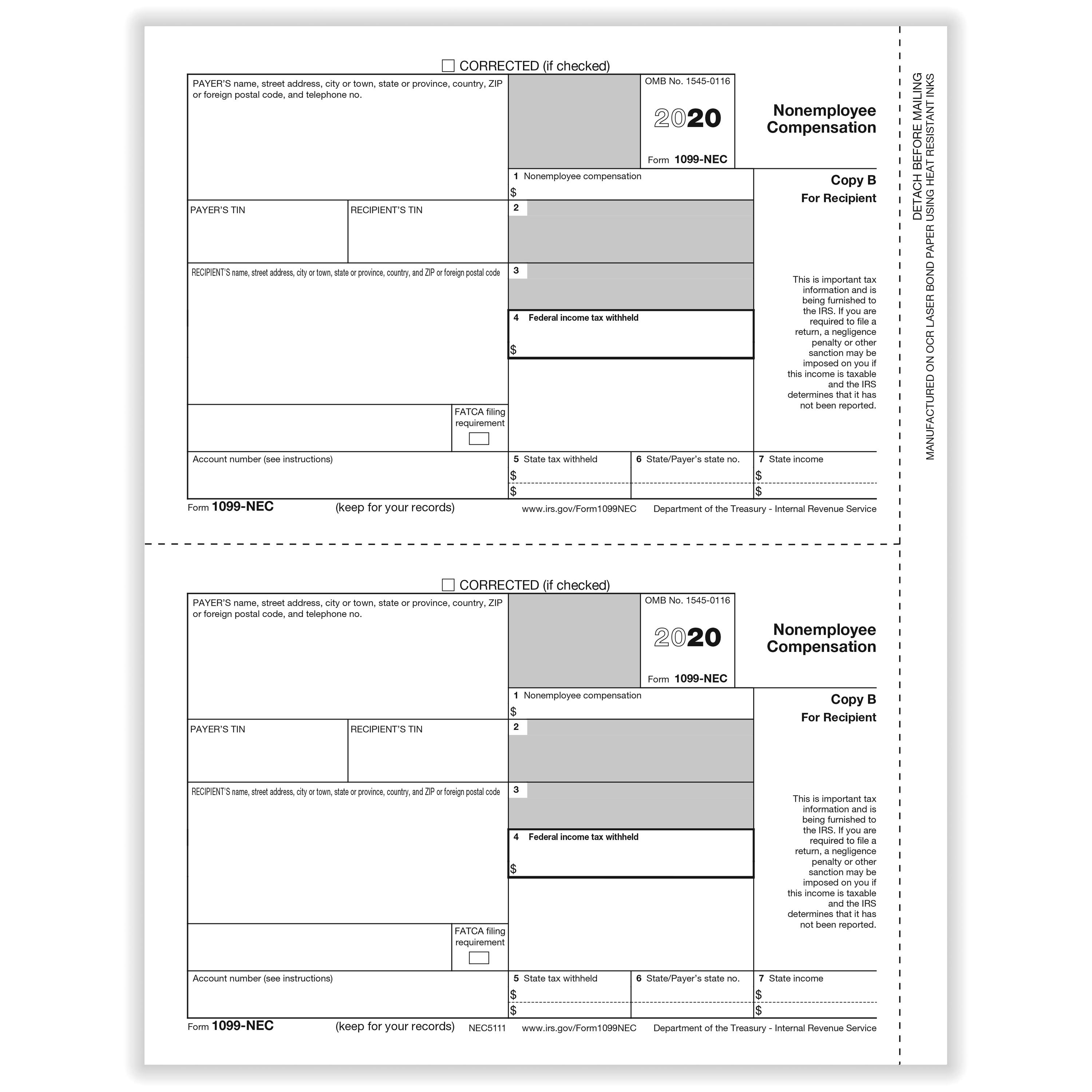

Form 1099NEC Nonemployee Compensation, Recipient Copy B

It also includes professionals such as accountants and attorneys. Payer’s information, including name, address and taxpayer identification number (tin). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Instructions for the recipient (copy b) are printed on the back of each of the 3 forms. Press the green arrow with the inscription next to jump from one field to.

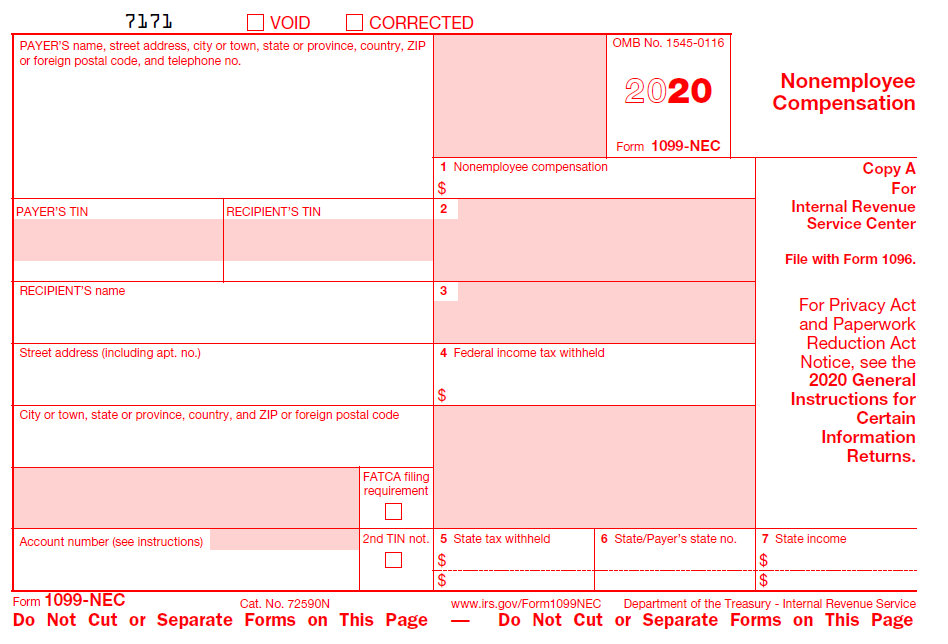

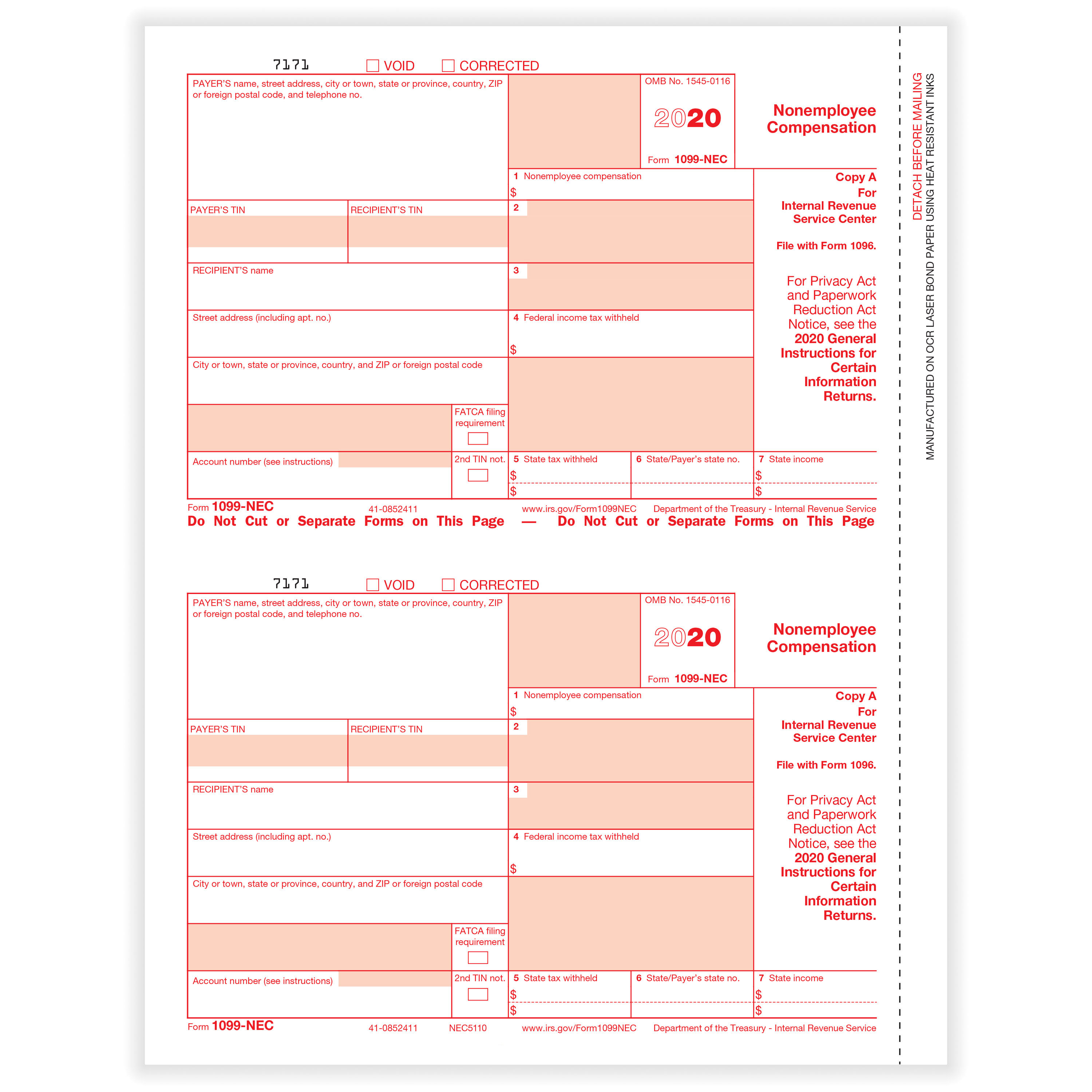

1099NEC Federal Copy A Cut Sheet HRdirect

It also includes professionals such as accountants and attorneys. Current general instructions for certain information returns. Examples of this include freelance work or driving for doordash or uber. For internal revenue service center. Web the 1099 form is a combined federal/state information return, with a copy furnished to the recipient payee.

What Is Form 1099NEC?

It also includes professionals such as accountants and attorneys. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Both the forms and instructions will be updated as needed. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone engaged in the trade or.

1099NEC Recipient Copy B Cut Sheet HRdirect

Both the forms and instructions will be updated as needed. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Payer’s information, including name, address and taxpayer identification number (tin). Current general instructions for certain information returns. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone engaged in the trade or business.

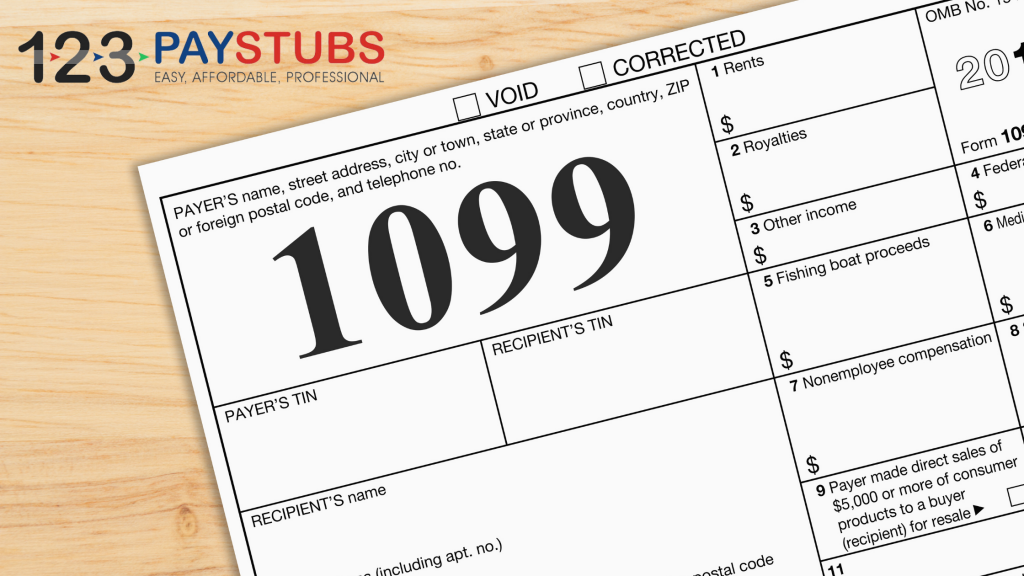

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

You'll be able to obtain the blank form from the pdfliner catalog. Both the forms and instructions will be updated as needed. Current general instructions for certain information returns. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

1099 NEC Form 2022

Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. The address you use depends on the location of your business and will either need to be. Web this form is used to report payments made to independent contractors and other nonemployees for services performed. Both the forms and.

1099 Nec Form 2021 Fill and Sign Printable Template Online US Legal

Current general instructions for certain information returns. For internal revenue service center. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone engaged in the trade or business. Instructions for the recipient (copy b) are printed on the back of each of the 3 forms. Fill out the nonemployee compensation online and print it out.

Accounts Payable Software for Small Business Accurate Tracking

Web the 1099 form is a combined federal/state information return, with a copy furnished to the recipient payee. You'll be able to obtain the blank form from the pdfliner catalog. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone engaged in the trade or business. Payer’s information, including name, address and taxpayer identification number.

The Address You Use Depends On The Location Of Your Business And Will Either Need To Be.

Examples of this include freelance work or driving for doordash or uber. It also includes professionals such as accountants and attorneys. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during the year. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

Instructions For The Recipient (Copy B) Are Printed On The Back Of Each Of The 3 Forms.

Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Current general instructions for certain information returns. Web the 1099 form is a combined federal/state information return, with a copy furnished to the recipient payee. Press the green arrow with the inscription next to jump from one field to another.

Fill Out The Nonemployee Compensation Online And Print It Out For Free.

Payer’s information, including name, address and taxpayer identification number (tin). Both the forms and instructions will be updated as needed. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone engaged in the trade or business. You'll be able to obtain the blank form from the pdfliner catalog.

Web This Form Is Used To Report Payments Made To Independent Contractors And Other Nonemployees For Services Performed.

For internal revenue service center.

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)