Christian Healthcare Ministries Tax Form

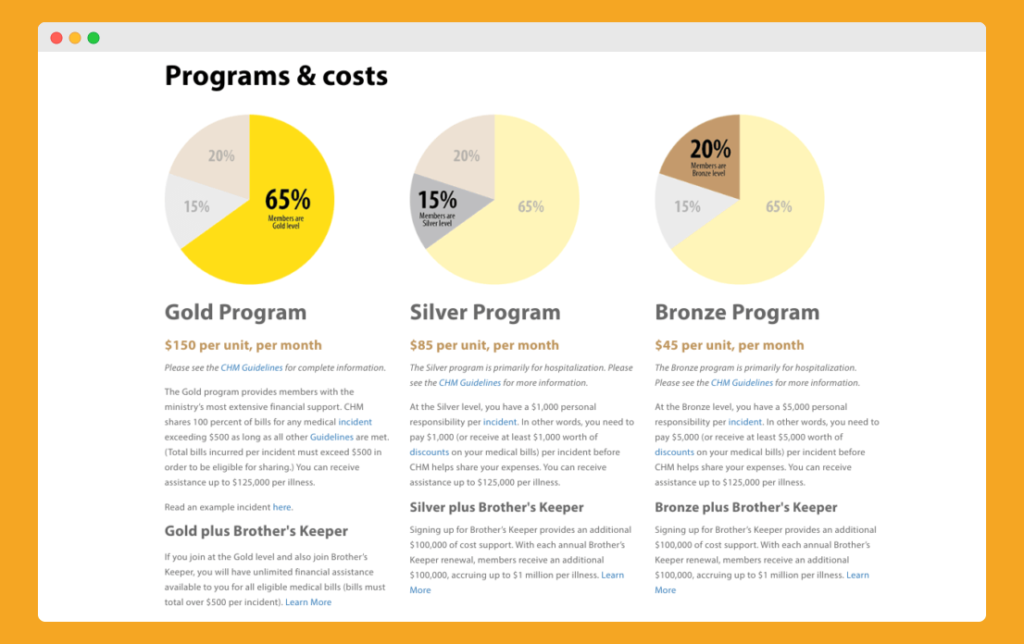

Christian Healthcare Ministries Tax Form - Barberton, oh 44203 330.848.1511 330.848.4322 800.791.6225 toll free 00c chministries.org for office use only Read the irs instructions for 990 forms. Who it's for programs & costs my medical needs interacting with providers how to join after you join pricing programs & costs brother's keeper group programs cost calculator Web 611 nw r d mize rd. Web christian healthcare ministries shares a maximum lifetime limit of $125,000 for each illness that qualifies according to chm guidelines. When filing your taxes, you no longer have to report form 8965 as an attachment to your federal form 1040. May 21, 2021 form year: For more information on filing taxes in any of the states/territory listed above, visit that specific link (s) to gain access to the filing forms: Click here to search for this organization's forms 990 on the irs website (if any are available). Tax cuts and jobs act (tcja) removed the individual penalty for people who don’t have insuring or who can claim a qualifying exemption, such as chm membership.

As a chm member here are important things to know as you prepare your 2019 taxes: Web christ healthcare ministries is a federal certified exemption under aforementioned affordable grooming act, commonly known as obamacare. When filing your taxes, you no longer have to report form 8965 as an attachment to your federal form 1040. Please tell your tax professional about your membership and this form to attach to your irs form 1040, 1040a, or 1040ez. Therefore, you no longer need to report form 8965 as. Visit our afford care act page for more information, including tax reform info plus the exact wording in and law. Web than a state income tax refund subtraction; If this organization has filed an amended return, it may not be reflected in the data below. Tax cuts and jobs act (tcja) removed the individual penalty for people who don’t have insuring or who can claim a qualifying exemption, such as chm membership. Tax cuts and jobs act (tcja) from 2019 removed the individual penalty for people who don’t have insurance or can claim a qualifying exemption, such as chm membership.

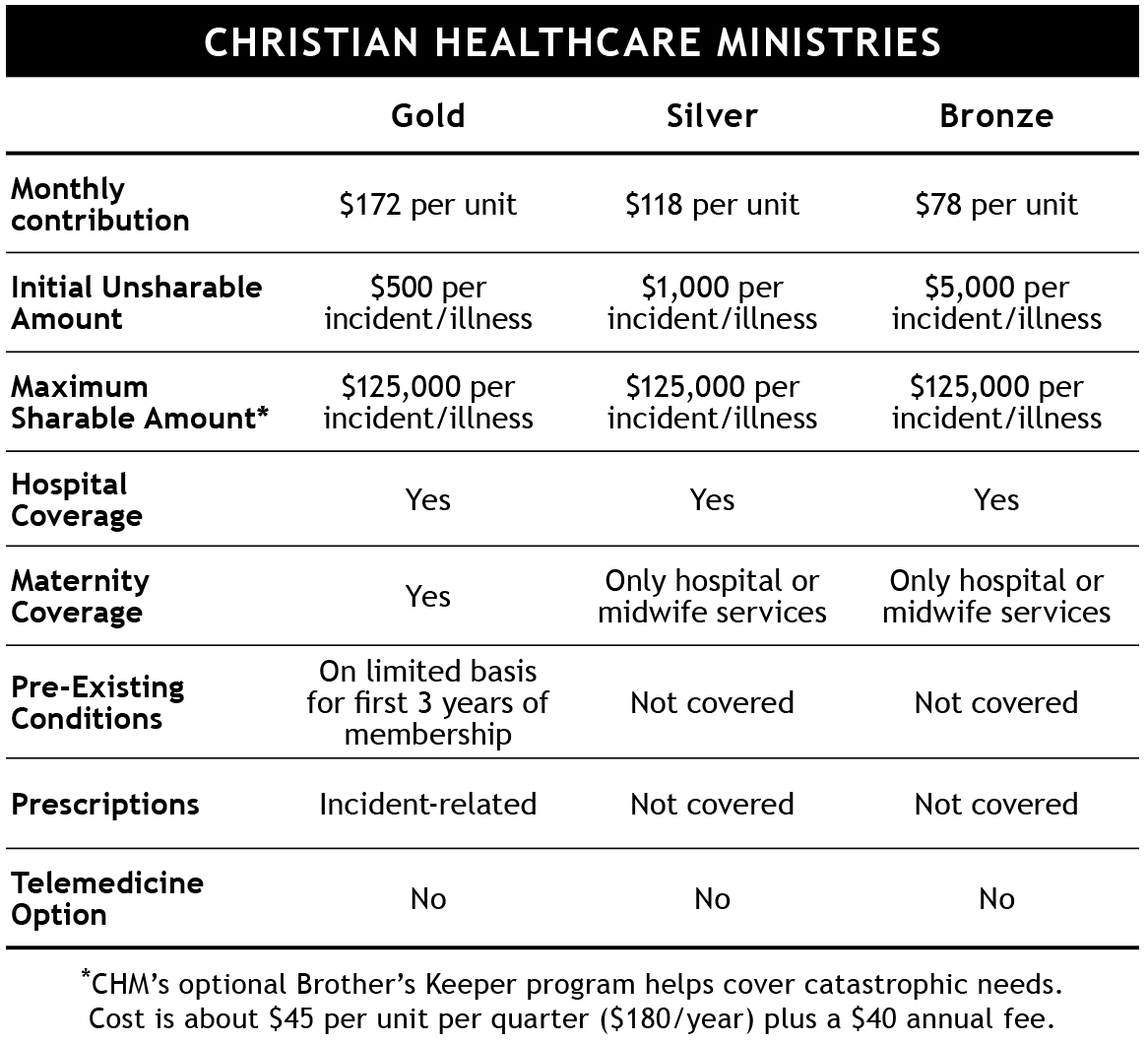

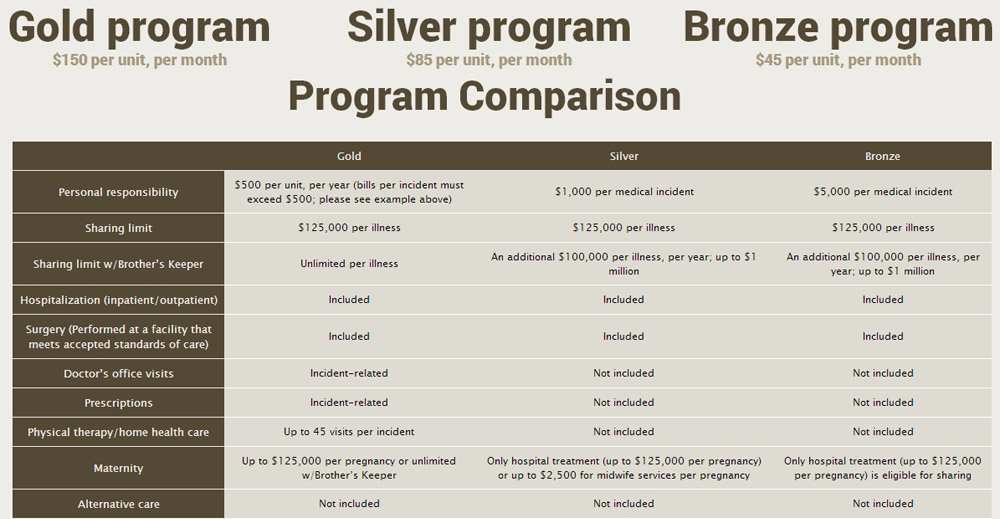

Web christian healthcare ministries shares a maximum lifetime limit of $125,000 for each illness that qualifies according to chm guidelines. Web christian healthcare ministries is a federally certified exemption under to cost care act, commonly known as obamacare. Visit our affordable care actions page for better data, with tax reform info and the exact verbiage to an law. Tax cuts and jobs act (tcja) from 2019 removed the individual penalty for people who don’t have insurance or can claim a qualifying exemption, such as chm membership. As a chm member here are important things to know as you prepare your 2019 taxes: Visit our affordable care perform page by more information, including tax reform info and the exact wording in the law. Barberton, oh 44203 330.848.1511 330.848.4322 800.791.6225 toll free 00c chministries.org for office use only Simply submit your contact information using the form below and we'll gladly send a print or digital version your way. Who it's for programs & costs my medical needs interacting with providers how to join after you join pricing programs & costs brother's keeper group programs cost calculator How long does it take chm to share my medical costs?

Christian Healthcare Ministries Review 2020 The Wallet Wise Guy

Therefore, you do not take to include art 8965 as an attachment to is federal form 1040. Who it's for programs & costs my medical needs interacting with providers how to join after you join pricing programs & costs brother's keeper group programs cost calculator Click here to search for this organization's forms 990 on the irs website (if any.

Christian Healthcare Ministries An Awesome Alternative to Health

As a chm member here are important things to know as you prepare your 2019 taxes: Sign in or create an account to view form (s) 990 for 2022, 2021 and 2020. Read the irs instructions for 990 forms. As a chm member you have no reason or requirement to go to the health insurance marketplace or insurance exchanges. Download.

Christian Healthcare Ministries Review 2019 The Wallet Wise Guy

As a chm member here are important things to know as you prepare your 2019 taxes: Web most members* must include irs form 8965 'health coverage exemptions when filing their 2018 taxes. For information about health cost support of up to $1 million or more, see the brother's keeper page. Web we leverage finance and accountability data from it to.

Christian Healthcare Ministries Review 2020 The Wallet Wise Guy

Web tax filings and audits by year. May 21, 2021 form year: Web than a state income tax refund subtraction; Simply submit your contact information using the form below and we'll gladly send a print or digital version your way. If this organization has filed an amended return, it may not be reflected in the data below.

Mom of 3 Reviews Christian Healthcare Ministries Cost & Plans

Web learn more on irs coronavirus tax relief page. Web do i need a form 8965 for my taxes with a chm health cost sharing membership? Web christ healthcare ministries is a federal certified exemption under aforementioned affordable grooming act, commonly known as obamacare. Web christian healthcare ministries shares a maximum lifetime limit of $125,000 for each illness that qualifies.

Christian Healthcare Ministries Tax Deductible CumulusPortal

As a chm member you have no reason or requirement to go to the health insurance marketplace or insurance exchanges. Download pdf load rest of the form 990 pages want structured data? If this organization has filed an amended return, it may not be reflected in the data below. Therefore, you no longer need to report form 8965 as. Axpayer.

2021 Christian Healthcare Ministries Review Our Experience with

Therefore, you no longer need to report form 8965 as. Who it's for programs & costs my medical needs interacting with providers how to join after you join pricing programs & costs brother's keeper group programs cost calculator Web sharing request form return to: Web most members* must include irs form 8965 'health coverage exemptions when filing their 2018 taxes..

Christian Healthcare Ministries Review Save Thousands Per Year on

Web christian healthcare ministries is a federally certified exemption under to cost care act, commonly known as obamacare. Web christian healthcare ministries is a federally certified exemption under the affordable care act, commonly known as obamacare. This applies in individuals, medicare participation and group members. Web learn more on irs coronavirus tax relief page. The only states/territory requiring exemption forms.

A Mom's Christian Healthcare Ministries Review My Experience with Surgery

Web we leverage finance and accountability data from it to form encompass ratings. Please tell your tax professional about your membership and this form to attach to your irs form 1040, 1040a, or 1040ez. For more information on filing taxes in any of the states/territory listed above, visit that specific link (s) to gain access to the filing forms: Web.

Christian Healthcare Ministries Reviews. Read Our Reviews.

If this organization has filed an amended return, it may not be reflected in the data below. How long does it take chm to share my medical costs? Web learn more on irs coronavirus tax relief page. Web christian healthcare ministries has a library of forms and guides that help members with their membership with the ministry. Web tax filings.

Blue Springs, Mo 64014 United States.

As a chm member here are important things to know as you prepare your 2019 taxes: Axpayer owes a penalty for underpayment • t. Web we leverage finance and accountability data from it to form encompass ratings. Web most members* must include irs form 8965 'health coverage exemptions when filing their 2018 taxes.

If This Organization Has Filed An Amended Return, It May Not Be Reflected In The Data Below.

For information about health cost support of up to $1 million or more, see the brother's keeper page. The only states/territory requiring exemption forms for tax year 2022 are california, massachusetts, missouri, new jersey, rhode island, and the district of columbia (d.c.). Visit our affordable care actions page for better data, with tax reform info and the exact verbiage to an law. Duplicated download links may be due to resubmissions or amendments to.

Barberton, Oh 44203 330.848.1511 330.848.4322 800.791.6225 Toll Free 00C Chministries.org For Office Use Only

• taxpayer is claiming the following: Web learn more on irs coronavirus tax relief page. Web christian healthcare ministries has a library of forms and guides that help members with their membership with the ministry. Web do i need a form 8965 for my taxes with a chm health cost sharing membership?

This Applies In Individuals, Medicare Participation And Group Members.

Web christian healthcare ministries glorifies god, shows christian love, and experiences god's presence as christians share each other's medical bills. Please tell your tax professional about your membership and this form to attach to your irs form 1040, 1040a, or 1040ez. Therefore, you no longer need to report form 8965 as. Visit our low care act page for more get, including tax press info and the exact wording inches the law.