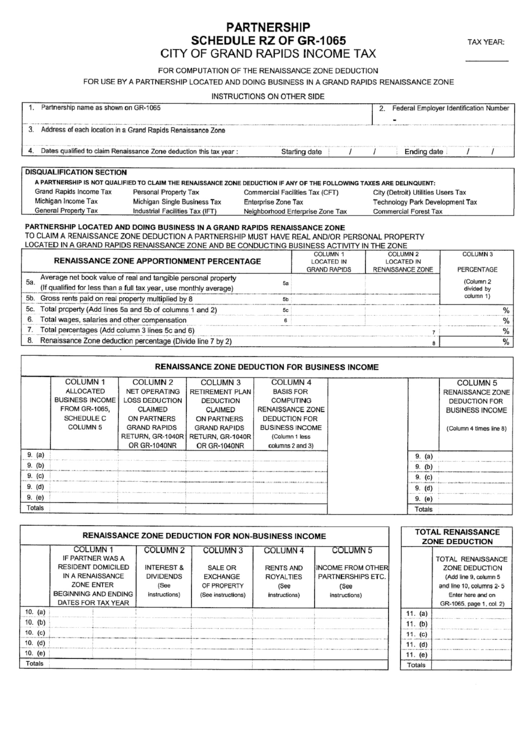

City Of Grand Rapids Tax Form

City Of Grand Rapids Tax Form - Web city of big rapids. Web turbotax will ask you if you live or work in any of the cities that have local income taxes. Forms submitted for approval may be sent to either city. Complete, edit or print tax forms instantly. Web the 2023 summer tax bills are in the process of being mailed, with payment due by july 31, 2023, to avoid late fees. Web residents of grand rapids pay a flat city income tax of 1.50% on earned income, in addition to the michigan income tax and the federal income tax. Grand rapids income tax department. — tax season is already a stressful time, and. Web 2023 employer withholding tax. Select the form you need in the library of legal.

Click the city name to access the appropriate. Web turbotax will ask you if you live or work in any of the cities that have local income taxes. Web rapids income tax department and the city of walker income tax department. Web it takes only a couple of minutes. Web individual tax forms current year tax forms. Max goldwasser posted at 6:25 pm, apr 15, 2022 and last updated 6:35 pm, apr 15, 2022 grand rapids, mich. Mark the box for grand rapids (if it isn't already marked]. Web 2022 city of grand rapids income tax. Web city of big rapids. Choose the correct version of the editable.

Nonresidents who work in grand. Total wages, salaries, and tips. City of detroit 2014 and previous years; Web residents of grand rapids pay a flat city income tax of 1.50% on earned income, in addition to the michigan income tax and the federal income tax. Web turbotax will ask you if you live or work in any of the cities that have local income taxes. Web the 2023 summer tax bills are in the process of being mailed, with payment due by july 31, 2023, to avoid late fees. Forms submitted for approval may be sent to either city. Select the form you need in the library of legal. Web rapids income tax department and the city of walker income tax department. Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form.

Top 35 City Of Grand Rapids Tax Forms And Templates free to download in

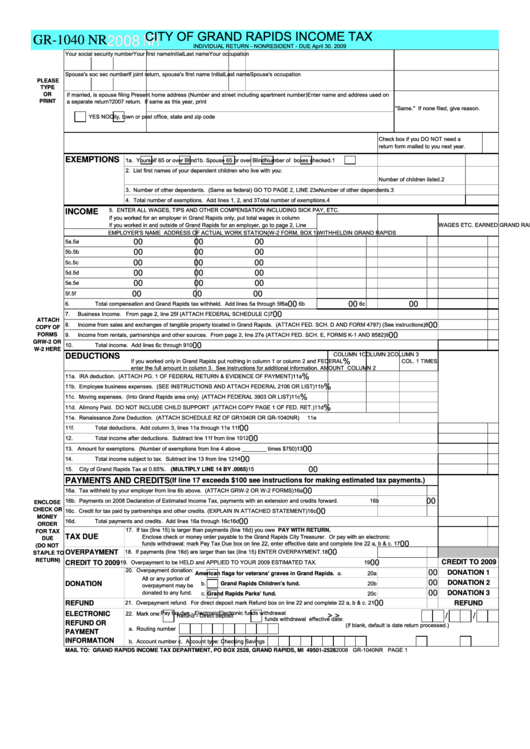

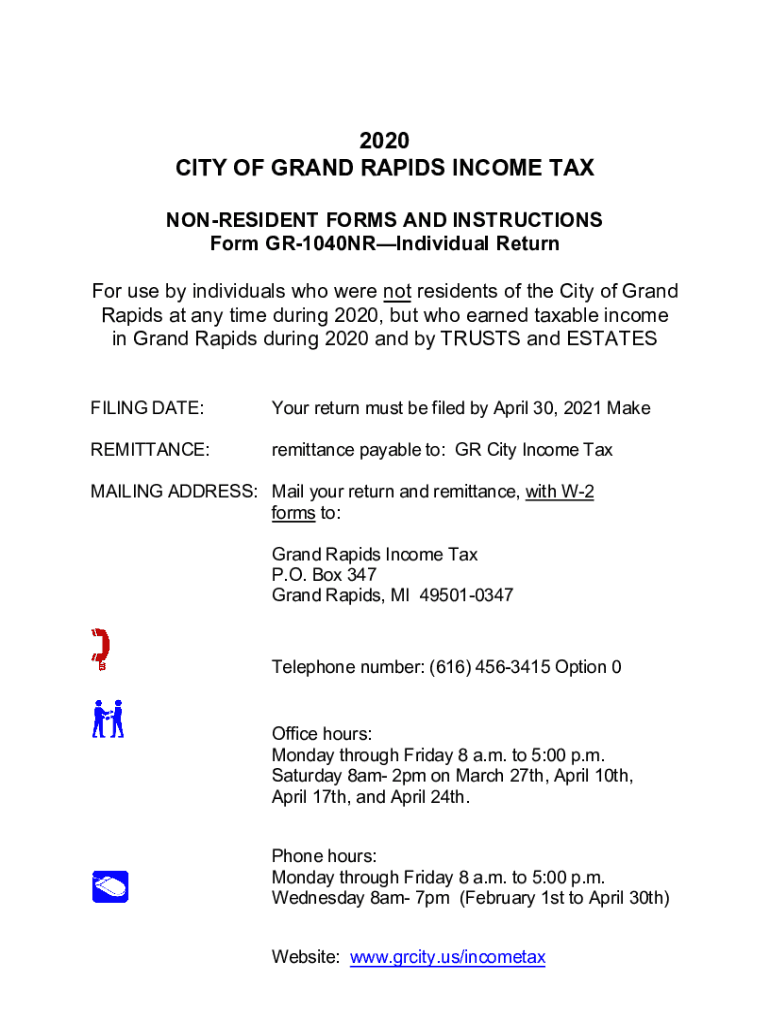

Web 2022 city of grand rapids income tax. For use by individuals who were not residents of. Web turbotax will ask you if you live or work in any of the cities that have local income taxes. Web rapids income tax department and the city of walker income tax department. — tax season is already a stressful time, and.

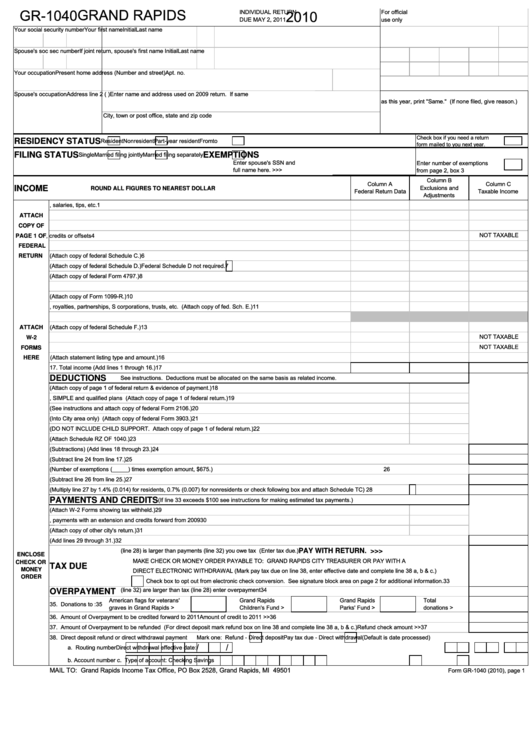

Form Gr1040 Grand Rapids Individual Return 2010 printable pdf download

Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Web please call or email the city of grand rapids income tax department to request that a printed form be mailed to you: Web for use by individuals who were residents of the city of.

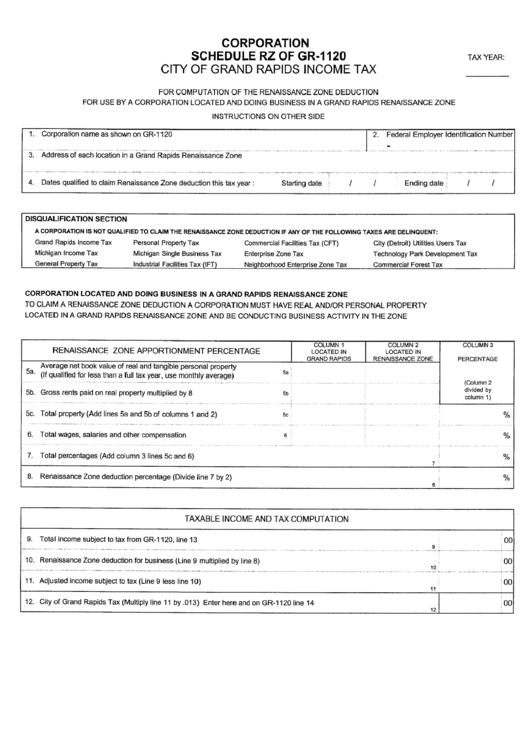

Corporation Schedule Rz Of Gr1120 City Of Grand Rapids Tax

Select the form you need in the library of legal. Choose the correct version of the editable. For use by individuals who were not residents of. Web turbotax will ask you if you live or work in any of the cities that have local income taxes. Web 2023 employer withholding tax.

Grand Rapids Coins Charges No Sales Tax on Coins Bought In Michigan

We have everything individuals, businesses, and withholders need to file taxes with the city. Nonresidents who work in grand. Web city of big rapids. Web for use by individuals who were residents of the city of grand rapids at any time during 2021. Web rapids income tax department and the city of walker income tax department.

Form Gr1040 Nr City Of Grand Rapids Tax 2008 printable pdf

Web residents of grand rapids pay a flat city income tax of 1.50% on earned income, in addition to the michigan income tax and the federal income tax. Select the form you need in the library of legal. Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city.

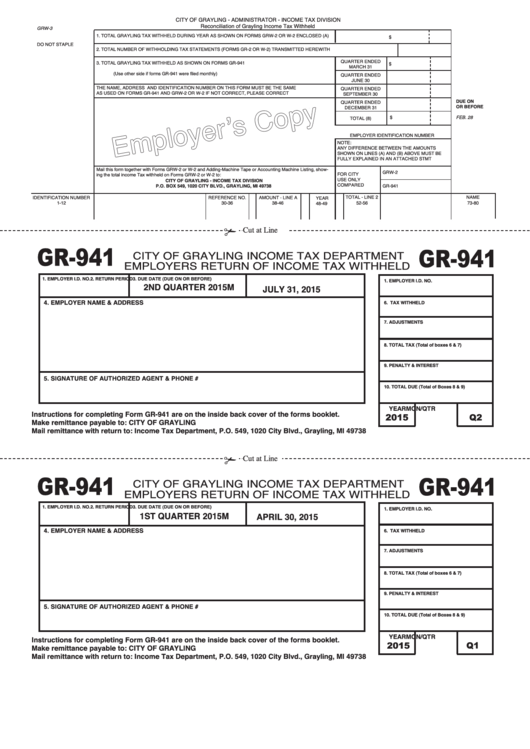

Form Gr941 Employers Return Of Tax Withheld City Of

Web the income tax department's library of income tax forms. Web the 2023 summer tax bills are in the process of being mailed, with payment due by july 31, 2023, to avoid late fees. Mark the box for grand rapids (if it isn't already marked]. Web turbotax will ask you if you live or work in any of the cities.

Rapids Tax Form Fill Out and Sign Printable PDF Template signNow

For use by individuals who were not residents of. Your return must be filed by may 2nd, 2022 make. Choose the correct version of the editable. Click the city name to access the appropriate. Web the income tax department's library of income tax forms.

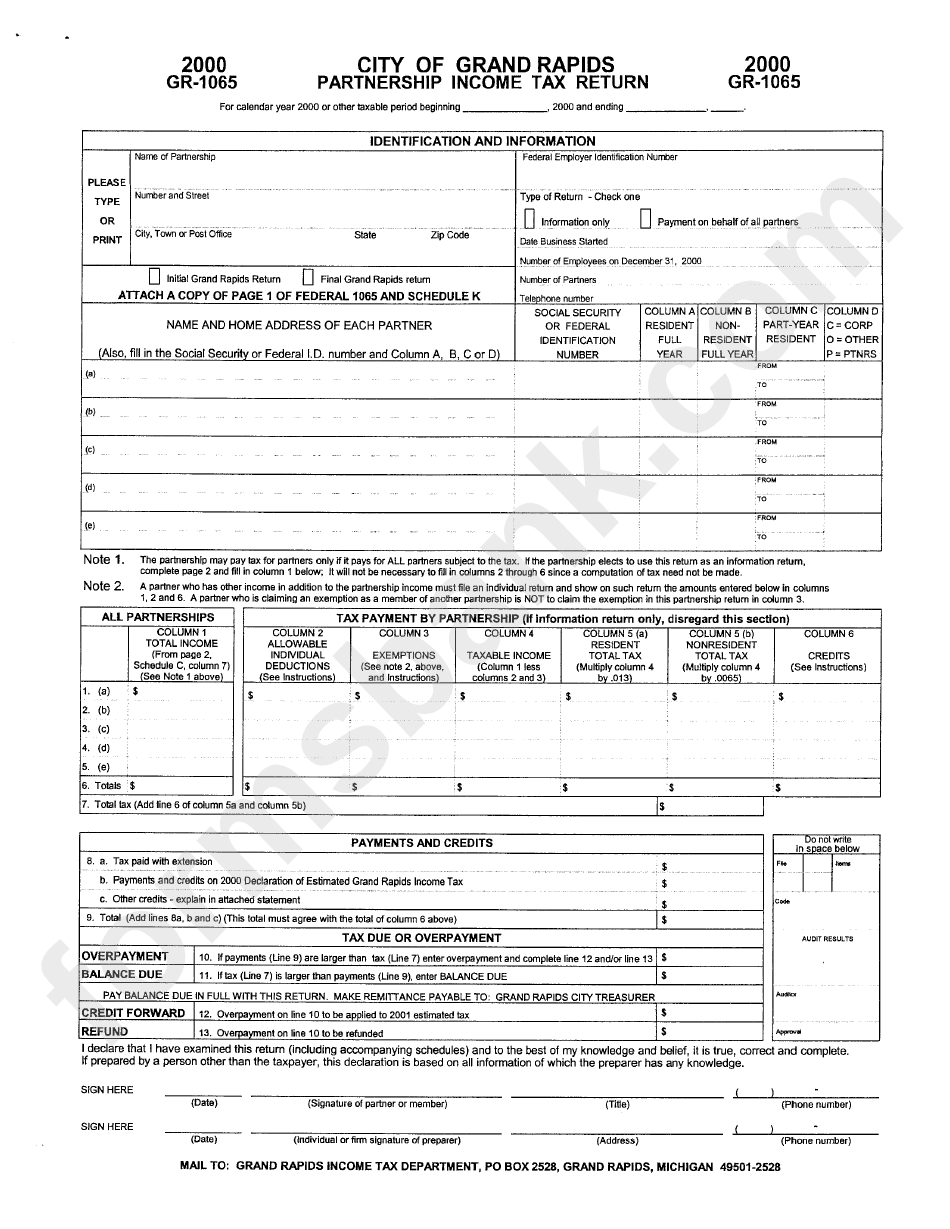

Form Gr1065 Partnership Tax Return City Of Grand Rapids

Your return must be filed by may 2nd, 2022 make. Grand rapids income tax department. — tax season is already a stressful time, and. Web 2022 city of grand rapids income tax. Web for use by individuals who were residents of the city of grand rapids at any time during 2021.

Grand Rapids offers free city tax help on two Saturdays

— tax season is already a stressful time, and. Web city of big rapids. Total wages, salaries, and tips. Max goldwasser posted at 6:25 pm, apr 15, 2022 and last updated 6:35 pm, apr 15, 2022 grand rapids, mich. Your return must be filed by may 2nd, 2022 make.

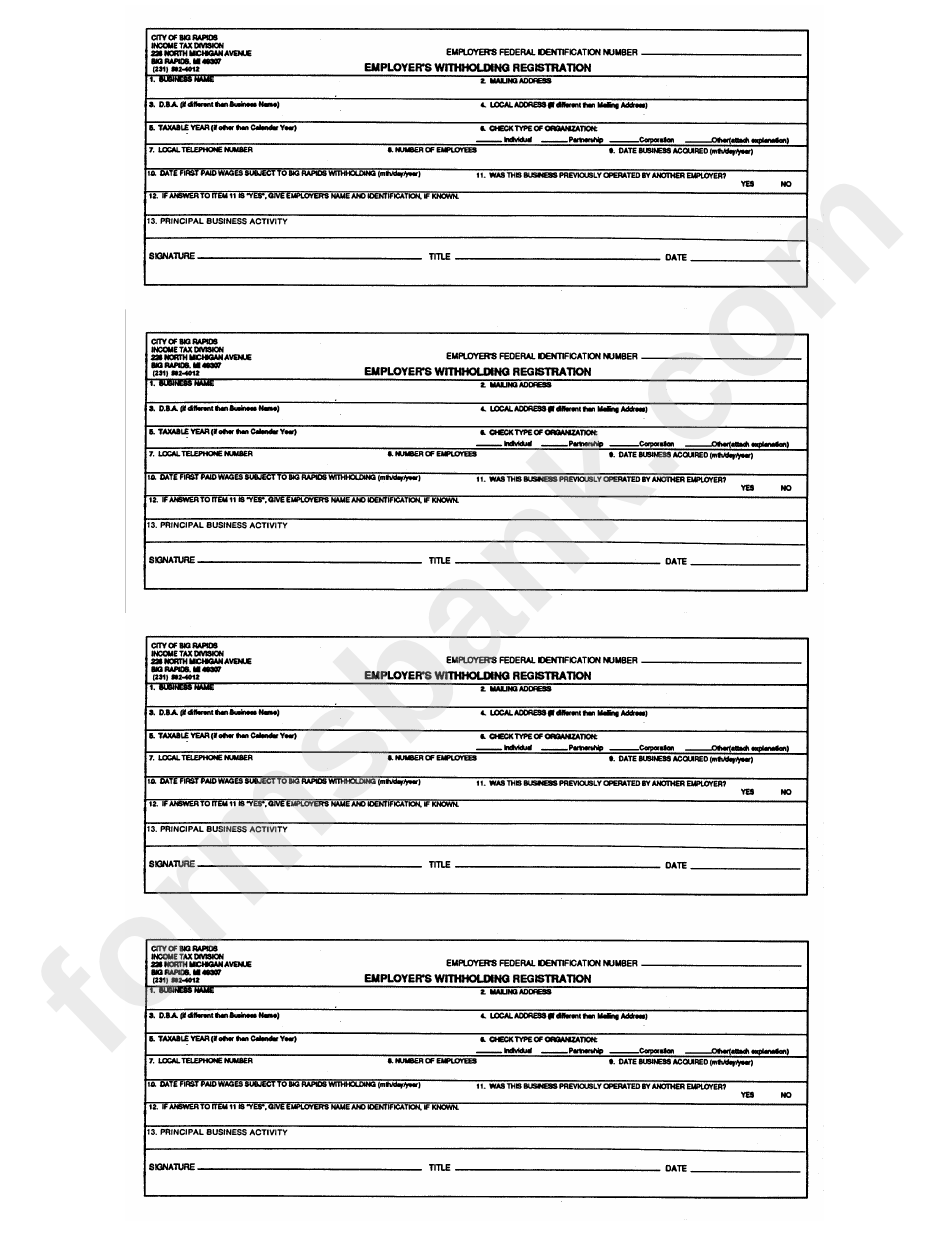

Employer'S Withholding Registration Form City Of Big Rapids printable

Web 2022 city of grand rapids income tax. Web please call or email the city of grand rapids income tax department to request that a printed form be mailed to you: Web turbotax will ask you if you live or work in any of the cities that have local income taxes. City of detroit 2014 and previous years; Your return.

Select The Form You Need In The Library Of Legal.

— tax season is already a stressful time, and. Grand rapids income tax department. Web 2023 employer withholding tax. Web residents of grand rapids pay a flat city income tax of 1.50% on earned income, in addition to the michigan income tax and the federal income tax.

Forms Submitted For Approval May Be Sent To Either City.

Web it takes only a couple of minutes. Web turbotax will ask you if you live or work in any of the cities that have local income taxes. Nonresidents who work in grand. Max goldwasser posted at 6:25 pm, apr 15, 2022 and last updated 6:35 pm, apr 15, 2022 grand rapids, mich.

Web The 2023 Summer Tax Bills Are In The Process Of Being Mailed, With Payment Due By July 31, 2023, To Avoid Late Fees.

Web please call or email the city of grand rapids income tax department to request that a printed form be mailed to you: We have everything individuals, businesses, and withholders need to file taxes with the city. Web rapids income tax department and the city of walker income tax department. Total wages, salaries, and tips.

Mark The Box For Grand Rapids (If It Isn't Already Marked].

Choose the correct version of the editable. Web city of big rapids. Web for use by individuals who were residents of the city of grand rapids at any time during 2021. Click the city name to access the appropriate.