Empower Retirement Withdrawal Form

Empower Retirement Withdrawal Form - Periodic withdrawal request (not available on claims) (minimum withdrawal amount for each payment is $100) complete sections 1, 4, 5 & 6 to request periodic. Plan number:plan name and number can be found on your account online or on your statement. Now that you've decided to use an ira as a tool to help you save for your retirement, let's take a quick look at how you might fund it. As of the year of distribution: Please have the following documents. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Web you can withdraw money from your ira at any time. Use get form or simply click on the template preview to open it in the editor. Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more. Efsi is an affiliate of empower retirement, llc;

Web you can withdraw money from your ira at any time. Please have the following documents. Need to change where your retirement money would. As of the year of distribution: Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Web withdraw some of your retirement savings to pay for an immediate and heavy financial need. Plan number:plan name and number can be found on your account online or on your statement. However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age. Efsi is an affiliate of empower retirement, llc; Web obtains a hardship distribution request form online or by speaking with a service center representative.

Submits hardship request with appropriate supporting documentation to. Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more. Web unforeseeable emergency withdrawal request. Efsi is an affiliate of empower retirement, llc; Web obtains a hardship distribution request form online or by speaking with a service center representative. 04/04/2020 l withdrawal | [ldom] plan name: Web empower personal cash is a program that offers you the ability to earn a higher interest rate on your cash than you might earn in a traditional checking or savings. Use get form or simply click on the template preview to open it in the editor. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Need to change where your retirement money would.

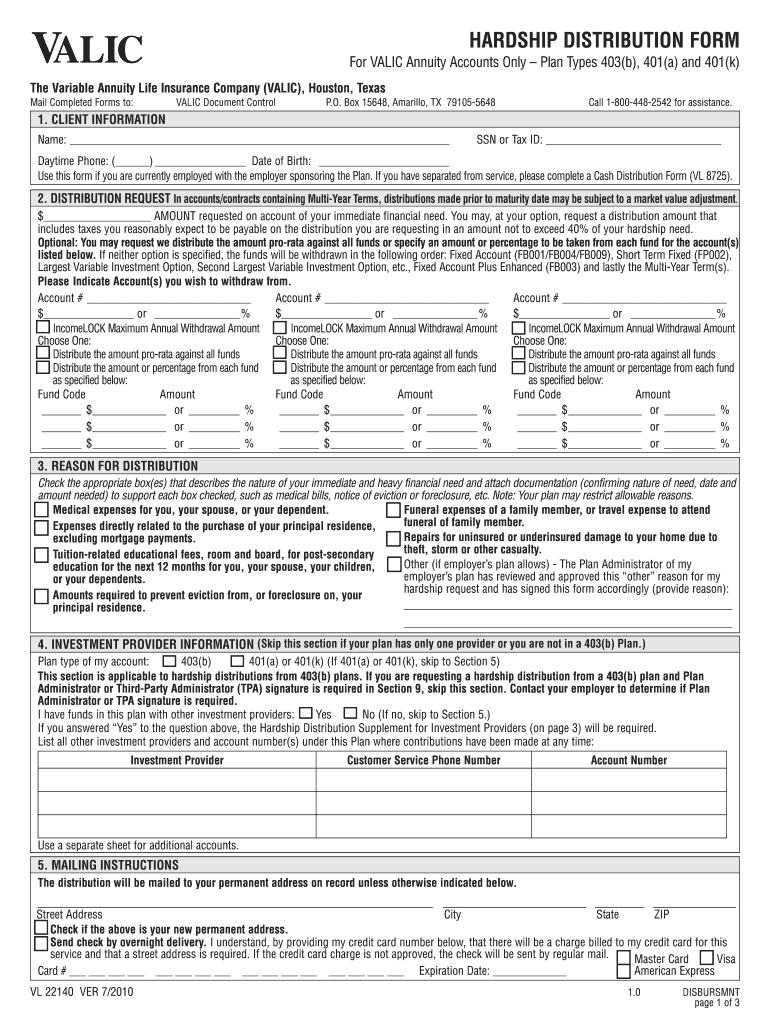

Valic Retirement Withdrawal Fill Online, Printable, Fillable, Blank

Now that you've decided to use an ira as a tool to help you save for your retirement, let's take a quick look at how you might fund it. 04/04/2020 l withdrawal | [ldom] plan name: Please have the following documents. Periodic withdrawal request (not available on claims) (minimum withdrawal amount for each payment is $100) complete sections 1, 4,.

Empower 401k Withdrawal Form Universal Network

Web withdraw some of your retirement savings to pay for an immediate and heavy financial need. However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Web unforeseeable emergency withdrawal request. Please.

Distribution From 401K Fill Out and Sign Printable PDF Template signNow

(1) you must have been invested in the roth. Web unforeseeable emergency withdrawal request. Now that you've decided to use an ira as a tool to help you save for your retirement, let's take a quick look at how you might fund it. Submits hardship request with appropriate supporting documentation to. Please have the following documents.

Empower Retirement Plan Forms Form Resume Examples 023dZ6W1N5

Efsi is an affiliate of empower retirement, llc; As of the year of distribution: Web you can withdraw money from your ira at any time. (1) you must have been invested in the roth. Web withdraw some of your retirement savings to pay for an immediate and heavy financial need.

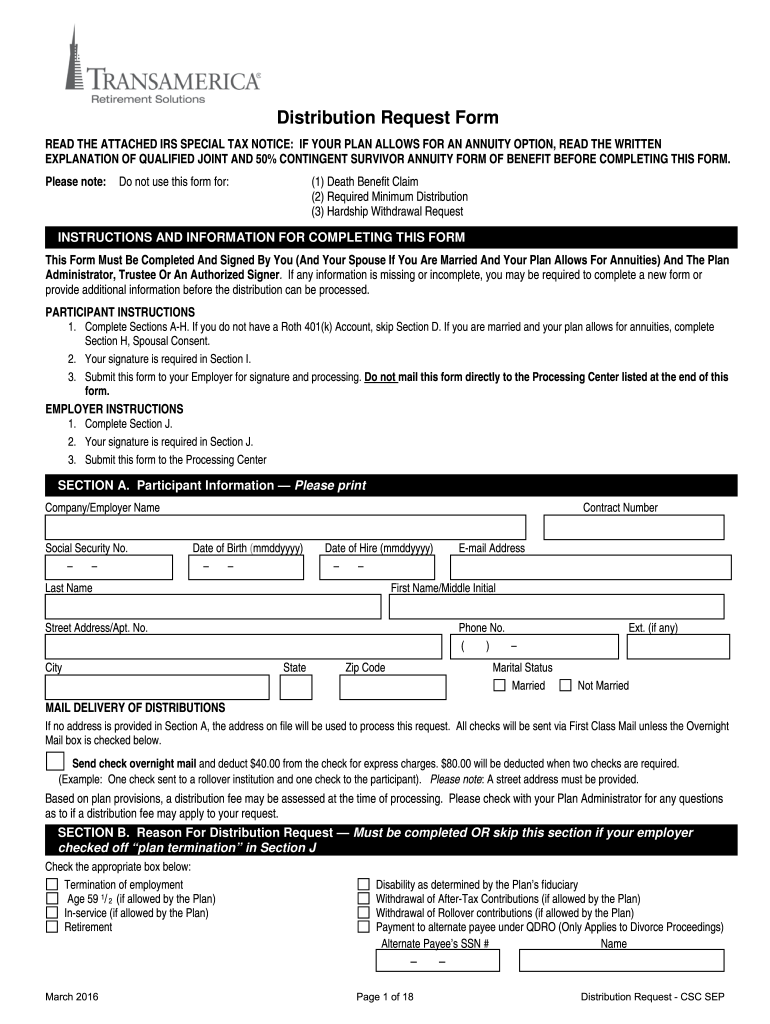

Fillable Online transamerica 401k withdrawal form Fax Email Print

Web obtains a hardship distribution request form online or by speaking with a service center representative. Web withdraw some of your retirement savings to pay for an immediate and heavy financial need. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Use get form or simply click on the template.

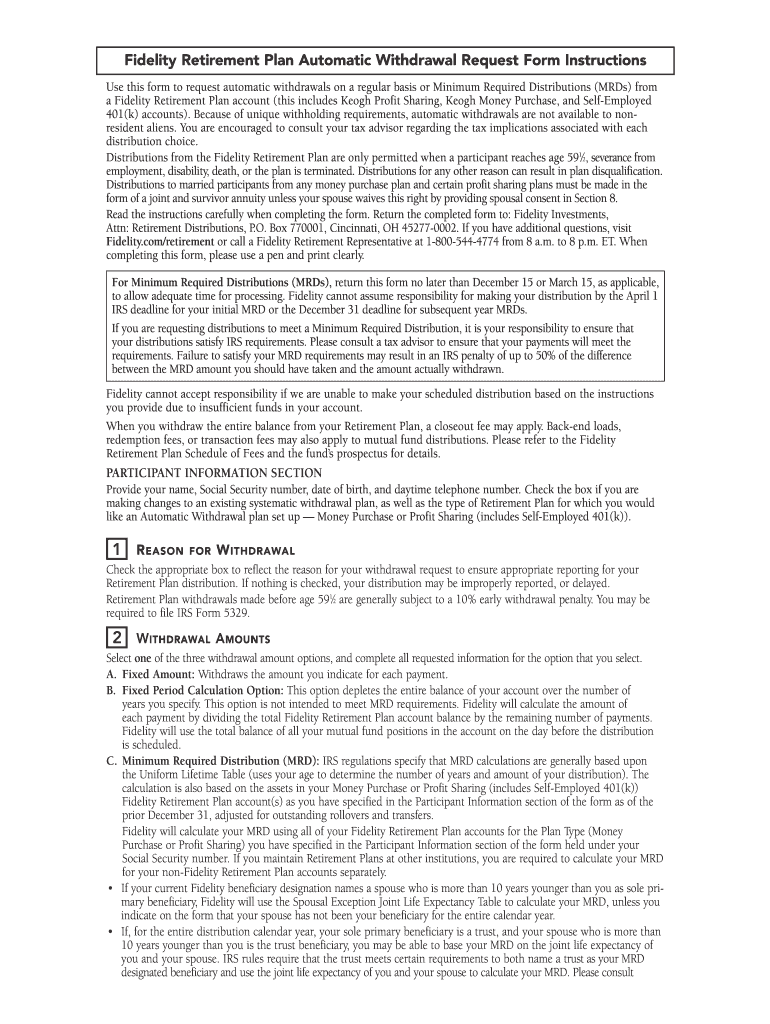

Fidelity Retirement Terms And Conditions Of Withdrawal Form Fill and

Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Now that you've decided to use an ira as a tool to help you save for your retirement, let's take a quick look at how you might fund it. Plan number:plan name and number can be found on your account online.

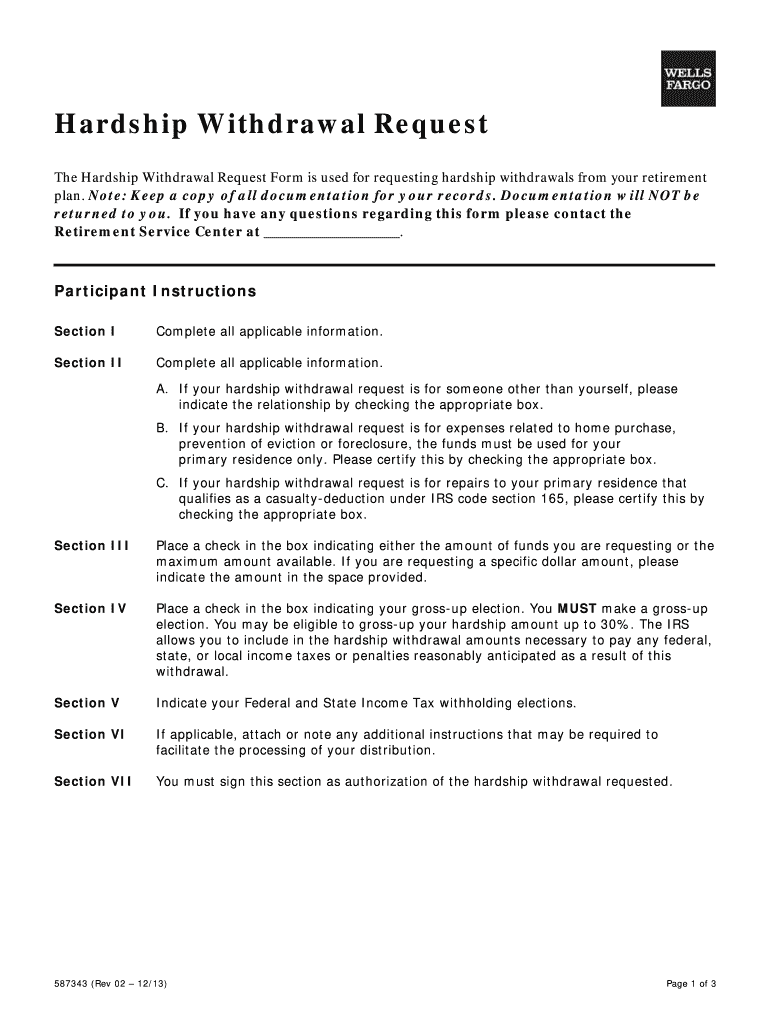

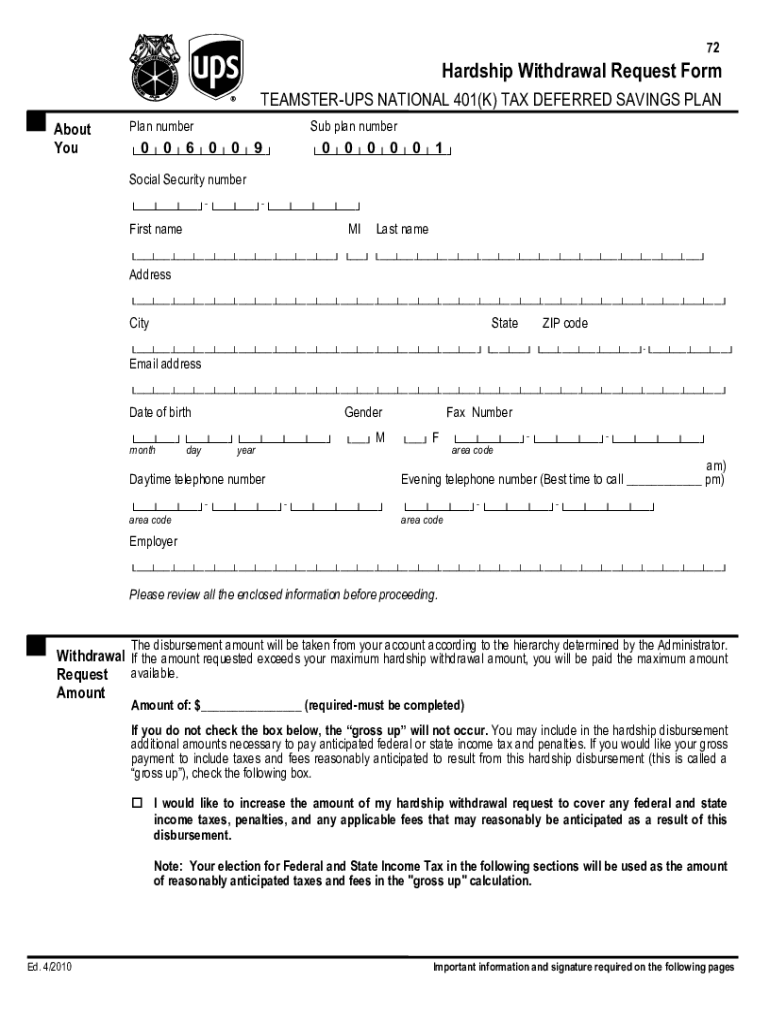

Hardship Withdrawal Fill Out and Sign Printable PDF Template signNow

Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more. 04/04/2020 l withdrawal | [ldom] plan name: (1) you must have been invested in the roth. Use get form or simply click on the template preview to open it in the editor. Please have the following documents.

EPF Withdrawal Before Retirement Is It Right for You?

Need to change where your retirement money would. However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age. Periodic withdrawal request (not available on claims) (minimum withdrawal amount for each payment is $100) complete sections 1, 4, 5 & 6 to request periodic. Web securities, when presented, are offered and/or distributed.

Prudential 401k Terms Of Withdrawal Pdf Fill Online, Printable

Web obtains a hardship distribution request form online or by speaking with a service center representative. Use get form or simply click on the template preview to open it in the editor. (1) you must have been invested in the roth. However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age..

2020 Form MetLife NonErisa 403(b) Withdrawal Request Fill Online

Web withdraw some of your retirement savings to pay for an immediate and heavy financial need. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Plan number:plan name and number can be found on your account online or on your statement. Please have the following documents. Periodic withdrawal request (not.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Periodic withdrawal request (not available on claims) (minimum withdrawal amount for each payment is $100) complete sections 1, 4, 5 & 6 to request periodic. Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more. 04/04/2020 l withdrawal | [ldom] plan name: Web obtains a hardship distribution request form online or by speaking with a service center representative.

Now That You've Decided To Use An Ira As A Tool To Help You Save For Your Retirement, Let's Take A Quick Look At How You Might Fund It.

Web unforeseeable emergency withdrawal request. Web you can withdraw money from your ira at any time. Web securities, when presented, are offered and/or distributed by empower financial services, inc., member finra/sipc. As of the year of distribution:

Submits Hardship Request With Appropriate Supporting Documentation To.

Web empower personal cash is a program that offers you the ability to earn a higher interest rate on your cash than you might earn in a traditional checking or savings. Efsi is an affiliate of empower retirement, llc; (1) you must have been invested in the roth. However, a 10% additional tax generally applies if you withdraw ira or retirement plan assets before you reach age.

Please Have The Following Documents.

Web withdraw some of your retirement savings to pay for an immediate and heavy financial need. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Plan number:plan name and number can be found on your account online or on your statement. Need to change where your retirement money would.