Form 2439 Reporting

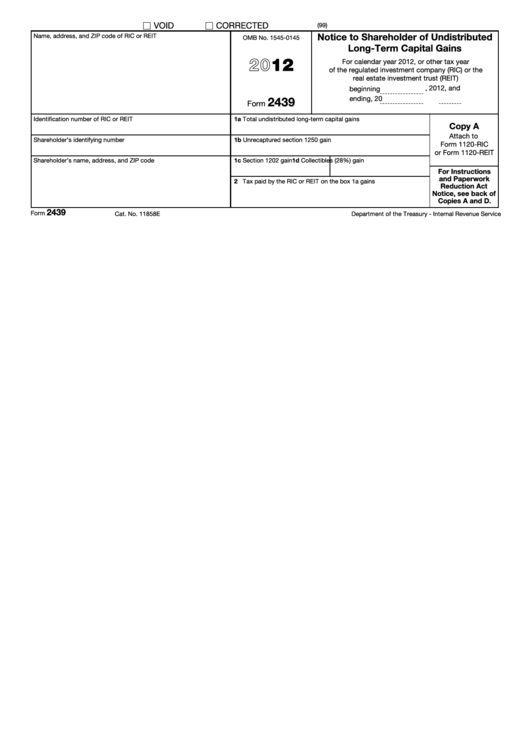

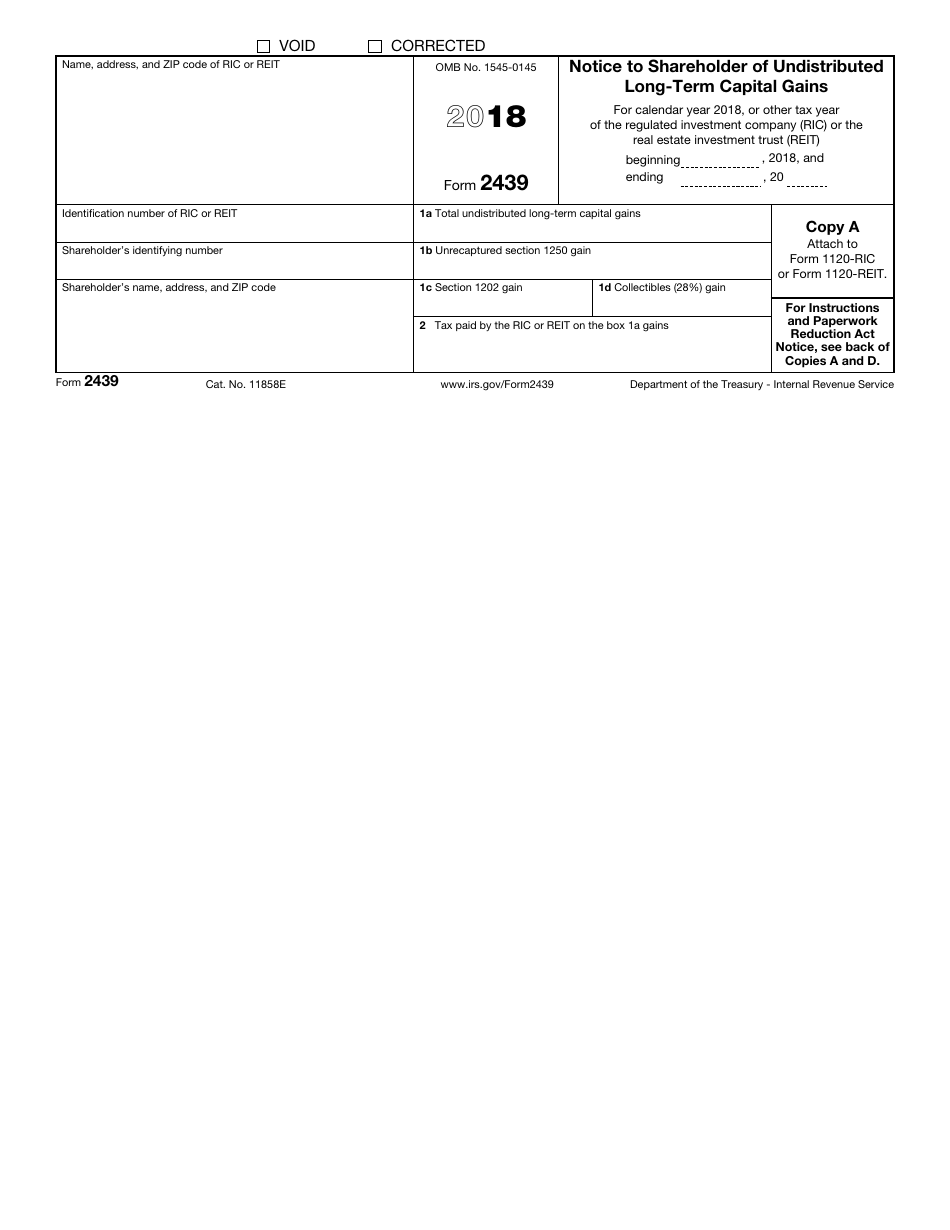

Form 2439 Reporting - Web •to report a gain from form 2439 or 6252 or part i of form 4797; Web gain from form 2439. Meaning of form 2439 as a finance term. To enter form 2439 go to investment. It will flow to your schedule d when it is entered into turbotax. Web ask for the information on this form to carry out the internal revenue laws of the united states. Web to enter the 2439 in the individual module: Complete copies a, b, c, and d for each shareholder for whom the regulated investment company (ric) or real estate investment trust (reit) paid tax. Attach copy b of form 2439 to your completed tax return. Furnish copies b and c of form 2439 to the.

Furnish copies b and c of form 2439 to the. Web the information on form 2439 is reported on schedule d. Solved•by intuit•updated 5 hours ago. •to report a gain or loss from a partnership, s. To enter the 2439 in the individual module: We need it to ensure that you are. From the dispositions section select form 2439. Web •to report a gain from form 2439 or 6252 or part i of form 4797; Web updated for tax year 2022 • june 2, 2023 08:41 am overview cost basis or tax basis? Meaning of form 2439 as a finance term.

Web to enter the 2439 in the individual module: Whatever you call it, don't fear it. Furnish copies b and c of form 2439 to the. Web gain from form 2439. It will flow to your schedule d when it is entered into turbotax. To enter the 2439 in the individual module: Go to the input return. Web the information on form 2439 is reported on schedule d. Web report the capital gain on your income tax return for the year. •to report a gain or loss from form 4684, 6781, or 8824;

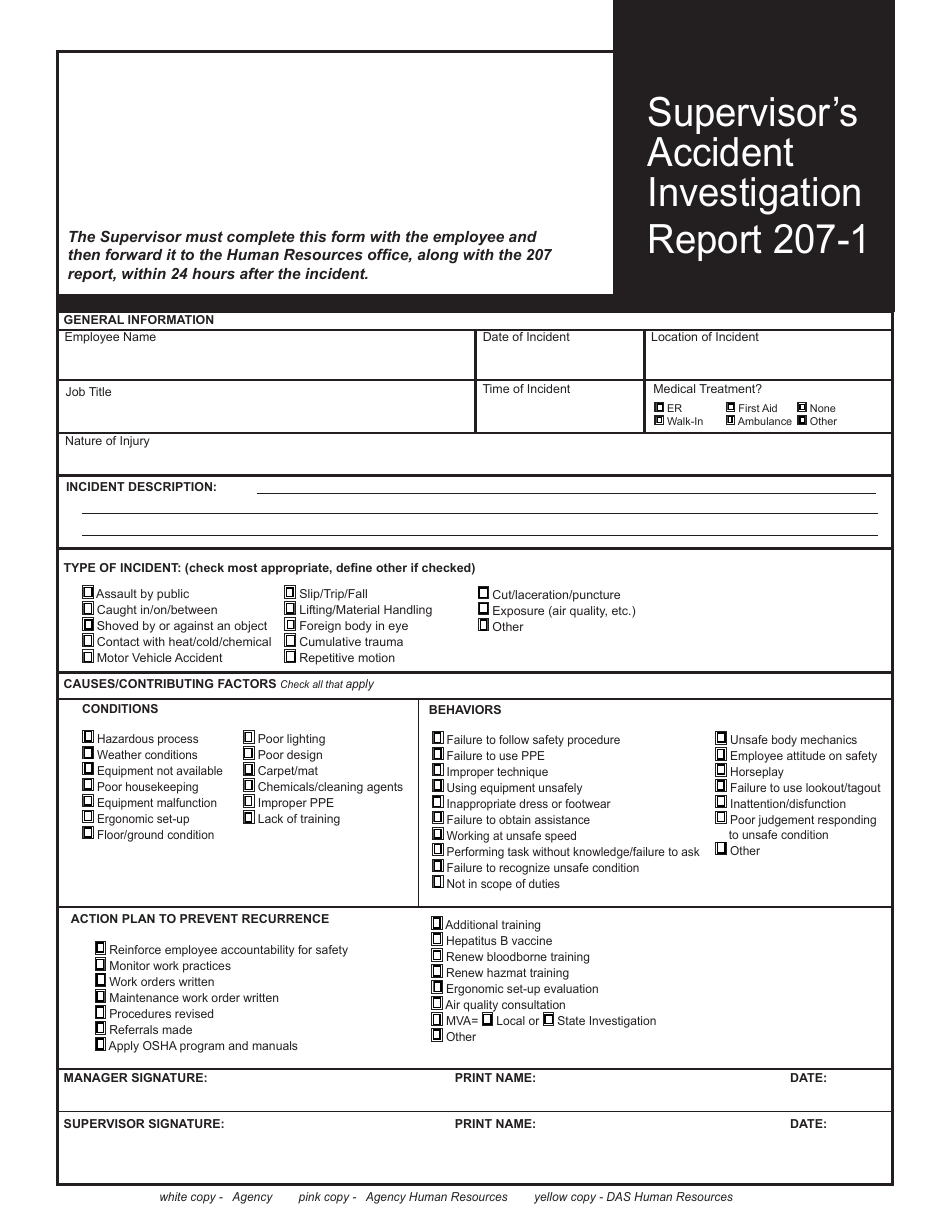

Form 2071 Download Fillable PDF or Fill Online Supervisor's Accident

To enter the 2439 in the individual module: Web or for reporting the tax paid only from form 2439 go to the payments/penalties > payments worksheet. You are required to give us the information. Web if you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains, you would.

Fillable Form 2439 Notice To Shareholder Of Undistributed LongTerm

You are required to give us the information. Web gain from form 2439. Claim a credit for the tax paid by the mutual fund. •to report a gain or loss from a partnership, s. To enter form 2439 go to investment.

10++ Capital Gains Tax Worksheet

Web to enter form 2439 capital gains, complete the following: Claim a credit for the tax paid by the mutual fund. Solved•by intuit•updated 5 hours ago. From the dispositions section select form 2439. Go to screen 17.1 dispositions (schedule d, 4797, etc.).

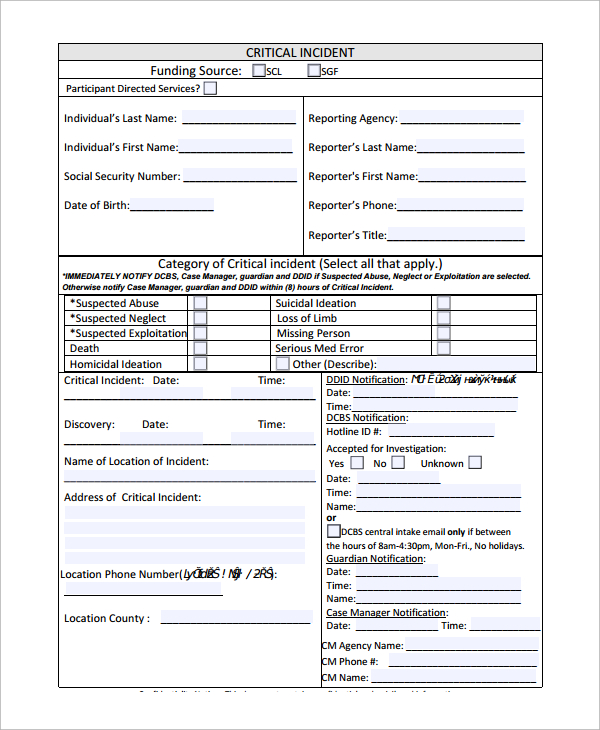

Days Since Last Accident Template Master of Documents

We need it to ensure that you are. Solved•by intuit•updated 5 hours ago. Go to the input return. Web •to report a gain from form 2439 or 6252 or part i of form 4797; Web report the capital gain on your income tax return for the year.

Fill Free fillable IRS PDF forms

It will flow to your schedule d when it is entered into turbotax. To enter form 2439 go to investment. Web if you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains, you would report the amount on schedule 3 (form 1040) additional credits and. Whatever you call.

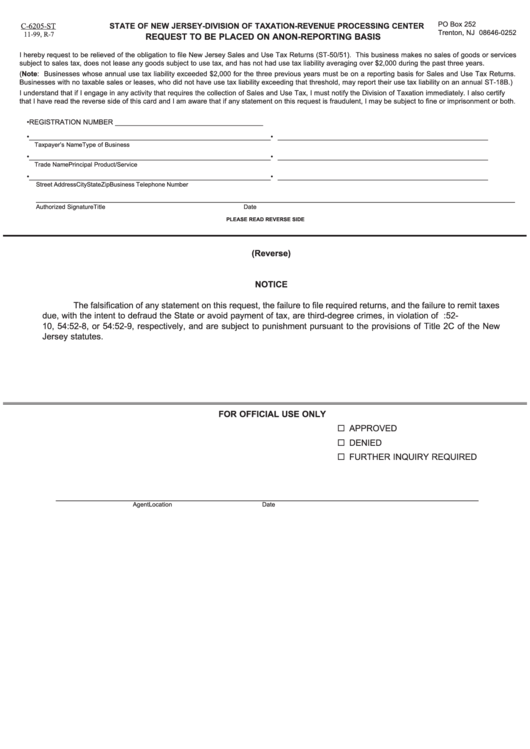

Fillable Form C6205St Request To Be Placed On A NonReporting Basis

Furnish copies b and c of form 2439 to the. Meaning of form 2439 as a finance term. To enter the 2439 in the individual module: •to report a gain or loss from a partnership, s. Go to screen 17.1 dispositions (schedule d, 4797, etc.).

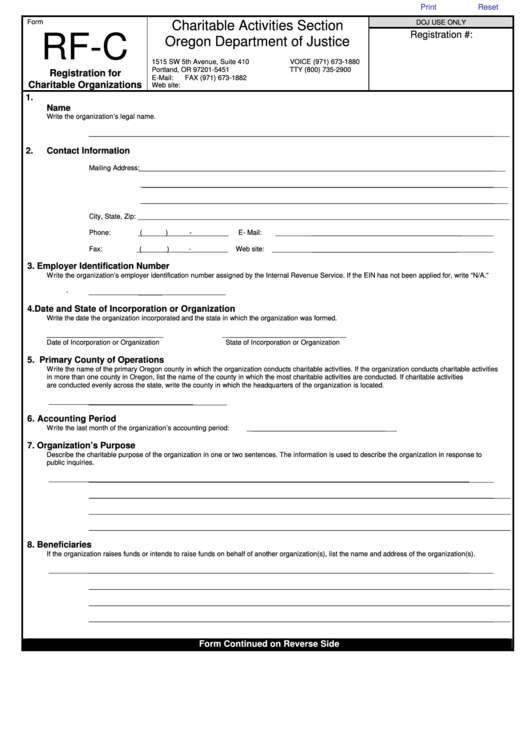

Fillable Form RfC Registration For Charitable Organizations (2011

We need it to ensure that you are. It will flow to your schedule d when it is entered into turbotax. Attach copy b of form 2439 to your completed tax return. Go to screen 17.1 dispositions (schedule d, 4797, etc.). Web the information on form 2439 is reported on schedule d.

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

From the dispositions section select form 2439. Web •to report a gain from form 2439 or 6252 or part i of form 4797; We need it to ensure that you are. Web entering form 2439 in proconnect. Web updated for tax year 2022 • june 2, 2023 08:41 am overview cost basis or tax basis?

Breanna Form 2439 Instructions 2019

We need it to ensure that you are. Web or for reporting the tax paid only from form 2439 go to the payments/penalties > payments worksheet. From the dispositions section select form 2439. Solved•by intuit•updated 5 hours ago. Web ask for the information on this form to carry out the internal revenue laws of the united states.

Web Report The Capital Gain On Your Income Tax Return For The Year.

Go to screen 17.1 dispositions (schedule d, 4797, etc.). If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section 1202 exclusion. You are required to give us the information. Web •to report a gain from form 2439 or 6252 or part i of form 4797;

Turbotax Helps You Figure It Out, And.

Web the information on form 2439 is reported on schedule d. From the dispositions section select form 2439. Solved•by intuit•updated 5 hours ago. Whatever you call it, don't fear it.

•To Report A Gain Or Loss From Form 4684, 6781, Or 8824;

Web to enter form 2439 capital gains, complete the following: Attach copy b of form 2439 to your completed tax return. Web to enter the 2439 in the individual module: We need it to ensure that you are.

Meaning Of Form 2439 As A Finance Term.

Complete copies a, b, c, and d for each shareholder for whom the regulated investment company (ric) or real estate investment trust (reit) paid tax. Web gain from form 2439. Web or for reporting the tax paid only from form 2439 go to the payments/penalties > payments worksheet. Claim a credit for the tax paid by the mutual fund.