Form 3115 Example

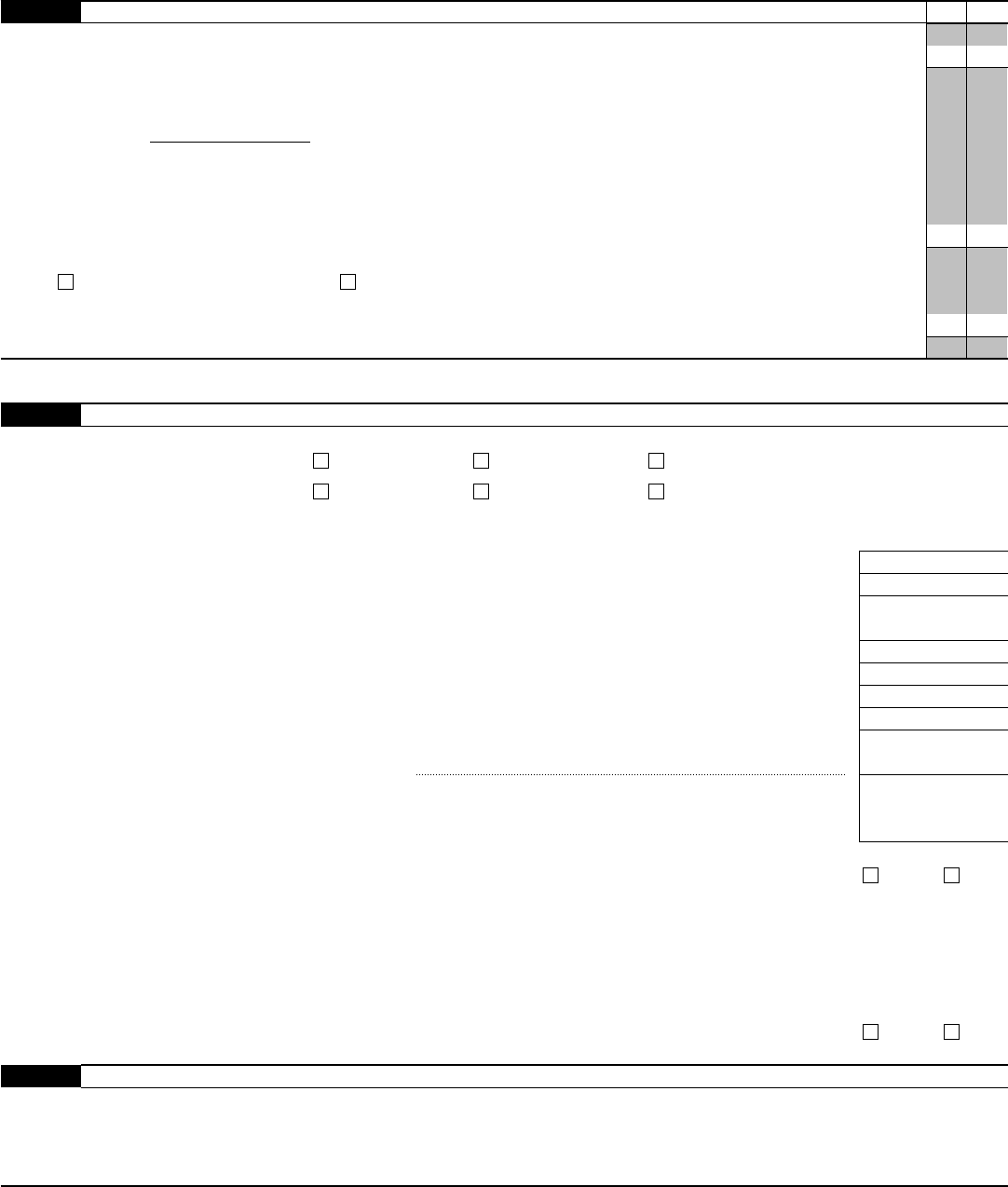

Form 3115 Example - Web has a copy of this form 3115 been provided to the examining agent identified on line 6c? Web view sample form 3115 filled out. If “yes,” check the applicable box and attach the required statement. If “no,” attach an explanation. See section 6.03(3) of rev. City or town, state, and zip code identification number For example, we have been cash basis since we started, but for several reasons, want to change to accrual. Web have you ever had a client who was not depreciating their rental property? Web kbkg has put together a sample form 3115 template with attachments for the concurrent designated change numbers (dcn) 244 and 7. This template is free and can be accessed in our resource library.

Also known as application for change in accounting method, irs form 3115 is required for any taxpayer that changes their accounting method or makes or revokes certain late elections. City or town, state, and zip code identification number Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Failing to request the change could result in penalties. Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or production costs (dcn 192) may file a single form 3115 for both changes by including both dcns 184 and 192 on line 1a of form 3115. Web kbkg has put together a sample form 3115 template with attachments for these new changes using designated change numbers (dcn) 244 and 245. See section 6.03(3) of rev. A straightforward process allows building owners to utilize cost segregation on older properties without amending returns. Web can you use the form 3115 to change an accounting method for a prior year? File this form to request a change in either:

Web 1 part i information for automatic change request other (specify) enter the requested designated accounting method change number from the list of automatic accounting method changes (see instructions). Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. About form 3115, application for change in accounting method | internal revenue service Failing to request the change could result in penalties. The form is required for both changing your overall accounting method or the treatment of a particular item. Web key takeaways businesses can choose to use the accrual accounting method or the cash accounting method, and they must inform the irs of their choice. Web kbkg has put together a sample form 3115 template with attachments for the concurrent designated change numbers (dcn) 244 and 7. Web if you’d like to review an example form 3115 for a cost segregation study, email our director of cost segregation. Web for example, a taxpayer with accounts receivables of $2.0mm and accounts payable of $1.0mm would obtain a negative §481(a) adjustment, which is a tax deduction, in the year the irs form 3115 was properly filed for the taxpayer employing dcn 233. If “yes,” check the applicable box and attach the required statement.

Form 3115 Edit, Fill, Sign Online Handypdf

A straightforward process allows building owners to utilize cost segregation on older properties without amending returns. Web key takeaways businesses can choose to use the accrual accounting method or the cash accounting method, and they must inform the irs of their choice. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Web 1.

Form 3115 Edit, Fill, Sign Online Handypdf

Web can you use the form 3115 to change an accounting method for a prior year? Select the template you require in the collection of legal form samples. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. If “yes,” check the applicable box and attach the required.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Select the get form button to open the document and start editing. This template is free and can be accessed in our resource library. If you want to change the accounting method your business uses, you need to request it from the irs by filing form 3115. Web 1 part i information for automatic change request other (specify) enter the.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Web has a copy of this form 3115 been provided to the examining agent identified on line 6c? Select the template you require in the collection of legal form samples. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Web to obtain the irs's consent, taxpayers file form 3115,.

Form 3115 Edit, Fill, Sign Online Handypdf

Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Web view sample form 3115 filled out. Does audit protection apply to the applicant’s requested change in method of accounting? Web reduced form 3115 filing requirements are retained but taxpayers must take the remaining portion of a positive irc section.

Form 3115 App for change in acctg method Capstan Tax Strategies

Web for example, a taxpayer with accounts receivables of $2.0mm and accounts payable of $1.0mm would obtain a negative §481(a) adjustment, which is a tax deduction, in the year the irs form 3115 was properly filed for the taxpayer employing dcn 233. If “yes,” check the applicable box and attach the required statement. Web for example, an applicant requesting both.

TPAT Form 3115 and New Tangible Property Regulations (TPR)

Web has a copy of this form 3115 been provided to the examining agent identified on line 6c? This blog post is designed as an example on how to apply a cost segregation study on a tax return. The form 3115 is the way you must make corrections in these types of situations. Also known as application for change in.

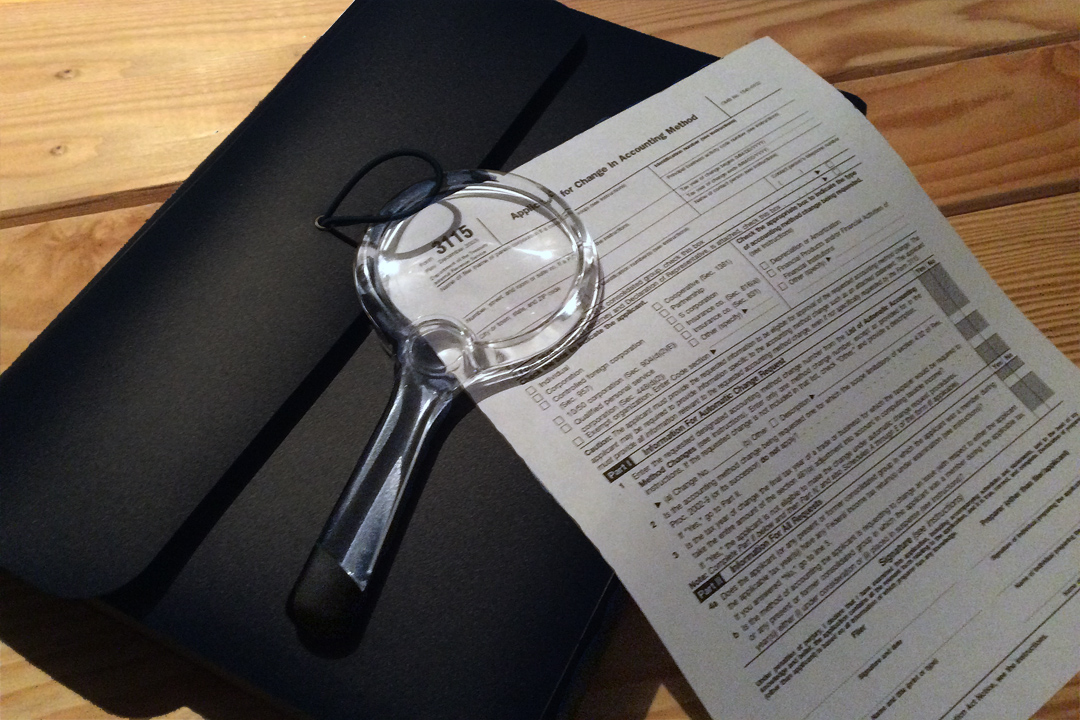

Instructions For Form 3115 (Rev. December 2015) printable pdf download

City or town, state, and zip code identification number About form 3115, application for change in accounting method | internal revenue service Web kbkg has put together a sample form 3115 template with attachments for the concurrent designated change numbers (dcn) 244 and 7. Select the get form button to open the document and start editing. Web reduced form 3115.

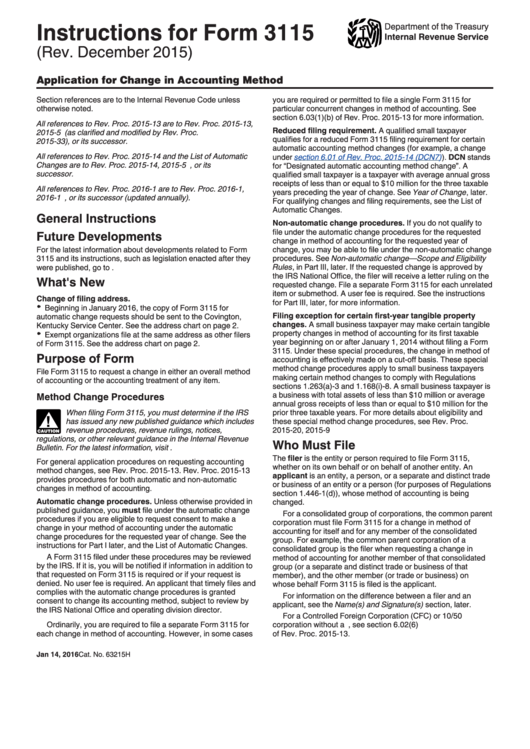

Fill Free fillable Form 3115 2018 Application for Change in

Web have you ever had a client who was not depreciating their rental property? Here’s a list of types of businesses and individuals who may need to. Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual method, accelerating depreciation, expensing a previously.

3115 Purpose of Form and Filing

See section 6.03(3) of rev. If “yes,” check the applicable box and attach the required statement. Enter only one method change number, except as provided for in the instructions. Web in most cases, business owners will fill out form 3115 to request a change in their accounting method. Select the get form button to open the document and start editing.

Web Go To Www.irs.gov/Form3115 For Instructions And The Latest Information.

For example, we have been cash basis since we started, but for several reasons, want to change to accrual. Web key takeaways businesses can choose to use the accrual accounting method or the cash accounting method, and they must inform the irs of their choice. Even when the irs's consent is not required, taxpayers must file form 3115. Web kbkg has put together a sample form 3115 template with attachments for the concurrent designated change numbers (dcn) 244 and 7.

Or One Who Was Depreciating The Land As Well As The Building?

If “yes,” check the applicable box and attach the required statement. Web have you ever had a client who was not depreciating their rental property? Does audit protection apply to the applicant’s requested change in method of accounting? Web kbkg has put together a sample form 3115 template with attachments for these new changes using designated change numbers (dcn) 244 and 245.

File This Form To Request A Change In Either:

Web has a copy of this form 3115 been provided to the examining agent identified on line 6c? City or town, state, and zip code identification number Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or production costs (dcn 192) may file a single form 3115 for both changes by including both dcns 184 and 192 on line 1a of form 3115.

Here’s A List Of Types Of Businesses And Individuals Who May Need To.

Web in most cases, business owners will fill out form 3115 to request a change in their accounting method. Web can you use the form 3115 to change an accounting method for a prior year? Enter only one method change number, except as provided for in the instructions. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method.