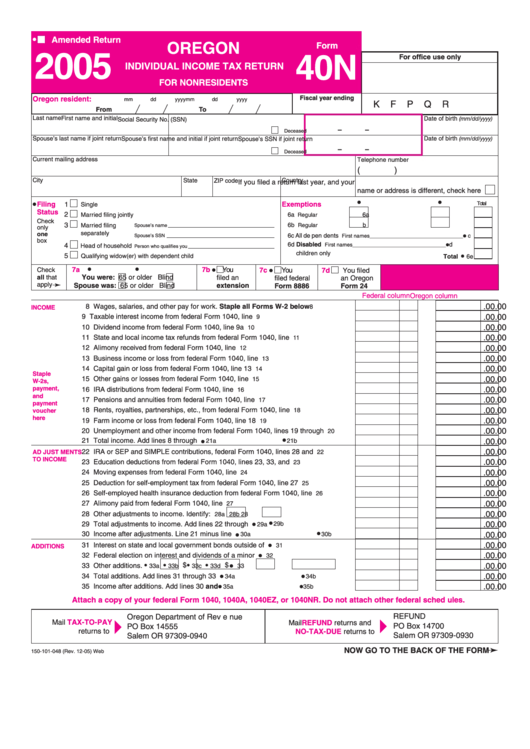

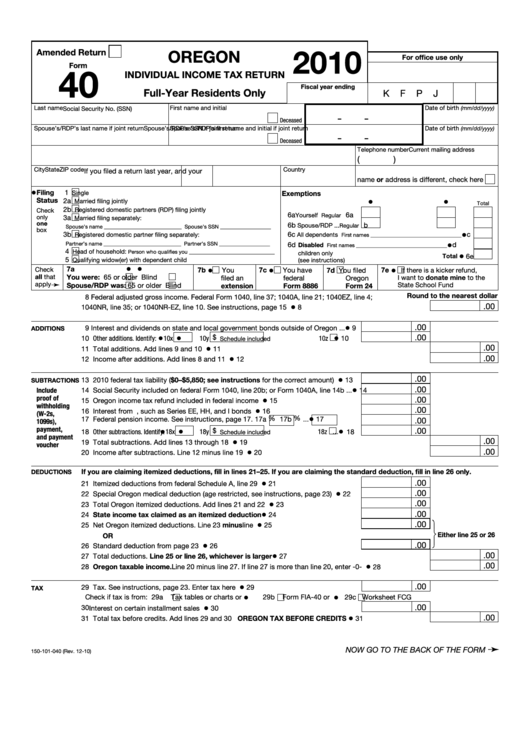

Form 40 Oregon

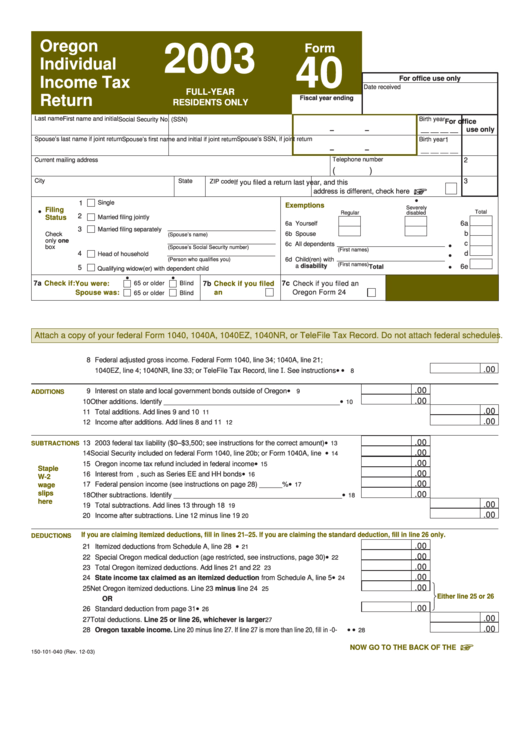

Form 40 Oregon - If more than four, check this box with your return. 01) • use uppercase letters. Web enter the tax from your 2013 form 40, line 29; • print actual size (100%). The special oregon medical deduction is no longer available. Form 40 is the general income tax return for oregon residents. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Form 40 can be efiled, or a paper copy can be filed via mail. 18 —don’t include this form with your oregon return. List your dependents in order from youngest to oldest.

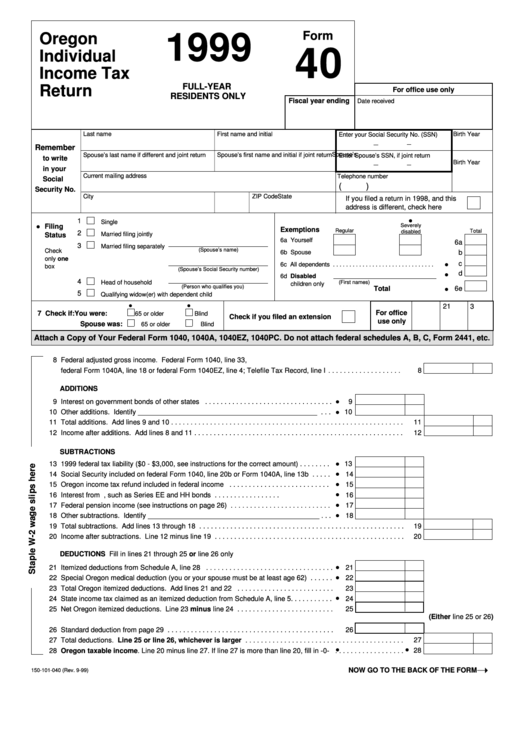

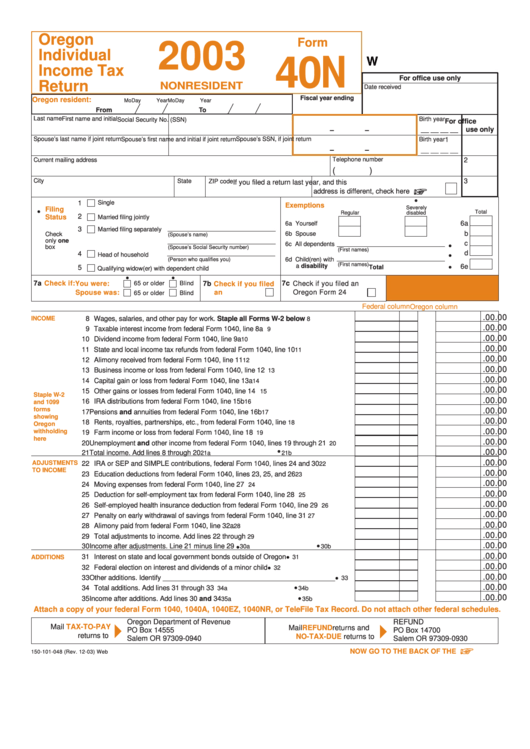

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web we last updated oregon form 40 in january 2023 from the oregon department of revenue. Or form 40p, line 50. Web printable oregon income tax form 40. 01) • use uppercase letters. Web form 40 is the general income tax return for oregon residents. Web oregon individual income tax return for nonresidents dependents. We last updated the resident individual income tax. Web check the amended return. on the upper left corner of the form to report that it's a tax amendment. Complete, edit or print tax forms instantly.

18 —don’t include this form with your oregon return. • print actual size (100%). Web oregon form 40 instructions new information special oregon medical deduction. Form 40 can be efiled, or a paper copy can be filed via mail. We last updated the resident individual income tax. If you’re mailing a payment with your tax. 01) • use uppercase letters. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Keep it with your records.—.

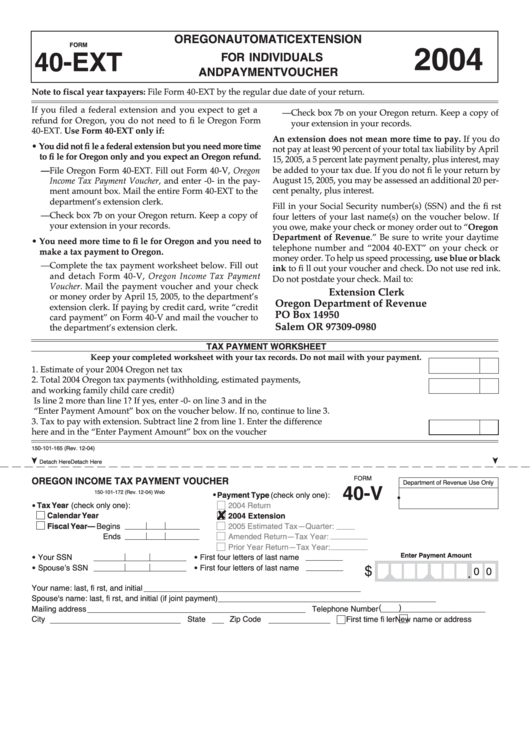

2020 Form OR OR40V Fill Online, Printable, Fillable, Blank pdfFiller

Select a heading to view its forms, then u se the search feature to locate a form or publication. • don’ t submit photocopies or. Oregon.gov/dor july 15, 2020is the due date for filing your return and paying your tax due. Form 40 can be efiled, or a paper copy can be filed via mail. Part b— prorate your total.

Form 40 Oregon Individual Tax Return (FullYear Residents Only

Web enter the tax from your 2013 form 40, line 29; Complete, edit or print tax forms instantly. 01) • use uppercase letters. Web oregon individual income tax return for nonresidents dependents. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result.

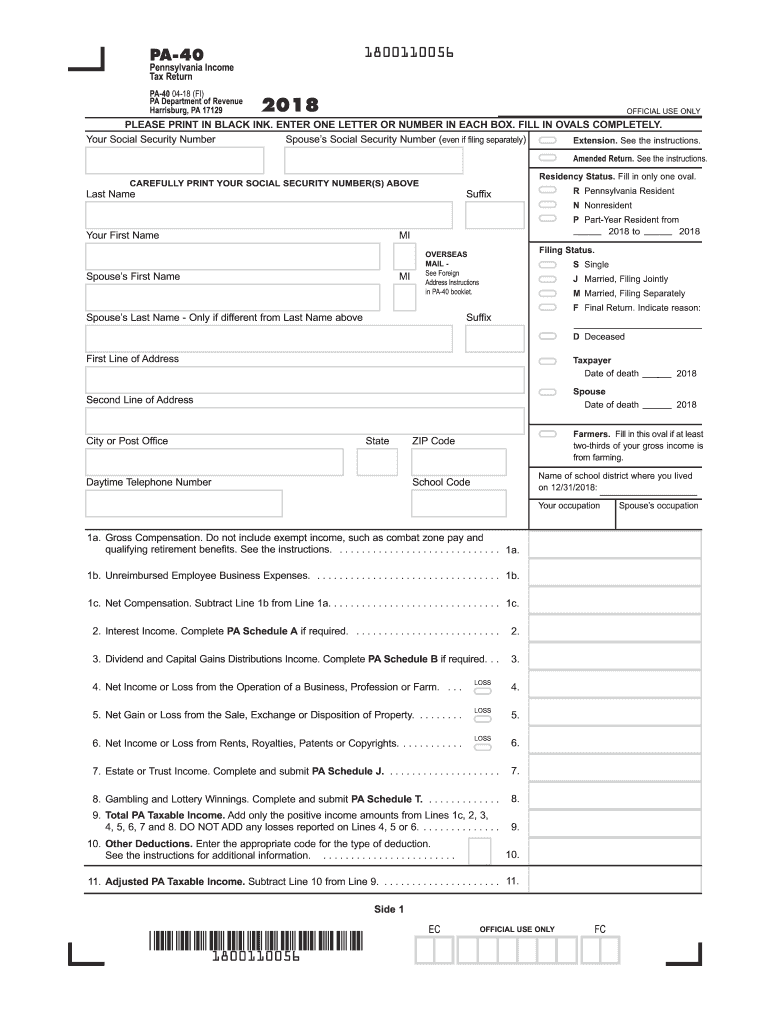

Fillable Form 40 Oregon Individual Tax Return 1999 printable

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web check the amended return. on the upper left corner of the form to report that it's a tax amendment. 01) • use uppercase letters. The special oregon.

Fillable Form 40n Oregon Individual Tax Return Nonresident

01) • use uppercase letters. Complete, edit or print tax forms instantly. Web check the amended return. on the upper left corner of the form to report that it's a tax amendment. Complete, edit or print tax forms instantly. Web we last updated oregon form 40 in january 2023 from the oregon department of revenue.

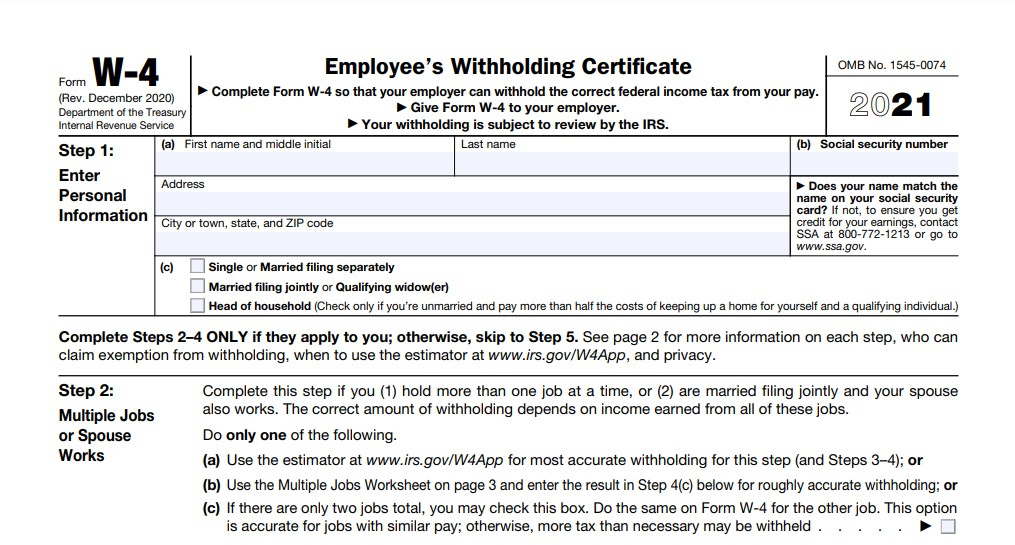

Oregon W4 2021 Form Printable 2022 W4 Form

18 —don’t include this form with your oregon return. Web view all of the current year's forms and publications by popularity or program area. File electronically—it’s fast, easy, and secure. If more than four, check this box with your return. 01) • use uppercase letters.

Oregon Form 40 Instructions 2018 slidesharedocs

Web check the amended return. on the upper left corner of the form to report that it's a tax amendment. Web enter the tax from your 2013 form 40, line 29; This form is for income earned in tax year 2022, with tax returns due in april. File electronically—it’s fast, easy, and secure. Web view all of the current year's.

Fillable Form 40n Individual Tax Return For Nonresidents

If you’re mailing a payment with your tax. Oregon.gov/dor july 15, 2020is the due date for filing your return and paying your tax due. We last updated the resident individual income tax. Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due in.

Fillable Form 40Ext Oregon Automatic Extension For Individuals And

Or form 40p, line 50. • use blue or black ink. 01) • use uppercase letters. Web view all of the current year's forms and publications by popularity or program area. Web check the amended return. on the upper left corner of the form to report that it's a tax amendment.

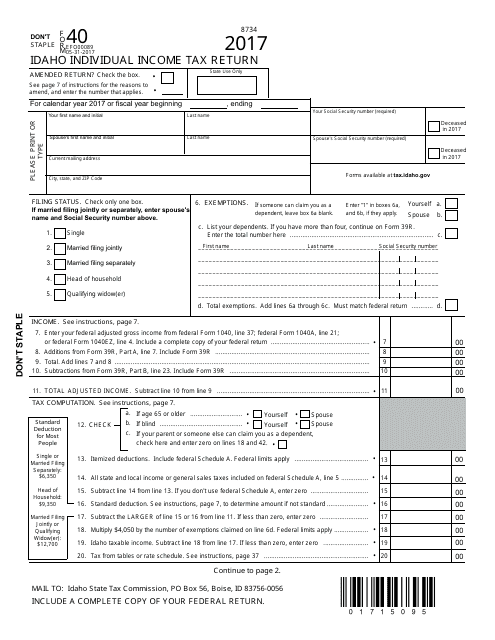

Form 40 Download Fillable PDF or Fill Online Idaho Individual

Form 40 can be efiled, or a paper copy can be filed via mail. Keep it with your records.—. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web oregon individual income tax return for nonresidents dependents..

Oregon.gov/Dor July 15, 2020Is The Due Date For Filing Your Return And Paying Your Tax Due.

• print actual size (100%). If more than four, check this box with your return. • don’ t submit photocopies or. Web check the amended return. on the upper left corner of the form to report that it's a tax amendment.

Web Enter The Tax From Your 2013 Form 40, Line 29;

Complete, edit or print tax forms instantly. Form 40 is the general income tax return for oregon residents. Complete, edit or print tax forms instantly. • print actual size (100%).

• Use Blue Or Black Ink.

Form 40 can be efiled, or a paper copy can be filed via mail. Web printable oregon income tax form 40. This form is for income earned in tax year 2022, with tax returns due in april. Or form 40p, line 50.

Keep It With Your Records.—.

Web oregon form 40 instructions new information special oregon medical deduction. Web view all of the current year's forms and publications by popularity or program area. Part b— prorate your total. 18 —don’t include this form with your oregon return.