Transfer On Death Form California

Transfer On Death Form California - In addition to assets that already have a designated beneficiary (like a life insurance or a bank account), estates with a value of $166,250 or less may qualify for a. Web you will need to do the following: This form is not filed with the court. The transferor simply executes a todd form, then records it during the course of his/her natural life, and. Added 2016, revised 2021 (california probate code section 5642) assessor’s parcel number: Hcd rt 490.8 (pdf) — report of additional description or additional junior lienholder; This party is known as either a beneficiary or a grantee. Specify who requests the recording and the address to which the document should be sent after its registration. Web transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution. And dealing with the courts and the property of someone who has died is very complicated.

Added 2016, revised 2021 (california probate code section 5642) assessor’s parcel number: And dealing with the courts and the property of someone who has died is very complicated. Addition of beneficiary complete the following statement if no beneficiary is recorded on the ownership registration and title and you wish to add a. Web you will need to do the following: Web the transfer on death deed is fully revocable before the death of the real property owner. Hcd 490.9 (pdf) — application for substitute decal; Ad ca revocable tod deed & more fillable forms, register and subscribe now! The transferor simply executes a todd form, then records it during the course of his/her natural life, and. 1 tod deeds—which have become a popular tool in california estate planning—allow property owners to transfer real estate. Specify who requests the recording and the address to which the document should be sent after its registration.

This document is exempt from documentary transfer tax under revenue & taxation code 11930. This party is known as either a beneficiary or a grantee. (b) nothing in this part invalidates an otherwise valid transfer. Floating home the serial number(s) is: Sometimes, however, family or relatives may be able to transfer property from someone who has. Submit the decedent’s california dl/id card to dmv (even if it is expired). Ad answer simple questions to make a transfer on death deed on any device in minutes. Web to transfer or inherit property after someone dies, you must usually go to court. Submit a written statement listing the: It’s also common for these deeds to identify an alternate beneficiary or grantee.

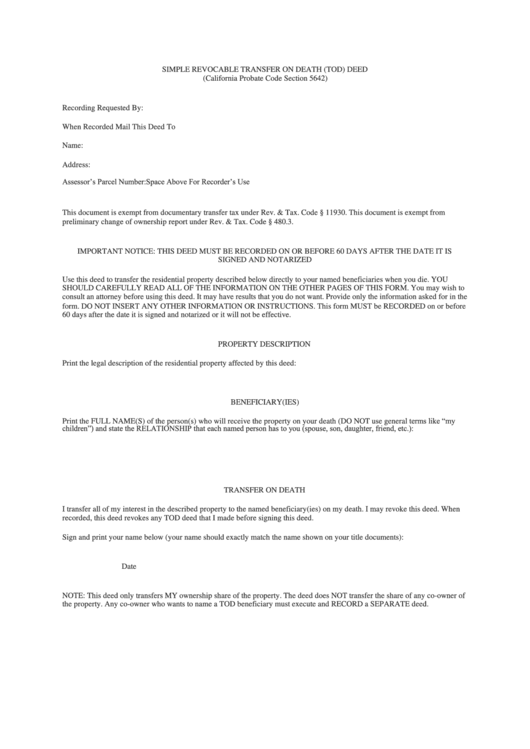

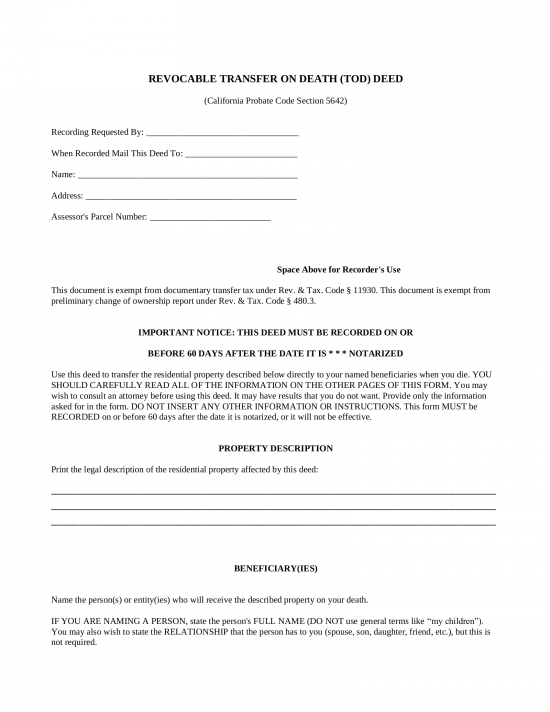

Simple Revocable Transfer On Death Form State Of California printable

In addition to assets that already have a designated beneficiary (like a life insurance or a bank account), estates with a value of $166,250 or less may qualify for a. Floating home the serial number(s) is: Submit the decedent’s california dl/id card to dmv (even if it is expired). It’s also common for these deeds to identify an alternate beneficiary.

Nebraska Transfer Death Form Fill Out and Sign Printable PDF Template

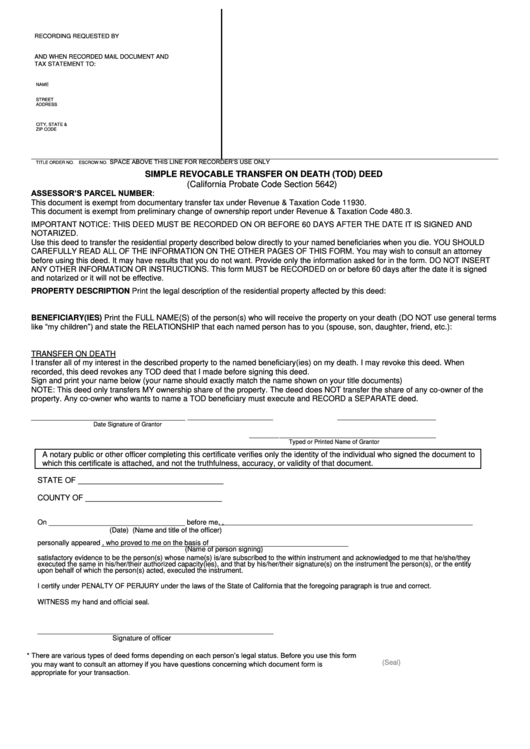

Web simple revocable transfer on death (tod) deed. Added 2016, revised 2021 (california probate code section 5642) assessor’s parcel number: Write the grantor’s details start filling from the upper left corner of the paper. Web transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: Floating home the serial number(s).

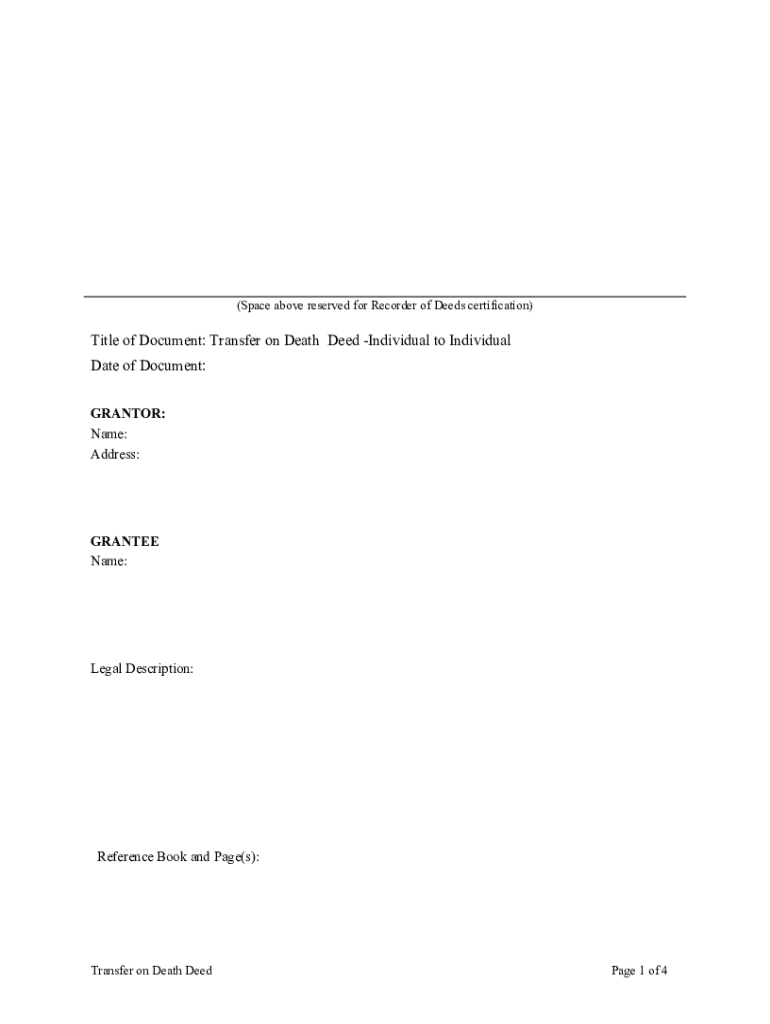

Transfer Death Form Missouri Fill Online, Printable, Fillable, Blank

How do i transfer my spouse’s property to me? Specify who requests the recording and the address to which the document should be sent after its registration. Web the transfer on death deed is fully revocable before the death of the real property owner. Web use this deed to transfer the residential property described below directly to your named beneficiaries.

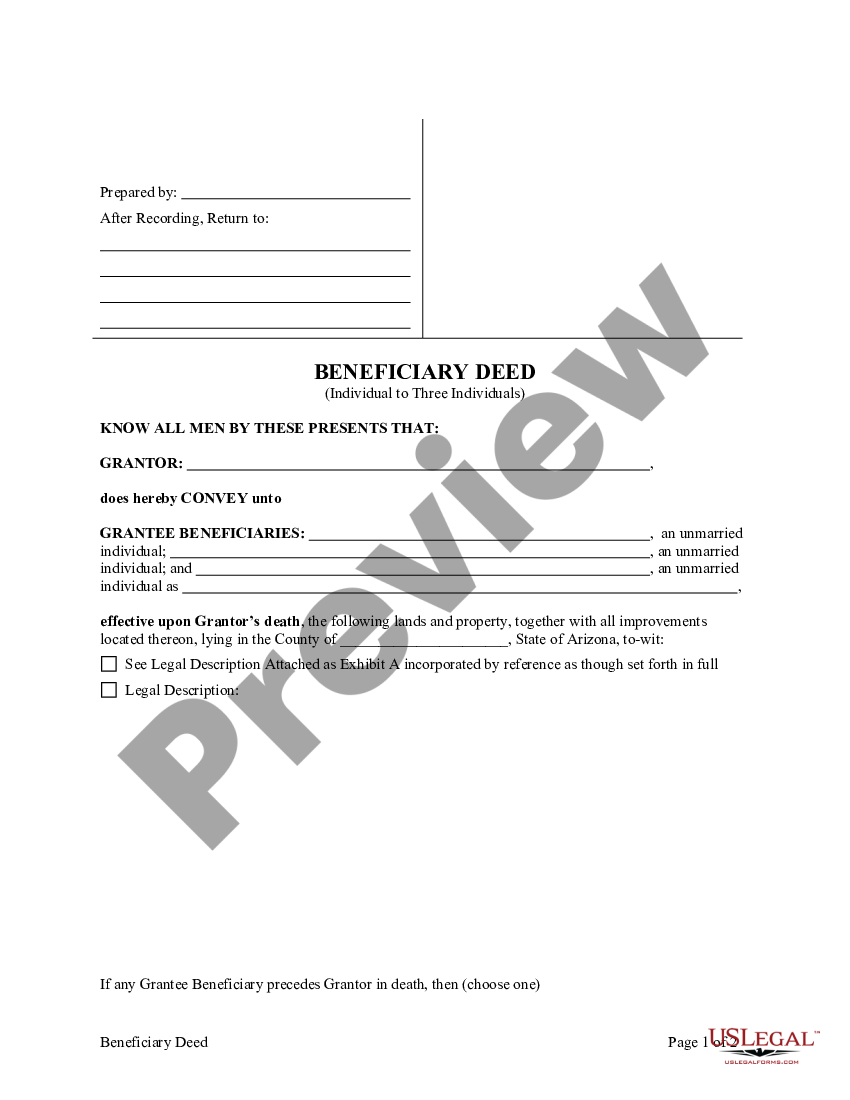

Arizona Transfer on Death or TOD Beneficiary Deed Transfer Death

Addition of beneficiary complete the following statement if no beneficiary is recorded on the ownership registration and title and you wish to add a. The transferor simply executes a todd form, then records it during the course of his/her natural life, and. Web hcd 488.4 (pdf) — transfer on death beneficiary; It’s also common for these deeds to identify an.

Oklahoma Transfer on Death Deed Transfer Death Deed US Legal Forms

Web it can be difficult to figure out whether you can use a simplified informal process to transfer property. Addition of beneficiary complete the following statement if no beneficiary is recorded on the ownership registration and title and you wish to add a. Web certified copy of the decedent’s death certificate and have a notarized signature. Web transfer on death.

Free California Revocable Transfer on Death (TOD) Deed Form Word

Hcd 490.9 (pdf) — application for substitute decal; You may wish to consult an. Ad answer simple questions to make a transfer on death deed on any device in minutes. 1 tod deeds—which have become a popular tool in california estate planning—allow property owners to transfer real estate. Web to transfer or inherit property after someone dies, you must usually.

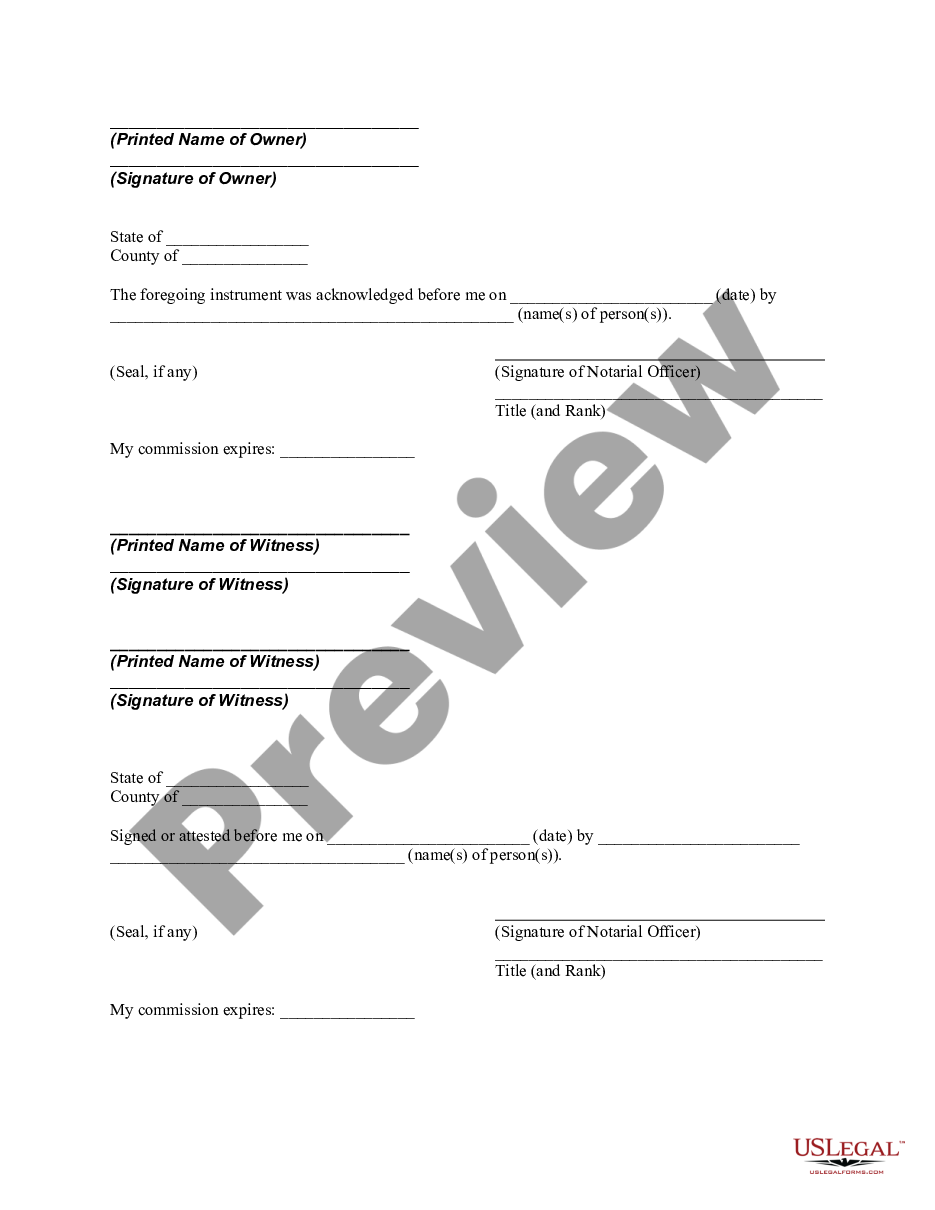

Ohio Transfer on Death Designation Affidavit Ohio Transfer Death Form

Web to transfer or inherit property after someone dies, you must usually go to court. Submit the decedent’s california dl/id card to dmv (even if it is expired). The transferor simply executes a todd form, then records it during the course of his/her natural life, and. You may wish to consult an. Web • a certified copy of the death.

Transfer on Death Deed Texas Form 2022 Fill Out and Sign Printable

Web certified copy of the decedent’s death certificate and have a notarized signature. Ad ca revocable tod deed & more fillable forms, register and subscribe now! And dealing with the courts and the property of someone who has died is very complicated. Web to transfer or inherit property after someone dies, you must usually go to court. (b) nothing in.

Fillable Simple Revocable Transfer On Death (Tod) Deed Form State Of

(a) this part applies to a revocable transfer on death deed made by a transferor who dies on or after january 1, 2016, whether the deed was executed or recorded before, on, or after january 1, 2016. Web use this deed to transfer the residential property described below directly to your named beneficiaries when you die. Ad answer simple questions.

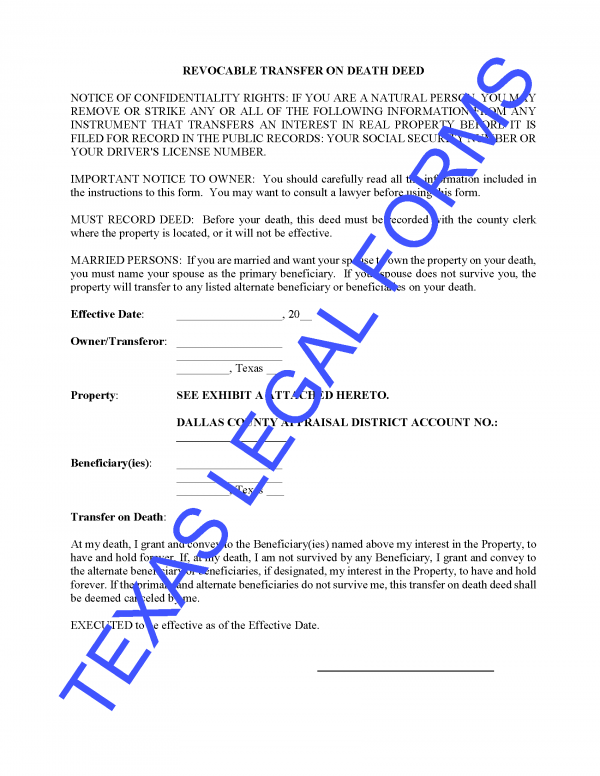

Revocable Transfer on Death Deed Texas Legal Forms by David Goodhart

You may wish to consult an. 1 tod deeds—which have become a popular tool in california estate planning—allow property owners to transfer real estate. You should carefully read all of the information on the other pages of this form. There are 3 effective ways to revoke this deed: If a grantee beneficiary predeceases the owner, the conveyance to that grantee.

You Should Carefully Read All Of The Information On The Other Pages Of This Form.

Web it can be difficult to figure out whether you can use a simplified informal process to transfer property. And dealing with the courts and the property of someone who has died is very complicated. Hcd rt 490.8 (pdf) — report of additional description or additional junior lienholder; Web transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution.

Record A New Transfer On.

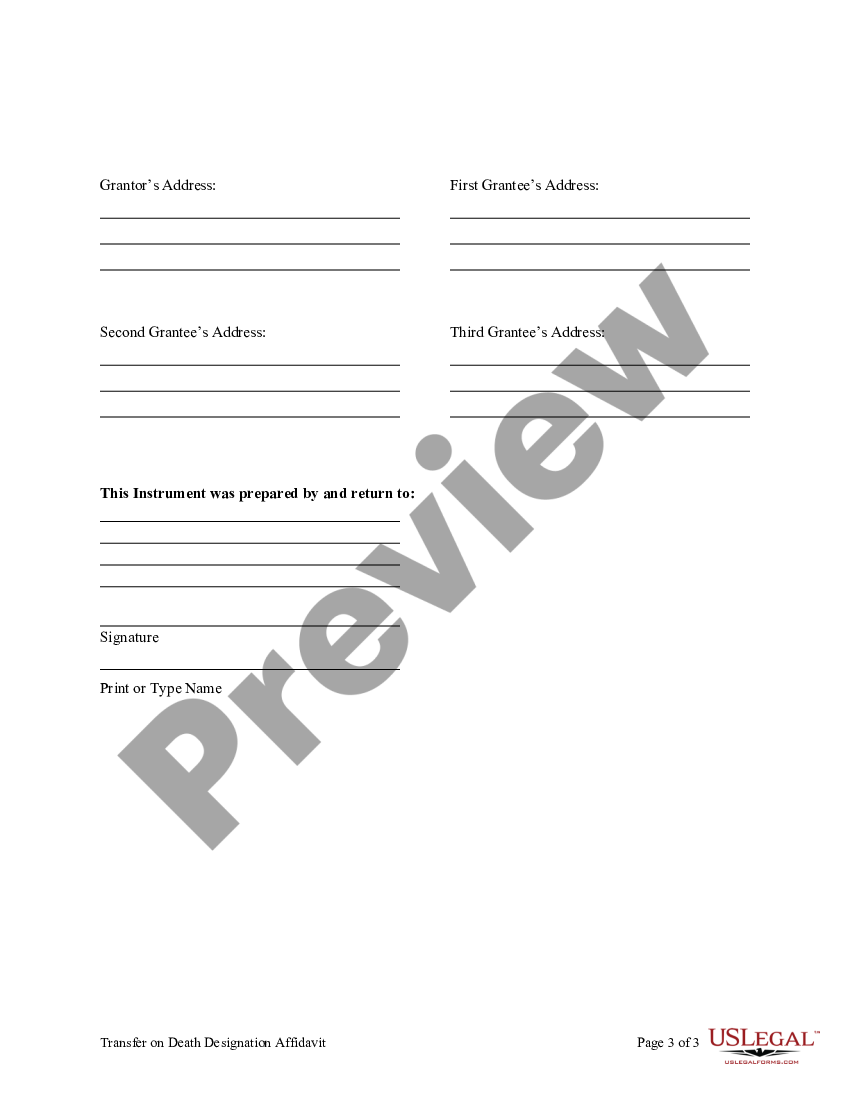

Web you will need to do the following: Web under a transfer on death deed, an owner, also called a grantor, selects a person or entity to receive real property. Web • a certified copy of the death certificate of the person who died • proof that the person who died owned the property (like a bank passbook, storage receipt, stock certificate) • proof of your identity (like a driver’s license or passport) • an inventory and appraisal of all real. (b) nothing in this part invalidates an otherwise valid transfer.

(A) This Part Applies To A Revocable Transfer On Death Deed Made By A Transferor Who Dies On Or After January 1, 2016, Whether The Deed Was Executed Or Recorded Before, On, Or After January 1, 2016.

Web to transfer or inherit property after someone dies, you must usually go to court. Web certified copy of the decedent’s death certificate and have a notarized signature. This party is known as either a beneficiary or a grantee. Ad answer simple questions to make a transfer on death deed on any device in minutes.

How Do I Transfer My Spouse’s Property To Me?

You may wish to consult an. 1 tod deeds—which have become a popular tool in california estate planning—allow property owners to transfer real estate. It’s also common for these deeds to identify an alternate beneficiary or grantee. The transferor simply executes a todd form, then records it during the course of his/her natural life, and.