Form 480 Puerto Rico

Form 480 Puerto Rico - Formulario 480.5 / for 480.5 (informativo) Series 480.6a and series 480.6d. When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source Nonresident annual return for income tax withheld at source. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Annual reconciliation statement of other income subject to withholding. Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. There is no de minimis for either form. Just make sure that you include this amount in usd.

Series 480.6a and series 480.6d. Annual reconciliation statement of other income subject to withholding. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. There is no de minimis for either form. Web instructions form 480.20(ec) circular letter no. Formulario 480.5 / for 480.5 (informativo) ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Nonresident annual return for income tax withheld at source.

Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. Web instructions form 480.20(ec) circular letter no. Formulario 480.5 / for 480.5 (informativo) Just make sure that you include this amount in usd. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Annual reconciliation statement of other income subject to withholding. When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source There is no de minimis for either form.

W2 Puerto Rico Form Fill Out and Sign Printable PDF Template signNow

Nonresident annual return for income tax withheld at source. When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source Just make sure that you include this amount in usd. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Annual reconciliation statement of other income.

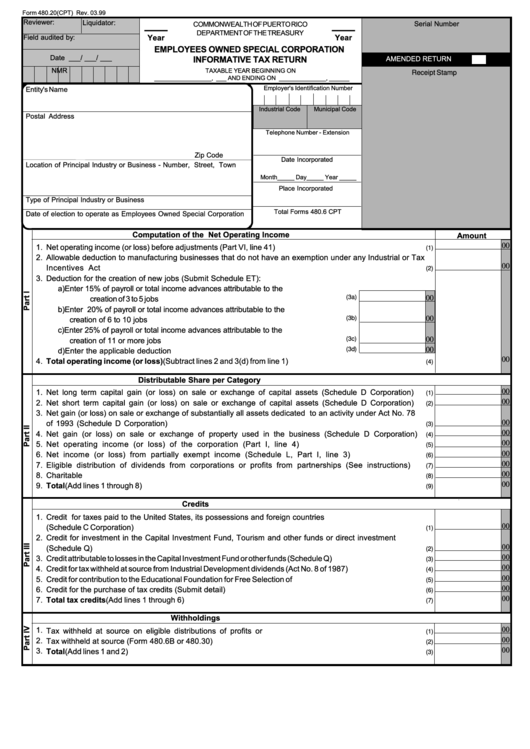

Form 480.20(Cpt) Employees Owned Special Corporation Informative Tax

Annual reconciliation statement of other income subject to withholding. Just make sure that you include this amount in usd. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Formulario 480.5 / for 480.5 (informativo) Web instructions form 480.20(ec) circular letter no.

Form 480 puerto rico Fill out & sign online DocHub

Annual reconciliation statement of other income subject to withholding. Nonresident annual return for income tax withheld at source. Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source.

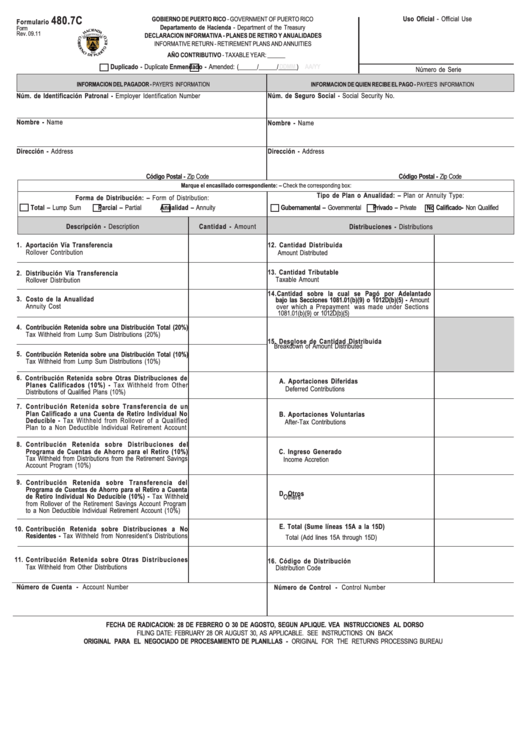

Form 480.7c Informative Return Retirement Plans And Annuities

Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. Web there are two separate series 480 forms that.

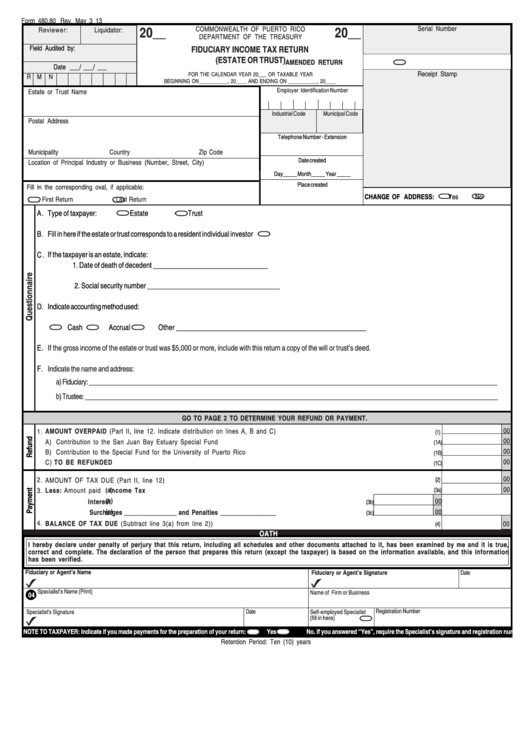

Form 480.80 Fiduciary Tax Return (Estate Or Trust) 2013

Nonresident annual return for income tax withheld at source. Series 480.6a and series 480.6d. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: There is no de minimis for either form. Annual reconciliation statement of other income subject to withholding.

2012 Form PR 480.20 Fill Online, Printable, Fillable, Blank pdfFiller

Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. Formulario 480.5 / for 480.5 (informativo) Nonresident annual return for income tax withheld at source. Web instructions form 480.20(ec) circular letter no. Annual reconciliation statement of other income subject to withholding.

Form 480.7E Tax Alert RSM Puerto Rico

¿qué formulario se debe completar para solicitar copia del comprobante de retención. Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: Just make sure that you include this amount in usd. Series.

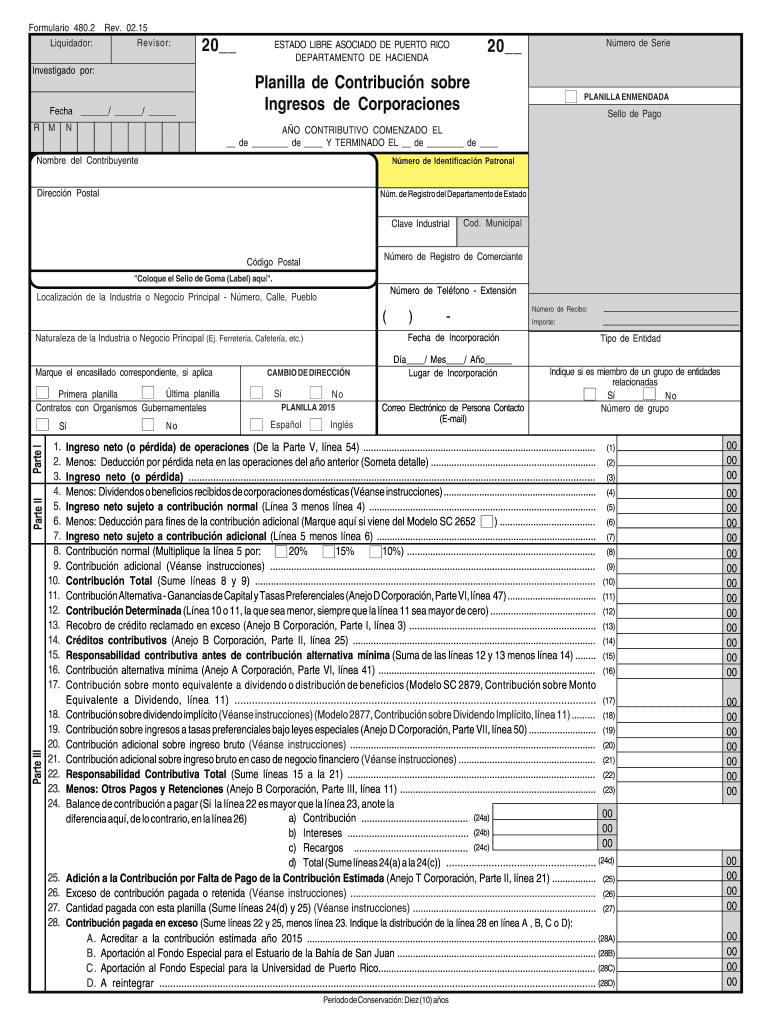

Puerto Rico 480 2 Form Fill Out and Sign Printable PDF Template signNow

Nonresident annual return for income tax withheld at source. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Formulario 480.5 / for 480.5 (informativo) Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. There is no de minimis for either form.

Puerto Rico Corporation Tax Return Fill Out and Sign Printable

When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source ¿qué formulario se debe completar para solicitar copia del comprobante de retención. There is no de minimis for either form. Web yes, you will need to report this puerto rican bank interest as income on your income.

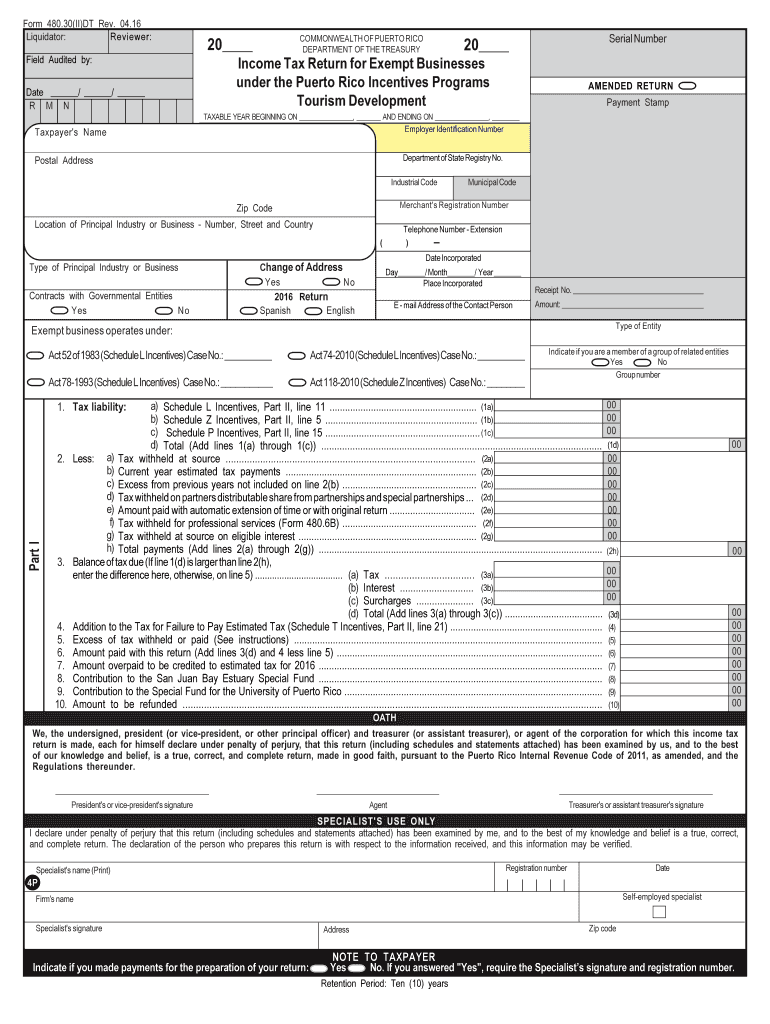

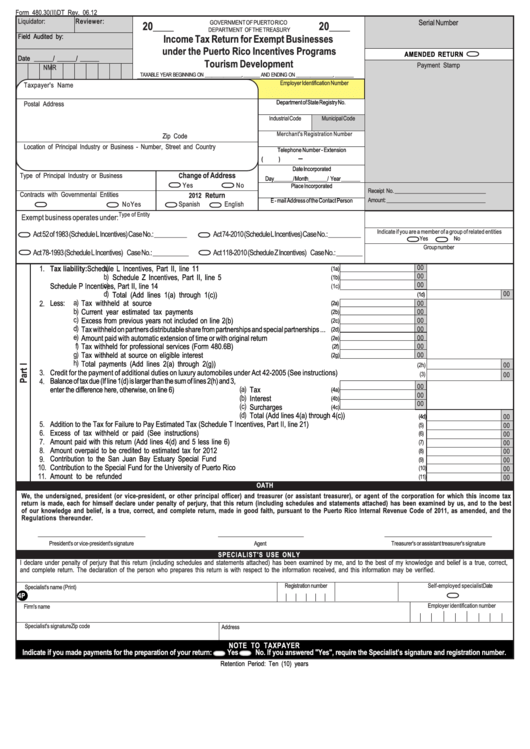

Form 480.30(Ii)dt Tax Return For Exempt Businesses Under The

Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Nonresident annual return for income tax withheld at source. Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. There is no de minimis for either form. Formulario 480.5 / for.

Web Instructions Form 480.20(Ec) Circular Letter No.

Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. There is no de minimis for either form. Annual reconciliation statement of other income subject to withholding. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico:

Series 480.6A And Series 480.6D.

Formulario 480.5 / for 480.5 (informativo) Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Nonresident annual return for income tax withheld at source.

When You Need To File 480.6A If You Pay Natural Or Juridical Person Payments That Are Not Subject To Withholding At The Source

Just make sure that you include this amount in usd.