Form 5227 Instructions 2021

Form 5227 Instructions 2021 - Sign up with your credentials or create a free account to test the service. Ad complete irs tax forms online or print government tax documents. Web a federal form 5227 for a charitable remainder trust, you are not required to file a wisconsin tax return. Web the instructions for form 5227 in a later year will describe the actions that the crt must take to transition from the sniic to calculating nii using the section 664 category and. Web follow the instructions below to complete form 5227 online easily and quickly: Log in to your account. Form 1041 may be electronically filed, but form 5227 must. However, if the charitable remainder trust has at least $1,000 of wisconsin. Go to www.irs.gov/form5227 for instructions and the. See the instructions pdf for more.

Web at least 30 days prior to making application for title, the owner of the real property on which the abandoned property has been abandoned must send this notice by certified mail to. Provide certain information regarding charitable deductions and distributions of or from a. Web follow the instructions below to complete form 5227 online easily and quickly: Web can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? These instructions apply to such trusts unless the context clearly. Get ready for tax season deadlines by completing any required tax forms today. See the instructions pdf for more. Form 5227 filers need to complete only parts i and ii. Form 1041 may be electronically filed, but form 5227 must. However, if the charitable remainder trust has at least $1,000 of wisconsin.

See the instructions pdf for more. Web follow the instructions below to complete form 5227 online easily and quickly: Log in to your account. Web the instructions for form 5227 in a later year will describe the actions that the crt must take to transition from the sniic to calculating nii using the section 664 category and. Web can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Get ready for tax season deadlines by completing any required tax forms today. Web use form 5227 to: Web a federal form 5227 for a charitable remainder trust, you are not required to file a wisconsin tax return. Sign up with your credentials or create a free account to test the service. Go to www.irs.gov/form5227 for instructions and the.

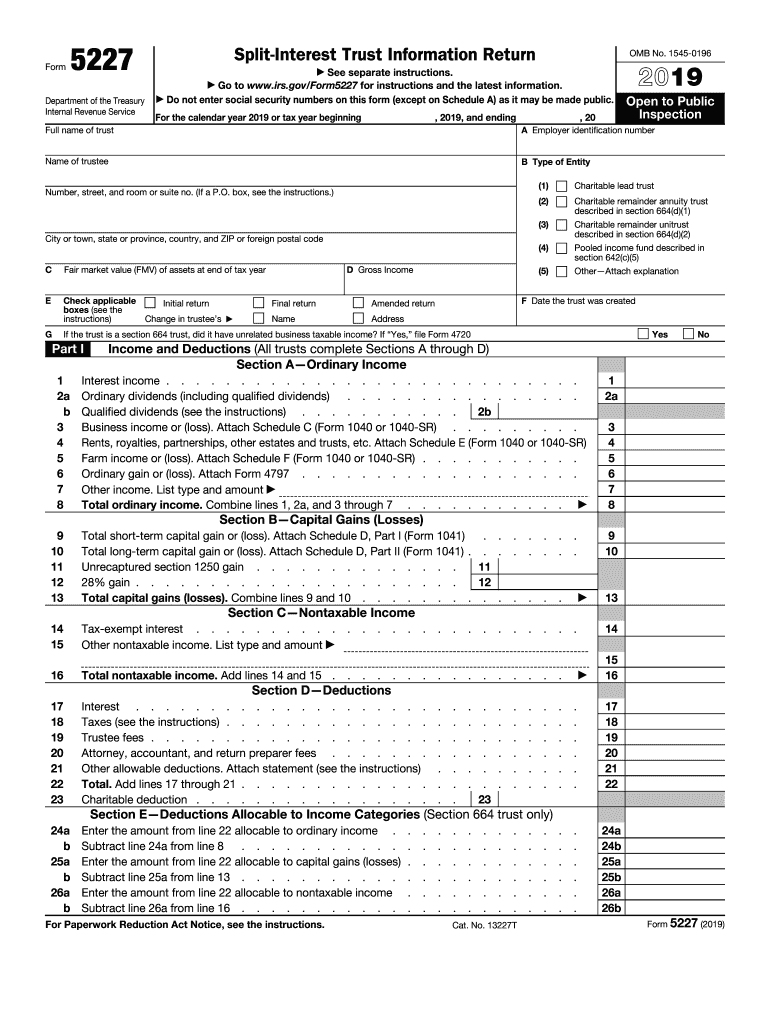

Form 5227 SplitInterest Trust Information Return (2014) Free Download

These instructions apply to such trusts unless the context clearly. Web general instructions purpose of form use form 5227 to: However, if the charitable remainder trust has at least $1,000 of wisconsin. Provide certain information regarding charitable deductions and distributions of or from a. You can download or print.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Form 1041 may be electronically filed, but form 5227 must. Get ready for tax season deadlines by completing any required tax forms today. Web at least 30 days prior to making application for title, the owner of the real property on which the abandoned property has been abandoned must send this notice by certified mail to. Go to www.irs.gov/form5227 for.

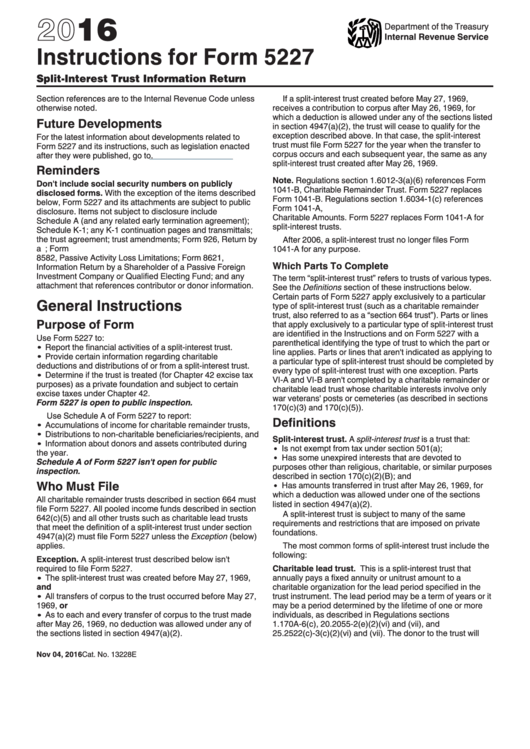

Instructions For Form 5227 2016 printable pdf download

Sign up with your credentials or create a free account to test the service. Web can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Log in to your account. Provide certain information regarding charitable deductions and distributions of or from a. These instructions apply to such trusts unless the context clearly.

8889 Form 2021 IRS Forms Zrivo

However, if the charitable remainder trust has at least $1,000 of wisconsin. Ad complete irs tax forms online or print government tax documents. Form 1041 may be electronically filed, but form 5227 must. Get ready for tax season deadlines by completing any required tax forms today. Log in to your account.

5227 Instructions Form Fill Out and Sign Printable PDF Template signNow

Form 5227 filers need to complete only parts i and ii. Web general instructions purpose of form use form 5227 to: Go to www.irs.gov/form5227 for instructions and the. Sign up with your credentials or create a free account to test the service. Form 1041 may be electronically filed, but form 5227 must.

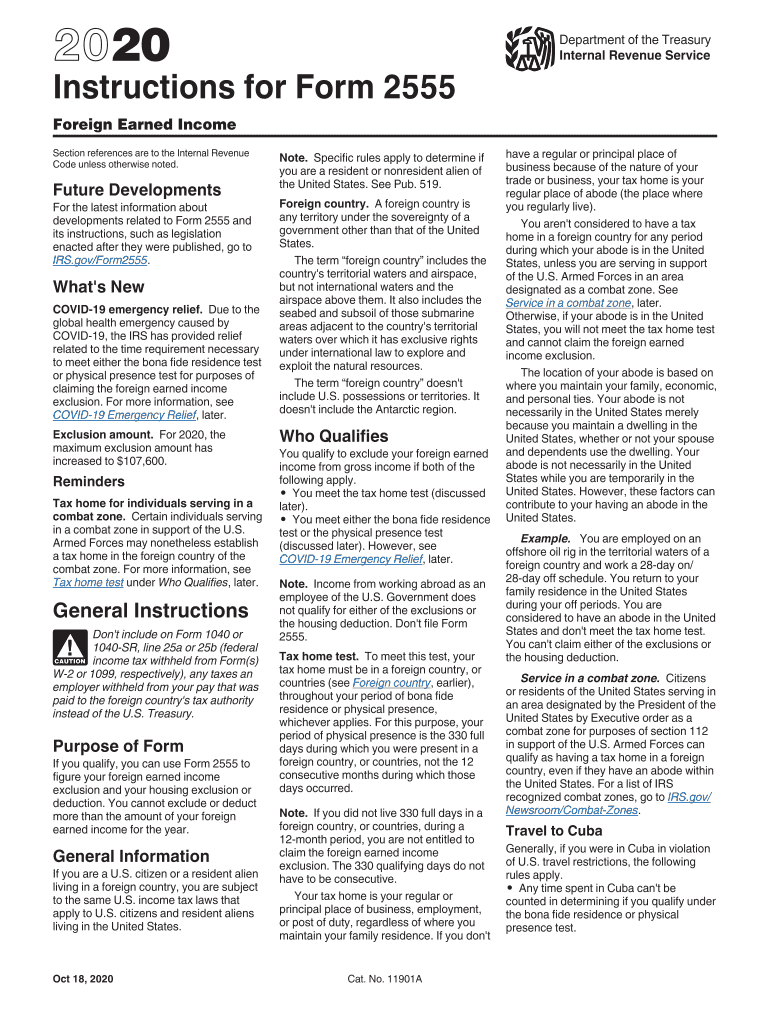

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

These instructions apply to such trusts unless the context clearly. Web general instructions purpose of form use form 5227 to: Form 5227 filers need to complete only parts i and ii. Web can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Get ready for tax season deadlines by completing any required.

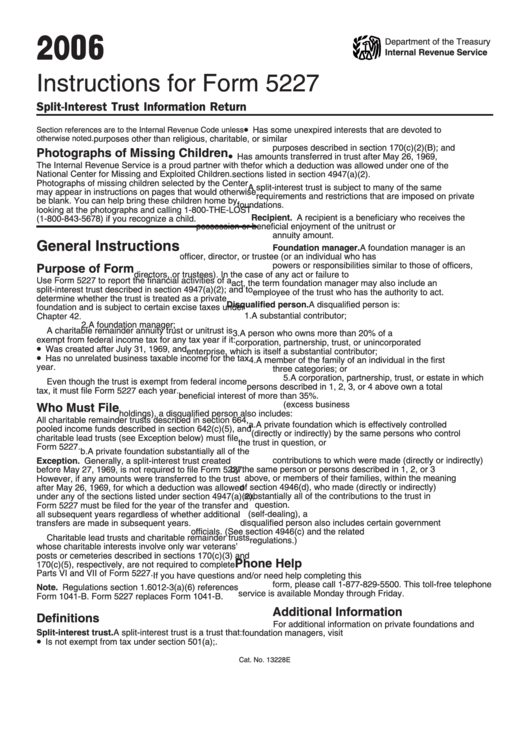

Instructions For Form 5227 printable pdf download

Web general instructions purpose of form use form 5227 to: However, if the charitable remainder trust has at least $1,000 of wisconsin. Get ready for tax season deadlines by completing any required tax forms today. Provide certain information regarding charitable deductions and distributions of or from a. Web can a pooled income or charitable lead trust return with form 1041.

Instructions for Form 5227 IRS Fill Out and Sign Printable PDF

Get ready for tax season deadlines by completing any required tax forms today. See the instructions pdf for more. Log in to your account. Web can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Form 5227 filers need to complete only parts i and ii.

Form 5227 Missouri Department Of Revenue Edit, Fill, Sign Online

Web can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Provide certain information regarding charitable deductions and distributions of or from a. Ad complete irs tax forms online or print government tax documents. Web general instructions purpose of form use form 5227 to: Web use form 5227 to:

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Get ready for tax season deadlines by completing any required tax forms today. Log in to your account. Provide certain information regarding charitable deductions and distributions of or from a. Web general instructions purpose of form use form 5227 to: Form 1041 may be electronically filed, but form 5227 must.

Form 1041 May Be Electronically Filed, But Form 5227 Must.

Web general instructions purpose of form use form 5227 to: See the instructions pdf for more. Ad complete irs tax forms online or print government tax documents. Sign up with your credentials or create a free account to test the service.

Web Use Form 5227 To:

However, if the charitable remainder trust has at least $1,000 of wisconsin. Web follow the instructions below to complete form 5227 online easily and quickly: Form 5227 filers need to complete only parts i and ii. Get ready for tax season deadlines by completing any required tax forms today.

You Can Download Or Print.

Provide certain information regarding charitable deductions and distributions of or from a. Log in to your account. These instructions apply to such trusts unless the context clearly. Web can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed?

Web At Least 30 Days Prior To Making Application For Title, The Owner Of The Real Property On Which The Abandoned Property Has Been Abandoned Must Send This Notice By Certified Mail To.

Web a federal form 5227 for a charitable remainder trust, you are not required to file a wisconsin tax return. Web the instructions for form 5227 in a later year will describe the actions that the crt must take to transition from the sniic to calculating nii using the section 664 category and. Go to www.irs.gov/form5227 for instructions and the.