Form 5500 Due Date Extension 2022

Form 5500 Due Date Extension 2022 - Action steps an employer must file a form 5500 for each separate employee benefit plan that it. Web the form 5558 cannot be used to further extend that automatic extension—the form 5558 extension is only measured from the regular form 5500. Filing form 5558 the form 5558 is used specifically to extend the filing deadlines for certain. Schedule mb (form 5500), multiemployer defined benefit plan and. 17 2022) by filing irs form 5558 by aug. Web individuals and families. Web for those with a due date of april 15 th, the extended due date is october 15 th. Form 5500, annual return/report of employee benefit plan; Typically, the form 5500 is due by. An extension granted under this exception cannot.

An extension granted under this exception cannot. Since april 15 falls on a saturday, and emancipation day. (usually due by july 31, which falls on a. Web individuals and families. C premiums due but unpaid at the end of the year. June 28, 2022 in compliance , employee benefits , reporting requirements & notices. Web effective march 28 2023, only the latest filing for a plan year will be provided in the form 5500 series search results. Schedule mb (form 5500), multiemployer defined benefit plan and. Web for those with a due date of april 15 th, the extended due date is october 15 th. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in.

Action steps an employer must file a form 5500 for each separate employee benefit plan that it. On february 23, 2023, dol, irs, and pbgc. Web for those with a due date of april 15 th, the extended due date is october 15 th. Schedule mb (form 5500), multiemployer defined benefit plan and. Web form 5500 filing deadline without an extension for plan years ended june 30, or deadline to file form 5558 for an extended due date of april 18. In this primer article we highlight who must file,. However, you must collect and retain for your records completed. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in. Web form 5500 is due by august 1, 2022 for calendar year plans posted: Web effective march 28 2023, only the latest filing for a plan year will be provided in the form 5500 series search results.

Retirement plan 5500 due date Early Retirement

(usually due by july 31, which falls on a. Web for those with a due date of april 15 th, the extended due date is october 15 th. Deadlines and extensions applicable to the form 5500 series return. C premiums due but unpaid at the end of the year. An extension granted under this exception cannot.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

However, you must collect and retain for your records completed. Web x form 5558 x automatic extension x the dfvc program x special extension (enter description). Web effective march 28 2023, only the latest filing for a plan year will be provided in the form 5500 series search results. Filing form 5558 the form 5558 is used specifically to extend.

form 5500 extension due date 2022 Fill Online, Printable, Fillable

Typically, the form 5500 is due by. June 28, 2022 in compliance , employee benefits , reporting requirements & notices. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web the form 5558 cannot be used to further extend that automatic extension—the form 5558 extension is only measured from the regular form 5500. An extension granted under.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an. In this primer article we highlight who must file,. Requesting a waiver of the electronic filing requirements: Web individuals and families. Deadlines and extensions applicable to the form 5500.

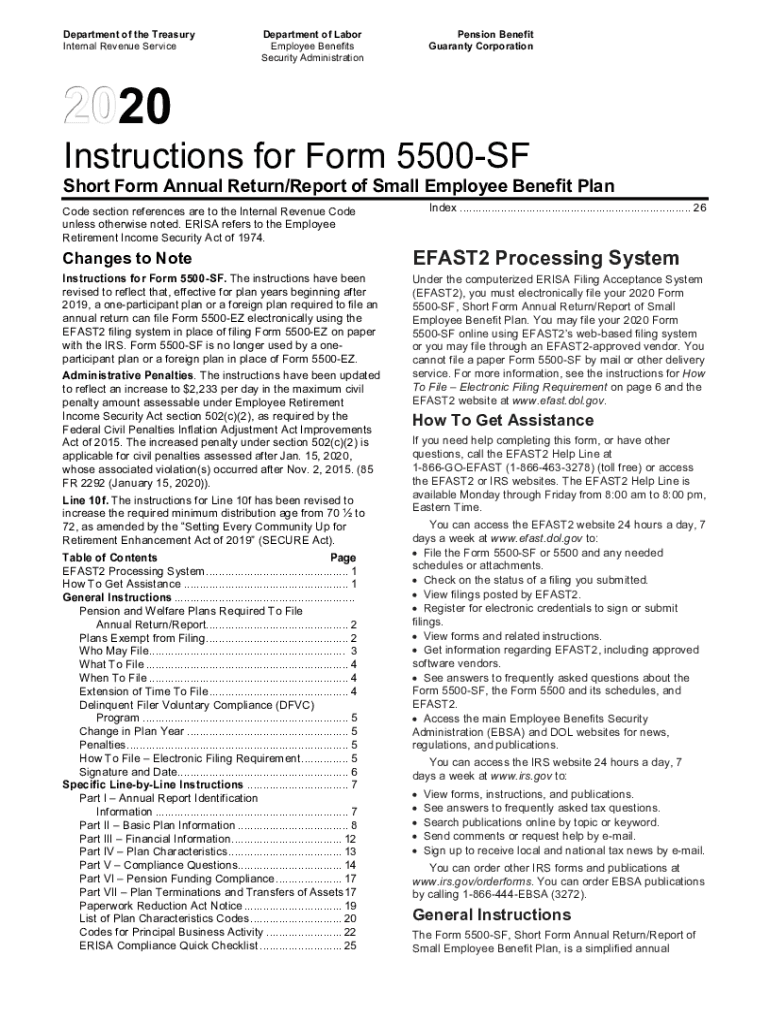

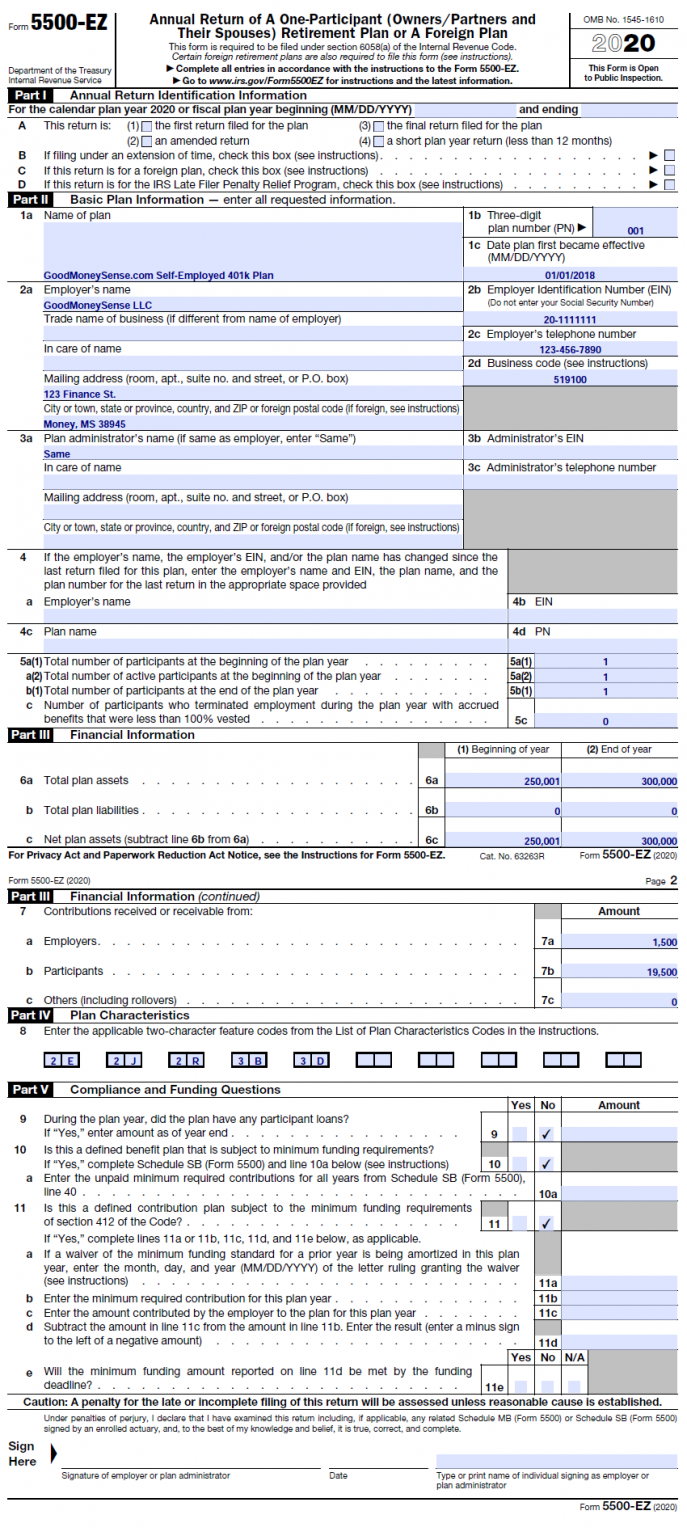

How to File Form 5500EZ Solo 401k

Requesting a waiver of the electronic filing requirements: Web x form 5558 x automatic extension x the dfvc program x special extension (enter description). However, you must collect and retain for your records completed. Web form 5500 is due by august 1, 2022 for calendar year plans posted: Web advance copies of form 5500 information returns, to report on plan.

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

Web x form 5558 x automatic extension x the dfvc program x special extension (enter description). Since april 15 falls on a saturday, and emancipation day. Web individuals and families. Web hurricane ida — extended due date of january 3, 2022 this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting. Form 5500, annual return/report.

August 1st Form 5500 Due Matthews, Carter & Boyce

An extension granted under this exception cannot. Filing form 5558 the form 5558 is used specifically to extend the filing deadlines for certain. June 28, 2022 in compliance , employee benefits , reporting requirements & notices. (usually due by july 31, which falls on a. Action steps an employer must file a form 5500 for each separate employee benefit plan.

Form 5500EZ Example Complete in a Few Easy Steps!

Web the form 5558 cannot be used to further extend that automatic extension—the form 5558 extension is only measured from the regular form 5500. Web hurricane ida — extended due date of january 3, 2022 this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting. In this primer article we highlight who must file,. Deadlines.

Retirement plan 5500 due date Early Retirement

June 28, 2022 in compliance , employee benefits , reporting requirements & notices. However, you must collect and retain for your records completed. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. Typically, the form 5500 is due by. Web individuals.

Form 5500 Is Due by July 31 for Calendar Year Plans

An extension granted under this exception cannot. Web individuals and families. (usually due by july 31, which falls on a. Web effective march 28 2023, only the latest filing for a plan year will be provided in the form 5500 series search results. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022,.

Web If You Received A Cp Notice About Filing Your Form 5500 Series Return Or Form 5558, Application For Extension Of Time To File Certain Employee Plan Returns, The Following.

Web x form 5558 x automatic extension x the dfvc program x special extension (enter description). C premiums due but unpaid at the end of the year. 17 2022) by filing irs form 5558 by aug. Web individuals and families.

On February 23, 2023, Dol, Irs, And Pbgc.

Web the form 5558 cannot be used to further extend that automatic extension—the form 5558 extension is only measured from the regular form 5500. Web for those with a due date of april 15 th, the extended due date is october 15 th. An extension granted under this exception cannot. Filing form 5558 the form 5558 is used specifically to extend the filing deadlines for certain.

(Usually Due By July 31, Which Falls On A.

Action steps an employer must file a form 5500 for each separate employee benefit plan that it. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. Web effective march 28 2023, only the latest filing for a plan year will be provided in the form 5500 series search results. Web form 5500 filing deadline without an extension for plan years ended june 30, or deadline to file form 5558 for an extended due date of april 18.

Web Quarterly Payroll And Excise Tax Returns Normally Due On May 1.

Requesting a waiver of the electronic filing requirements: Web form 5500 is due by august 1, 2022 for calendar year plans posted: Since april 15 falls on a saturday, and emancipation day. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an.