Form 8829 Schedule C

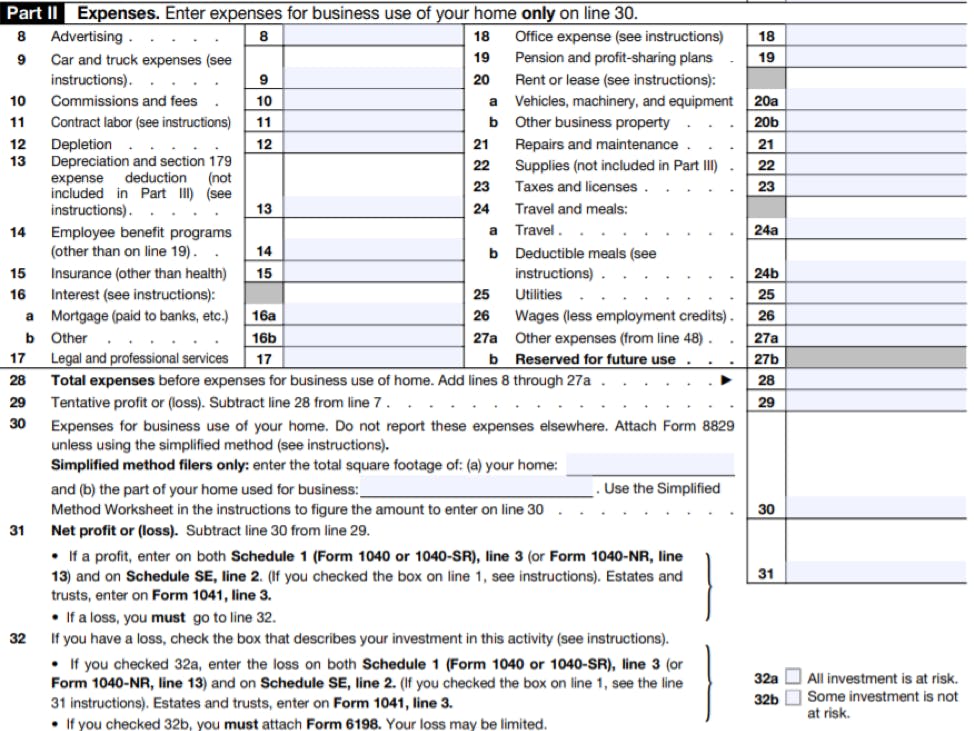

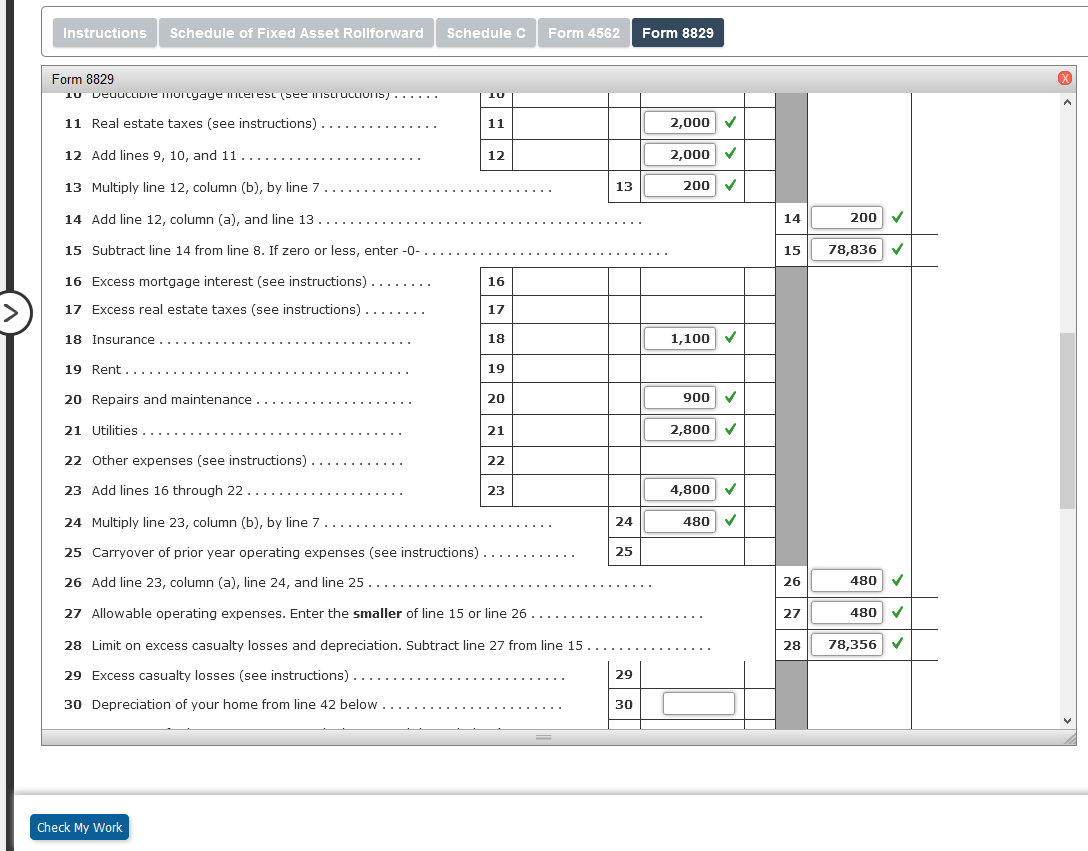

Form 8829 Schedule C - Any loss from the trade or business not derived from the business use. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. I can't get line c for the simplified office space calculation for form 8829 to accept a number higher than 111. See the instructions for lines 25 and 31. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. If no separate business name, leave blank. Form 8829 is produced only when directed to a schedule c using the for drop list at the. Web use screen 8829 to report expenses associated with an office in the taxpayer's main home. Web schedule c, line 30 schedule f, line 32 form 2106, line 4 e.pg2 as upe (unreimbursed partnership expenses), line 28 in the example above, schedule c displays the. Ad complete irs tax forms online or print government tax documents.

Ad complete irs tax forms online or print government tax documents. There are two ways to claim. Form 8829 is produced only when directed to a schedule c using the for drop list at the. Complete, edit or print tax forms instantly. June 5, 2022 9:05 pm. General instructions purpose of form use. Web unallowed expenses from a prior year form 8829 that you can carry over to your 2021 form 8829. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web form8829 department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). Web intuit help intuit common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form.

Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses (so if you work from home—this means you). Web form8829 department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. An activity qualifies as a business. Web a principal business or profession, including product or service (see instructions) b enter code from instructions c business name. If no separate business name, leave blank. Web if your business qualifies for the home office deduction, you’ll file form 8829 with your schedule c, profit or loss from business. Ad complete irs tax forms online or print government tax documents. June 5, 2022 9:05 pm. Any gain derived from the business use of your home, minus.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Web a principal business or profession, including product or service (see instructions) b enter code from instructions c business name. General instructions purpose of form use. There are two ways to claim. Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses (so if you work from home—this.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Web you’re filing schedule c form 8829 is only for taxpayers filing form 1040 schedule c. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. Web a principal business or profession, including product or service (see instructions) b enter code from instructions c business.

The New York Times > Business > Image > Form 8829

June 5, 2022 9:05 pm. Web unallowed expenses from a prior year form 8829 that you can carry over to your 2021 form 8829. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. An activity qualifies as a.

Schedule C Profit or Loss From Business Definition

When the online turbotax se system. Form 8829 is produced only when directed to a schedule c using the for drop list at the. Web enter the amount from schedule c, line 29, plus. Complete, edit or print tax forms instantly. Web you’re filing schedule c form 8829 is only for taxpayers filing form 1040 schedule c.

Tax Write Off Guide for Home Office Deductions & Expenses

Any gain derived from the business use of your home, minus. Web you’re filing schedule c form 8829 is only for taxpayers filing form 1040 schedule c. Web unallowed expenses from a prior year form 8829 that you can carry over to your 2021 form 8829. Web schedule c, line 30 schedule f, line 32 form 2106, line 4 e.pg2.

Irs 1040 Form C Checklist For Irs Schedule C Profit Of Loss From

Web intuit help intuit common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form. Web if your business qualifies for the home office deduction, you’ll file form 8829 with your schedule c, profit or loss from business. Web form8829 department of the treasury internal revenue service.

Solved Required Complete Trish's Schedule C, Form 8829, and

Web if your business qualifies for the home office deduction, you’ll file form 8829 with your schedule c, profit or loss from business. Complete, edit or print tax forms instantly. When the online turbotax se system. Web you’re filing schedule c form 8829 is only for taxpayers filing form 1040 schedule c. Web information about form 8829, expenses for business.

Working for Yourself? What to Know about IRS Schedule C Credit Karma

There are two ways to claim. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Any loss from the trade or business not derived from the business use. Ad complete irs tax forms online or print government tax.

I NEED HELP WITH THE BLANKS PLEASE. """ALL

Web schedule c, line 30 schedule f, line 32 form 2106, line 4 e.pg2 as upe (unreimbursed partnership expenses), line 28 in the example above, schedule c displays the. Web enter the amount from schedule c, line 29, plus. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced.

Solved Required Complete Trish's Schedule C, Form 8829, and

I can't get line c for the simplified office space calculation for form 8829 to accept a number higher than 111. Web you’re filing schedule c form 8829 is only for taxpayers filing form 1040 schedule c. Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses (so.

Web Use Screen 8829 To Report Expenses Associated With An Office In The Taxpayer's Main Home.

Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. I can't get line c for the simplified office space calculation for form 8829 to accept a number higher than 111. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. Web a principal business or profession, including product or service (see instructions) b enter code from instructions c business name.

Web Form 8829, Expenses For Business Use Of Home, Is A Tax Form You Fill Out To Claim Your Home Office Expenses (So If You Work From Home—This Means You).

Web unallowed expenses from a prior year form 8829 that you can carry over to your 2021 form 8829. If no separate business name, leave blank. Any loss from the trade or business not derived from the business use. Any gain derived from the business use of your home, minus.

Web Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any Carryover To 2023 Of Amounts Not Deductible In 2022.

June 5, 2022 9:05 pm. Web schedule c, line 30 schedule f, line 32 form 2106, line 4 e.pg2 as upe (unreimbursed partnership expenses), line 28 in the example above, schedule c displays the. Form 8829 is produced only when directed to a schedule c using the for drop list at the. Complete, edit or print tax forms instantly.

Web If Your Business Qualifies For The Home Office Deduction, You’ll File Form 8829 With Your Schedule C, Profit Or Loss From Business.

General instructions purpose of form use. Web enter the amount from schedule c, line 29, plus. An activity qualifies as a business. See the instructions for lines 25 and 31.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

:max_bytes(150000):strip_icc()/Screenshot58-cb1ceaa73b884957a1108ca88b1c2da8.png)