Form 8829 Simplified Method

Form 8829 Simplified Method - In other words, it's a fraction where the numerator (the top. Web in some cases, deducting actual expenses could result in a higher deduction than the safe harbor. Web you used for business, you can use the simplified method for only one home. Use a separate form 8829 for each home you used for business during the year. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Ad access irs tax forms. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not. Web 10 rows simplified option for home office deduction beginning in tax. Web a simplified option is available that allows you to calculate the square footage of your business space, up to 300 square feet, and multiply it by $5 a square foot. Web what is the simplified form of 88/29?

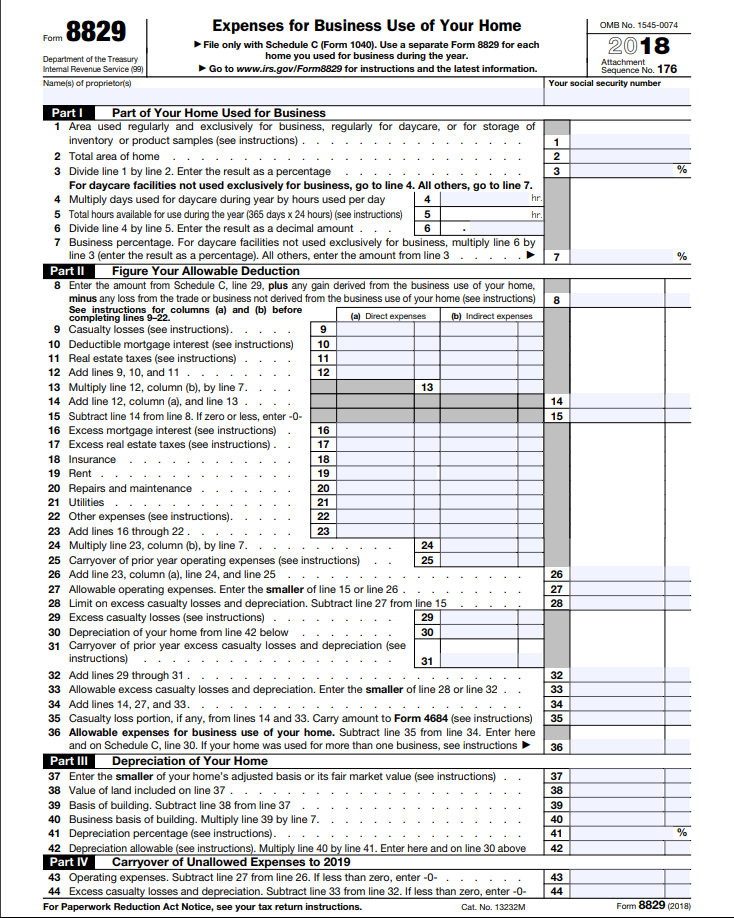

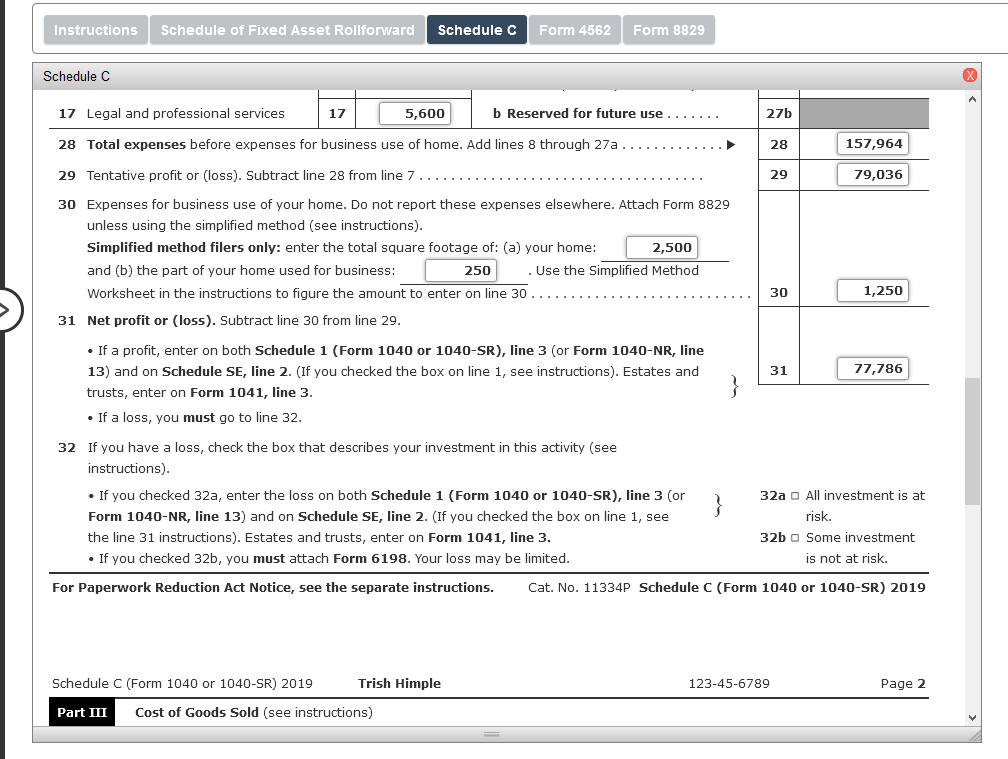

Web if you’re using the simplified method for the home office deduction (which allows you to take a standard deduction of $5 per square foot of your home office, up to. A simplified fraction is a fraction that has been reduced to its lowest terms. In other words, it's a fraction where the numerator (the top. Get ready for tax season deadlines by completing any required tax forms today. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total. If you end up choosing to use the simplified safe harbor method. Web a simplified option is available that allows you to calculate the square footage of your business space, up to 300 square feet, and multiply it by $5 a square foot. Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or. Check out the work below for reducing 8829 into simplest radical form. Web original home office deduction:

Web a simplified option is available that allows you to calculate the square footage of your business space, up to 300 square feet, and multiply it by $5 a square foot. Web if you’re using the simplified method for the home office deduction (which allows you to take a standard deduction of $5 per square foot of your home office, up to. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Get ready for tax season deadlines by completing any required tax forms today. If you want to use the regular method, you'll need to do more calculations and. A simplified fraction is a fraction that has been reduced to its lowest terms. Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or. Complete, edit or print tax forms instantly. Use a separate form 8829 for each home you used for business during the year. Enter a 2 in the field 1=use actual expenses (default),.

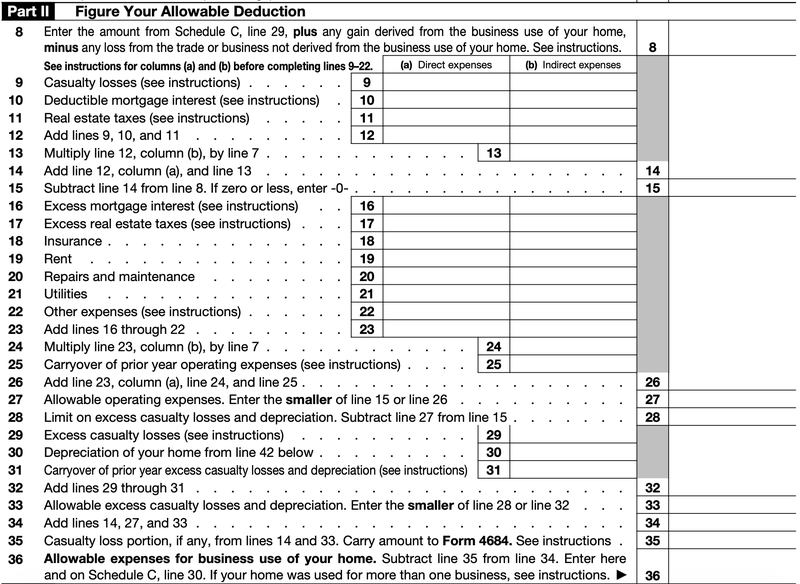

U.S. Tax Form 8829—Expenses for Business Use of Your Home FreshBooks Blog

Web you used for business, you can use the simplified method for only one home. Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or. Complete, edit or print tax forms instantly. Web expenses for business use of your home file only.

How to Complete and File IRS Form 8829 The Blueprint

Web 10 rows simplified option for home office deduction beginning in tax. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web you used for business, you can use the simplified method for only one home. Web there are two ways to claim the deduction: Using the simplified method and.

8829 Simplified Method (ScheduleC, ScheduleF)

Web if you’re using the simplified method for the home office deduction (which allows you to take a standard deduction of $5 per square foot of your home office, up to. A simplified fraction is a fraction that has been reduced to its lowest terms. Web what is the square root of 8829 in simplest radical form? Get ready for.

We cover how to deduct a home office using Form 8829, including the new

Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or. Web a simplified option is available that allows you to calculate the square footage of your business space, up to 300 square feet, and multiply it by $5 a square foot. Web.

Form 8829 Instructions Your Complete Guide to Expense Your Home Office

A simplified fraction is a fraction that has been reduced to its lowest terms. Web there are two ways to claim the deduction: Web you used for business, you can use the simplified method for only one home. Use a separate form 8829 for each home you used for business during the year. Check out how easy it is to.

How to Claim the Home Office Deduction with Form 8829 Ask Gusto

Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total. Use form 8829 to claim expenses for business use of the other home. Check out the work below for reducing 8829 into simplest radical form. Web follow these steps to select the simplified method: Enter a 2 in.

Form_8829_explainer_PDF3 Camden County, NJ

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web follow these steps to select the simplified method: Web you used for business, you can use the simplified method for only one home. Web if you want to use the simplified method, your deduction is $5 x 150 sq. Web.

Simplified Method Worksheet Schedule C

Web if you want to use the simplified method, your deduction is $5 x 150 sq. In other words, it's a fraction where the numerator (the top. Get ready for tax season deadlines by completing any required tax forms today. If you want to use the regular method, you'll need to do more calculations and. Use form 8829 to claim.

2019 Form IRS 8829 Instructions Fill Online, Printable, Fillable, Blank

If you want to use the regular method, you'll need to do more calculations and. Web if you’re using the simplified method for the home office deduction (which allows you to take a standard deduction of $5 per square foot of your home office, up to. Enter a 2 in the field 1=use actual expenses (default),. If you work or.

Instructions For Form 8829 Expenses For Business Use Of Your Home

Get ready for tax season deadlines by completing any required tax forms today. Web in some cases, deducting actual expenses could result in a higher deduction than the safe harbor. If you want to use the regular method, you'll need to do more calculations and. Web what is the square root of 8829 in simplest radical form? Web the simplified.

Web If You’re Using The Simplified Method For The Home Office Deduction (Which Allows You To Take A Standard Deduction Of $5 Per Square Foot Of Your Home Office, Up To.

Check out the work below for reducing 8829 into simplest radical form. Web intuit help intuit common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form. Use a separate form 8829 for each home you used for business during the year. Go to screen 29, business use of home (8829).

Web A Simplified Option Is Available That Allows You To Calculate The Square Footage Of Your Business Space, Up To 300 Square Feet, And Multiply It By $5 A Square Foot.

Use form 8829 to claim expenses for business use of the other home. Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or. Enter a 2 in the field 1=use actual expenses (default),. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total.

Web In Some Cases, Deducting Actual Expenses Could Result In A Higher Deduction Than The Safe Harbor.

If you work or run your business from home, the irs. Complete, edit or print tax forms instantly. If you want to use the regular method, you'll need to do more calculations and. Web expenses for business use of your home file only with schedule c (form 1040).

Web Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any Carryover To Next Year Of Amounts Not.

Web original home office deduction: Web follow these steps to select the simplified method: Web 10 rows simplified option for home office deduction beginning in tax. Web what is the square root of 8829 in simplest radical form?