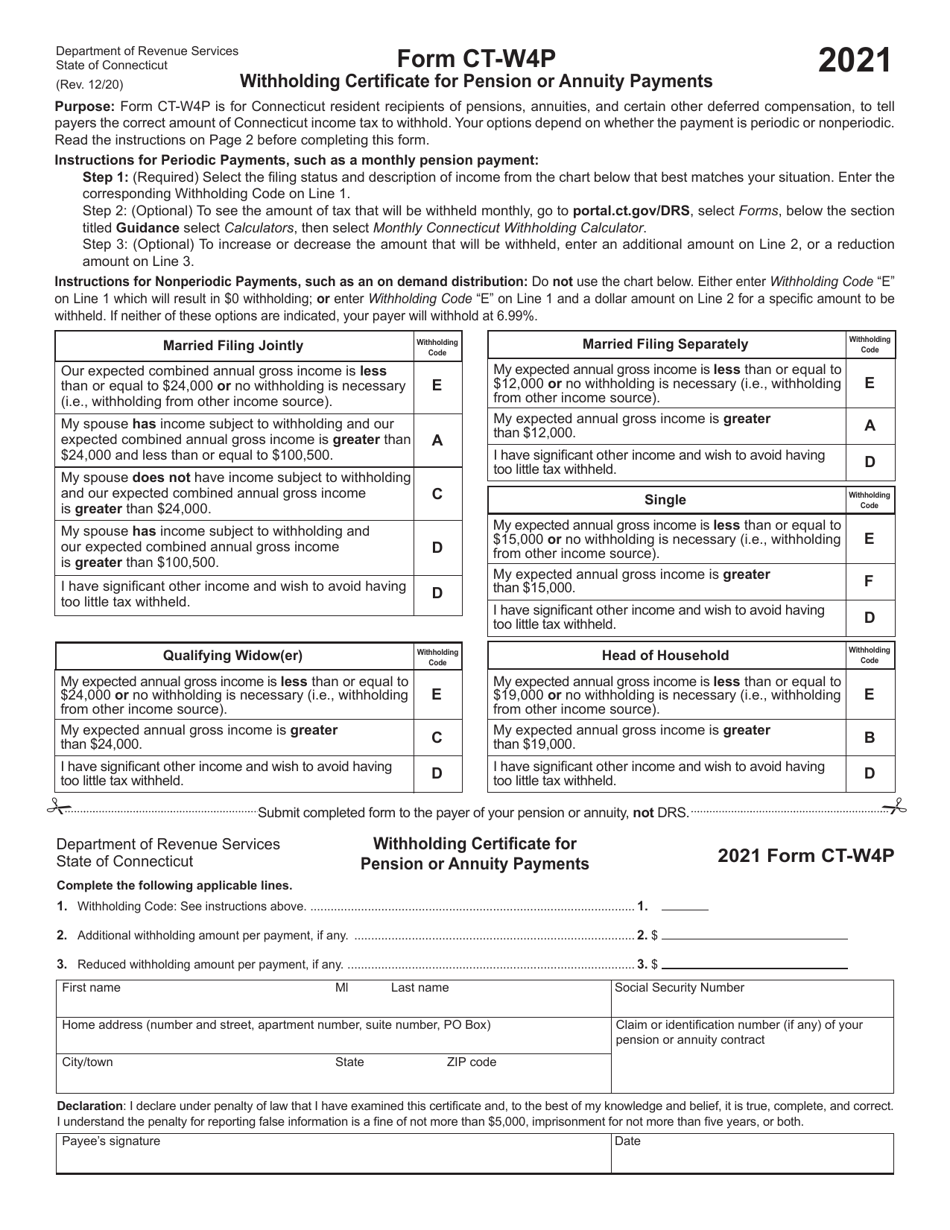

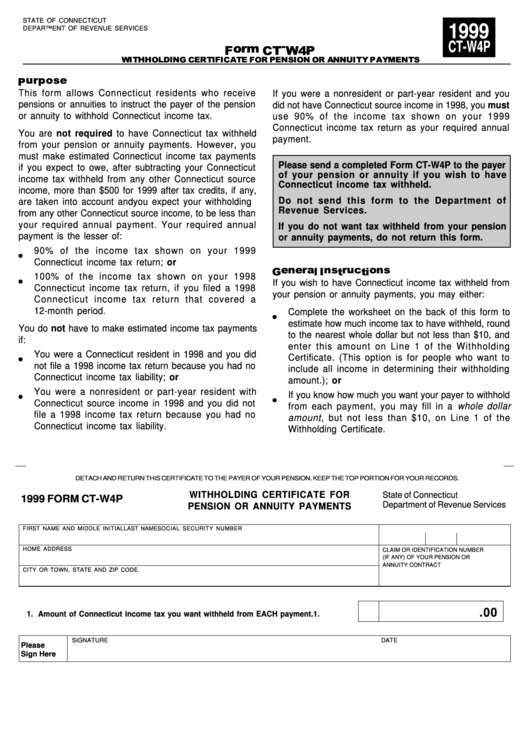

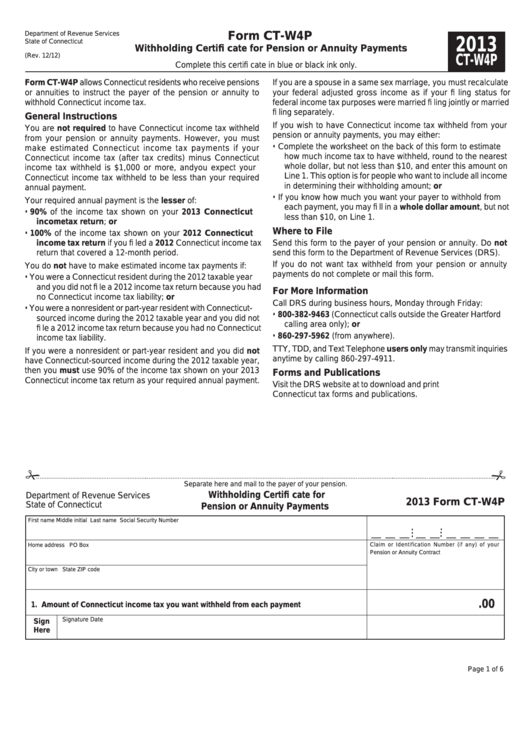

Form Ct-W4P

Form Ct-W4P - Effective january 1, 2018, a payer must withhold connecticut income tax from taxable pension or ~ annuity payments made to a connecticut resident. Your options depend on whether the payment is. Your options depend on whether the payment is periodic or nonperiodic. 10/17) withholding certificate for pension or annuity payments r7.'\l new withholding requirement: Read the instructions on page 2 before completing this form. Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity distributions to ct residents, to withhold income tax from such distributions. Approved for use with investors. Use this form if you have an ira or retirement account and live in connecticut. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut income tax to withhold. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax withholding.

Use this form if you have an ira or retirement account and live in connecticut. Approved for use with investors. Read the instructions on page 2 before completing this form. Effective january 1, 2018, a payer must withhold connecticut income tax from taxable pension or ~ annuity payments made to a connecticut resident. Your options depend on whether the payment is. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut income tax to withhold. Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity distributions to ct residents, to withhold income tax from such distributions. Your options depend on whether the payment is periodic or nonperiodic. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax withholding. 10/17) withholding certificate for pension or annuity payments r7.'\l new withholding requirement:

10/17) withholding certificate for pension or annuity payments r7.'\l new withholding requirement: Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity distributions to ct residents, to withhold income tax from such distributions. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax withholding. Use this form if you have an ira or retirement account and live in connecticut. Approved for use with investors. Your options depend on whether the payment is periodic or nonperiodic. Read the instructions on page 2 before completing this form. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut income tax to withhold. Your options depend on whether the payment is. Effective january 1, 2018, a payer must withhold connecticut income tax from taxable pension or ~ annuity payments made to a connecticut resident.

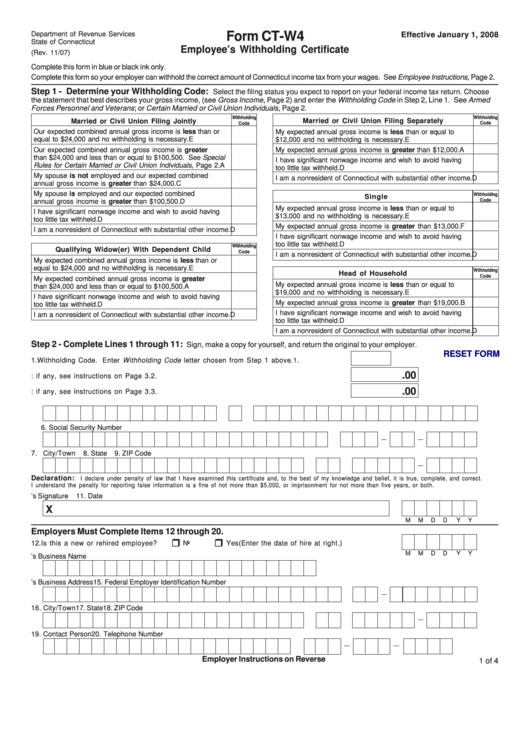

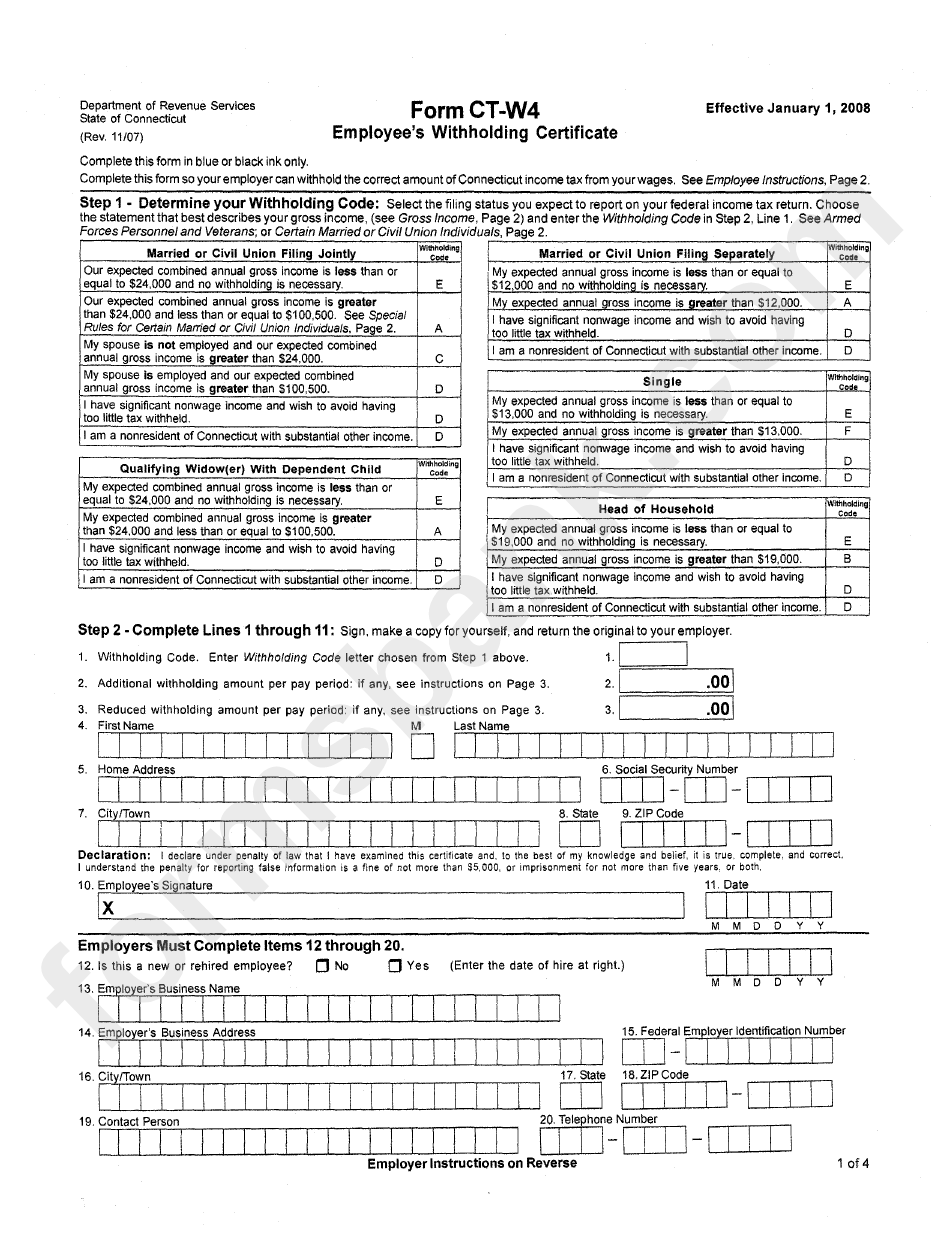

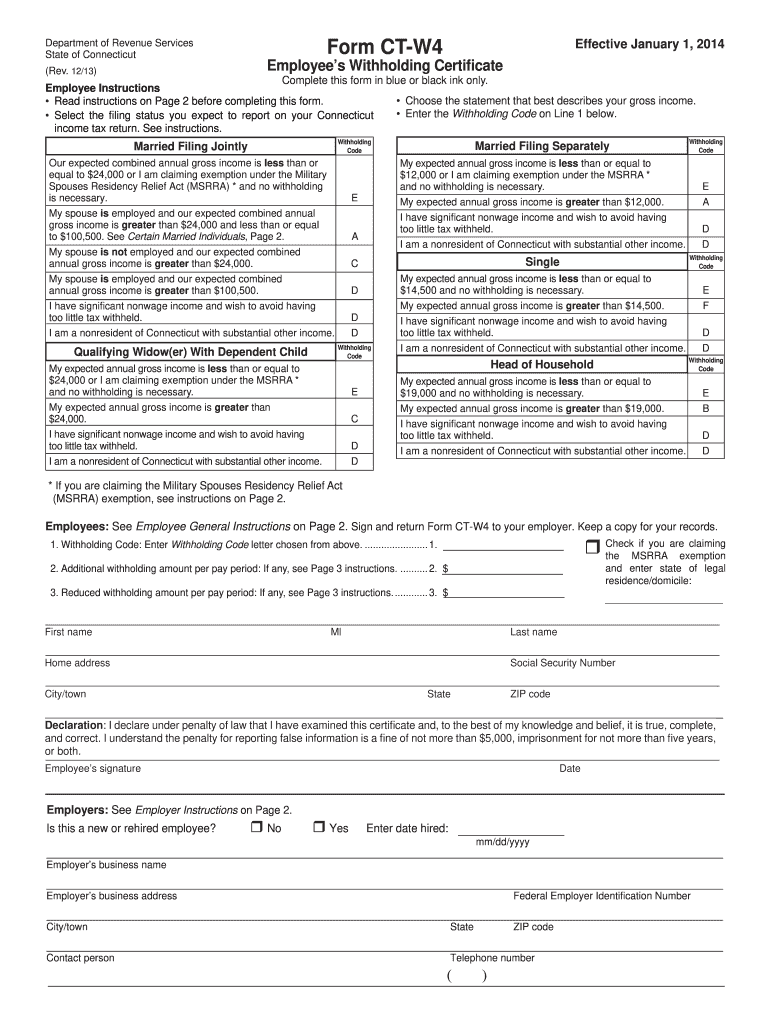

Fillable Form CtW4 Employee'S Withholding Certificate printable pdf

Effective january 1, 2018, a payer must withhold connecticut income tax from taxable pension or ~ annuity payments made to a connecticut resident. Your options depend on whether the payment is. Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity distributions to ct residents, to withhold.

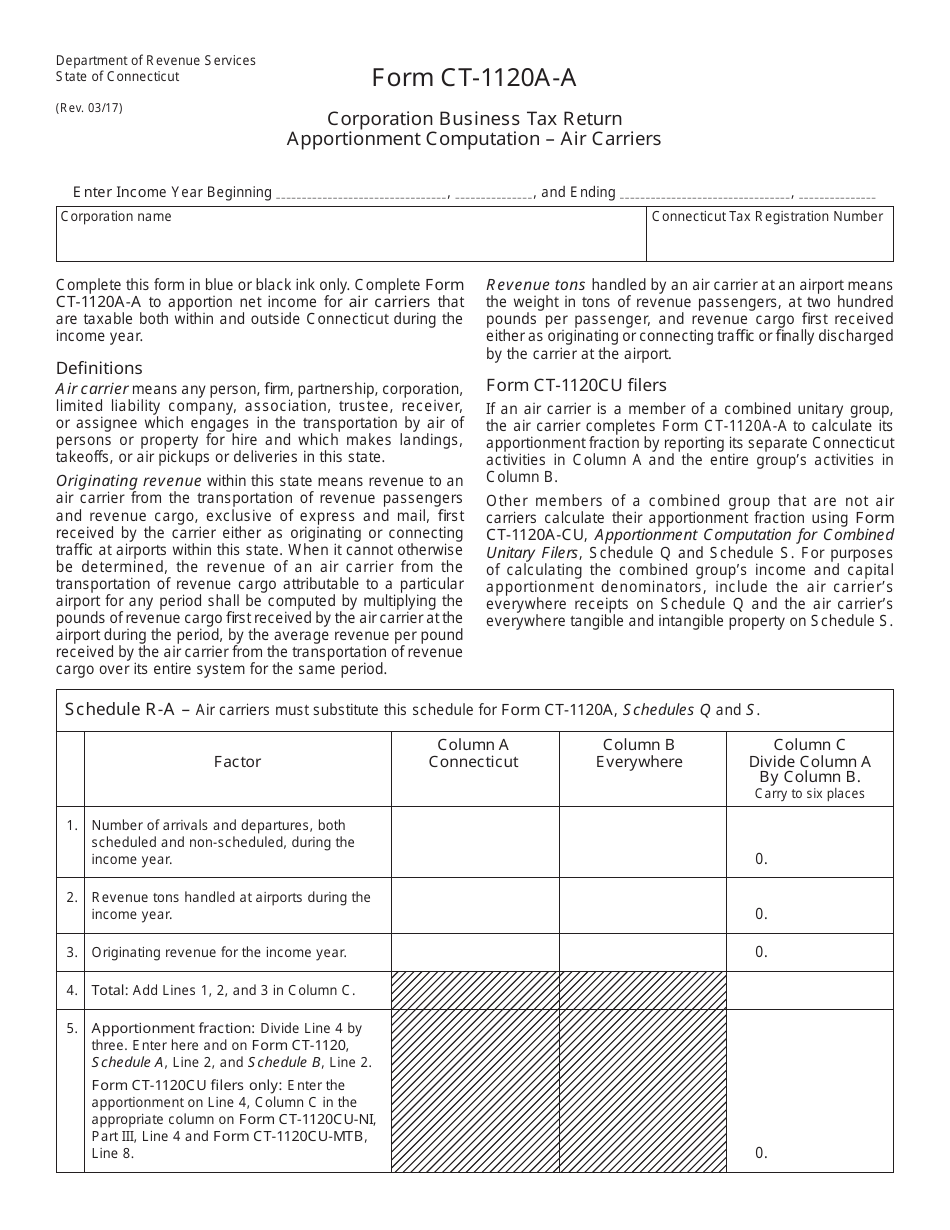

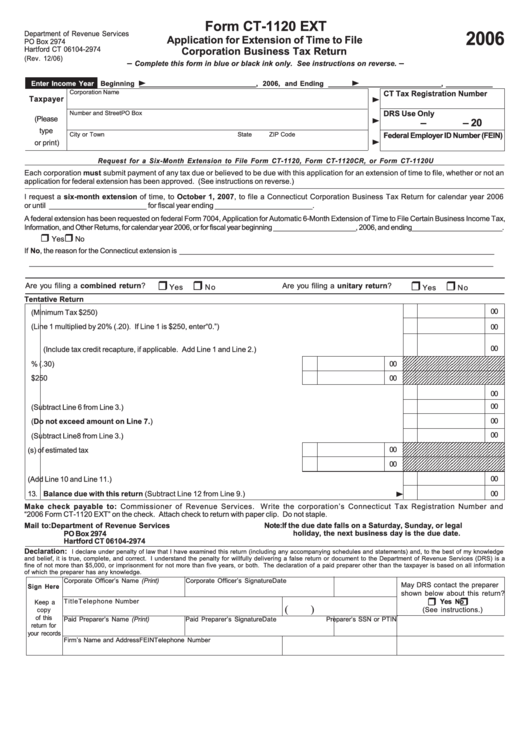

Form CT1120AA Download Printable PDF or Fill Online Corporation

Read the instructions on page 2 before completing this form. Use this form if you have an ira or retirement account and live in connecticut. Your options depend on whether the payment is. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax withholding. Your options depend on whether the payment is periodic.

Form CTW4P Download Printable PDF or Fill Online Withholding

This calculator is intended to be used as a tool to calculate your monthly connecticut income tax withholding. Effective january 1, 2018, a payer must withhold connecticut income tax from taxable pension or ~ annuity payments made to a connecticut resident. Your options depend on whether the payment is periodic or nonperiodic. Approved for use with investors. Your options depend.

Fillable Form CtW4 Employee'S Withholding Certificate printable pdf

Effective january 1, 2018, a payer must withhold connecticut income tax from taxable pension or ~ annuity payments made to a connecticut resident. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut income tax to withhold. Approved for use with investors. This calculator is intended to.

Fillable Form CtW4p Withholding Certificate For Pension Or Annuity

Your options depend on whether the payment is. 10/17) withholding certificate for pension or annuity payments r7.'\l new withholding requirement: Use this form if you have an ira or retirement account and live in connecticut. Your options depend on whether the payment is periodic or nonperiodic. Legislation passed in 2017 requires payers that maintain an office or transact business in.

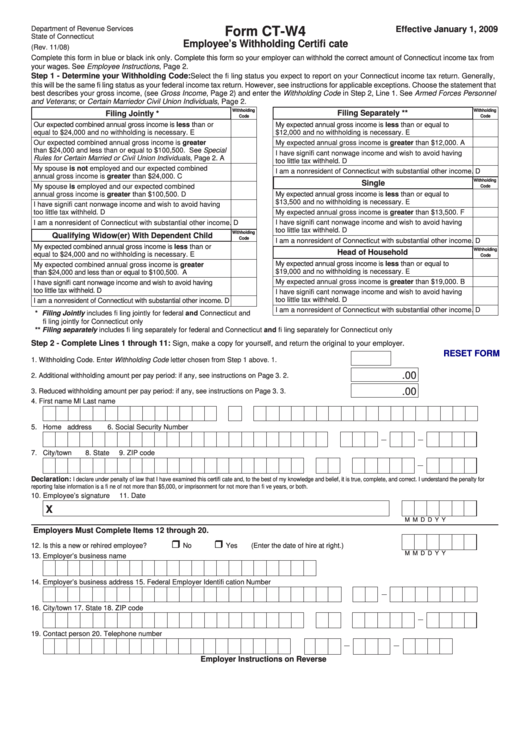

Form Ct W4 2008 printable pdf download

This calculator is intended to be used as a tool to calculate your monthly connecticut income tax withholding. Effective january 1, 2018, a payer must withhold connecticut income tax from taxable pension or ~ annuity payments made to a connecticut resident. 10/17) withholding certificate for pension or annuity payments r7.'\l new withholding requirement: Legislation passed in 2017 requires payers that.

Form Ct1120 Ext Application Form For Extension Of Time To File

Approved for use with investors. 10/17) withholding certificate for pension or annuity payments r7.'\l new withholding requirement: Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity distributions to ct residents, to withhold income tax from such distributions. Your options depend on whether the payment is periodic.

CT DRS CTW4 2012 Fill out Tax Template Online US Legal Forms

10/17) withholding certificate for pension or annuity payments r7.'\l new withholding requirement: Your options depend on whether the payment is periodic or nonperiodic. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax withholding. Read the instructions on page 2 before completing this form. Effective january 1, 2018, a payer must withhold connecticut.

Form CtW4p Withholding Certifi Cate For Pension Or Annuity Payments

Approved for use with investors. Read the instructions on page 2 before completing this form. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax withholding. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut income tax to withhold..

AnnuityF W 4 Annuity

Approved for use with investors. Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity distributions to ct residents, to withhold income tax from such distributions. Read the instructions on page 2 before completing this form. 10/17) withholding certificate for pension or annuity payments r7.'\l new withholding.

Your Options Depend On Whether The Payment Is Periodic Or Nonperiodic.

Use this form if you have an ira or retirement account and live in connecticut. Read the instructions on page 2 before completing this form. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut income tax to withhold. This calculator is intended to be used as a tool to calculate your monthly connecticut income tax withholding.

Approved For Use With Investors.

Legislation passed in 2017 requires payers that maintain an office or transact business in ct and make payments of taxable pensions or annuity distributions to ct residents, to withhold income tax from such distributions. Effective january 1, 2018, a payer must withhold connecticut income tax from taxable pension or ~ annuity payments made to a connecticut resident. Your options depend on whether the payment is. 10/17) withholding certificate for pension or annuity payments r7.'\l new withholding requirement: