Hcc Tax Form

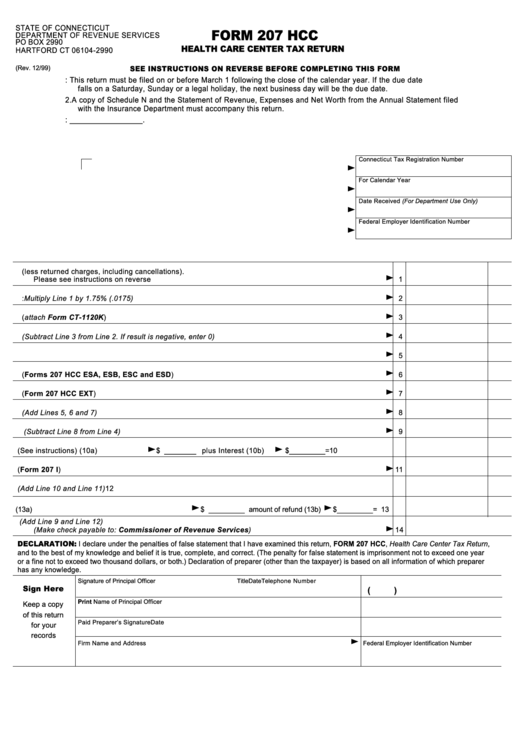

Hcc Tax Form - Send all information returns filed on paper to the following. Attach a copy of student’s 2019 tax transcript/return) check here if you. It shows various amounts of tuition charged,. Check here if you (student) filed taxes for 2019. If there are differences between taxes and the fafsa reported data, hcc will make the corrections. Form name (for a copy of form, instruction, or publication) address to mail form to irs: Web student tax filing information check only one box below: All loan paperwork [revision requests, master promissory note, and loan entrance. Web __ amended tax return: Web statement of student eligibility texas form.

Statement of student eligibility and selective service_2022 form. Resident income tax return instructions. Who must file a health care center tax return. Check here if you (student) filed taxes for 2019. Web health care center tax information. File this form if you received any advance payments during the calendar year of qualified. Virtual lobby for current/former students: If there are differences between taxes and the fafsa reported data, hcc will make the corrections. Web student tax filing information check only one box below: Web statement of student eligibility texas form.

Web statement of student eligibility texas form. All loan paperwork [revision requests, master promissory note, and loan entrance. Web insurance premiums tax return or health care center tax return, check the applicable box on the front of this form. Web __ amended tax return: Statement of student eligibility and selective service_2022 form. Students who file an amended return (irs form 1040x) must provide the following documents to complete verification: Virtual lobby for current/former students: Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. If you are required to submit a copy of an irs tax transcript, you can request an irs tax. • a signed copy of the 1040x.

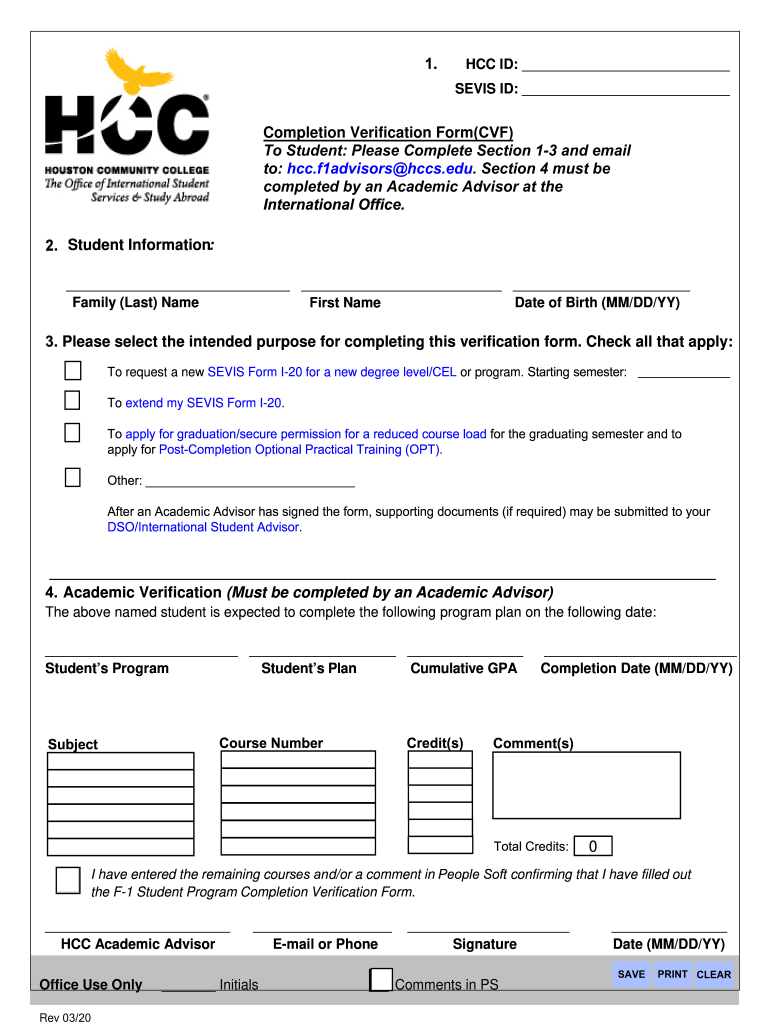

HCC Completion Verification Form 2020 Fill and Sign Printable

Web student tax filing information check only one box below: Web people needing free help to complete their federal tax forms have a resource at housatonic community college (hcc). Web insurance premiums tax return or health care center tax return, check the applicable box on the front of this form. (attach a copy of student’s 2018 tax transcript/return) check here.

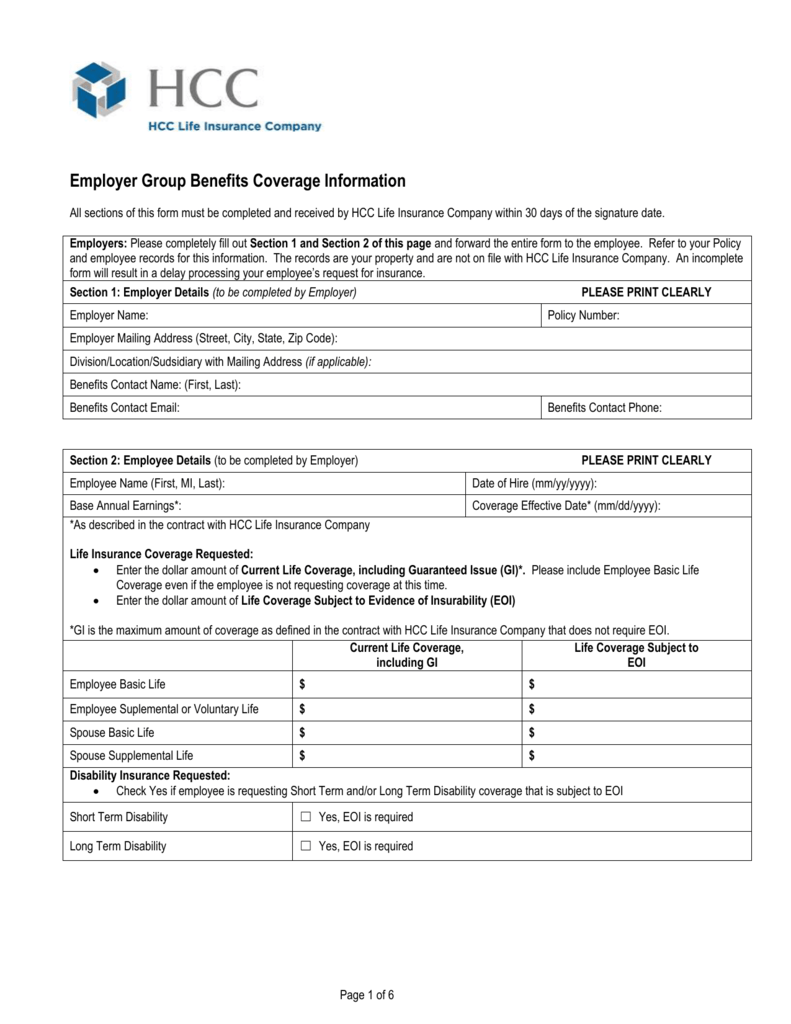

sections of this form must be completed and received by HCC Life

Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Attach a copy of student’s 2019 tax transcript/return) check here if you. Web health care center tax information. If there are differences between taxes and the fafsa reported data, hcc will make the corrections. To avoid delays in processing, use forms.

HCC CSA 600E 20132021 Fill and Sign Printable Template Online US

Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Send all information returns filed on paper to the following. Statement of student eligibility and selective service_2022 form. Who must file a health care center tax return. To avoid delays in processing, use forms approved by the revenue division of the.

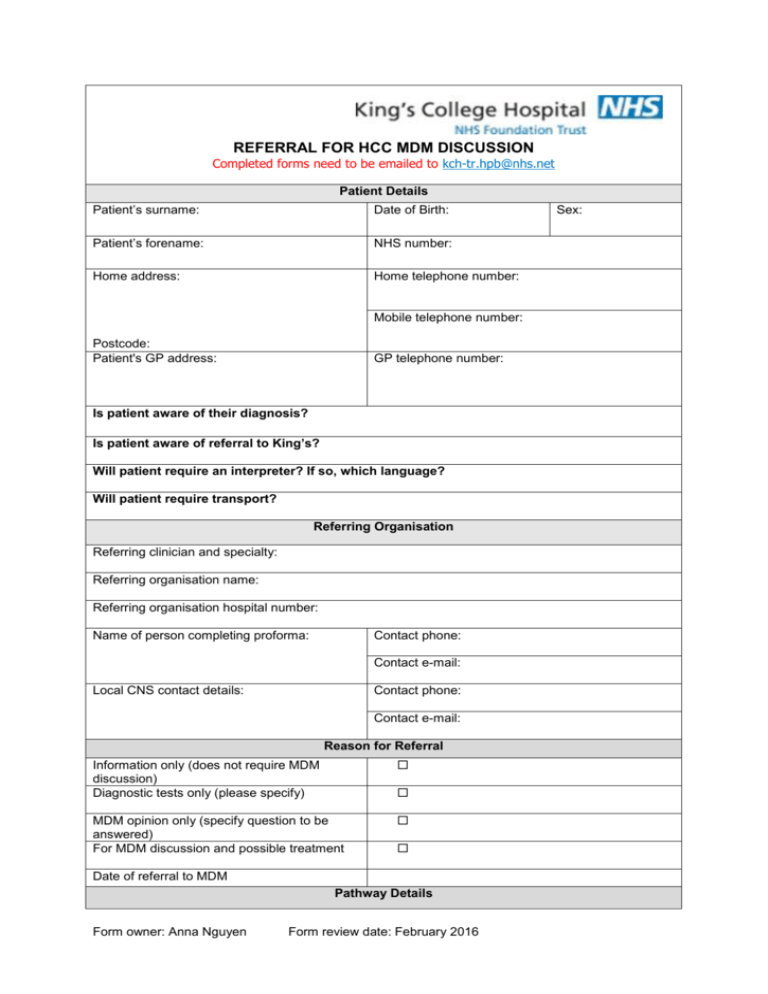

HCC referral form King's College Hospital

Resident income tax return instructions. Web addresses for forms beginning with the letter c; Our 1040 solutions integrate with your existing tax software to boost efficiency. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Students who file an amended return (irs form 1040x) must provide the following documents to.

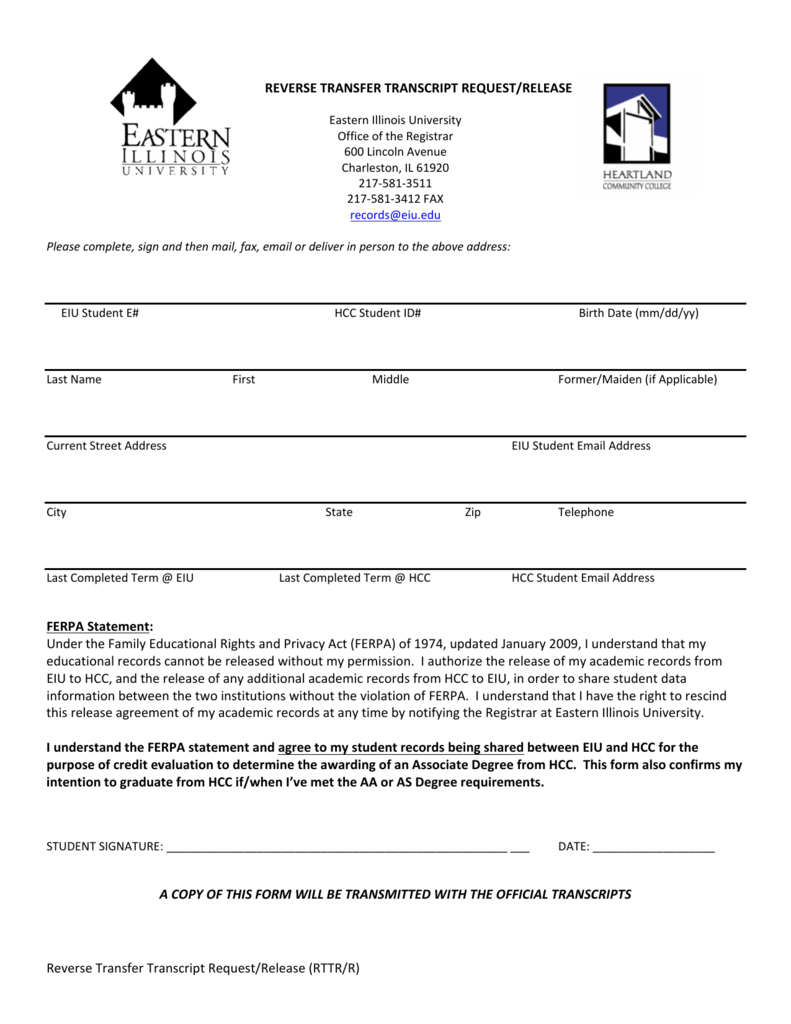

HCC Reverse Transfer Credit Form

File form 207/207 hcc ext and pay all the tax you expect to owe. Web student services contact center. Web people needing free help to complete their federal tax forms have a resource at housatonic community college (hcc). Claim for refund of estimated gross income tax payment required on the sale of real property located in new. Students who file.

Kirkwood Community College Tax Form 19 Discover beautiful designs and

Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web student services contact center. Web applicable, spouse’s irs tax transcript(s) for tax year 2019. Statement of student eligibility and selective service_2022 form. Web • failure to provide no tax due letter from state of missouri (if applicable) 3.

Form 207 Hcc Health Care Center Tax Return printable pdf download

Check here if you (student) filed taxes for 2018. It shows various amounts of tuition charged,. Our 1040 solutions integrate with your existing tax software to boost efficiency. Web applicable, spouse’s irs tax transcript(s) for tax year 2019. Web health care center tax information.

HCC AE 4000 20152021 Fill and Sign Printable Template Online US

(attach a copy of student’s 2018 tax transcript/return) check here if you. Students who file an amended return (irs form 1040x) must provide the following documents to complete verification: Who must file a health care center tax return. Our 1040 solutions integrate with your existing tax software to boost efficiency. Web student tax filing information check only one box below:

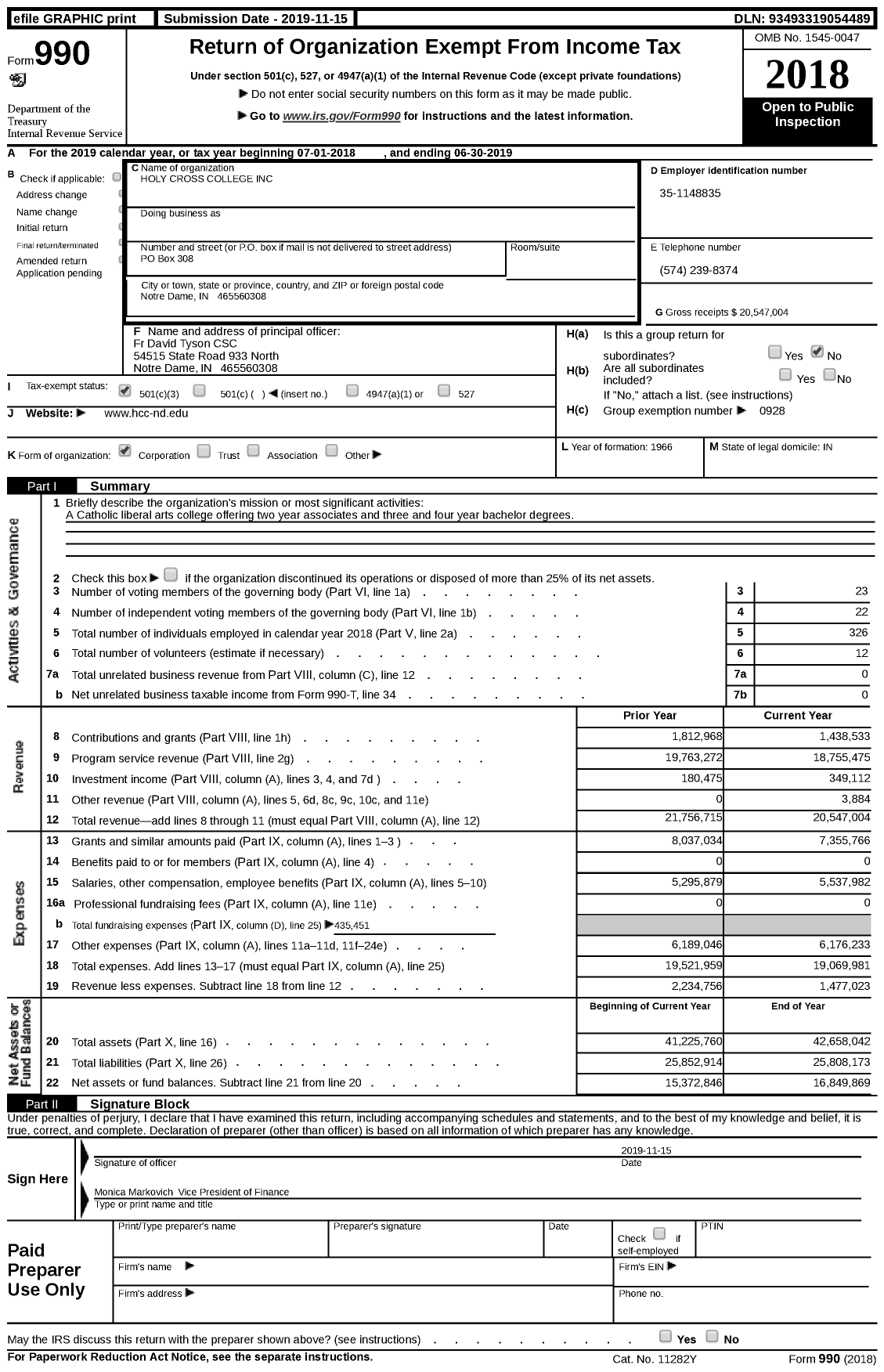

2019 Form 990 for Holy Cross College (HCC) Cause IQ

Virtual lobby for current/former students: If there are differences between taxes and the fafsa reported data, hcc will make the corrections. File form 207/207 hcc ext and pay all the tax you expect to owe. (attach a copy of student’s 2018 tax transcript/return) check here if you. Check here if you (student) filed taxes for 2019.

Ferpa Form Hcc Five Ferpa Form Hcc Rituals You Should Know In 9 AH

Web insurance premiums tax return or health care center tax return, check the applicable box on the front of this form. File form 207/207 hcc ext and pay all the tax you expect to owe. File this form if you received any advance payments during the calendar year of qualified. Web __ amended tax return: Web statement of student eligibility.

File Form 207/207 Hcc Ext And Pay All The Tax You Expect To Owe.

Web student tax filing information check only one box below: Web select a year. File this form if you received any advance payments during the calendar year of qualified. Statement of student eligibility and selective service_2022 form.

Send All Information Returns Filed On Paper To The Following.

If there are differences between taxes and the fafsa reported data, hcc will make the corrections. Attach a copy of student’s 2019 tax transcript/return) check here if you. (attach a copy of student’s 2018 tax transcript/return) check here if you. Web people needing free help to complete their federal tax forms have a resource at housatonic community college (hcc).

Web Health Care Center Tax Information.

If you are required to submit a copy of an irs tax transcript, you can request an irs tax. Web student services contact center. Virtual lobby for current/former students: Web insurance premiums tax return or health care center tax return, check the applicable box on the front of this form.

Web Statement Of Student Eligibility Texas Form.

Who must file a health care center tax return. When to file (tax due dates and extensions) how to file. Web __ amended tax return: Resident income tax return instructions.