Indiana Form 130

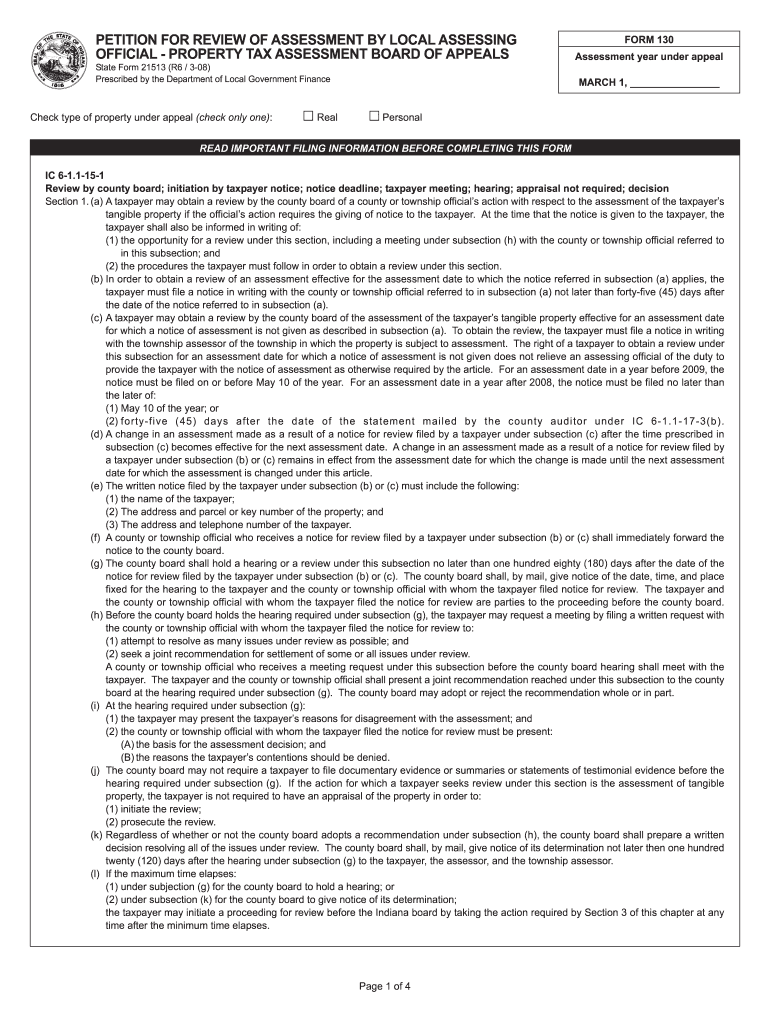

Indiana Form 130 - Ibtr form used to appeal the decision of. The ibtr has also created several samples of documents often submitted as part of the hearing process. Quick guide on how to complete indiana state form 130. Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form are prescribed by the department of local government finance (dlgf). Web dor forms.in.gov find indiana tax forms. Web to access all department of local government finance forms please visit the state forms online catalog available here. Claim a gambling loss on my indiana return. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Petition for review of assessment before the indiana board of tax review. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed.

To correctly fill out the form, follow the instructions below: Taxpayer’s notice to initiate an appeal. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident. Web a taxpayer may also file a form 130 appeal with the county auditor within 45 days of the date of a change in assessment (form 11) or by may 10 of that year, whichever is later. Form 130 taxpayer's notice to initiate an appeal Web rate indiana form 130 as 5 stars rate indiana form 130 as 4 stars rate indiana form 130 as 3 stars rate indiana form 130 as 2 stars rate indiana form 130 as 1 stars. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Taxpayer’s notice to initiate an appeal/correction of error. Petition for review of assessment before the indiana board of tax review. We will update this page with a new version of the form for 2024 as soon as it is made available by the indiana government.

Web dor forms.in.gov find indiana tax forms. Web you will receive the results of the determination by mail in the form of a form 115. Web a taxpayer may also file a form 130 appeal with the county auditor within 45 days of the date of a change in assessment (form 11) or by may 10 of that year, whichever is later. Forget about scanning and printing out forms. Web property tax assessment appeals process. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident. Hardwood timber land management plan: Web taxpayer files a property tax appeal with assessing official. Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form are prescribed by the department of local government finance (dlgf). The appeal will be heard by the county board of review.

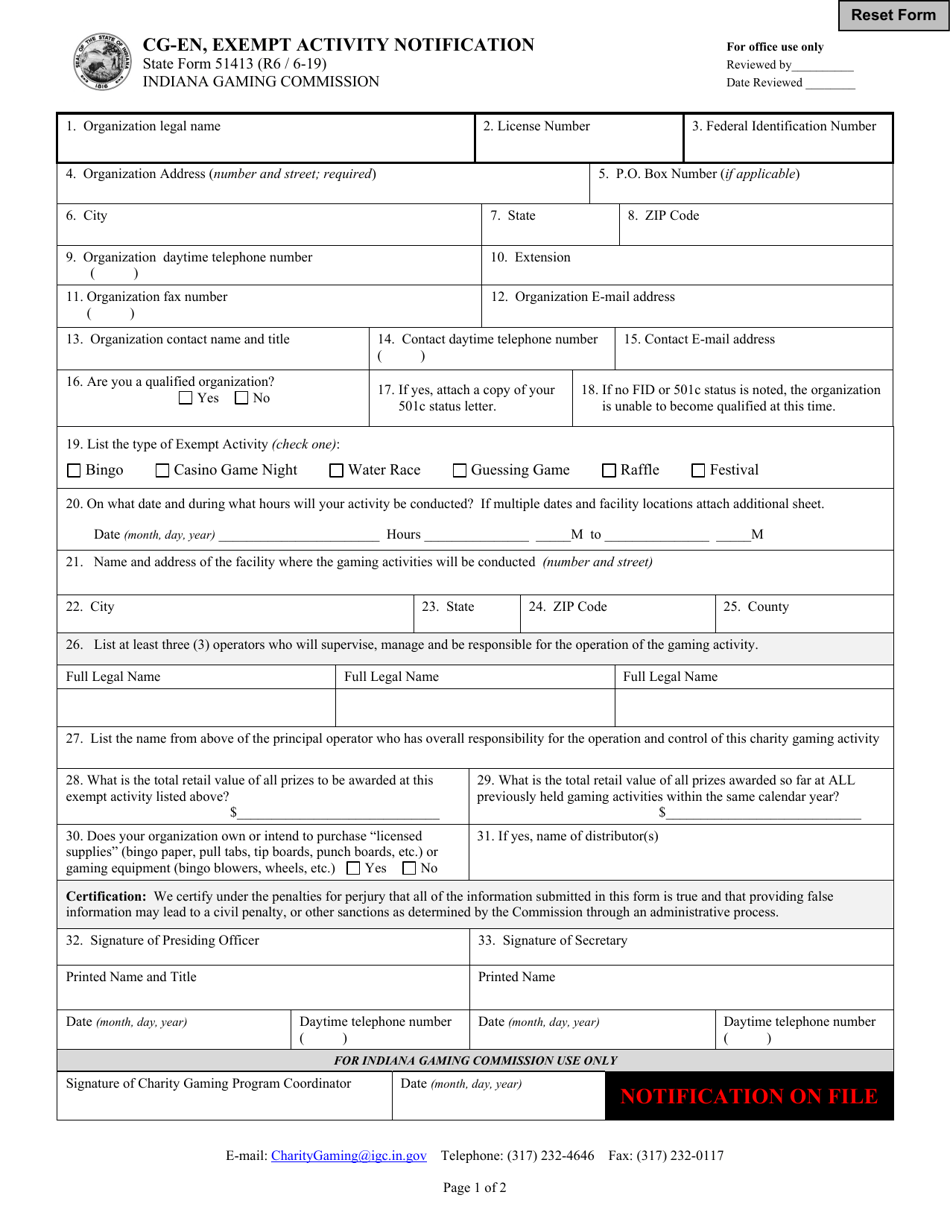

Form CGEN (State Form 51413) Download Fillable PDF or Fill Online

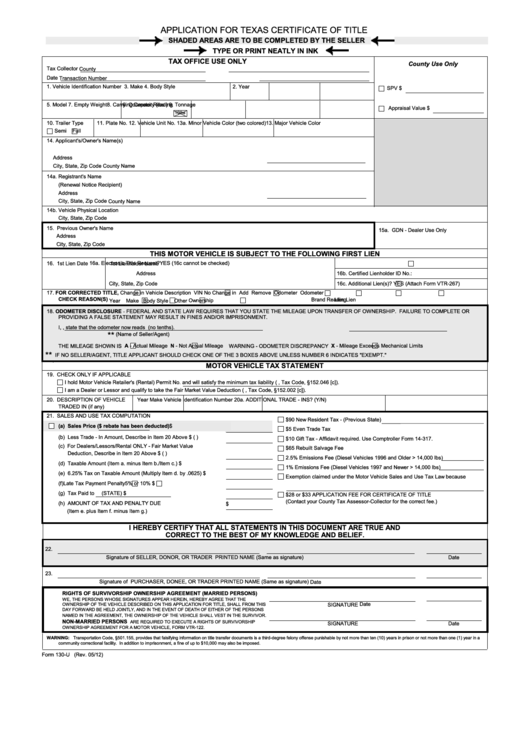

And 2) requires the assessing official to schedule a preliminary informal meeting with the taxpayer. Web up to $40 cash back form 130 is typically used in indiana for vehicle title and registration transactions. Upload, modify or create forms. Claim a gambling loss on my indiana return. To correctly fill out the form, follow the instructions below:

2012 IN State Form 53958 Fill Online, Printable, Fillable, Blank

We will update this page with a new version of the form for 2024 as soon as it is made available by the indiana government. Web a taxpayer may also file a form 130 appeal with the county auditor within 45 days of the date of a change in assessment (form 11) or by may 10 of that year, whichever.

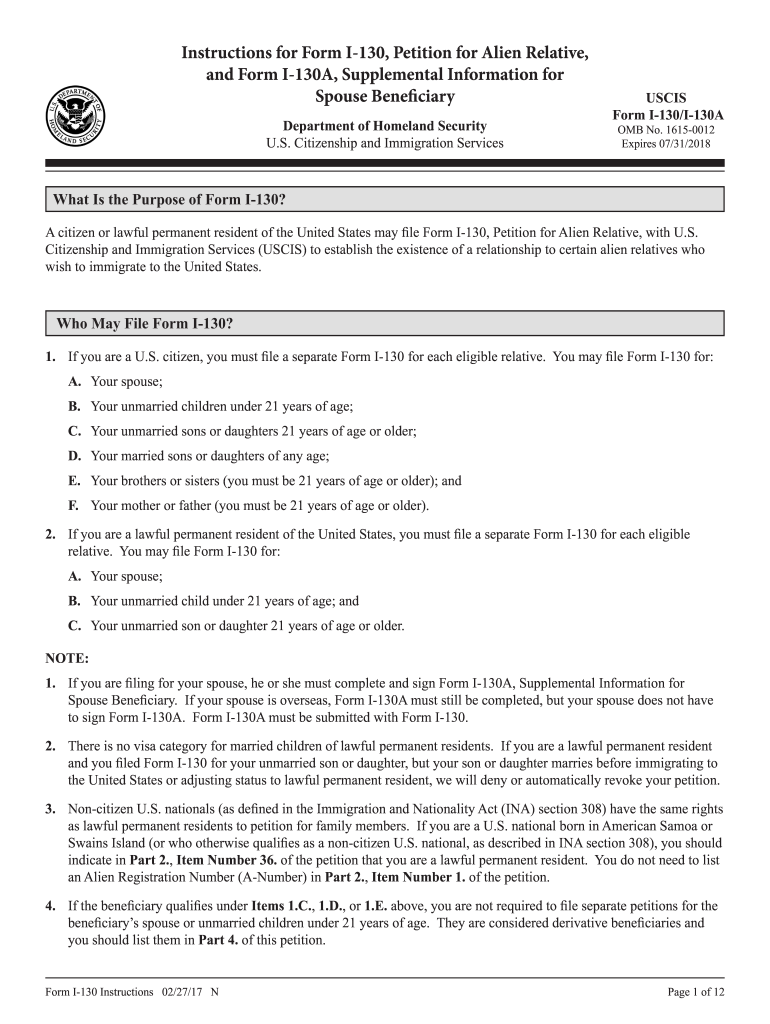

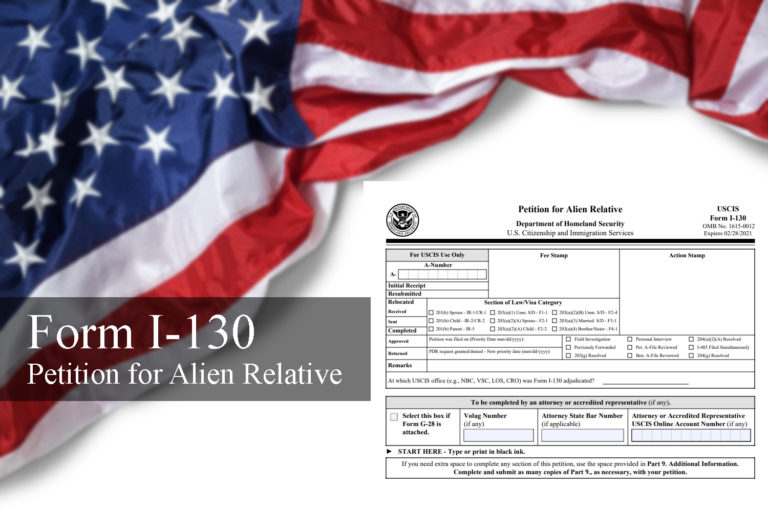

2015 Form USCIS I130 Instructions Fill Online, Printable, Fillable

Web a taxpayer may also file a form 130 appeal with the county auditor within 45 days of the date of a change in assessment (form 11) or by may 10 of that year, whichever is later. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. The appeal should detail the pertinent.

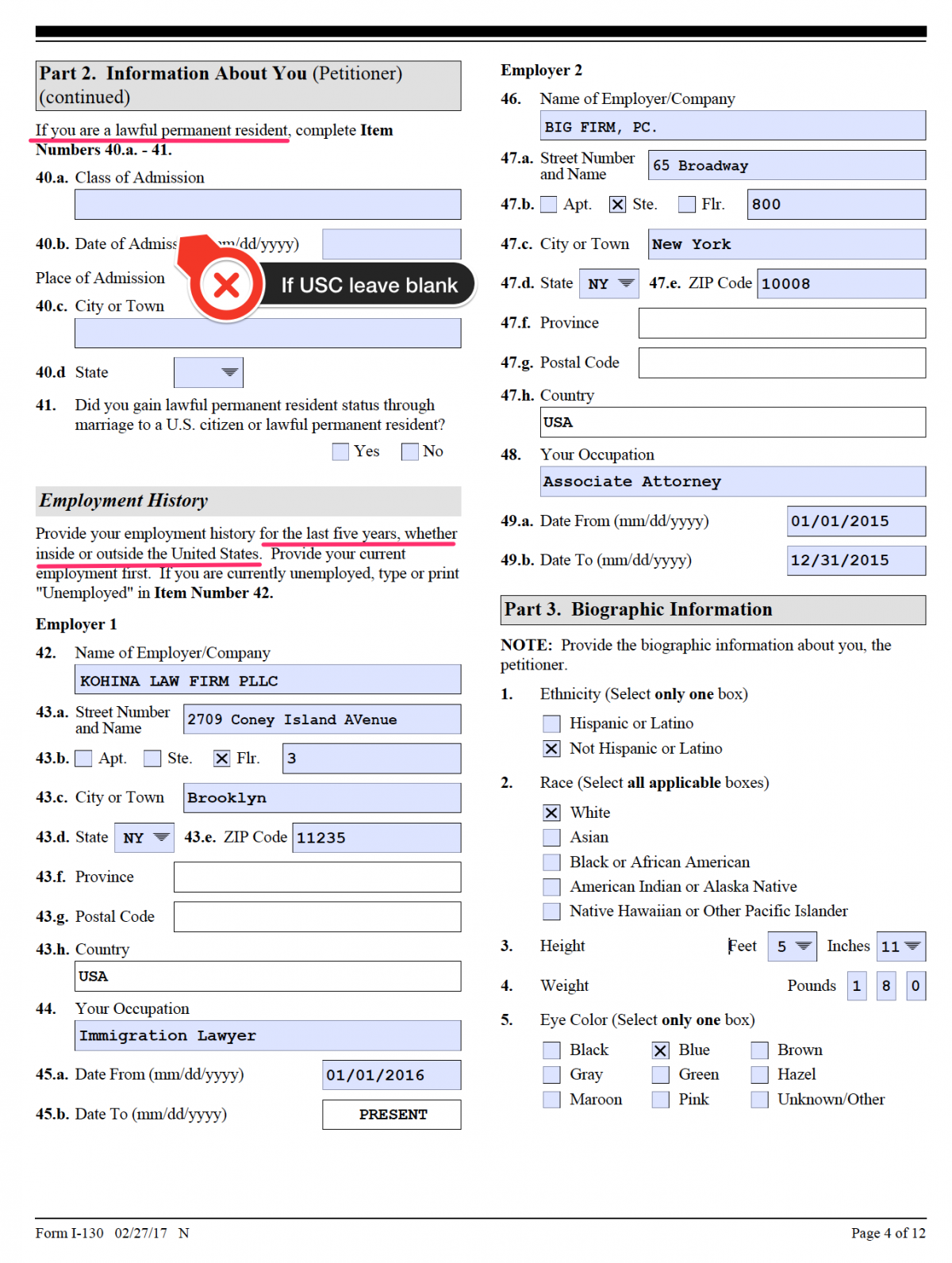

Page 3 of 8 How to Fill Form I130 and I130A Complete Step by Step

Try it for free now! Web a taxpayer may also file a form 130 appeal with the county auditor within 45 days of the date of a change in assessment (form 11) or by may 10 of that year, whichever is later. Web property tax assessment appeals process. Petition for review of assessment before the indiana board of tax review..

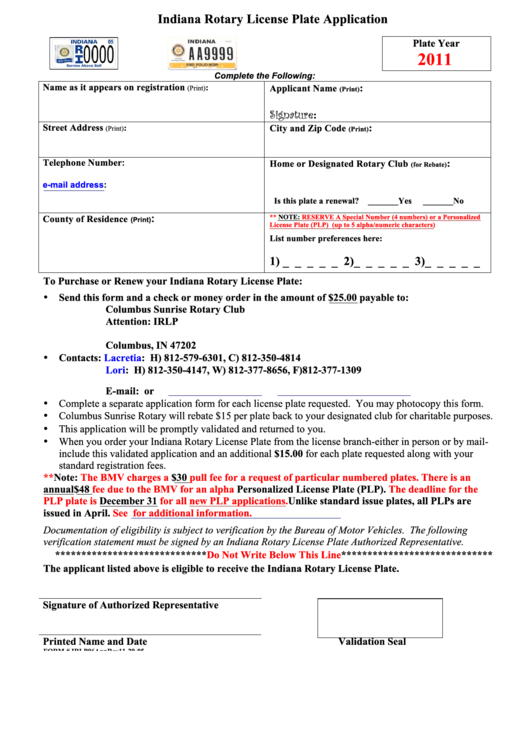

Top 8 Indiana Bmv Forms And Templates free to download in PDF, Word and

To correctly fill out the form, follow the instructions below: Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form are prescribed by the department of local government finance (dlgf). Claim a gambling loss on my indiana return. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being.

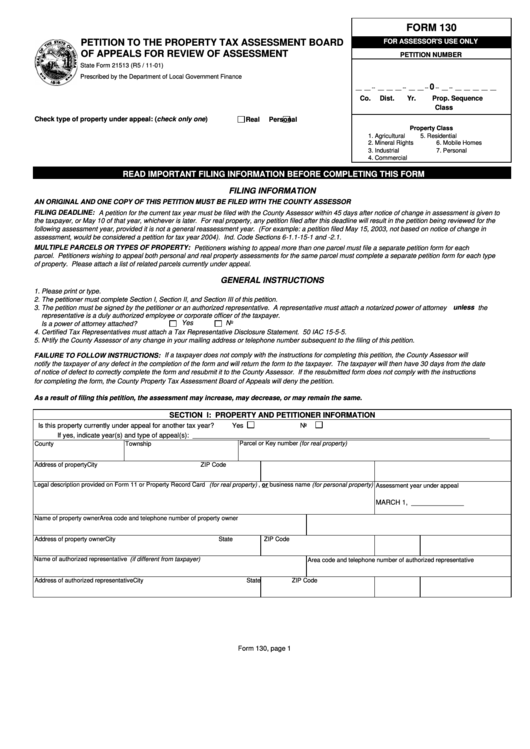

Fillable Form 130 Petition To The Property Tax Assessment Board Of

The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident. The ibtr has also created several samples of documents often submitted as part of the hearing process. Web we last updated indiana.

What is a Form I130 Petition? Enterline And Partners Consulting

Web rate indiana form 130 as 5 stars rate indiana form 130 as 4 stars rate indiana form 130 as 3 stars rate indiana form 130 as 2 stars rate indiana form 130 as 1 stars. Taxpayer’s notice to initiate an appeal. Notice of annual session all ptaboa meetings will begin at 9:00 am and will be held in suite.

Top 6 Form 130u Templates free to download in PDF format

The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. A taxpayer may only request a. Petition for review of assessment before the indiana board of tax review. Know when i will receive my tax refund. Web you will receive the results of the determination by mail in the form of a form.

Form 130 Indiana Fill Out and Sign Printable PDF Template signNow

Taxpayer’s notice to initiate an appeal. The appeal should detail the pertinent facts of why the assessed value is being disputed. The ibtr has also created several samples of documents often submitted as part of the hearing process. Form 130 taxpayer's notice to initiate an appeal Notice of annual session all ptaboa meetings will begin at 9:00 am and will.

Form I130 Petition for Alien Relative RapidVisa®

To correctly fill out the form, follow the instructions below: Web property tax assessment appeals process. Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form are prescribed by the department of local government finance (dlgf). Web taxpayer files a property tax appeal with assessing official. Petition for review of assessment before the indiana.

Web A Taxpayer May Also File A Form 130 Appeal With The County Auditor Within 45 Days Of The Date Of A Change In Assessment (Form 11) Or By May 10 Of That Year, Whichever Is Later.

Forget about scanning and printing out forms. Web property tax assessment appeals process. Web rate indiana form 130 as 5 stars rate indiana form 130 as 4 stars rate indiana form 130 as 3 stars rate indiana form 130 as 2 stars rate indiana form 130 as 1 stars. Know when i will receive my tax refund.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Indiana Government.

Form 130 taxpayer's notice to initiate an appeal Web dor forms.in.gov find indiana tax forms. Notice of annual session all ptaboa meetings will begin at 9:00 am and will be held in suite 419 of the edwin rousseau centre located at 1 east main street, fort wayne, indiana 46802. Petition for review of assessment before the indiana board of tax review.

And 2) Requires The Assessing Official To Schedule A Preliminary Informal Meeting With The Taxpayer.

Pay my tax bill in installments. If you disagree with the determination of the ptaboa you may file an appeal at the state level with the indiana board of tax review (ibtr). Ad download or email 2008 130 & more fillable forms, register and subscribe now! Upload, modify or create forms.

To Visit The Dlgf's Forms Catalog, Click Here.

The appeal should detail the pertinent facts of why the assessed value is being disputed. The ibtr has also created several samples of documents often submitted as part of the hearing process. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident. A taxpayer may only request a.