Md Form 505 Instructions 2022

Md Form 505 Instructions 2022 - Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. Sign it in a few clicks draw your signature, type. Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Multiply line 13 by.0125 (1.25%). When we resume our normal. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Enter this amount on line. Show details we are not affiliated with any brand or entity on this form.

This form is for income earned in tax year 2022, with tax returns due in. When we resume our normal. Web use a maryland form 505 2022 template to make your document workflow more streamlined. Return taxpayer who moved into or out. Web opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Web download or print the 2022 maryland form 505nr (nonresident income tax computation) for free from the maryland comptroller of maryland. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Web multiply line 14 by line 15 to arrive at your maryland tax. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax.

Enter this amount on line 16 and on form 505, line 32a. When we resume our normal. Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Web ing to maryland instructions for form 502, you are required to file a maryland income tax return if you are or were a maryland resident, you are required to file a federal return. Enter this amount on line. Web more about the maryland form pv individual income tax estimated ty 2022 the form pv is a payment voucher you will send with your check or money order for any balance due. Web opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. For returns filed without payments, mail your completed return to:

Fill Free fillable forms Comptroller of Maryland

This form is for income earned in tax year 2022, with tax returns due in april. For returns filed without payments, mail your completed return to: This form is for income earned in tax year 2022, with tax returns due in. Multiply line 13 by.0125 (1.25%). Web we last updated maryland form 505 in january 2023 from the maryland comptroller.

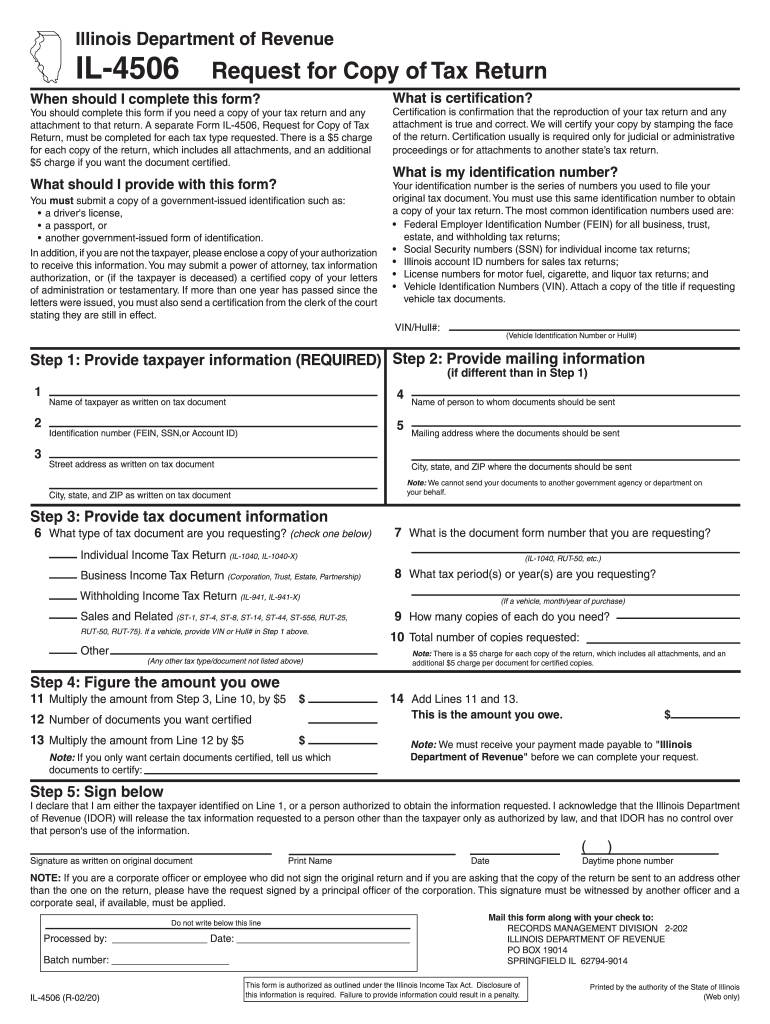

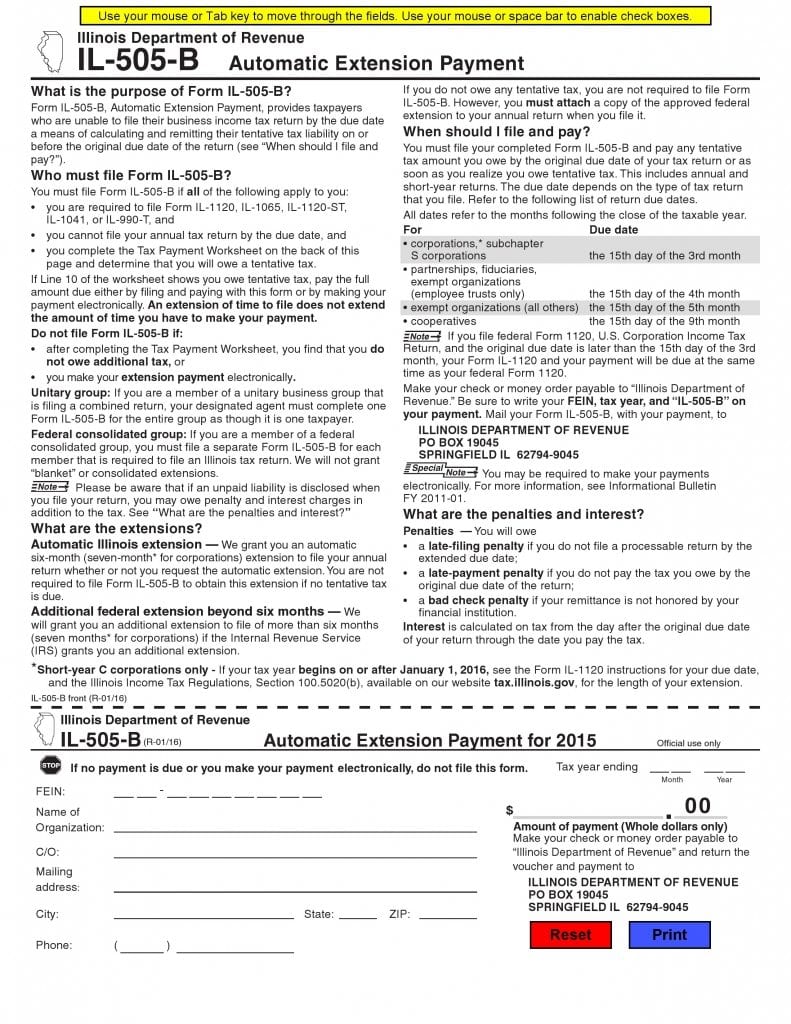

Illinois Dept Of Revenue Forms Fill Out and Sign Printable PDF

From to check here for maryland taxes withheld in error. Edit your 505 maryland form online type text, add images, blackout confidential details, add comments, highlights and more. Web use a maryland form 505 2022 template to make your document workflow more streamlined. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. When.

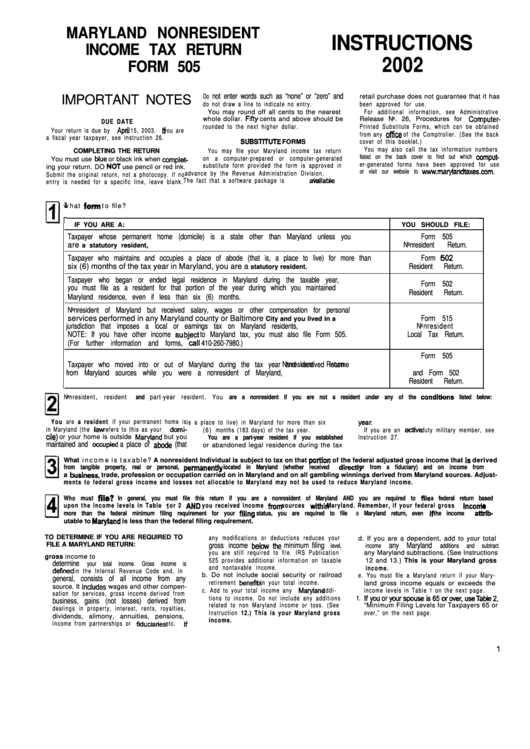

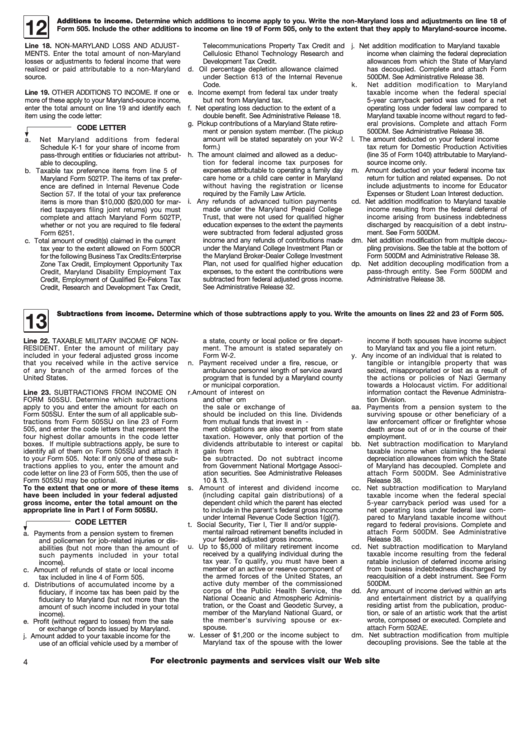

Instructions For Maryland Nonresident Tax Return Form 505 2002

Web ing to maryland instructions for form 502, you are required to file a maryland income tax return if you are or were a maryland resident, you are required to file a federal return. This form is for income earned in tax year 2022, with tax returns due in april. 2022 business income tax forms popular. This form is for.

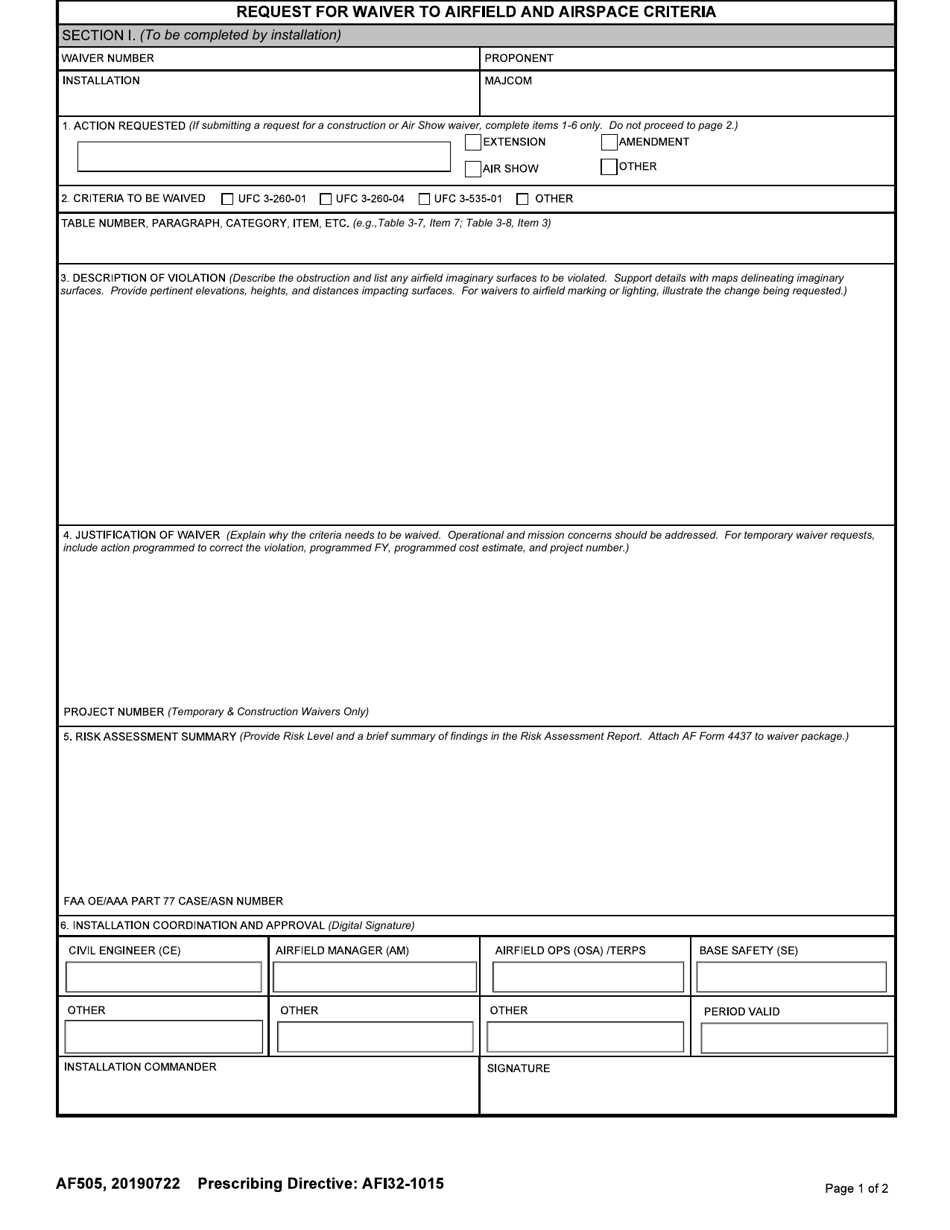

AF Form 505 Download Fillable PDF or Fill Online Request for Waiver to

Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. When we resume our normal. Enter this amount on line 16 and on form 505, line 32a. Enter this amount on line. 2022 business income tax forms popular.

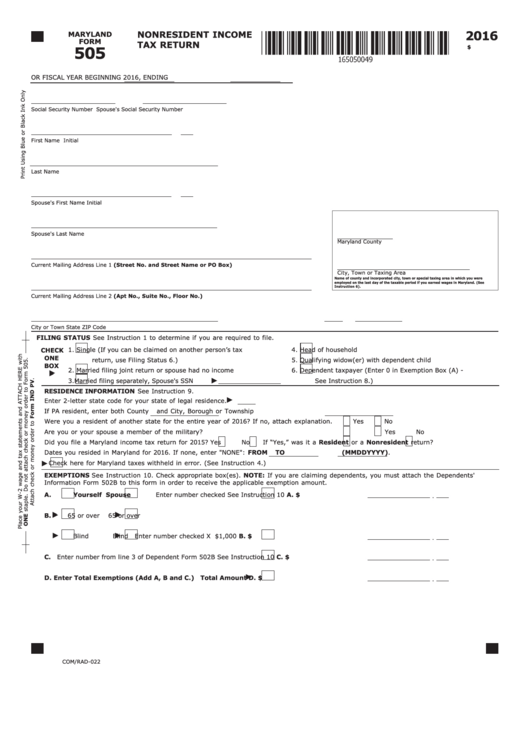

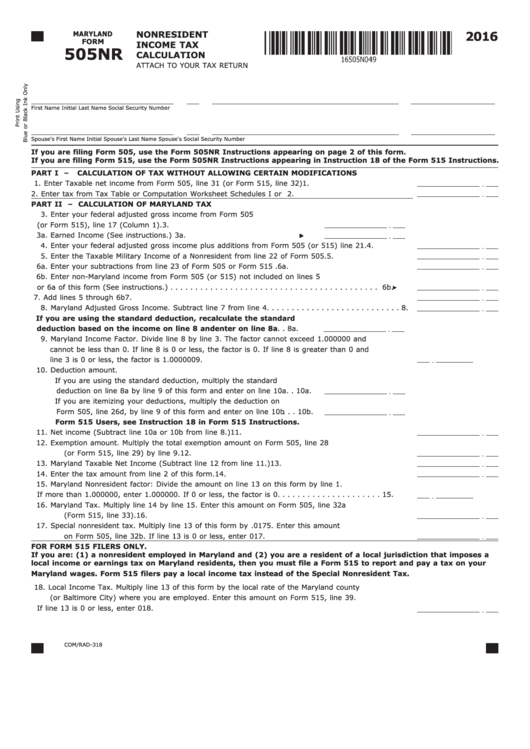

Fillable Maryland Form 505 Nonresident Tax Return 2016

Sign it in a few clicks draw your signature, type. Web ing to maryland instructions for form 502, you are required to file a maryland income tax return if you are or were a maryland resident, you are required to file a federal return. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident.

Free Automatic Extension Payment Form IL505B PDF Template Form

Enter this amount on line 16 and on form 505, line 32a. Return taxpayer who moved into or out. Sign it in a few clicks draw your signature, type. From to check here for maryland taxes withheld in error. 2022 business income tax forms popular.

Fillable Nonresident Tax Calculation Maryland Form 505nr

Web multiply line 14 by line 15 to arrive at your maryland tax. Show details we are not affiliated with any brand or entity on this form. Web opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. Web use a maryland form 505 2022 template to.

Instruction For Form 505 Maryland Nonresident Tax Return

Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Show details we are not affiliated with any brand or entity on this form. Web maryland tax, you must also file form 505. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Web ing to.

If you are a nonresident, you must file Form 505 and Form 505NR.

Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. This form is for income earned in tax year 2022, with tax returns due in. Web form 505nr.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

This form is for income earned in tax year 2022, with tax returns due in april. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Sign it in a few clicks draw your signature, type..

2022 Business Income Tax Forms Popular.

Web download or print the 2022 maryland form 505nr (nonresident income tax computation) for free from the maryland comptroller of maryland. This form is for income earned in tax year 2022, with tax returns due in. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Web maryland tax, you must also file form 505.

Enter This Amount On Line.

When we resume our normal. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Web more about the maryland form 505x individual income tax nonresident ty 2022 generally, form 505x must be filed within three years from the date the original return. From to check here for maryland taxes withheld in error.

Return Taxpayer Who Moved Into Or Out.

For returns filed without payments, mail your completed return to: This form is for income earned in tax year 2022, with tax returns due in april. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs.

Show Details We Are Not Affiliated With Any Brand Or Entity On This Form.

Web use a maryland form 505 2022 template to make your document workflow more streamlined. Web multiply line 14 by line 15 to arrive at your maryland tax. Multiply line 13 by.0125 (1.25%). Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su.