Mn Tax Form M1 Instructions

Mn Tax Form M1 Instructions - Web current home address city 2020 federal filing status (place an x in one box): Web for examples of qualifying education expenses, see the form m1 instructions. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. Web free printable 2022 minnesota form m1 and 2022 minnesota form m1 instructions booklet in pdf format to print, fill in, and mail your state income tax return. Web more about the minnesota form m1x. You can also look for forms by category below the search box. Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota department of. State zip code (4) head of household (5) qualifying widow(er) dependent 3 first name dependent 3 last name dependent 3 ssn. Single (2) married filing jointly (3) married filing separately state zip code spouse’s date of birth. Minnesota individual income tax, mail station 0010, 600 n.

This form is for income earned in tax. Subtraction limits the maximum subtraction allowed for purchases of personal computer hardware. Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota department of. Extension of time to appeal from an order of commissioner of revenue. Web this will not increase your tax or reduce your refund. Web if they total more than $770, file form ut1, individual use tax return, by april 15, 2020, for all taxable items you purchased during the calendar year. We last updated minnesota form m1x in february 2023 from the minnesota department of revenue. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web for examples of qualifying education expenses, see the form m1 instructions. This form is for income earned in tax.

Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota department of. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. State zip code (4) head of household (5) qualifying widow(er) dependent 3 first name dependent 3 last name dependent 3 ssn. This form is for income earned in tax. Web current home address city 2020 federal filing status (place an x in one box): Single (2) married filing jointly (3) married filing separately state zip code spouse’s date of birth. Web more about the minnesota form m1x. Extension of time to appeal from an order of commissioner of revenue. Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Web if they total more than $770, file form ut1, individual use tax return, by april 15, 2020, for all taxable items you purchased during the calendar year.

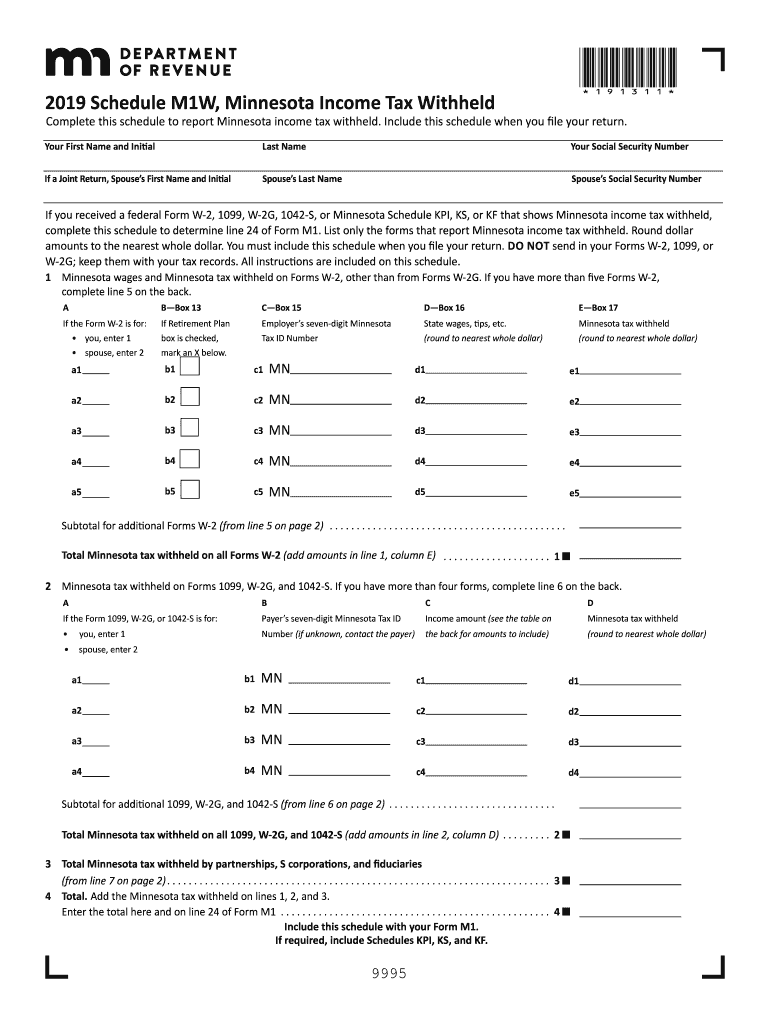

Minnesota tax forms Fill out & sign online DocHub

State zip code (4) head of household (5) qualifying widow(er) dependent 3 first name dependent 3 last name dependent 3 ssn. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web go to www.revenue.state.mn.us to: We last updated minnesota form m1mt in february 2023 from the minnesota department of revenue. This form is.

Fill Free fillable Minnesota Department of Revenue PDF forms

State zip code (4) head of household (5) qualifying widow(er) dependent 3 first name dependent 3 last name dependent 3 ssn. Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota department of. Web before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040.

Fill Free fillable Minnesota Department of Revenue PDF forms

Web current home address city 2020 federal filing status (place an x in one box): Web you must file a minnesota form m1, individual income tax return, if you are a: Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. State zip code (4) head of household (5) qualifying widow(er) dependent 3 first.

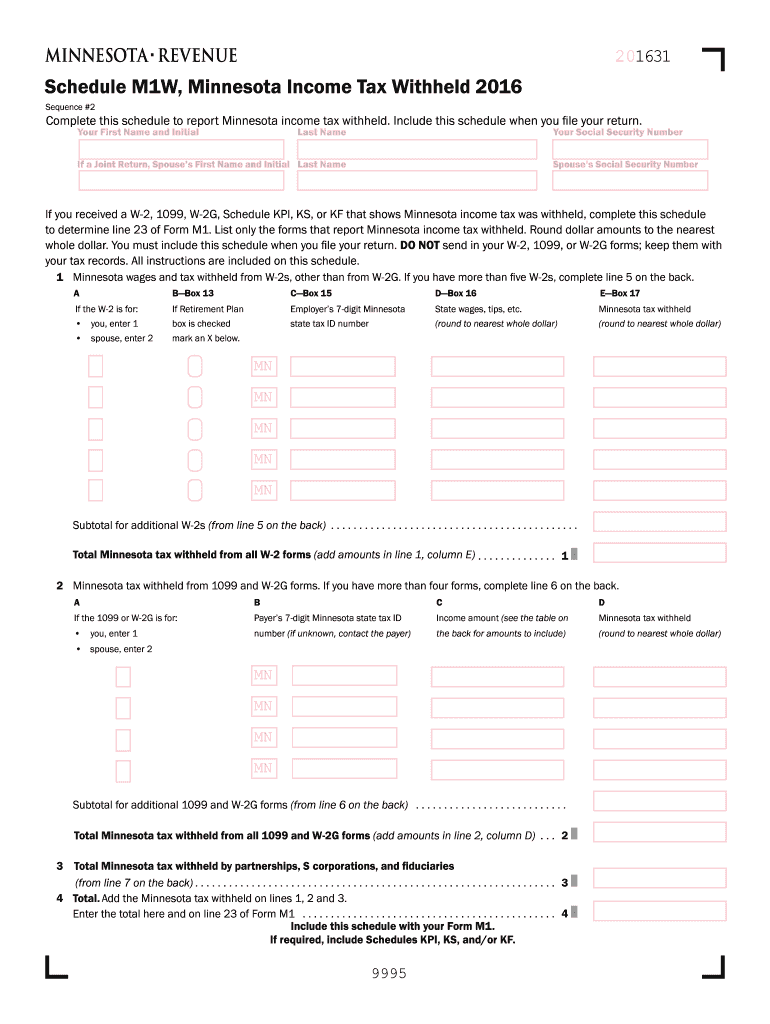

2016 Mn Fill Out and Sign Printable PDF Template signNow

Extension of time to appeal from an order of commissioner of revenue. Web using the amount from line 13 and line 17, find the amount to enter here from the renters refund table in the instructions. We last updated minnesota form m1x in february 2023 from the minnesota department of revenue. Web 5 rows we last updated minnesota form m1.

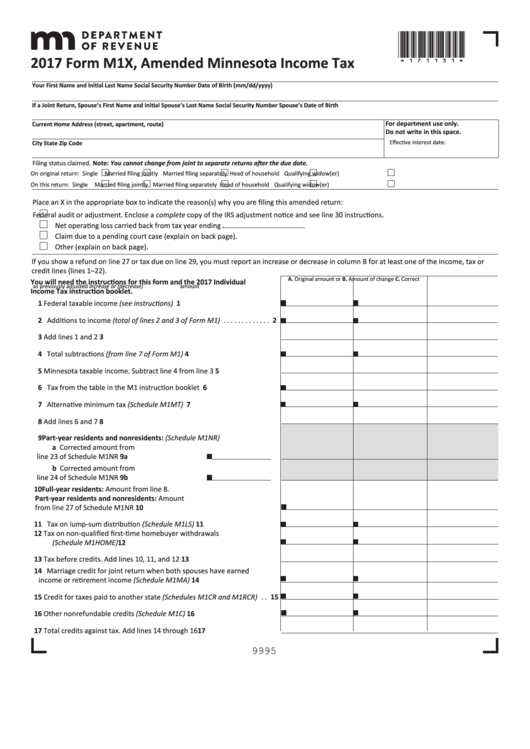

Fillable Form M1x Amended Minnesota Tax 2017 printable pdf

Web more about the minnesota form m1x. Web using the amount from line 13 and line 17, find the amount to enter here from the renters refund table in the instructions. Web more about the minnesota form m1mt. You can also look for forms by category below the search box. Single (2) married filing jointly (3) married filing separately state.

Tax Table M1 Instructions

Web if you use forms or instructions that are outdated, it will delay your refund. Web free printable 2022 minnesota form m1 and 2022 minnesota form m1 instructions booklet in pdf format to print, fill in, and mail your state income tax return. Web current home address city 2020 federal filing status (place an x in one box): This form.

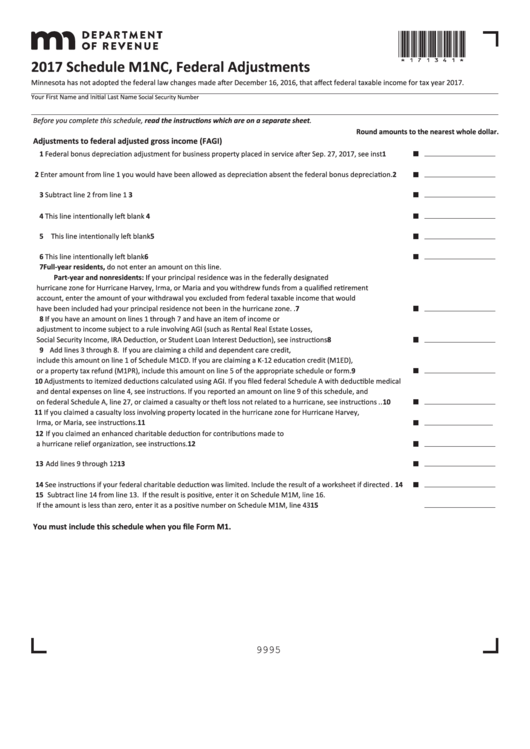

Fillable Schedule M1nc Federal Adjustments 2017 printable pdf download

This form is for income earned in tax. Extension of time to appeal from an order of commissioner of revenue. Web you must file yearly by april 15. State zip code (4) head of household (5) qualifying widow(er) dependent 3 first name dependent 3 last name dependent 3 ssn. Before starting your minnesota income tax return ( form m1 ,.

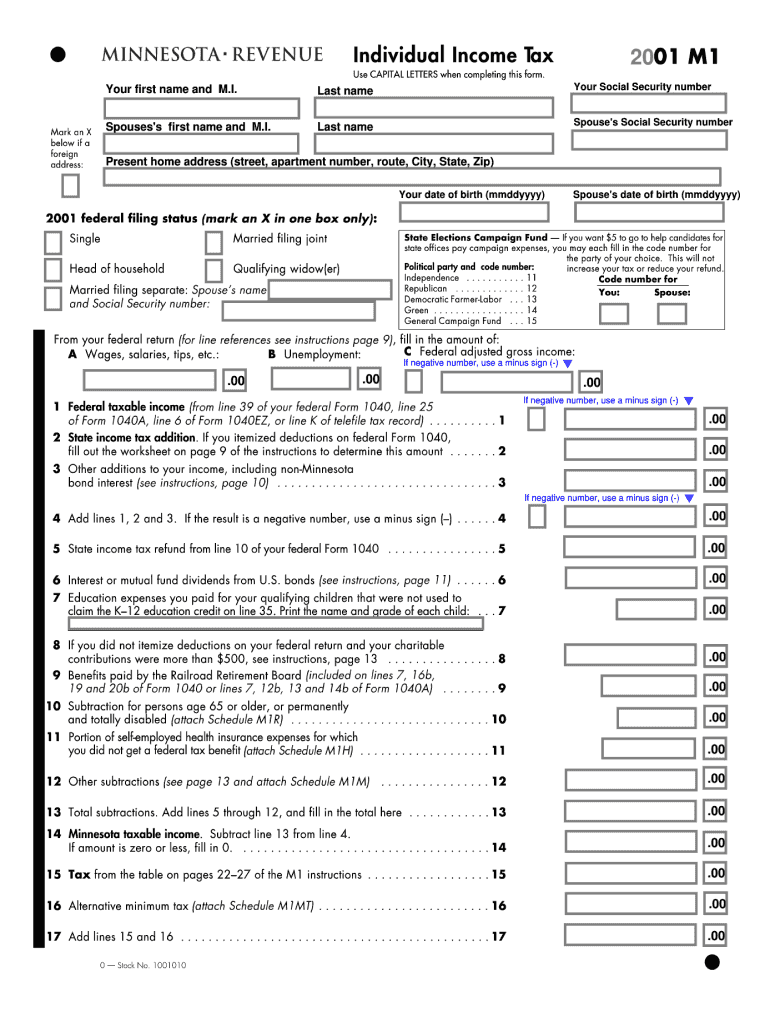

M1 Tax Documents Fill Out and Sign Printable PDF Template signNow

We last updated minnesota form m1mt in february 2023 from the minnesota department of revenue. Web more about the minnesota form m1x. Web if you use forms or instructions that are outdated, it will delay your refund. Minnesota individual income tax, mail station 0010, 600 n. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum.

2020 Minnesota Tax Fill Out and Sign Printable PDF Template signNow

Minnesota individual income tax, mail station 0010, 600 n. Web you must file a minnesota form m1, individual income tax return, if you are a: Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Use this tool to search for a specific tax form using the tax form number or name. Web you.

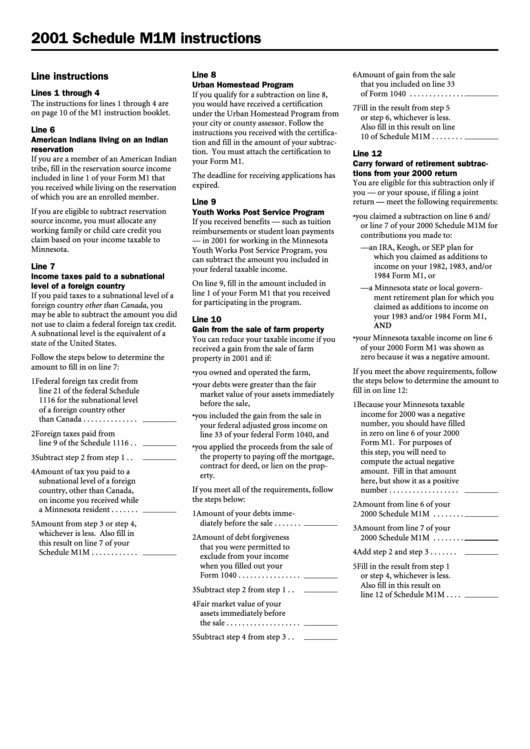

Schedule M1m Instructions 2001 printable pdf download

If your total purchases for. Ira, pensions, and annuities c. We last updated minnesota form m1x in february 2023 from the minnesota department of revenue. Web if they total more than $770, file form ut1, individual use tax return, by april 15, 2020, for all taxable items you purchased during the calendar year. Minnesota individual income tax, mail station 0010,.

Web Before Starting Your Minnesota Income Tax Return ( Form M1, Individual Income Tax ), You Must Complete Federal Form 1040 To Determine Your Federal Taxable Income.

Web if they total more than $770, file form ut1, individual use tax return, by april 15, 2020, for all taxable items you purchased during the calendar year. Single (2) married filing jointly (3) married filing separately state zip code spouse’s date of birth. This form is for income earned in tax. Web you must file yearly by april 15.

Minnesota Individual Income Tax Applies To Residents And Nonresidents Who Meet The State's Minimum Filing Requirements.

Subtraction limits the maximum subtraction allowed for purchases of personal computer hardware. Web more about the minnesota form m1mt. Web for examples of qualifying education expenses, see the form m1 instructions. State zip code (4) head of household (5) qualifying widow(er) dependent 3 first name dependent 3 last name dependent 3 ssn.

You Can Also Look For Forms By Category Below The Search Box.

Web if you use forms or instructions that are outdated, it will delay your refund. Web this will not increase your tax or reduce your refund. Web using the amount from line 13 and line 17, find the amount to enter here from the renters refund table in the instructions. If your total purchases for.

Web You Must File A Minnesota Form M1, Individual Income Tax Return, If You Are A:

This form is for income earned in tax. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. We last updated minnesota form m1mt in february 2023 from the minnesota department of revenue. Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form.