Payroll Deduction Form Pdf

Payroll Deduction Form Pdf - Web schedule b (form 941), employer's record of federal tax liability schedule d (form 941), report of discrepancies caused by acquisitions, statutory mergers, or consolidations schedule r (form 941), allocation schedule for aggregate form 941 filers form 8974, qualified small business payroll tax credit for increasing research activities Thanks to this form, you can easily control. Web i understand and agree that any amount that is due and owing at the time of my termination, regardless of whether my termination was voluntary or not, will be deducted from my last paycheck or any other amounts that may be owed to me. 4(a) $ 4(b) $ 4(c) $ Web fillable and printable payroll deduction form 2023. Web this payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. Fill, sign and download payroll deduction form online on handypdf.com Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2021 tax return and want to reduce your withholding to account for these deductions. This includes both itemized deductions and other deductions such as for student loan interest and iras. You can edit the fine print to match your policies and legal requirements;

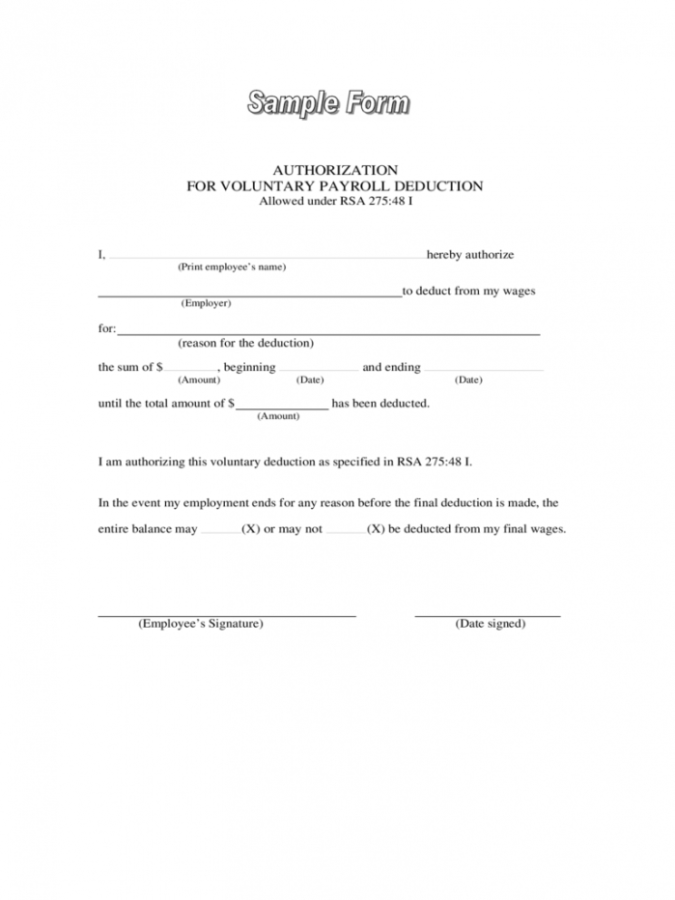

Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Fill, sign and download payroll deduction form online on handypdf.com Employees then provide signatures to authorize the deductions. Enter any additional tax you want withheld each pay period. (if you are in the hr department, you might want to look at some templates for effective that do their job.) payroll deduction authorization form. Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2021 tax return and want to reduce your withholding to account for these deductions. This includes both itemized deductions and other deductions such as for student loan interest and iras. Thanks to this form, you can easily control. Web fillable and printable payroll deduction form 2023. 4(a) $ 4(b) $ 4(c) $

Thanks to this form, you can easily control. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Web schedule b (form 941), employer's record of federal tax liability schedule d (form 941), report of discrepancies caused by acquisitions, statutory mergers, or consolidations schedule r (form 941), allocation schedule for aggregate form 941 filers form 8974, qualified small business payroll tax credit for increasing research activities This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. You can edit the fine print to match your policies and legal requirements; Your employer’s name and address your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address. (if you are in the hr department, you might want to look at some templates for effective that do their job.) payroll deduction authorization form. 4(a) $ 4(b) $ 4(c) $ Web i understand and agree that any amount that is due and owing at the time of my termination, regardless of whether my termination was voluntary or not, will be deducted from my last paycheck or any other amounts that may be owed to me. Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2021 tax return and want to reduce your withholding to account for these deductions.

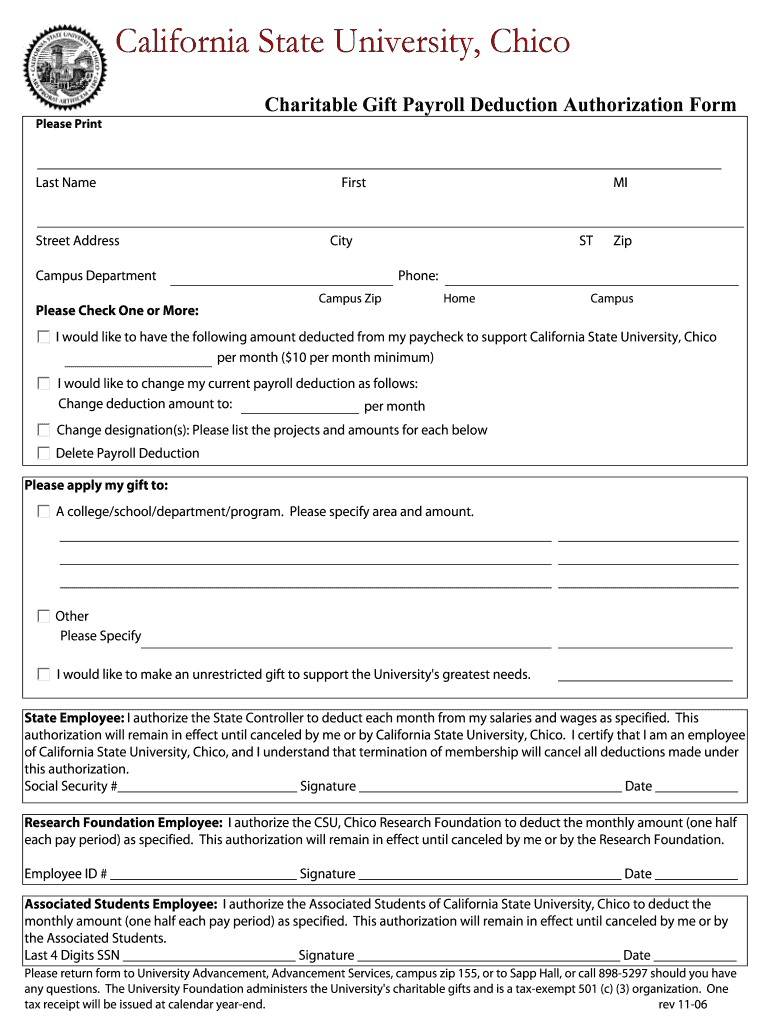

Payroll Deduction Authorization Form Template charlotte clergy coalition

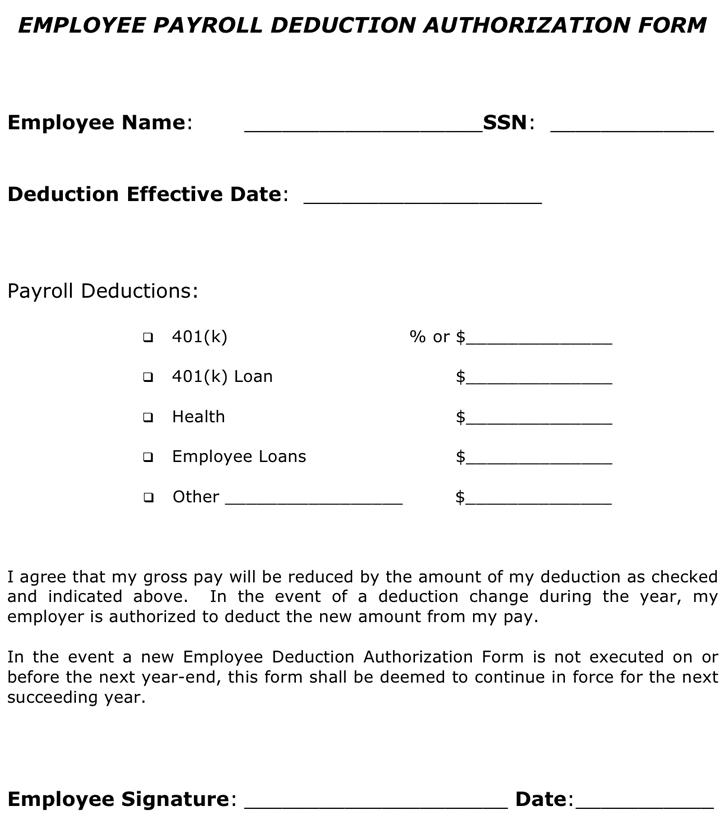

Web a payroll deduction form is a document that contains a list of items that are to be deducted from a paycheque. Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2021 tax return and want to reduce your withholding to account.

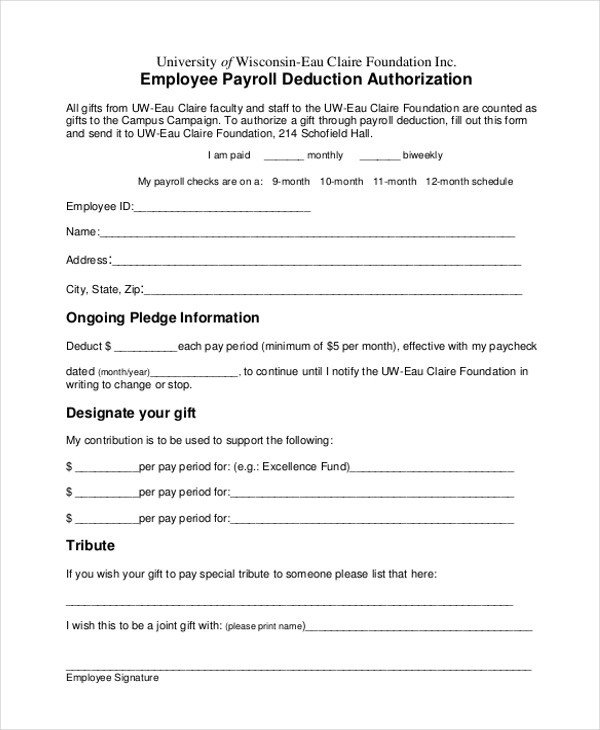

FREE 31+ Payroll Samples & Templates in MS Word MS Excel Pages

This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Web i understand and agree that any amount that is due and owing at the time of my termination, regardless of whether my termination was voluntary or not, will be deducted from my last paycheck or any other amounts that may be.

Payroll Deduction Form PDF Fill Out and Sign Printable PDF Template

Web i understand and agree that any amount that is due and owing at the time of my termination, regardless of whether my termination was voluntary or not, will be deducted from my last paycheck or any other amounts that may be owed to me. Thanks to this form, you can easily control. (if you are in the hr department,.

Payroll Deduction Agreement Template PDF Template

Your employer’s name and address your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address. Fill, sign and download payroll deduction form online on handypdf.com This includes both itemized deductions and other deductions such as for student loan interest and iras. 4(a) $ 4(b) $ 4(c) $ Web i understand and agree that.

FREE 9+ Sample Payroll Deduction Forms in PDF MS Word

Fill, sign and download payroll deduction form online on handypdf.com Web this payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Web schedule b (form 941), employer's record of federal tax liability schedule d (form.

FREE 14+ Sample Payrolle Deduction Forms in PDF Excel Word

You can edit the fine print to match your policies and legal requirements; Thanks to this form, you can easily control. Web a payroll deduction form is a document that contains a list of items that are to be deducted from a paycheque. Your employer’s name and address your name(s) (plus spouse’s name if the amount owed is for a.

FREE 9+ Sample Payroll Deduction Forms in PDF MS Word

It is useful for employees to keep track of what their paycheque is being reduced by. Web schedule b (form 941), employer's record of federal tax liability schedule d (form 941), report of discrepancies caused by acquisitions, statutory mergers, or consolidations schedule r (form 941), allocation schedule for aggregate form 941 filers form 8974, qualified small business payroll tax credit.

Payroll Deduction Authorization Form Template Collection

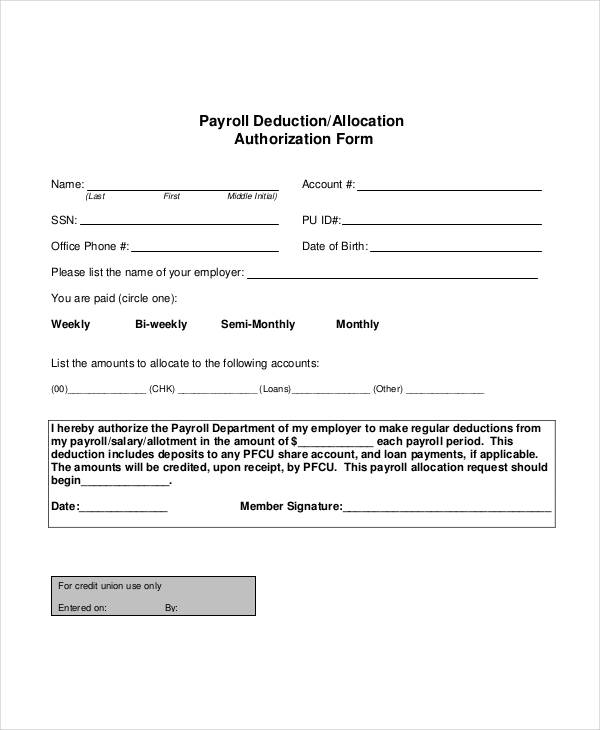

Web payroll deduction authorization employee name employee id number ( last name ) ( first name ) ( middle initial ) ssn date of birth account number work phone personal phone employer name pay frequency ( x ) list amounts to allocate to the following accounts: Employees then provide signatures to authorize the deductions. Web i understand and agree that.

Payroll Deduction Form Template PDF Template

Fill, sign and download payroll deduction form online on handypdf.com Enter any additional tax you want withheld each pay period. Web fillable and printable payroll deduction form 2023. Web this payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. Web i understand and agree that any amount that is due and owing at.

Payroll Deduction Form 2 Free Templates In Pdf Word Employee Payroll

4(a) $ 4(b) $ 4(c) $ It is useful for employees to keep track of what their paycheque is being reduced by. Web fillable and printable payroll deduction form 2023. This includes both itemized deductions and other deductions such as for student loan interest and iras. Employees then provide signatures to authorize the deductions.

Web I Understand And Agree That Any Amount That Is Due And Owing At The Time Of My Termination, Regardless Of Whether My Termination Was Voluntary Or Not, Will Be Deducted From My Last Paycheck Or Any Other Amounts That May Be Owed To Me.

Web fillable and printable payroll deduction form 2023. Enter any additional tax you want withheld each pay period. Web a payroll deduction form is a document that contains a list of items that are to be deducted from a paycheque. Web schedule b (form 941), employer's record of federal tax liability schedule d (form 941), report of discrepancies caused by acquisitions, statutory mergers, or consolidations schedule r (form 941), allocation schedule for aggregate form 941 filers form 8974, qualified small business payroll tax credit for increasing research activities

Web Enter In This Step The Amount From The Deductions Worksheet, Line 5, If You Expect To Claim Deductions Other Than The Basic Standard Deduction On Your 2021 Tax Return And Want To Reduce Your Withholding To Account For These Deductions.

This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. This includes both itemized deductions and other deductions such as for student loan interest and iras. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. (if you are in the hr department, you might want to look at some templates for effective that do their job.) payroll deduction authorization form.

Employees Then Provide Signatures To Authorize The Deductions.

Thanks to this form, you can easily control. You can edit the fine print to match your policies and legal requirements; Web this payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. Fill, sign and download payroll deduction form online on handypdf.com

4(A) $ 4(B) $ 4(C) $

Your employer’s name and address your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address. Web payroll deduction authorization employee name employee id number ( last name ) ( first name ) ( middle initial ) ssn date of birth account number work phone personal phone employer name pay frequency ( x ) list amounts to allocate to the following accounts: It is useful for employees to keep track of what their paycheque is being reduced by.