Quickbooks W 4 Form

Quickbooks W 4 Form - It tells the employer how much to withhold from an employee’s paycheck for taxes. You might want to visit the irs website for more information about the child tax credit: Click the payroll info tab, then taxes in the. This way, you'll be guided on how to handle your. Web starting at $57.99 use for reporting employee wages and salaries to federal, state and local agencies; Each kit includes a copy for your employee. Are all employees required to furnish a new. In the provided payroll tax center, choose filings. What happened to withholding allowances? According to the irs provision for section 199a, for eligible taxpayers with total taxable income in.

This way, you'll be guided on how to handle your. In the provided payroll tax center, choose filings. Go down the filing resources part and choose employee setup. Web up to 50% cash back go to the top menu bar and click employees, then employee center. Click the payroll info tab, then taxes in the. Web in this video you’ll learn: Employee information for each employee who worked for you this calendar year (including active, inactive and terminated employees), you’ll need:. You might want to visit the irs website for more information about the child tax credit: What happened to withholding allowances? Choose taxes and then click payroll tax.

It tells the employer how much to withhold from an employee’s paycheck for taxes. Additionally, when you need details. Go down the filing resources part and choose employee setup. Web up to 50% cash back go to the top menu bar and click employees, then employee center. Click the payroll info tab, then taxes in the. Employee information for each employee who worked for you this calendar year (including active, inactive and terminated employees), you’ll need:. According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Each kit includes a copy for your employee. Choose taxes and then click payroll tax. You might want to visit the irs website for more information about the child tax credit:

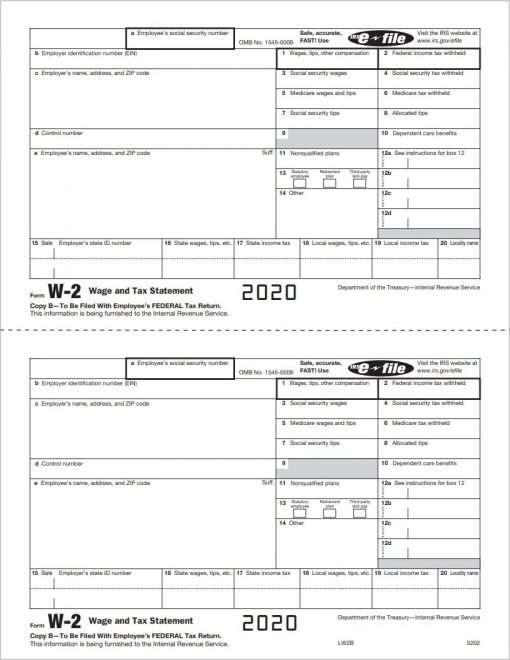

How do you input the new W4 for 2020 information for the employees?

Web up to 50% cash back go to the top menu bar and click employees, then employee center. Go down the filing resources part and choose employee setup. Web here are some forms commonly printed for new employees (pdf): It tells the employer how much to withhold from an employee’s paycheck for taxes. Additionally, when you need details.

QuickBooks Online Customize Invoices BlackRock

Employee information for each employee who worked for you this calendar year (including active, inactive and terminated employees), you’ll need:. It tells the employer how much to withhold from an employee’s paycheck for taxes. Web up to 50% cash back go to the top menu bar and click employees, then employee center. This way, you'll be guided on how to.

QuickBooks TipHow To Add a Logo and Customize Your Forms QuickBooks

Web in this video you’ll learn: Additionally, when you need details. Go down the filing resources part and choose employee setup. This way, you'll be guided on how to handle your. In the provided payroll tax center, choose filings.

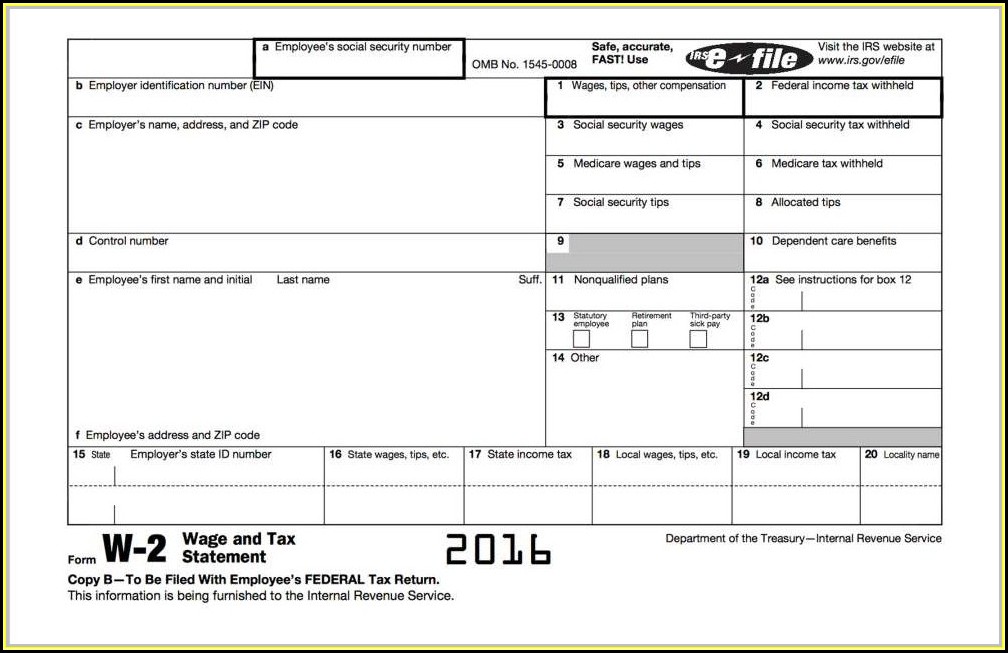

quickbook w2 form allignment

What happened to withholding allowances? Are all employees required to furnish a new. In the provided payroll tax center, choose filings. Choose taxes and then click payroll tax. Web in this video you’ll learn:

Quickbooks W2 Forms Blank Paper Form Resume Examples pv9wXxZKY7

Employee information for each employee who worked for you this calendar year (including active, inactive and terminated employees), you’ll need:. What happened to withholding allowances? According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Choose taxes and then click payroll tax. Web up to 50% cash back go to the top menu bar.

How to change QuickBooks password for Admin and other users?

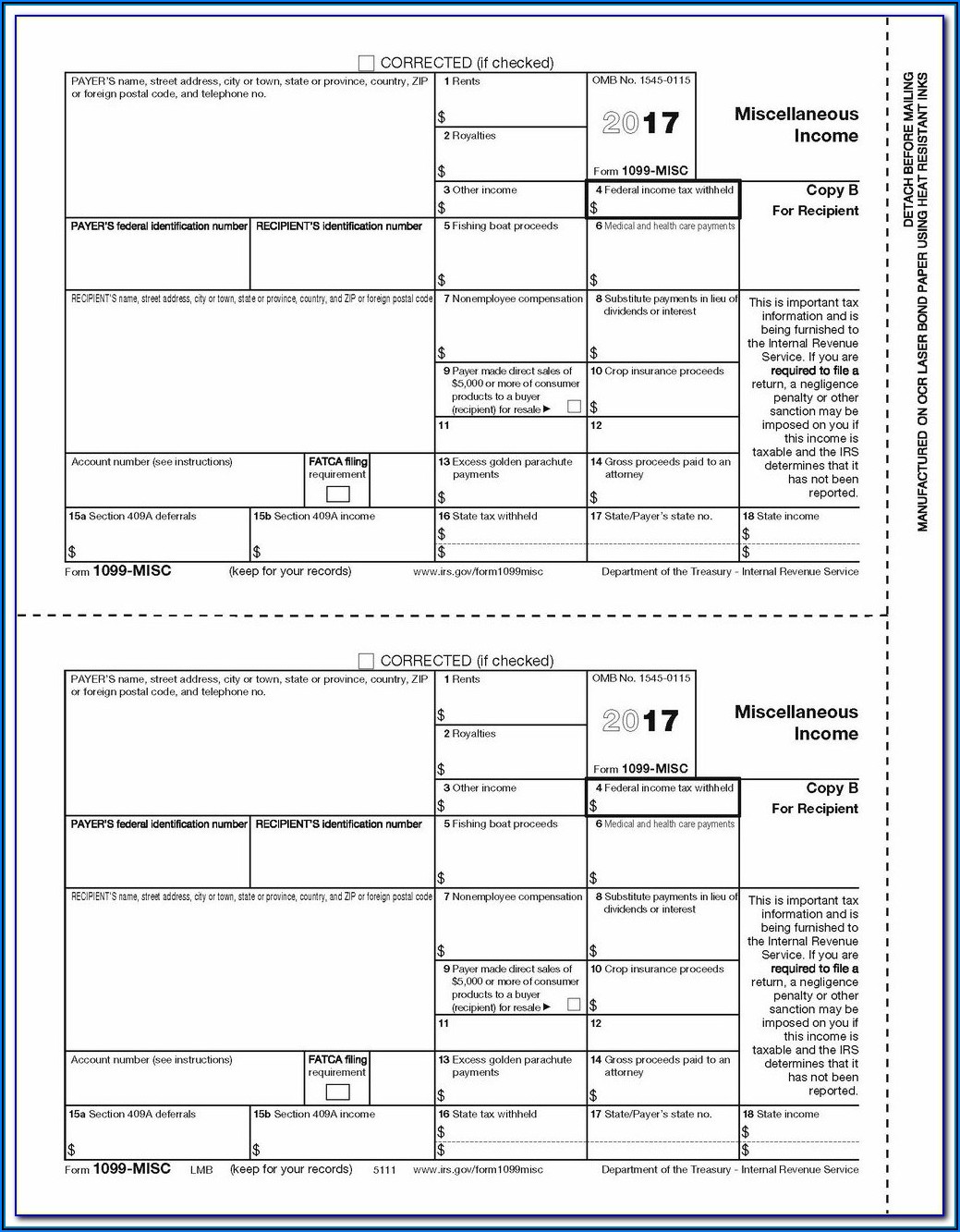

Web starting at $57.99 use for reporting employee wages and salaries to federal, state and local agencies; Each kit includes a copy for your employee. Additionally, when you need details. Web in this video you’ll learn: According to the irs provision for section 199a, for eligible taxpayers with total taxable income in.

Solved W4

This way, you'll be guided on how to handle your. Web starting at $57.99 use for reporting employee wages and salaries to federal, state and local agencies; According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Click the payroll info tab, then taxes in the. Additionally, when you need details.

Learn How to Enter the New 2020 W4 into QuickBooks Desktop Hawkins

Web in this video you’ll learn: This way, you'll be guided on how to handle your. Click the payroll info tab, then taxes in the. Web here are some forms commonly printed for new employees (pdf): Are all employees required to furnish a new.

Quickbooks W2 Forms Blank Paper Form Resume Examples pv9wXxZKY7

It tells the employer how much to withhold from an employee’s paycheck for taxes. Choose taxes and then click payroll tax. Web starting at $57.99 use for reporting employee wages and salaries to federal, state and local agencies; What happened to withholding allowances? In the provided payroll tax center, choose filings.

QuickBooks W2 Form Copy B, Employee / Federal

Web up to 50% cash back go to the top menu bar and click employees, then employee center. It tells the employer how much to withhold from an employee’s paycheck for taxes. This way, you'll be guided on how to handle your. Additionally, when you need details. Go down the filing resources part and choose employee setup.

Additionally, When You Need Details.

Click the payroll info tab, then taxes in the. According to the irs provision for section 199a, for eligible taxpayers with total taxable income in. Each kit includes a copy for your employee. This way, you'll be guided on how to handle your.

Employee Information For Each Employee Who Worked For You This Calendar Year (Including Active, Inactive And Terminated Employees), You’ll Need:.

Web in this video you’ll learn: Web up to 50% cash back go to the top menu bar and click employees, then employee center. You might want to visit the irs website for more information about the child tax credit: It tells the employer how much to withhold from an employee’s paycheck for taxes.

In The Provided Payroll Tax Center, Choose Filings.

Go down the filing resources part and choose employee setup. Choose taxes and then click payroll tax. What happened to withholding allowances? Are all employees required to furnish a new.

Web Starting At $57.99 Use For Reporting Employee Wages And Salaries To Federal, State And Local Agencies;

Web here are some forms commonly printed for new employees (pdf):