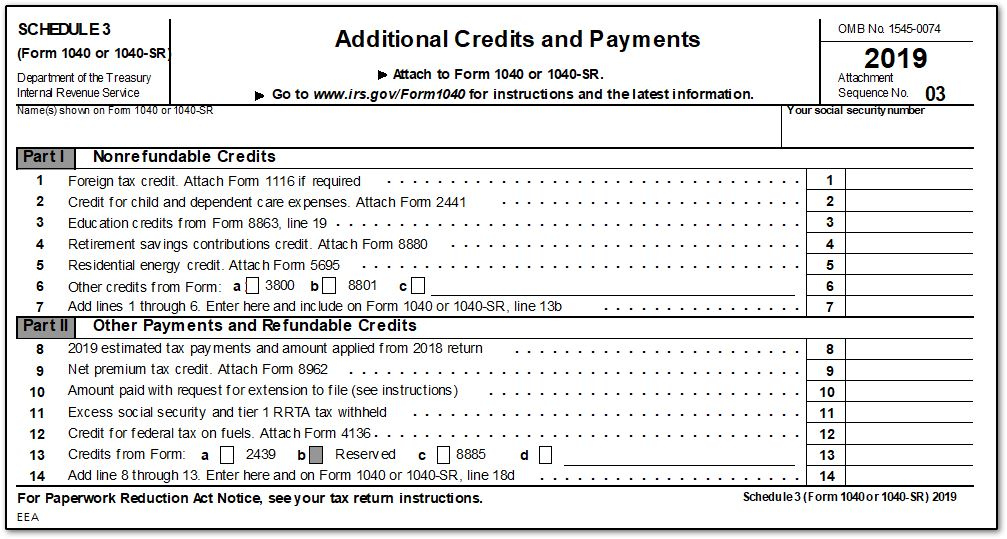

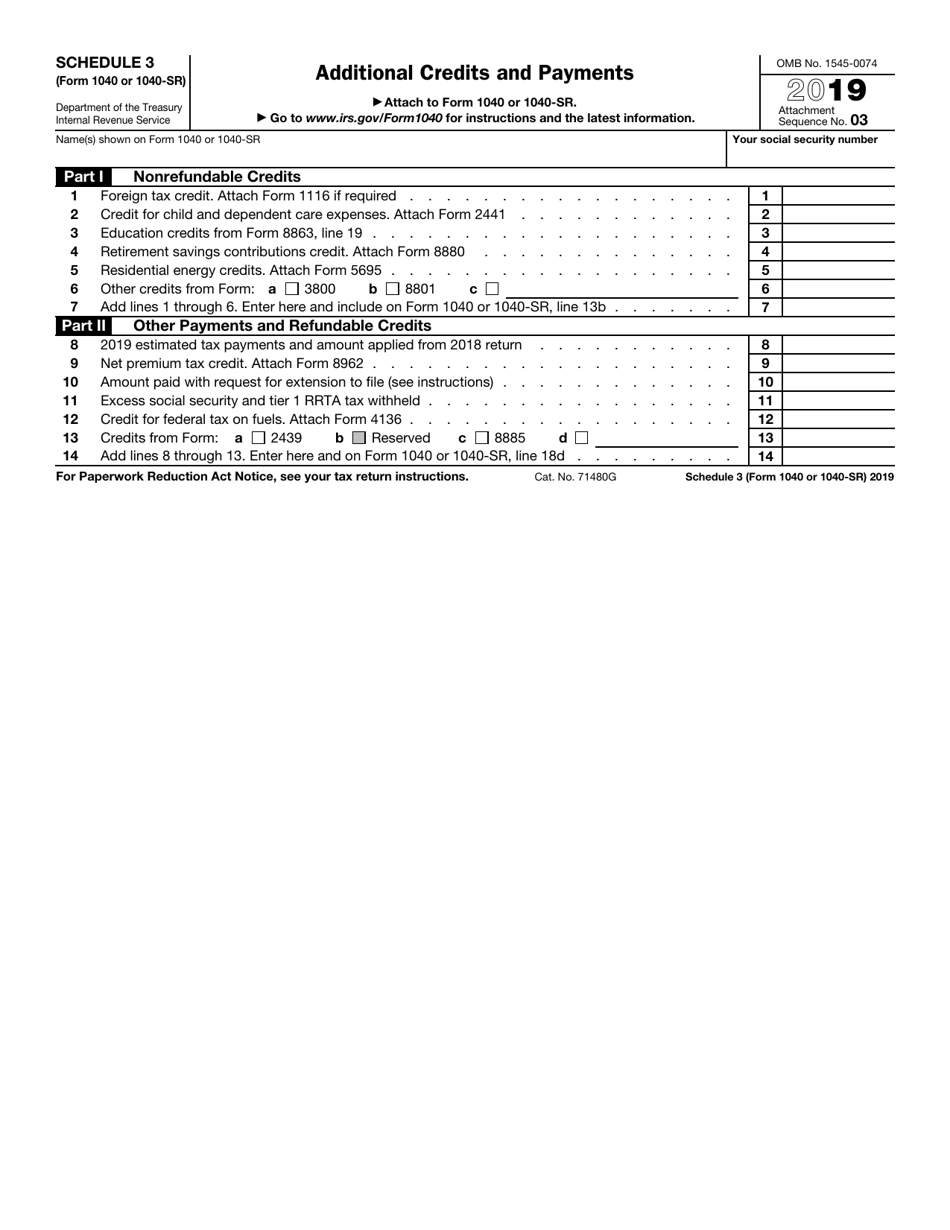

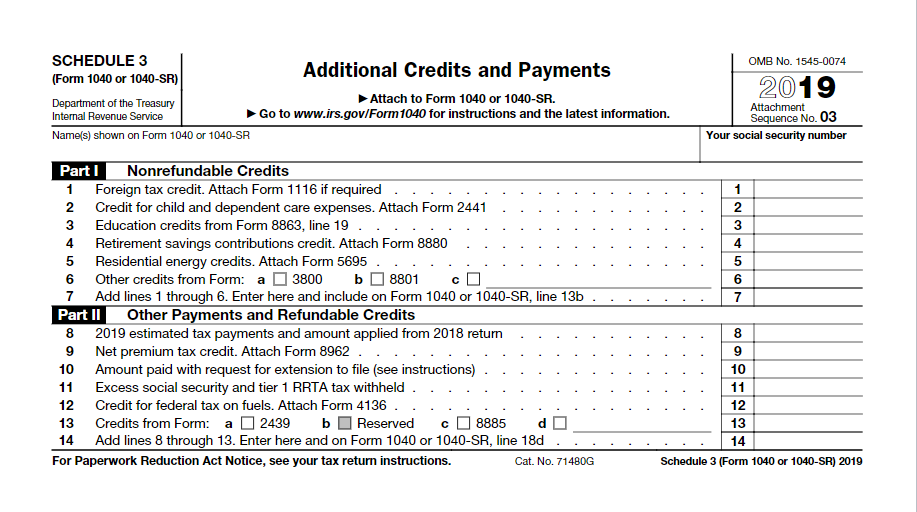

Sch 3 Form 1040

Sch 3 Form 1040 - This is your adjusted gross income 11 standard deduction for— • single or married filing separately, $12,550 • married filing jointly or qualifying. Open the template in our. Web this excess amount is entered on the applicable line on form 1040, schedule 3, and is a refundable credit. Web schedule 3 (form 1040) 2023. Web subtract line 10 from line 9. Web how can i make an adjustment to schedule 3, part ii for other payments? Web what is schedule 3 (form 1040)? To www.irs.gov/form1040 for instructions and the. If an adjusting entry is needed on schedule 3, for other payments, the adjustment can be made in data. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due.

Open the template in our. Get the document you want in the library of legal templates. Web schedule 3 is automatically generated by turbotax as part of the 1040 if you have any of a number of credits or other payment or refundable credits. If an adjusting entry is needed on schedule 3, for other payments, the adjustment can be made in data. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web what is schedule 3 (form 1040)? Web this excess amount is entered on the applicable line on form 1040, schedule 3, and is a refundable credit. Web how can i make an adjustment to schedule 3, part ii for other payments? Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service (irs) to report nonrefundable. Web schedule 3 (form 1040) 2023.

To www.irs.gov/form1040 for instructions and the. This is your adjusted gross income 11 standard deduction for— • single or married filing separately, $12,550 • married filing jointly or qualifying. Web subtract line 10 from line 9. Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service (irs) to report nonrefundable. Web what is schedule 3 (form 1040)? Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web schedule 3 is automatically generated by turbotax as part of the 1040 if you have any of a number of credits or other payment or refundable credits. Web schedule 3 (form 1040) 2023. If an adjusting entry is needed on schedule 3, for other payments, the adjustment can be made in data. Get the document you want in the library of legal templates.

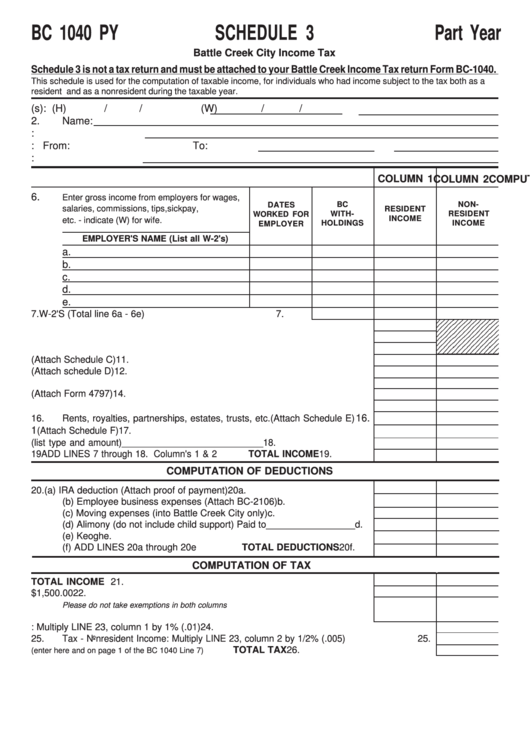

Form Bc 1040 Py Schedule 3 Battle Creek City Tax printable

Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service (irs) to report nonrefundable. This is your adjusted gross income 11 standard deduction for— • single or married filing separately, $12,550 • married filing jointly or qualifying. Web subtract line 10 from line 9. Web how can i make an adjustment to schedule.

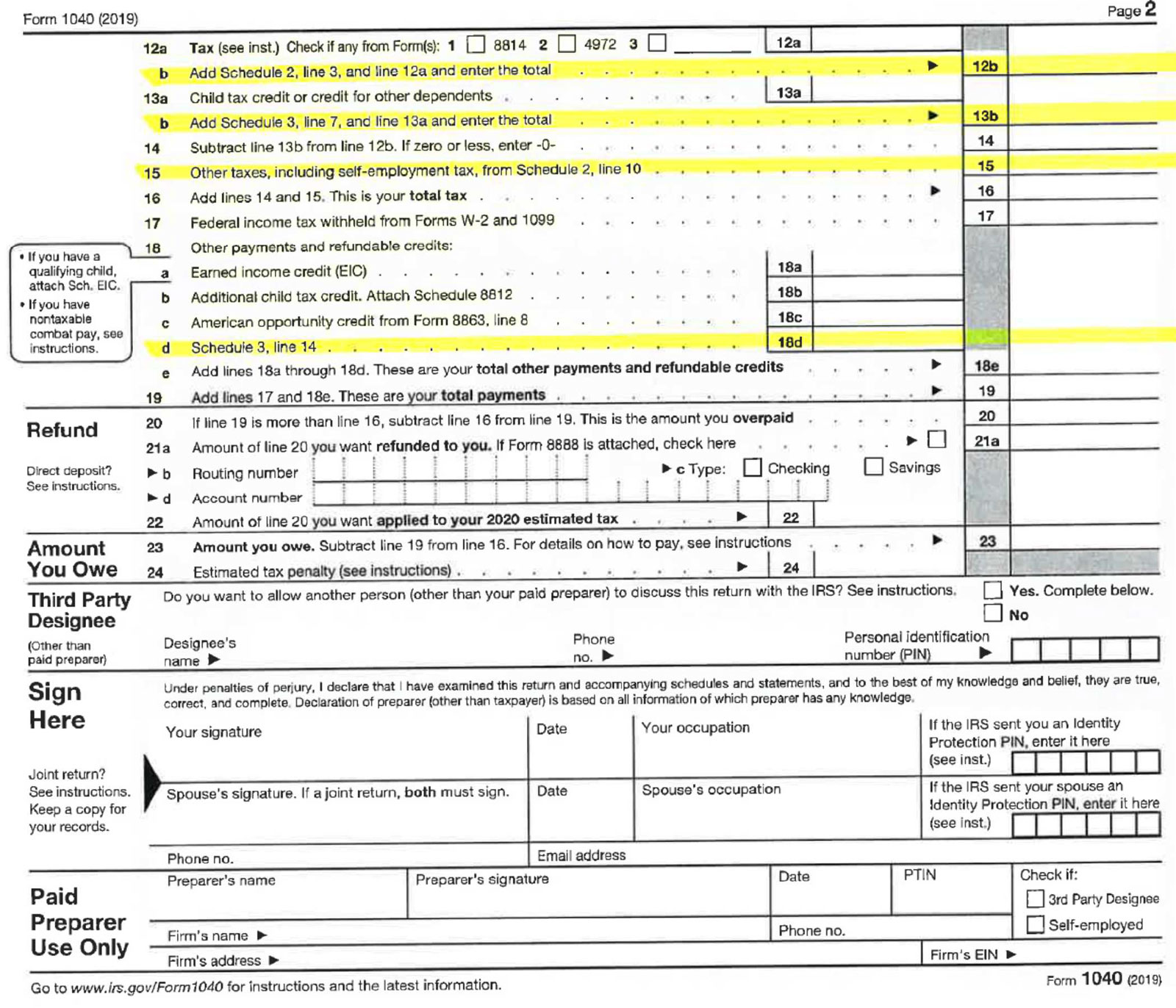

Do you need to submit a schedule 1, 2, and 3 along with your 1040 Tax

If an adjusting entry is needed on schedule 3, for other payments, the adjustment can be made in data. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Get the document you want in the library of legal templates. To www.irs.gov/form1040.

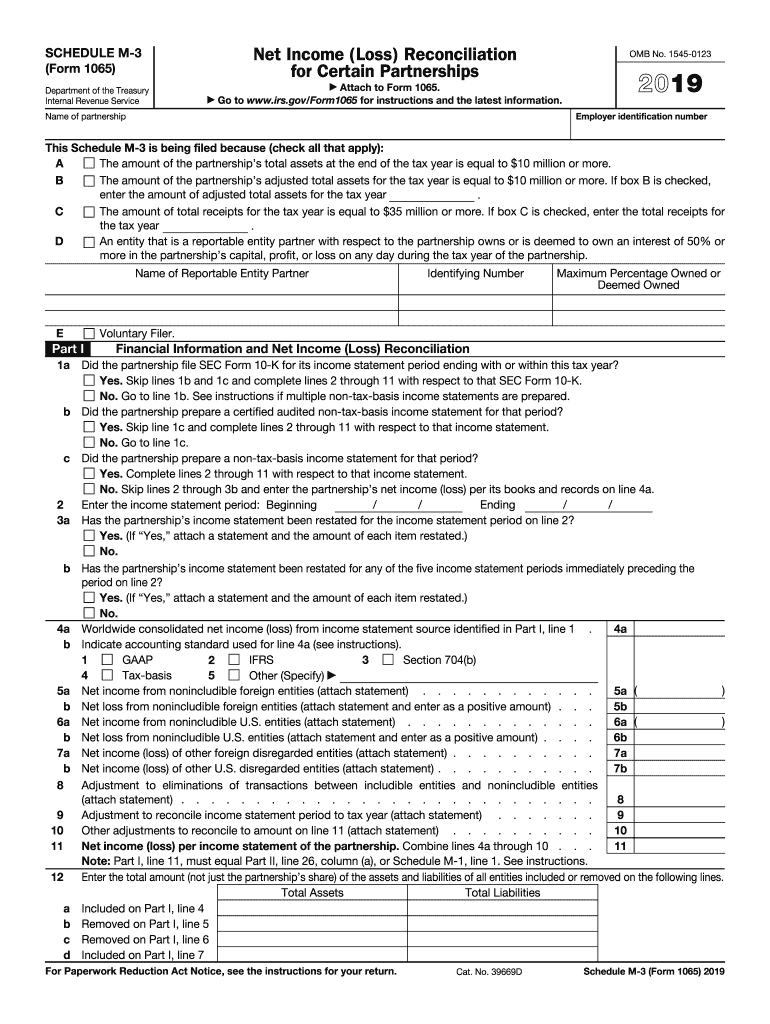

Form M 3 Fill Out and Sign Printable PDF Template signNow

Web subtract line 10 from line 9. Open the template in our. If an adjusting entry is needed on schedule 3, for other payments, the adjustment can be made in data. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Schedule.

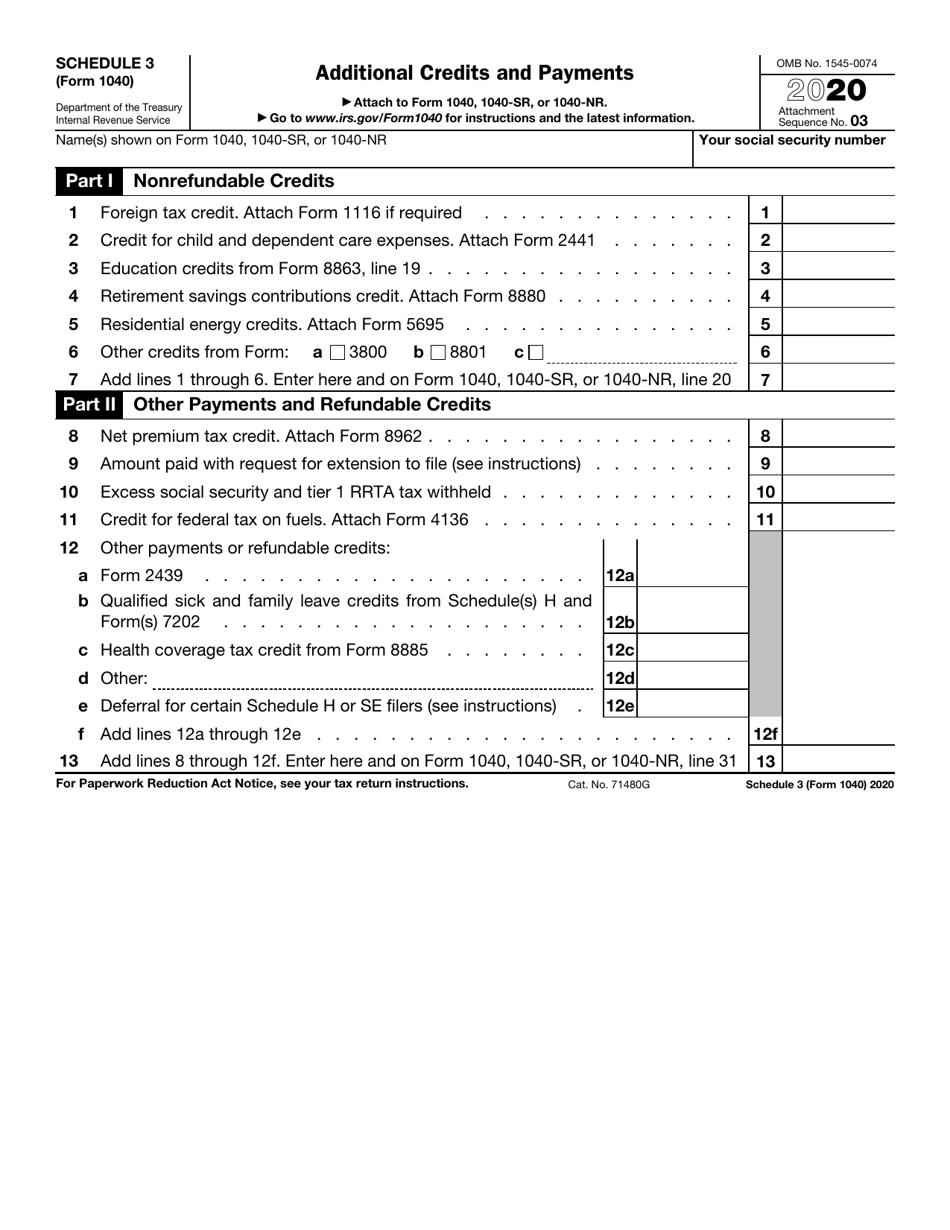

IRS Form 1040 Schedule 3 Download Fillable PDF or Fill Online

Web schedule 3 (form 1040) 2023. The software will calculate this automatically based. Web what is schedule 3 (form 1040)? Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service (irs) to report nonrefundable. Web schedule 3 is automatically generated by turbotax as part of the 1040 if you have any of a.

Top Facts About IRS Form 1040, Of which you might not be aware

Web subtract line 10 from line 9. To www.irs.gov/form1040 for instructions and the. Web schedule 3 (form 1040) 2023. Web this excess amount is entered on the applicable line on form 1040, schedule 3, and is a refundable credit. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report.

1040 Schedule 3 Form 2441 1040 Form Printable

Web what is schedule 3 (form 1040)? Web schedule 3 is automatically generated by turbotax as part of the 1040 if you have any of a number of credits or other payment or refundable credits. If an adjusting entry is needed on schedule 3, for other payments, the adjustment can be made in data. This is your adjusted gross income.

IRS Form 1040 (1040SR) Schedule 3 Download Fillable PDF or Fill Online

The software will calculate this automatically based. To www.irs.gov/form1040 for instructions and the. Web how can i make an adjustment to schedule 3, part ii for other payments? Web this excess amount is entered on the applicable line on form 1040, schedule 3, and is a refundable credit. Open the template in our.

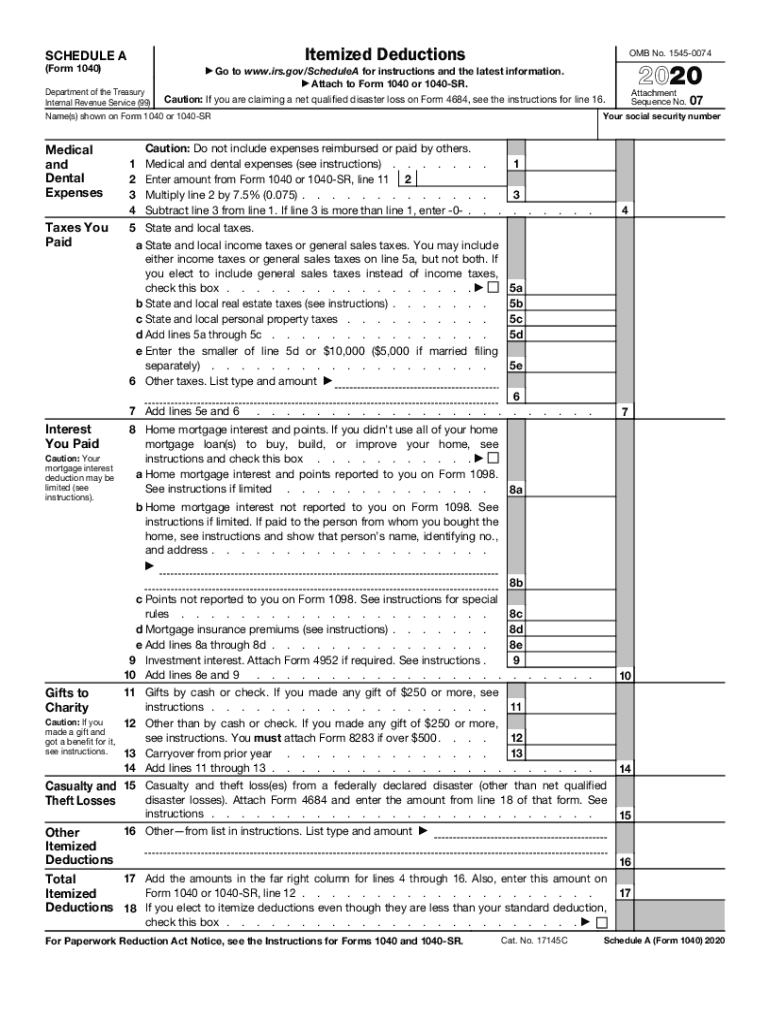

Irs Schedule A Fill Out and Sign Printable PDF Template signNow

Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service (irs) to report nonrefundable. If an adjusting entry is needed on schedule 3, for other payments, the adjustment can be made in data. Web how can i make an adjustment to schedule 3, part ii for other payments? Web the 1040 form is.

PLEASE USE THIS INFORMATION TO FILL OUT 1) Indivi...

If an adjusting entry is needed on schedule 3, for other payments, the adjustment can be made in data. Web how can i make an adjustment to schedule 3, part ii for other payments? Open the template in our. Get the document you want in the library of legal templates. Web this excess amount is entered on the applicable line.

New for 2019 taxes revised 1040 & only 3 schedules Don't Mess With Taxes

The software will calculate this automatically based. Web this excess amount is entered on the applicable line on form 1040, schedule 3, and is a refundable credit. Web what is schedule 3 (form 1040)? This is your adjusted gross income 11 standard deduction for— • single or married filing separately, $12,550 • married filing jointly or qualifying. Web schedule 3.

Web This Excess Amount Is Entered On The Applicable Line On Form 1040, Schedule 3, And Is A Refundable Credit.

Web schedule 3 is automatically generated by turbotax as part of the 1040 if you have any of a number of credits or other payment or refundable credits. If an adjusting entry is needed on schedule 3, for other payments, the adjustment can be made in data. To www.irs.gov/form1040 for instructions and the. Web what is schedule 3 (form 1040)?

Web Subtract Line 10 From Line 9.

Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service (irs) to report nonrefundable. This is your adjusted gross income 11 standard deduction for— • single or married filing separately, $12,550 • married filing jointly or qualifying. Get the document you want in the library of legal templates. Web schedule 3 (form 1040) 2023.

Web How Can I Make An Adjustment To Schedule 3, Part Ii For Other Payments?

Open the template in our. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. The software will calculate this automatically based.