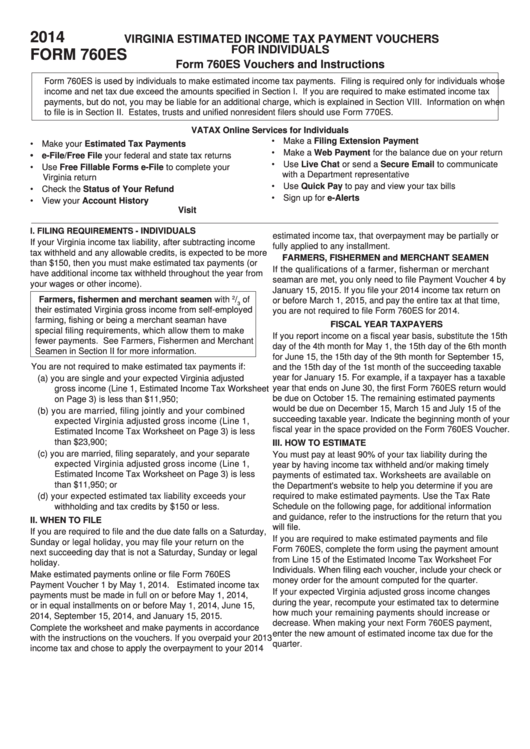

Virginia Form 760Es

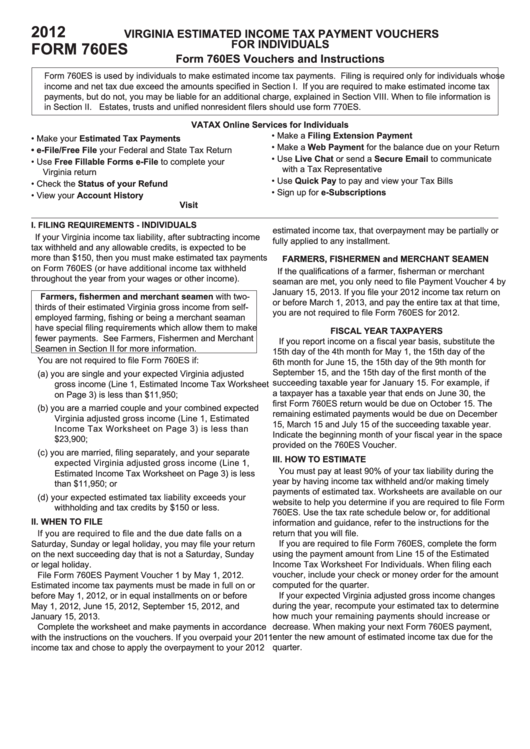

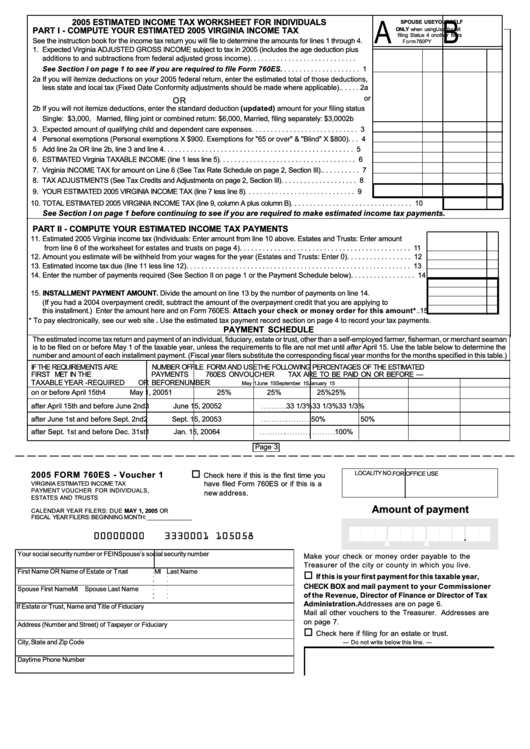

Virginia Form 760Es - Form 760es click here for pdf. You are married and your combined expected virginia adjusted gross income is less than. Save or instantly send your ready documents. Web form 760es is used by individuals to make estimated income tax payments. Easily fill out pdf blank, edit, and sign them. Farmers, fishermen and merchant seamen. Web form 760es is used by individuals to make estimated income tax payments. Filing is required only for individuals whose income and net tax due exceed the amounts. Web see the instructions for form 760, 760py or 763 for more on computing your estimated tax liability. Filing is required only for individuals whose income and net tax due exceed the amounts.

Web forms library 2023 form 760es, estimated income tax payment vouchers for individuals. We last updated the resident individual income tax return in january 2023, so. Have a comment, suggestion, or request? 2023 form 760es, estimated income tax payment vouchers for individuals get the up. 07/21 social security number first 4 letters. Complete, edit or print tax forms instantly. Eforms are not intended to be printed directly from your browser. You will have the option to print a pdf version of your eform once your filing is complete. Web form 760es is used by individuals to make estimated income tax payments. You are not required to file form 760es if:

Filing is required only for individuals whose income and net tax due exceed the amounts. Filing is required only for individuals whose income and net tax due exceed the amounts. Web see the instructions for form 760, 760py or 763 for more on computing your estimated tax liability. Web form 760 is the general income tax return for virginia residents; Eforms are not intended to be printed directly from your browser. Ad get ready for tax season deadlines by completing any required tax forms today. Go digital and save time with signnow, the best solution for. Once you enter your estimated 2022 income into the estimated payments section of the. Farmers, fishermen and merchant seamen. Web web2021 virginia form 760 resident income tax return file by may 1, 2022 — use black ink *va0760121888* 2601031rev.

Fillable Form 760es Virginia Estimated Tax Payment Voucher For

Web form 760es is used by individuals to make estimated income tax payments. 07/21 social security number first 4 letters. 2023 form 760es, estimated income tax payment vouchers for individuals get the up. Go digital and save time with signnow, the best solution for. Complete, edit or print tax forms instantly.

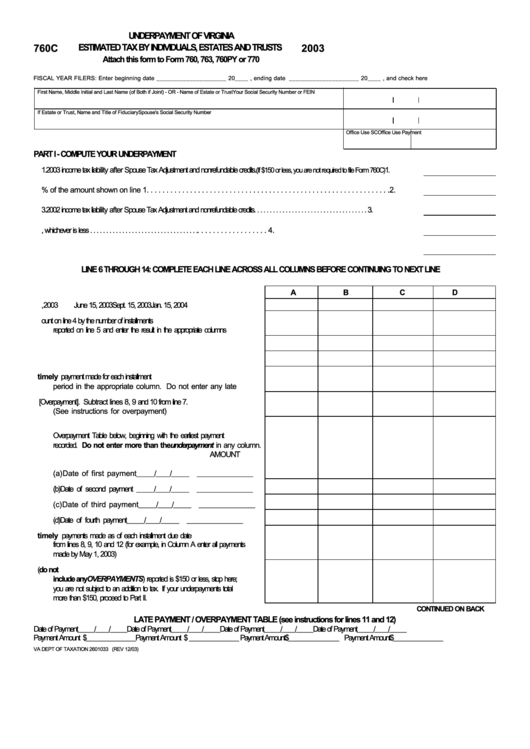

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

Web fill online, printable, fillable, blank form 760es is used by individuals to make (virginia department of motor vehicles) form. Once you enter your estimated 2022 income into the estimated payments section of the. You are married and your combined expected virginia adjusted gross income is less than. Not filed contact us 760pmt. You are not required to file form.

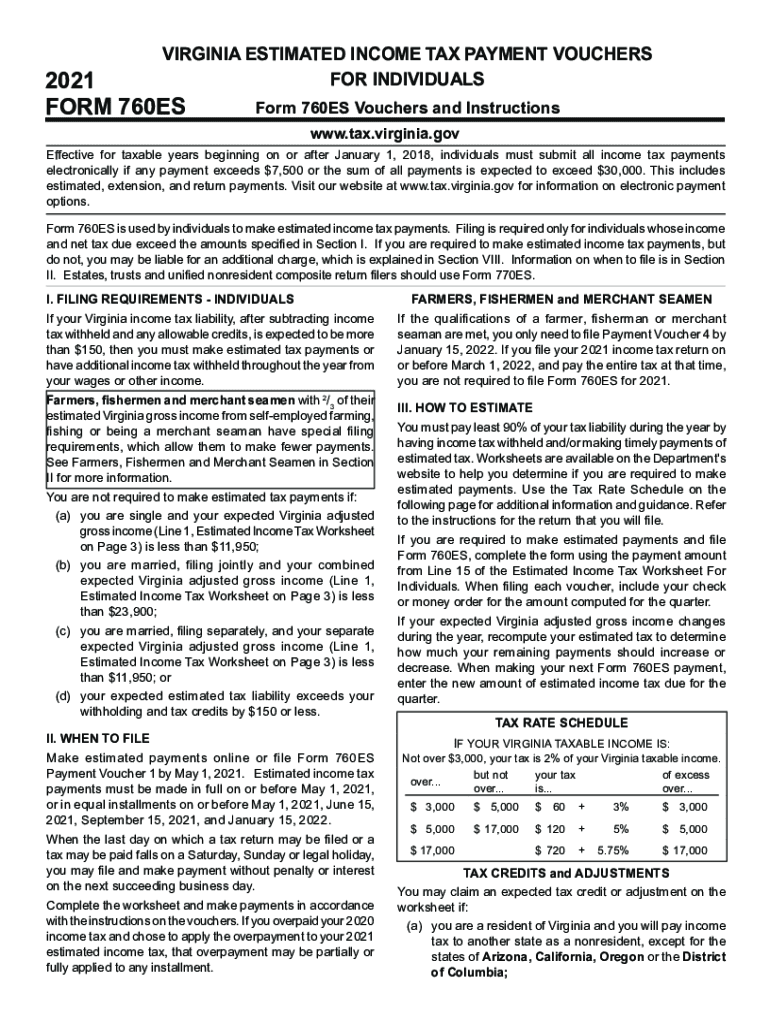

2021 Form 760es Fill Out and Sign Printable PDF Template signNow

You are married and your combined expected virginia adjusted gross income is less than. Web form 760 is the general income tax return for virginia residents; Web form 760es is used by individuals to make estimated income tax payments. Filing is required only for individuals whose income and net tax due exceed the amounts. Web fill online, printable, fillable, blank.

Form 760ES Download Fillable PDF or Fill Online Virginia Estimated

Web web2021 virginia form 760 resident income tax return file by may 1, 2022 — use black ink *va0760121888* 2601031rev. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 760 is the general income tax return for virginia residents; Web how to print va state form 760es for 2022 estimated state tax payments?.

Fill Free fillable Virginia Department of Motor Vehicles PDF forms

Web complete va dot 760es 2023 online with us legal forms. Complete, edit or print tax forms instantly. Filing is required only for individuals whose income and net tax due exceed the amounts. Web fill online, printable, fillable, blank form 760es is used by individuals to make (virginia department of motor vehicles) form. Download or email va 760es & more.

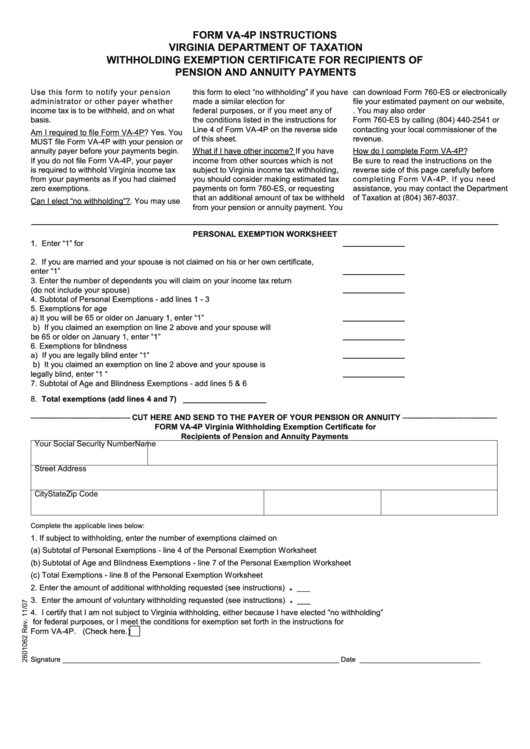

Fillable Form Va4p Withholding Exemption Certificate For Recipients

You will have the option to print a pdf version of your eform once your filing is complete. Printing and scanning is no longer the best way to manage documents. Use fill to complete blank online. Web form 760es is used by individuals to make estimated income tax payments. Web form 760es is used by individuals to make estimated income.

Form 760es Virginia Estimated Tax Payment Vouchers For

You will have the option to print a pdf version of your eform once your filing is complete. Have a comment, suggestion, or request? Printing and scanning is no longer the best way to manage documents. Filing is required only for individuals whose income and net tax due exceed the amounts. Go digital and save time with signnow, the best.

Top 22 Virginia Form 760 Templates free to download in PDF format

Web complete va dot 760es 2023 online with us legal forms. Web form 760es is used by individuals to make estimated income tax payments. Form 760es click here for pdf. Filing is required only for individuals whose income and net tax due exceed the amounts. Virginia estimated income tax payment vouchers for individuals.

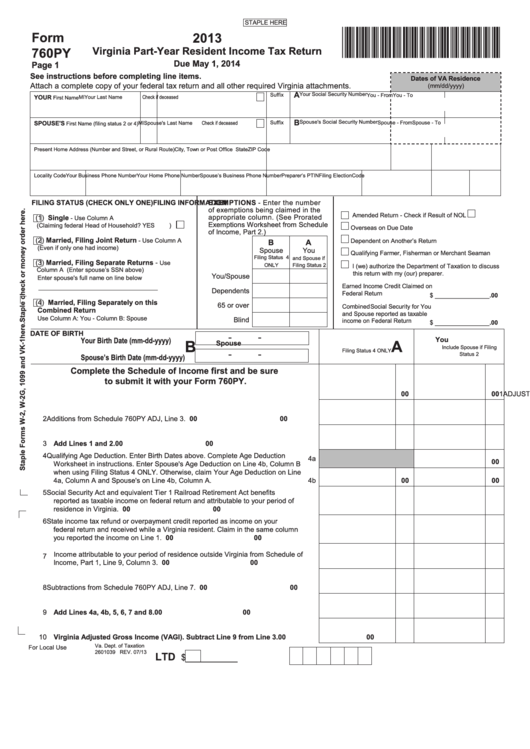

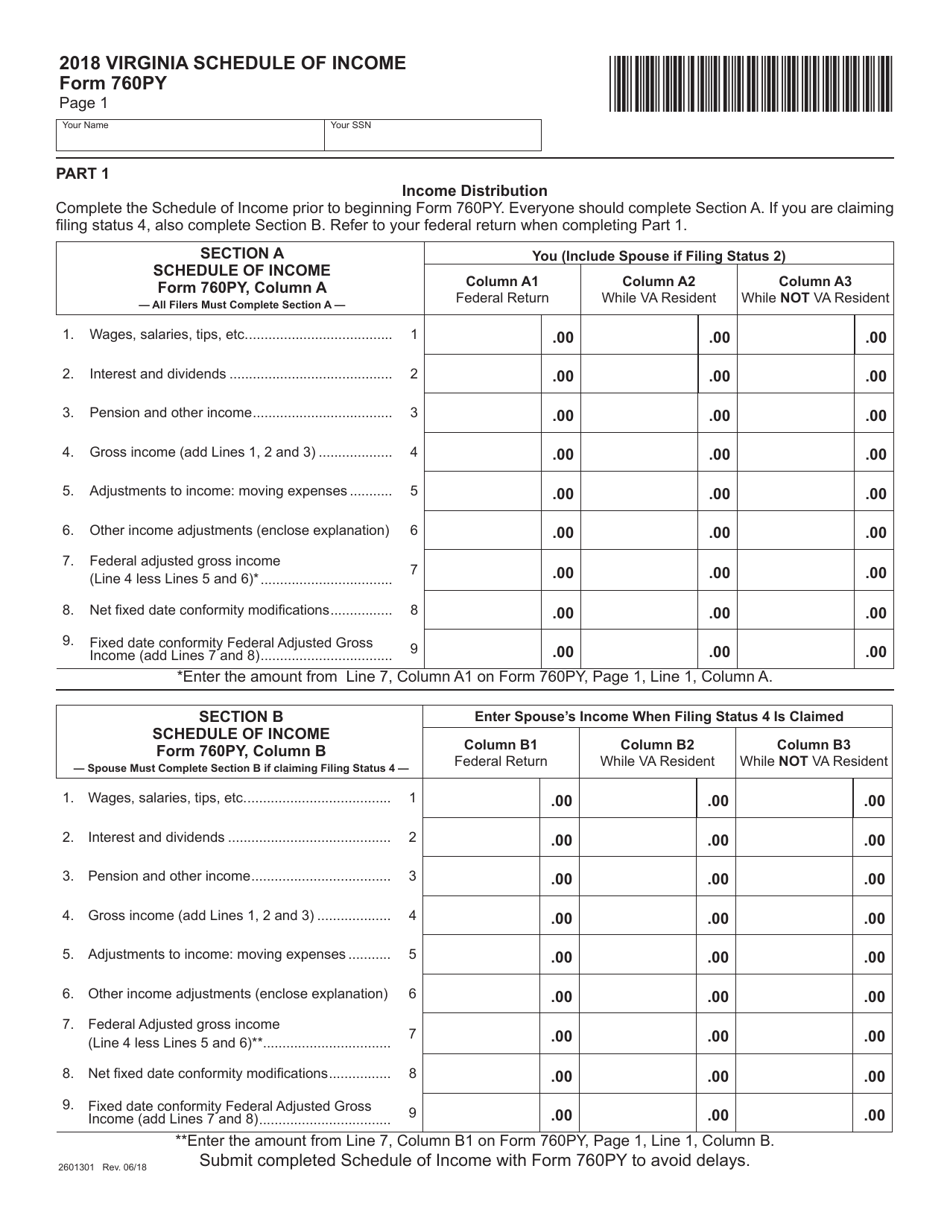

Form 760PY Download Fillable PDF or Fill Online Schedule of

Web form 760 is the general income tax return for virginia residents; Filing is required only for individuals whose income and net tax due exceed the amounts. Have a comment, suggestion, or request? Go digital and save time with signnow, the best solution for. Web see the instructions for form 760, 760py or 763 for more on computing your estimated.

Form 760es Virginia Estimated Tax Payment Voucher For

Web handy tips for filling out virginia 760es online. Eforms are not intended to be printed directly from your browser. Go digital and save time with signnow, the best solution for. Filing is required only for individuals whose income and net tax due exceed the amounts. Web for more information, see form 760es.

Filing Is Required Only For Individuals Whose Income And Net Tax Due Exceed The Amounts.

2023 form 760es, estimated income tax payment vouchers for individuals get the up. Use fill to complete blank online. Web form 760es is used by individuals to make estimated income tax payments. Download or email va 760es & more fillable forms, register and subscribe now!

Filing Is Required Only For Individuals Whose Income And Net Tax Due Exceed The Amounts.

Not filed contact us 760pmt. Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax returns due in april. You are married and your combined expected virginia adjusted gross income is less than.

Filing Is Required Only For Individuals Whose Income And Net Tax Due Exceed The Amounts.

Web form 760es is used by individuals to make estimated income tax payments. Web handy tips for filling out virginia 760es online. Once you enter your estimated 2022 income into the estimated payments section of the. Virginia estimated income tax payment vouchers for individuals.

Web Web2021 Virginia Form 760 Resident Income Tax Return File By May 1, 2022 — Use Black Ink *Va0760121888* 2601031Rev.

Web form 760es is used by individuals to make estimated income tax payments. Filing is required only for individuals whose income and net tax due exceed the amounts. Filing is required only for individuals whose income and net tax due exceed the amounts. You are not required to file form 760es if: