What Is A 8862 Form From The Irs

What Is A 8862 Form From The Irs - Web form 4868, also known as an “application for automatic extension of time to file u.s. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. Guide to head of household. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. Form 8862 is a federal individual income tax form. Web home about form 8962, premium tax credit check back for updates to this page for the latest updates on coronavirus tax relief related to this page, check irs.gov/coronavirus. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for.

Individual income tax return,” is a form that taxpayers can file with the irs if. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web documents needed to file itr; Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub. Web irs definition of disallowed credit. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. It allows you to claim. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. This form is for income. We last updated federal form 8862 in december 2022 from the federal internal revenue service.

Individual income tax return,” is a form that taxpayers can file with the irs if. You may be asked to provide other information before any. Complete, edit or print tax forms instantly. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. For more than half of the year. This form is for income. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web documents needed to file itr; Guide to head of household. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math.

Instructions for IRS Form 8862 Information to Claim Certain Credits

Get ready for tax season deadlines by completing any required tax forms today. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. We last updated federal form 8862 in december 2022 from the federal internal revenue service. Ad access irs tax forms. Web irs definition of disallowed credit.

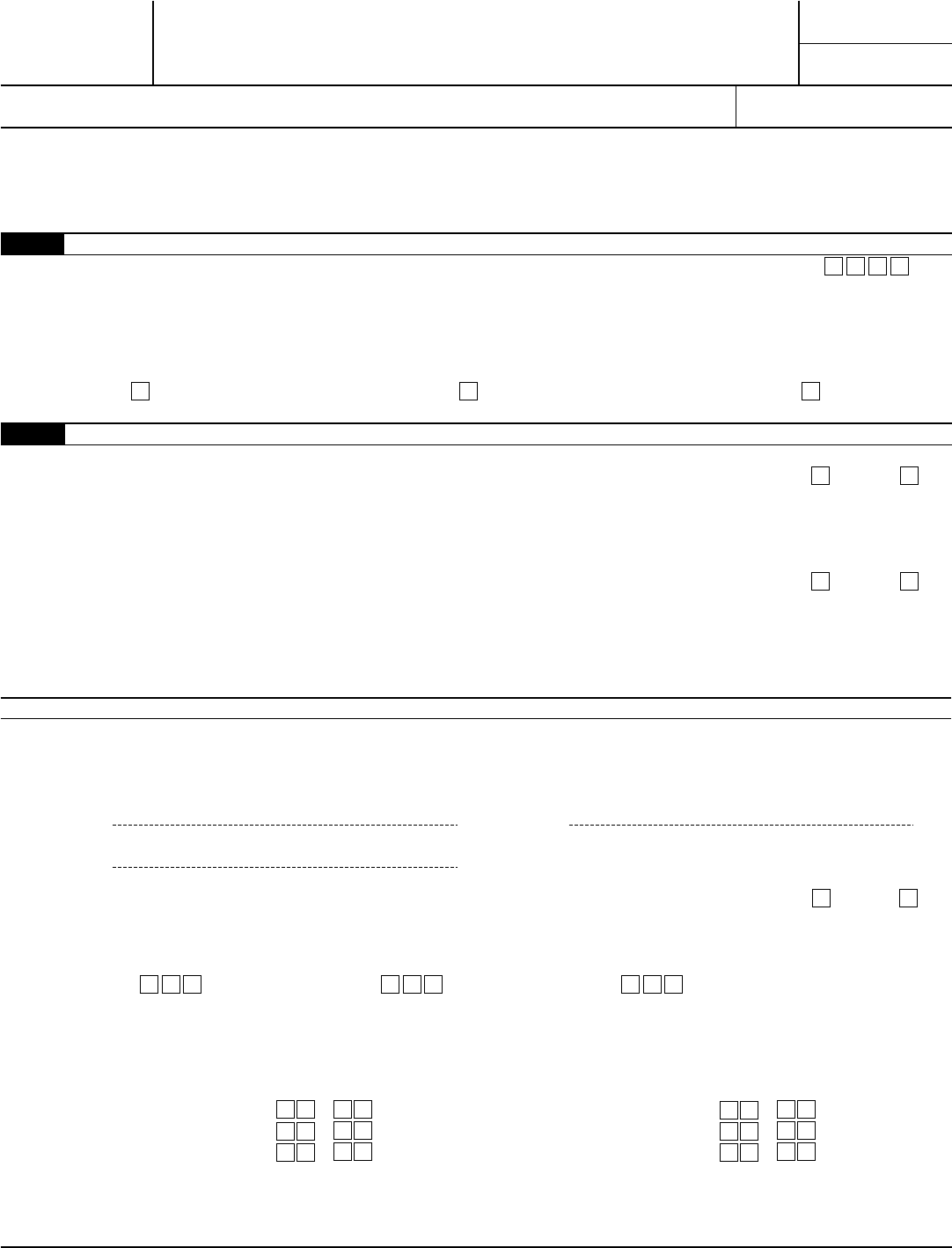

Download Instructions for IRS Form 8862 Information to Claim Certain

It allows you to claim. Web tax tips & video homepage. United states (spanish) canada (french) how do i enter form 8862? instructions for form 8862 irs form 8862 do you live in the us. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Web file form.

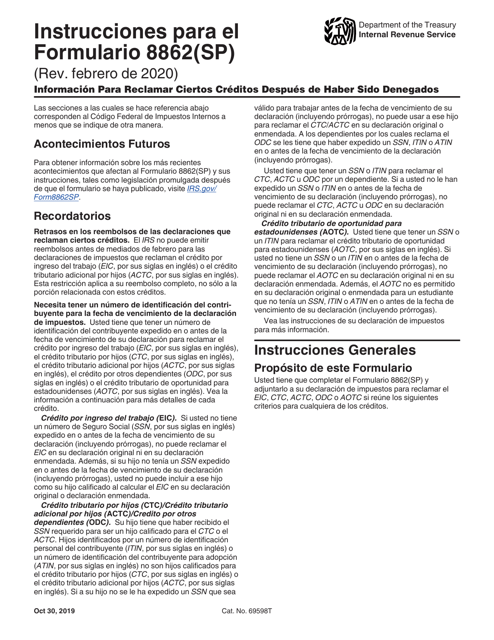

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Web documents needed to file itr; Guide to head of household. Web we last updated federal form 8862 from the internal revenue service in december 2022. If your earned income credit (eic), child tax credit (ctc), additional child tax credit (actc), or american opportunity tax credit (aotc) was. It allows you to claim.

Form 8862Information to Claim Earned Credit for Disallowance

Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. States often have dozens of even. Find the sample you want in our collection of legal templates. Married filing jointly vs separately. Guide to head.

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Web irs definition of disallowed credit. An individual having salary income should collect. Open the form in the online editor. For more than half of the year. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any.

Top 14 Form 8862 Templates free to download in PDF format

Web more about the federal form 8862 tax credit. This form is for income. Web stick to these simple steps to get irs 8862 completely ready for submitting: If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Ad download or email irs 8862 & more fillable.

Download Instrucciones para IRS Formulario 8862(SP) Informacion Para

States often have dozens of even. Complete, edit or print tax forms instantly. An individual having salary income should collect. Open the form in the online editor. We last updated federal form 8862 in december 2022 from the federal internal revenue service.

Form 8862 Edit, Fill, Sign Online Handypdf

Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. Web more about the federal form 8862 tax credit. Complete, edit or print tax forms instantly. Form 8862 is a federal individual income tax form. Web you must file form 8862 you must attach the.

IRS Formulario 8862(SP) Download Fillable PDF or Fill Online

Web we last updated federal form 8862 from the internal revenue service in december 2022. If your return was rejected because. An individual having salary income should collect. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for.

Form 8862 Information to Claim Earned Credit After

An individual having salary income should collect. Web several standards must be met for you to claim the eic: Guide to head of household. Web we last updated federal form 8862 from the internal revenue service in december 2022. United states (spanish) canada (french) how do i enter form 8862? instructions for form 8862 irs form 8862 do you live.

Web Home About Form 8962, Premium Tax Credit Check Back For Updates To This Page For The Latest Updates On Coronavirus Tax Relief Related To This Page, Check Irs.gov/Coronavirus.

Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. This form is for income. Married filing jointly vs separately. Web more about the federal form 8862 tax credit.

Web Information To Claim Earned Income Credit After Disallowance Before You Begin:usee Your Tax Return Instructions Or Pub.

We last updated federal form 8862 in december 2022 from the federal internal revenue service. Form 8862 is a federal individual income tax form. United states (spanish) canada (french) how do i enter form 8862? instructions for form 8862 irs form 8862 do you live in the us. Web stick to these simple steps to get irs 8862 completely ready for submitting:

Web Form 8862 Is Required To Be Filed With A Taxpayer’s Tax Return If In A Prior Year The Taxpayer’s Claim For Any Of The Following Credits Was Reduced Or Disallowed For Any Reason Other Than.

The first step of filing itr is to collect all the documents related to the process. Web irs definition of disallowed credit. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. An individual having salary income should collect.

Complete, Edit Or Print Tax Forms Instantly.

Web we last updated federal form 8862 from the internal revenue service in december 2022. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. It allows you to claim. 596, earned income credit (eic), for the year for which.